The global fund management software market represents a cornerstone of modern financial technology infrastructure, enabling investment firms to navigate increasingly complex regulatory environments while delivering superior portfolio performance. This specialized software ecosystem encompasses comprehensive solutions for portfolio management, risk assessment, compliance monitoring, and investor relations, fundamentally transforming how asset managers operate in today’s dynamic investment landscape.

Market Size & Insights

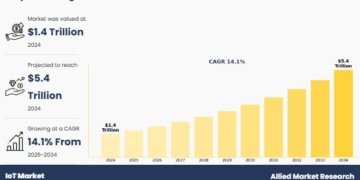

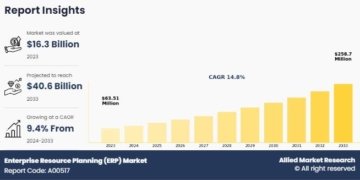

The fund management software market was valued at approximately USD 7.7 billion in 2024, and is expected to grow significantly, reaching a projected value of USD 17.4 billion by 2033, at a CAGR of 8.4% from 2025 to 2033.

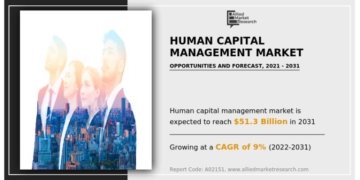

The fund management software market has experienced remarkable expansion, driven by escalating regulatory compliance requirements, growing assets under management, and the imperative for operational efficiency across investment organizations. Current market dynamics reflect substantial investments in cloud-based platforms, artificial intelligence integration, and real-time analytics capabilities that enable fund managers to make data-driven investment decisions with unprecedented speed and accuracy.

Institutional investors are increasingly demanding sophisticated reporting capabilities, risk management tools, and transparent performance attribution analysis, compelling software providers to develop comprehensive solutions that address these evolving requirements. The proliferation of alternative investment strategies, including hedge funds, private equity, and real estate investment trusts, has created demand for specialized software modules capable of handling complex asset classes and non-traditional valuation methodologies.

Emerging markets demonstrate particularly strong growth potential as local asset management industries mature and adopt international best practices for fund administration and regulatory compliance. The integration of environmental, social, and governance factors into investment decision-making processes has spurred development of ESG-focused software modules that enable comprehensive sustainability reporting and impact measurement across investment portfolios.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/fund-management-software-market-38561

Market Analysis

The competitive landscape within the fund management software sector exhibits significant fragmentation, with established enterprise software vendors competing alongside specialized fintech startups and in-house development initiatives. Market leaders differentiate themselves through comprehensive functionality, robust integration capabilities, and proven scalability across diverse organizational structures and investment strategies.

Technology adoption patterns reveal accelerating migration toward cloud-native architectures that offer enhanced flexibility, reduced infrastructure costs, and improved disaster recovery capabilities. Software-as-a-Service delivery models have gained substantial traction, enabling smaller investment firms to access enterprise-grade functionality without significant upfront capital investments. The emergence of application programming interfaces has facilitated seamless integration between disparate systems, creating interconnected technology ecosystems that optimize operational workflows.

Regulatory technology integration has become a critical differentiator, with leading solutions incorporating automated compliance monitoring, regulatory reporting, and audit trail management capabilities. The increasing complexity of global regulatory frameworks necessitates sophisticated software systems capable of adapting to evolving compliance requirements across multiple jurisdictions. Artificial intelligence and machine learning algorithms are increasingly embedded within fund management platforms to enhance portfolio optimization, risk assessment, and fraud detection capabilities.

Market consolidation trends indicate strategic acquisitions as larger software providers seek to expand their functional capabilities and geographic market presence while accessing specialized expertise in emerging technology areas.

Market Scope

The fund management software market encompasses a broad spectrum of applications serving diverse investment management functions across institutional and retail asset management organizations. Portfolio management systems represent the core functionality, providing comprehensive tools for investment research, asset allocation, trade execution, and performance monitoring across multiple asset classes and investment strategies.

Risk management modules enable sophisticated scenario analysis, value-at-risk calculations, and stress testing capabilities that help investment professionals identify potential portfolio vulnerabilities and optimize risk-adjusted returns. Compliance management features address regulatory reporting requirements, including SEC filings, GDPR compliance, and anti-money laundering protocols that ensure adherence to evolving regulatory standards.

Client relationship management functionality facilitates investor communications, performance reporting, and fee calculation processes that strengthen relationships between asset managers and their institutional or retail clients. Back-office operations support encompasses fund accounting, trade settlement, corporate actions processing, and reconciliation workflows that ensure operational accuracy and efficiency.

The market scope extends to specialized applications for alternative investments, including private equity fund administration, hedge fund operations, and real estate investment management platforms that address the unique requirements of these complex investment strategies. Integration capabilities enable connectivity with external data providers, trading platforms, custodial services, and third-party analytics tools that create comprehensive investment management ecosystems.

Market Segments

By Component:

o Software

o Services

By Deployment Mode:

o On-Premise

o Cloud-Based

By Application:

o Portfolio Management

o Accounting & Reporting

o Compliance & Risk Management

o Trading & Order Management

o Others

By End-User Industry:

o Banks & Financial Institutions

o Asset Management Firms

o Insurance Companies

o Wealth Management Firms

o Pension Funds

o Others

By Region:

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

Top 10 Market Companies

• BlackRock Inc.

• SS&C Technologies Holdings Inc.

• SimCorp A/S

• Charles River Development

• Eze Software Group LLC

• Bloomberg L.P.

• FactSet Research Systems Inc.

• MSCI Inc.

• Refinitiv (London Stock Exchange Group)

• Advent Software Inc.

Market Outlook

The fund management software market outlook demonstrates sustained growth momentum driven by continued digital transformation initiatives across the global asset management industry. The evolution toward artificial intelligence-powered investment decision support systems will create new opportunities for software providers to deliver predictive analytics, automated portfolio rebalancing, and intelligent risk management capabilities that enhance investment performance outcomes.

Regulatory technology integration will intensify as compliance requirements become increasingly sophisticated across international markets, necessitating software solutions capable of real-time monitoring and automated reporting across multiple regulatory jurisdictions. The growing emphasis on environmental, social, and governance investing will drive demand for specialized ESG analytics modules that enable comprehensive sustainability assessment and impact reporting.

Cloud computing adoption will accelerate as investment firms recognize the operational benefits of scalable, secure, and cost-effective infrastructure solutions that support remote work capabilities and global collaboration requirements. The integration of blockchain technology and distributed ledger systems may revolutionize trade settlement processes, custody arrangements, and investor reporting mechanisms.

Market consolidation trends suggest increased collaboration between traditional asset managers and fintech innovators to develop next-generation investment management platforms that combine institutional expertise with cutting-edge technology capabilities. The emergence of robo-advisory platforms and automated investment management solutions will create new market segments while driving innovation in user interface design and investor engagement strategies.

Investment in cybersecurity capabilities will remain paramount as fund management organizations recognize the critical importance of protecting sensitive financial data and maintaining investor confidence in an increasingly connected digital environment that demands robust security frameworks and comprehensive risk management protocols.

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Kitchen Towel Market: https://datahorizzonresearch.com/kitchen-towel-market-54085

Switchgear For Wind Turbine Market: https://datahorizzonresearch.com/switchgear-for-wind-turbine-market-54086

Running Shoes Market: https://datahorizzonresearch.com/running-shoes-market-54087

Casserole Market: https://datahorizzonresearch.com/casserole-market-54088

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.