The Global Smart Factory Market reached US$ 112.4 billion in 2024 and is expected to reach US$ 290.6 billion by 2033, growing at a CAGR of 12.6% during the forecast period 2025-2033. Market growth is driven by increasing adoption of Industry 4.0 practices, rising demand for automation and operational efficiency, and growing integration of digital technologies across manufacturing industries.

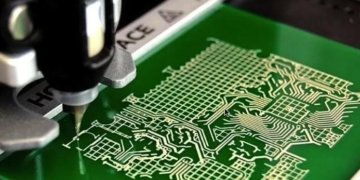

Smart factories leverage advanced technologies such as the Industrial Internet of Things (IIoT), artificial intelligence, robotics, big data analytics, cloud computing, and digital twins to enable connected, flexible, and self-optimizing production environments. Benefits such as reduced downtime, improved product quality, predictive maintenance, and enhanced supply chain visibility are accelerating adoption across automotive, electronics, pharmaceuticals, and consumer goods sectors. Supportive government initiatives and increasing investments in digital manufacturing infrastructure are further propelling global market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/smart-factory-market?sai-v

The Smart Factory Market refers to the global industry focused on the adoption of digitally connected manufacturing systems that use automation, IoT, AI, and data analytics to optimize production efficiency, flexibility, and quality.

Key Developments

✅ January 2026: In North America, manufacturers accelerated deployment of integrated IoT platforms, advanced robotics, and digital twin technologies to support real-time production optimization, predictive maintenance, and labor productivity improvements.

✅ December 2025: In Europe, automotive and aerospace sectors expanded use of edge computing and AI-enabled quality inspection systems in smart factory environments, enhancing automation and reducing defect rates.

✅ November 2025: In Asia-Pacific, strong investment in Industry 4.0 initiatives supported rapid adoption of smart sensors, cloud-based MES (Manufacturing Execution Systems), and collaborative robots to drive operational efficiency in electronics and discrete manufacturing.

✅ October 2025: In Latin America, smart factory pilot projects increased in food processing and consumer goods sectors as companies sought to improve traceability, energy efficiency, and flexible production capabilities.

✅ September 2025: In the Middle East, initiatives linking smart factory technologies with national digital transformation programs boosted uptake of automated production systems and analytics platforms across manufacturing hubs.

✅ August 2025: In Africa, early adoption of smart factory solutions occurred in automotive assembly and textile manufacturing, supported by partnerships with global technology providers and localized training programs.

Mergers & Acquisitions

✅ January 2026: In North America, a major industrial automation and software company acquired a smart robotics and AI analytics provider to strengthen its end-to-end smart factory solutions portfolio.

✅ December 2025: In Europe, a leading manufacturing systems integrator acquired an industrial IoT and edge computing specialist to enhance smart factory implementation capabilities across sectors.

✅ November 2025: In Asia-Pacific, a regional technology investment group acquired a factory automation solutions company to expand its footprint in digital manufacturing and Industry 4.0 deployments.

Key Players

Siemens AG | Schneider Electric SE | Honeywell International | Robert Bosch GmbH | Rockwell Automation | ABB Ltd | General Electric | General Dynamics Corporation | Invensys PLC | Mitsubishi Electric Co.

Key Highlights

Siemens AG holds 21.5% share, driven by its comprehensive industrial automation portfolio, strong digital twin and Industry 4.0 capabilities, and widespread adoption across manufacturing, energy, and infrastructure sectors.

Schneider Electric SE holds 18.2% share, supported by advanced automation solutions, energy management platforms, and strong integration of software-driven industrial control systems.

ABB Ltd holds 16.4% share, benefiting from leadership in robotics, motion control, and electrification solutions across industrial and utility applications.

Honeywell International holds 13.6% share, driven by process automation systems, industrial software platforms, and strong presence in oil & gas, chemicals, and power generation.

Rockwell Automation holds 11.1% share, supported by its Allen-Bradley automation products, industrial control hardware, and software-led manufacturing solutions.

General Electric holds 8.7% share, leveraging industrial digital platforms, automation solutions for power and heavy industries, and long-standing customer relationships.

Mitsubishi Electric Co. holds 5.4% share, driven by factory automation systems, PLCs, and motion control technologies with strong penetration in Asia-Pacific markets.

Robert Bosch GmbH holds 3.2% share, contributing through industrial sensors, automation components, and smart manufacturing technologies.

General Dynamics Corporation holds 1.2% share, focused on industrial and defense-grade control systems and secure automation technologies.

Invensys PLC holds 0.7% share, contributing legacy industrial automation platforms and installed base systems.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=smart-factory-market?sai-v

Market Drivers

– Increasing adoption of Industry 4.0 technologies such as IoT, AI, robotics, and cloud computing to enhance manufacturing efficiency.

– Rising need for real-time data visibility and analytics to optimize production processes and reduce downtime.

– Growing demand for automation and flexible manufacturing systems to address labor shortages and improve quality.

– Expansion of connected supply chains and digital integration across operations.

– Focus on cost reduction, energy efficiency, and sustainability initiatives driving smart factory investments.

Industry Developments

– Launch of advanced industrial IoT platforms and edge computing solutions tailored for manufacturing environments.

– Strategic collaborations and partnerships between technology providers and manufacturing enterprises to deploy end-to-end smart factory solutions.

– Increased deployment of autonomous mobile robots (AMRs), collaborative robots (cobots), and AI-driven quality inspection systems.

– Growth in digital twin technologies and predictive maintenance applications to boost operational uptime.

– Expansion of cybersecurity solutions for protecting connected factory assets and data.

Regional Insights

North America – 34% share: “Driven by high adoption of automation technologies, robust industrial infrastructure, strong R&D investments, and advanced digital transformation initiatives.”

Europe – 29% share: “Supported by well-established manufacturing base, emphasis on Industry 4.0 standards, and government incentives for smart production adoption.”

Asia Pacific – 28% share: “Fueled by rapid industrialization, expanding automotive and electronics sectors, increasing investments in factory automation, and supportive government policies.”

Latin America – 6% share: “Driven by growing interest in modernizing manufacturing processes and expanding automation deployments.”

Middle East & Africa – 3% share: “Supported by emerging smart manufacturing initiatives and gradual investment in advanced industrial technologies.”

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/smart-factory-market?sai-v

Key Segments

By Product Type

Industrial robotics dominate the product segment, driven by rising demand for automation, precision, and productivity across manufacturing operations. Control devices represent a significant share, supported by their critical role in process regulation and equipment coordination. Machine vision systems hold a substantial portion, driven by quality inspection, defect detection, and guidance applications. Communication technology contributes notably by enabling seamless data exchange across automated systems. Sensors account for an important share, driven by real-time monitoring, predictive maintenance, and smart factory initiatives.

By Technology

Programmable logic controllers (PLC) dominate the technology segment, driven by widespread adoption in discrete and process manufacturing. Distributed control systems (DCS) hold a significant share, supported by complex process automation needs in large-scale industrial operations. Manufacturing execution systems (MES) are growing rapidly, driven by demand for real-time production monitoring and optimization. Enterprise resource planning (ERP) and production lifecycle management (PLM) represent important segments, supporting enterprise-wide integration and product development processes. Supervisory control and data acquisition (SCADA) systems account for a notable share due to their role in remote monitoring and control. Other technologies, including HMI and SCARA systems, contribute to market growth through specialized automation applications.

By End-User

The automotive industry dominates the end-user segment, driven by high automation levels and adoption of robotics in vehicle manufacturing. Chemical and oil and gas industries represent substantial shares, supported by process automation and safety requirements. Aerospace holds a notable portion, driven by demand for precision manufacturing and quality control. Mining industry adoption is growing steadily, supported by automation for efficiency and worker safety. Other end users, including defense and consumer electronics, contribute to market growth through expanding use of smart manufacturing technologies.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.