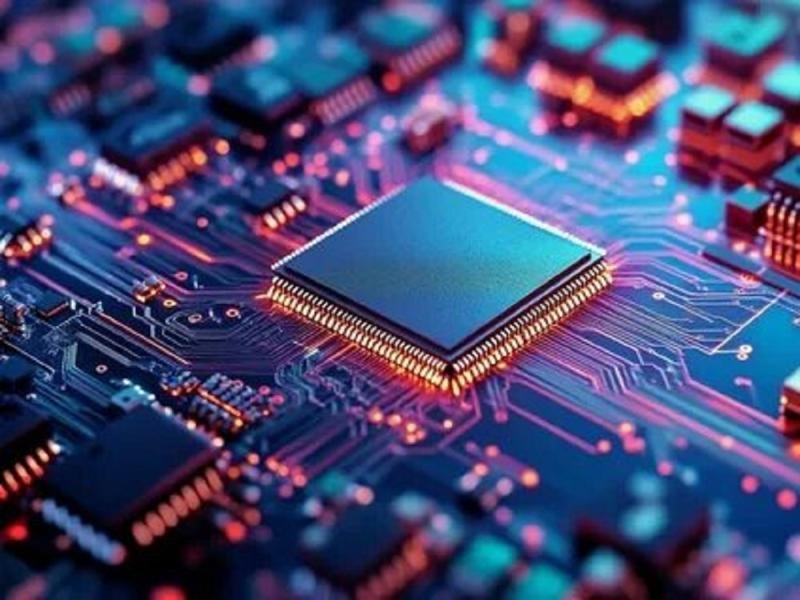

The Global Semiconductors Market reached US$ 640.6 billion in 2022 and is projected to reach US$ 1,132.8 billion by 2031, growing at a CAGR of 7.5% during the forecast period 2024-2031. The semiconductor industry is evolving rapidly, driven by technological advancements, rising digitalization and the increasing adoption of smart, connected and energy-efficient devices. Semiconductors remain the foundation of modern electronics, powering applications across consumer devices, automotive systems, telecommunications, healthcare, industrial automation and cloud computing. Continuous innovations in AI, 5G, IoT, electric vehicles and advanced chip architectures have further accelerated demand, pushing companies to enhance chip performance, reduce power consumption and expand manufacturing capacity globally.

The U.S. continues to lead the global semiconductor landscape in chip design, R&D and advanced architecture development. Silicon Valley and other technology hubs across the country are home to major companies specializing in chip design, SoC development, and integrated circuit engineering for consumer electronics, automotive, enterprise and industrial applications. A notable example is Apple’s transition to its in-house Arm-based M1 chip in 2020, which showcased significant gains in performance, efficiency and integration. This milestone highlighted the country’s innovation capabilities and strengthened its position in the global semiconductor value chain. As a result, the U.S. accounts for more than three-fourths of the regional market share, underscoring its dominant role in shaping the future of semiconductor technologies.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/semiconductors-market?sai-v

The Semiconductors Market refers to the industry manufacturing essential electronic components made from semiconductor materials that power devices ranging from smartphones and computers to automotive systems and industrial equipment.

Key Developments

✅ November 2025: Major U.S. chipmakers accelerated deployment of 2nm and sub-2nm manufacturing nodes, driven by rising demand for high-performance computing, AI accelerators, and next-gen data center architectures.

✅ October 2025: Leading Asian semiconductor foundries expanded advanced packaging capabilities, including 3D chip stacking and chiplet integration, to support AI, automotive, and edge-computing applications.

✅ September 2025: European semiconductor consortiums launched large-scale R&D programs focused on improving silicon carbide (SiC) and gallium nitride (GaN) technologies for EVs, renewable energy, and industrial power systems.

✅ August 2025: Global electronics manufacturers increased adoption of AI-driven fab automation tools for predictive yield optimization and defect analytics in semiconductor fabrication plants.

✅ June 2025: Integrated device manufacturers (IDMs) rolled out advanced photolithography systems leveraging EUV and next-gen high-NA EUV technologies to boost production efficiency.

Mergers & Acquisitions

✅ October 2025: A leading U.S. semiconductor company acquired a chip-design automation startup to enhance its AI-enabled EDA (Electronic Design Automation) capabilities.

✅ September 2025: A major Asian foundry entered a strategic partnership with a European semiconductor materials supplier to secure long-term access to high-purity wafers and advanced deposition materials.

✅ July 2025: A global IDM acquired a power semiconductor firm specializing in GaN-based high-efficiency components to strengthen its EV and industrial electronics portfolio.

Key Players

Intel Corporation | Qualcomm Technologies, Inc. | Texas Instruments Incorporated | Toshiba Corporation | Micron Technology, Inc. | Infineon Technologies | Samsung Electronics | NVIDIA Corporation | Broadcom, Inc. | SK Hynix

Key Highlights

Intel Corporation – Holds a 16.8% share, driven by its advanced semiconductor technologies, strong AI and edge-processing capabilities, and leadership in high-performance computing chips.

Qualcomm Technologies, Inc. – Holds a 14.3% share, supported by its dominance in wireless chipsets, 5G-enabled processors, and AI-optimized mobile platforms.

Texas Instruments Incorporated – Holds an 11.2% share, fueled by its broad analog and embedded processing portfolio, strong footprint in industrial and automotive electronics, and highly efficient semiconductor manufacturing.

Toshiba Corporation – Holds a 7.4% share, driven by its memory solutions, power semiconductors, and robust adoption across consumer electronics and automotive applications.

Micron Technology, Inc. – Holds a 12.7% share, supported by its leadership in DRAM, NAND flash memory, and AI-ready storage technologies.

Infineon Technologies – Holds an 8.9% share, fueled by its strong position in power semiconductors, automotive chips, and IoT-focused microcontrollers.

Samsung Electronics – Holds a 15.5% share, driven by its advanced memory technologies, high-performance processors, and leadership in semiconductor fabrication.

NVIDIA Corporation – Holds a 13.6% share, supported by its GPU architectures powering AI, autonomous systems, high-performance computing, and data center acceleration.

Broadcom, Inc. – Holds a 9.8% share, fueled by its networking chipsets, broadband processors, and integrated semiconductor solutions for cloud and telecom infrastructure.

SK Hynix – Holds a 9.1% share, driven by its strong DRAM and NAND product lines, advanced memory innovation, and expanding supply to global device manufacturers.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=semiconductors-market?sai-v

(Purchase 2 or more Reports and get 50% Discount)

Market Drivers

• Rising demand for advanced chips driven by AI, machine learning, IoT, 5G, autonomous systems, and cloud computing.

• Increasing semiconductor usage in consumer electronics including smartphones, wearables, laptops, and smart home devices.

• Rapid expansion of automotive electronics, including EVs, ADAS, infotainment systems, and power management chips.

• Growth of data centers and high-performance computing (HPC) requiring advanced processors and memory solutions.

• Strong investments in semiconductor manufacturing capacity and localization initiatives across the U.S., Europe, and Asia.

• Advancements in chip architectures such as 3D stacking, gate-all-around (GAA), chiplets, and heterogeneous integration.

• Rising adoption of power semiconductors for energy-efficient applications in renewable energy, industrial automation, and EV charging.

• Increasing demand from medical devices, aerospace, defense, and industrial automation sectors.

Industry Developments

• Launch of next-generation AI chips, GPUs, and edge-processing semiconductors for hyperscale computing.

• Strategic government-funded initiatives such as the U.S. CHIPS Act and EU Chips Act supporting domestic manufacturing.

• Rise of chiplet-based architectures enabling modular, scalable, cost-efficient chip design.

• Expansion of semiconductor fabs by leading players in Taiwan, the U.S., South Korea, Japan, and Europe.

• Growth in partnerships between foundries, fabless companies, cloud providers, and automotive OEMs.

• Increasing commercialization of 3 nm and 2 nm process technologies.

• Development of wide-bandgap semiconductors (GaN and SiC) for high-power and high-efficiency applications.

• Advancements in lithography technologies including EUV and next-gen high-NA EUV.

Regional Insights

Asia Pacific – 60% share: “Driven by strong semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan, along with growing electronics and automotive production.”

North America – 22% share: “Supported by leading fabless companies, strong demand for AI chips, and major investments in domestic chip manufacturing and R&D.”

Europe – 12% share: “Fueled by increasing investments under the EU Chips Act, strong automotive semiconductor demand, and expansion of advanced fabs.”

Latin America – 3% share: “Boosted by growing electronics assembly operations, increasing demand for consumer devices, and emerging semiconductor design capabilities.”

Middle East & Africa – 3% share: “Driven by rising smart infrastructure projects, growing electronics consumption, and emerging interest in semiconductor manufacturing.”

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/semiconductors-market?sai-v

Key Segments

➥ By Product

Intrinsic Semiconductors: Pure semiconductor materials without added impurities, used in high-precision electronics, sensors, and research applications where natural conductivity properties are required.

Extrinsic Semiconductors: Doped semiconductors enhanced with impurities to improve conductivity and performance, widely used in commercial electronics, power devices, and integrated circuits.

➥ By Material

Silicon: The most widely used semiconductor material, essential for ICs, processors, memory devices, and power electronics due to its stability, availability, and cost-effectiveness.

Gallium Arsenide (GaAs): Known for high electron mobility and efficiency, ideal for high-frequency applications such as RF devices, satellite communication, and optoelectronics.

Germanium: Used in photodetectors, high-speed electronics, and optical applications due to its superior carrier mobility and infrared sensitivity.

Silicon Carbide (SiC): A preferred material in power electronics, EV components, and high-temperature applications thanks to its high thermal conductivity and voltage tolerance.

Others: Includes materials such as gallium nitride (GaN), indium phosphide (InP), and emerging compound semiconductors for next-generation electronics.

➥ By Component

Analog IC: Integrated circuits designed for signal processing, amplification, and power management in communication devices, sensors, and consumer electronics.

Optical Semiconductors: Components such as LEDs, laser diodes, and photodetectors used in fiber-optic communication, displays, sensors, and imaging technologies.

Memory Type Semiconductors: Includes DRAM, NAND, NOR, and emerging memory solutions essential for data storage in consumer electronics, servers, and AI applications.

Micro Components: Microprocessors, microcontrollers, and digital ICs used across automotive, computing, industrial automation, and IoT applications.

Discrete Power Devices: Power transistors, diodes, MOSFETs, and IGBTs used for energy conversion, power management, and high-voltage control systems.

Others: Other semiconductor components such as sensors, RF devices, and specialty chips used in niche or customized applications.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.