The healthcare revenue cycle management (RCM) software market is witnessing robust growth, with projections indicating a rise from an estimated value of US$42.6 billion in 2024 to approximately US$65.7 billion by 2031. This steady expansion is expected to be fueled by a compound annual growth rate (CAGR) of 6.4%. The growing demand for efficient billing solutions, increasing healthcare costs, and the ongoing digital transformation in the healthcare industry are some of the key drivers behind the market’s expansion. RCM software helps healthcare organizations streamline their billing processes, improve revenue collection, and reduce the administrative burden, thus making it indispensable for providers.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): www.persistencemarketresearch.com/samples/34096

One of the leading segments in the healthcare RCM software market is the cloud-based solutions sector. Cloud-based RCM solutions offer significant advantages, such as lower upfront costs, scalability, and ease of access from any location. These advantages are crucial in meeting the operational needs of modern healthcare organizations. Additionally, North America remains the leading geographical region for this market, primarily due to the growing adoption of healthcare IT solutions, the presence of major players, and the region’s advanced healthcare infrastructure. The U.S., in particular, has been at the forefront of adopting such solutions as part of broader efforts to curb healthcare spending and improve efficiency.

Key Highlights from the Report

• The healthcare RCM software market is set to grow at a CAGR of 6.4% from 2024 to 2031.

• Cloud-based RCM software holds the largest market share due to its scalability and cost-effectiveness.

• North America continues to dominate the market, driven by technological advancements and widespread adoption.

• The increasing complexity of billing and reimbursement processes fuels demand for efficient RCM solutions.

• Small and medium-sized healthcare providers are increasingly adopting RCM software to optimize their operations.

• The need for enhanced data security and compliance with regulations like HIPAA drives the demand for advanced RCM solutions.

Market Segmentation

The healthcare revenue cycle management software market is primarily segmented based on deployment type, end-users, and service type. In terms of deployment, cloud-based solutions are expected to dominate the market due to their cost-efficiency, ease of use, and scalability. These solutions are increasingly preferred by healthcare providers looking to streamline billing, coding, and collections processes. Furthermore, on-premises software remains relevant but is gradually being overshadowed by cloud-based options, as many healthcare organizations shift toward more flexible and accessible solutions.

From an end-user perspective, the market can be segmented into hospitals, diagnostic laboratories, physician practices, and others. Among these, hospitals represent the largest end-user segment, driven by the growing complexity of billing systems and the demand for automation in revenue management. Physician practices are also adopting RCM software solutions at a faster pace, as small and medium-sized practices seek more efficient ways to handle administrative tasks and ensure timely payments.

Regional Insights

North America leads the global healthcare RCM software market, driven by advanced healthcare infrastructure, a high rate of technology adoption, and the presence of prominent RCM solution providers. The U.S. healthcare system, with its high administrative costs and complex billing processes, is a significant driver of the demand for RCM software. Furthermore, government regulations and the need for compliance with data security standards have pushed healthcare providers in the region to adopt digital solutions for revenue cycle management.

In Europe, the market is witnessing steady growth, primarily driven by increasing healthcare expenditures, the need for operational efficiency, and growing digitization in the region. Countries such as Germany, the UK, and France are actively investing in healthcare IT systems, including RCM solutions, to optimize revenue generation processes and reduce operational inefficiencies. However, while Europe is growing, it faces regulatory hurdles and budget constraints that sometimes slow down the pace of adoption compared to North America.

Market Drivers

The primary drivers for the healthcare RCM software market include increasing healthcare costs and the need for healthcare providers to improve operational efficiencies. Healthcare organizations face mounting financial pressures due to rising operational costs and complexities in billing. RCM software solutions help streamline these processes by automating billing, coding, and payment collection, which significantly reduces administrative costs and improves overall revenue.

Additionally, the need for improved data security and compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) is pushing healthcare organizations to adopt secure RCM solutions. As healthcare data becomes more sensitive and complex, the need for secure, compliant, and efficient software solutions is crucial to safeguarding both financial and patient information.

Market Restraints

One of the key restraints in the healthcare RCM software market is the high initial investment required for the implementation of such solutions. Many small and medium-sized healthcare providers find it challenging to justify the upfront costs, despite the long-term benefits. Additionally, the complexity of integrating RCM software with existing IT infrastructure and workflows poses a challenge to many organizations, especially in regions with underdeveloped healthcare IT ecosystems.

Another significant challenge is the lack of skilled professionals trained to use and manage these advanced RCM solutions. Healthcare providers must invest in employee training, which further raises costs and could delay the adoption process. These barriers are often more pronounced in developing regions, where healthcare providers may not have the resources to implement and maintain complex software systems.

Market Opportunities

The growing adoption of cloud-based solutions presents a significant opportunity for the healthcare RCM software market. Cloud technology allows healthcare providers, including smaller clinics and practices, to access high-quality revenue cycle management tools without significant upfront investment in IT infrastructure. This trend is expected to continue, as more healthcare organizations shift to cloud-based solutions due to their cost-effectiveness, scalability, and ease of implementation.

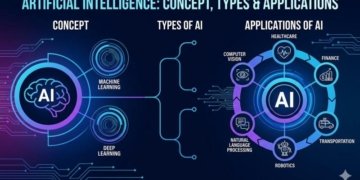

Additionally, the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies in RCM software provides a promising opportunity for the market. AI and ML can automate tasks such as coding and billing, detect discrepancies in claims, and predict reimbursement outcomes, improving accuracy and efficiency. The integration of these advanced technologies could transform the healthcare RCM process, driving greater demand for innovative software solutions.

Frequently Asked Questions (FAQs)

• How Big is the Healthcare Revenue Cycle Management Software Market?

• Who are the Key Players in the Global Market for Healthcare Revenue Cycle Management Software?

• What is the Projected Growth Rate of the Healthcare Revenue Cycle Management Software Market?

• What is the Market Forecast for Healthcare Revenue Cycle Management Software by 2031?

• Which Region is Estimated to Dominate the Healthcare Revenue Cycle Management Software Industry through the Forecast Period?

Company Insights

Key players operating in the healthcare revenue cycle management software market include:

1. Cerner Corporation

2. Allscripts Healthcare Solutions

3. McKesson Corporation

4. Athenahealth Inc.

5. Optum360

6. GE Healthcare

7. Truven Health Analytics

8. eCatalyst Healthcare Solutions

9. Waystar

10. Conifer Health Solutions

Recent developments in the market:

1. Cerner Corporation recently launched an AI-powered revenue cycle management solution to improve accuracy and efficiency in billing and coding processes.

2. McKesson Corporation announced its acquisition of a leading healthcare billing and coding company to enhance its RCM service offering.

The healthcare RCM software market is on an upward trajectory, driven by technological advancements and the increasing need for operational efficiency. The growing adoption of cloud-based solutions and AI technology provides numerous opportunities for stakeholders in the healthcare sector to streamline processes and improve financial performance. As healthcare providers continue to face financial pressures, the demand for RCM solutions will only increase, making it a market worth watching in the coming years.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies’ clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we’ve built over the years.

This release was published on openPR.