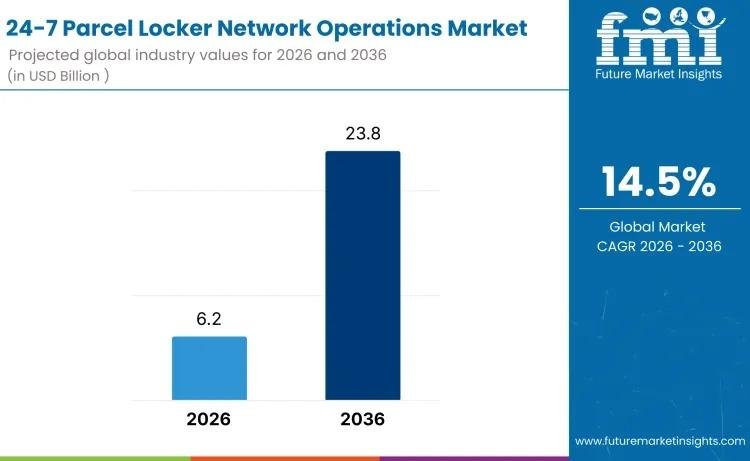

The 24-7 parcel locker network operations market is rapidly transitioning from a convenience-led delivery enhancement into a mission-critical layer of modern logistics infrastructure. Valued at USD 6.2 billion in 2026 and projected to reach USD 23.8 billion by 2036, the market is expanding at a robust CAGR of 14.5%, reflecting structural shifts in how parcels are delivered, secured, and collected across urban and suburban environments.

At its core, this growth is driven by a decisive recalibration of last-mile economics. As e-commerce volumes continue to rise globally, delivery networks face mounting pressure from failed delivery attempts, escalating labor costs, theft exposure, and congestion constraints. Parcel locker networks address these challenges by converting last-mile uncertainty into predictable, high-density delivery nodes that operate continuously, without staffing, and with minimal marginal cost per parcel.

Rather than replacing traditional delivery, lockers are becoming the stabilizing anchor that allows carriers, retailers, and property operators to scale parcel flow without proportional increases in cost or complexity.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-29813

Outdoor Parcel Lockers Anchor Network Economics

Among locker types, outdoor parcel lockers lead global demand with a 43.1% share, reflecting their strategic role in high-traffic, high-throughput environments. Their dominance is not incidental-it is structural.

Outdoor lockers offer durability, weather resistance, and flexible placement across transit hubs, residential clusters, fuel stations, and retail exteriors. More importantly, they enable carrier-dense consolidation, allowing multiple delivery routes to terminate at a single access point. Interoperability with carrier systems, modular compartment sizing, and advanced security controls support continuous utilization throughout the day and night.

From an operational standpoint, outdoor lockers improve network uptime and asset efficiency. IoT-enabled diagnostics, real-time access management, and remote monitoring reduce maintenance downtime while ensuring consistent service levels across distributed locations. As parcel volumes grow, outdoor lockers provide the scalability backbone required to absorb peaks without degrading delivery performance.

Carrier-Owned Networks Control the Largest Share

By deployment model, carrier-owned networks account for 41.6% of global demand, making them the most dominant structure in the market today. Carriers deploy lockers as a direct response to failed deliveries, route inefficiencies, and peak-volume volatility.

Locker-based delivery enables carriers to consolidate multiple stops into a single drop, improving route density and reducing fuel, labor, and reattempt costs. During seasonal surges, lockers provide surge capacity without requiring additional drivers or vehicles. Authentication via mobile apps or QR codes minimizes handoff time, while real-time occupancy analytics support dynamic routing decisions.

Retailer-owned networks follow closely, supporting omnichannel fulfillment and click-and-collect strategies. Third-party operators and public-private shared networks are emerging as neutral infrastructure providers, particularly in dense urban environments where shared access improves utilization economics and accelerates deployment.

E-Commerce Drives Utilization Intensity

From an application perspective, e-commerce parcel delivery represents 46.9% of total demand, making it the single largest utilization driver. Lockers reduce doorstep congestion, mitigate theft risk, and enable unattended delivery at scale. High parcel density translates into higher locker turnover, reinforcing the economic case for deployment in both urban and suburban corridors.

Click-and-collect retail benefits from predictable pickup patterns and reduced in-store congestion. Returns and reverse logistics are gaining traction as lockers simplify drop-off, shorten refund cycles, and reduce labor burden at retail locations. Enterprise and office package management further expands the market, particularly in commercial buildings seeking secure, automated parcel handling.

Asia-Pacific and the U.S. Define Global Growth Momentum

Geographically, China, India, the United States, and Japan form the core growth engine of the global market.

• China, with a CAGR of 16.1%, leads globally due to extreme parcel density, advanced e-commerce infrastructure, and municipal support for unattended delivery to reduce congestion.

• India, growing at 15.4% CAGR, benefits from rapid urbanization, high delivery failure rates in dense cities, and increasing consumer acceptance of self-service pickup.

• The United States, at 14.2% CAGR, reflects strong parcel demand, widespread residential delivery challenges, and expanding deployment across retail, multifamily housing, and logistics nodes.

• Japan, with a 13.3% CAGR, demonstrates disciplined, transit-integrated locker deployment aligned with structured logistics planning and consumer preference for reliable 24-hour access.

• The UK, at 12.7% CAGR, advances through urban consolidation initiatives and strong click-and-collect adoption.

Personalize Your Experience: Ask for Customization to Meet Your Requirements

https://www.futuremarketinsights.com/customization-available/rep-gb-29813

Competitive Landscape: Software, Density, and Reliability Win

Competition in the 24-7 parcel locker network operations market is shaped less by hardware alone and more by network density, software reliability, and integration capability.

• InPost S.A. expands through dense locker footprints optimized for high-frequency use.

• Amazon Hub leverages direct integration with e-commerce ordering platforms to drive utilization.

• Quadient supports postal operators and multi-carrier environments with automated parcel solutions.

• KEBA Group focuses on ruggedized hardware and control systems for high-volume throughput.

• TZ Limited serves commercial and residential buildings requiring secure, always-on access.

Procurement priorities increasingly center on vandal resistance, power efficiency, remote monitoring, multi-carrier compatibility, and data security-factors that directly influence long-term operating margins.

Strategic Outlook

The 24-7 parcel locker network operations market is no longer an auxiliary delivery option. It is becoming foundational infrastructure for modern logistics ecosystems. As last-mile efficiency, cost containment, and consumer flexibility converge, parcel lockers offer a scalable, data-driven solution that aligns operational control with user convenience.

With sustained double-digit growth, expanding deployment models, and deepening integration into urban logistics frameworks, the market presents compelling opportunities for stakeholders positioned to scale networks, optimize software platforms, and secure high-traffic locations ahead of demand.

Similar Industry Reports

Network Simulator Software Market

https://www.futuremarketinsights.com/reports/network-simulator-software-market

Network Connectivity Tester Market

https://www.futuremarketinsights.com/reports/network-connectivity-tester-market

Parcel Insulation Market

https://www.futuremarketinsights.com/reports/parcel-insulation-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.