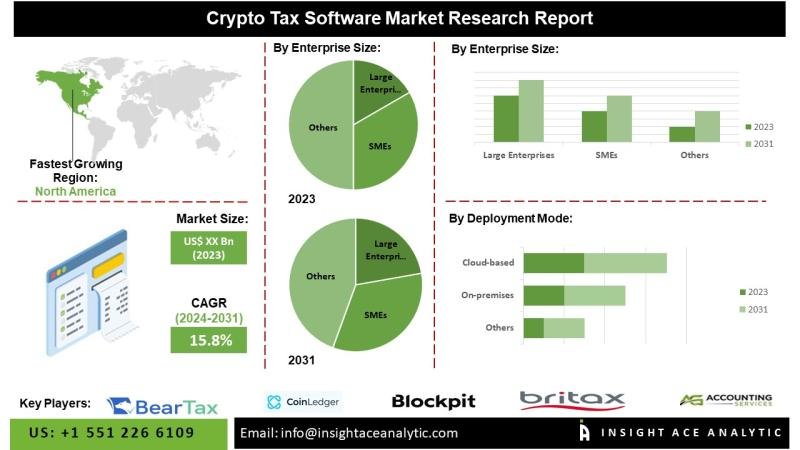

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Crypto Tax Software Market – (By Enterprise Size (Large Enterprises and SMEs), By Deployment Mode (Cloud-based and On-premises)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

According to the latest research by InsightAce Analytic, the Global Crypto Tax Software Market is expected to grow with a CAGR of 15.8% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2580

Utilizing cryptocurrency tax software is essential for traders and investors to ensure compliance with tax regulations and streamline the tax reporting process. The cryptocurrency tax software market is experiencing substantial growth, driven by the increasing global adoption of cryptocurrencies. This market provides specialized solutions that enable individuals and businesses to accurately calculate and report taxes related to cryptocurrency transactions. The market’s expansion is fueled by the growing complexity of cryptocurrency tax regulations, the need for precise record-keeping, and the importance of maintaining compliance with tax authorities. Leading market participants offer a comprehensive range of features, including cost-basis tracking, transaction reporting, and seamless integration with major cryptocurrency exchanges. As the cryptocurrency ecosystem continues to grow, the demand for reliable and user-friendly tax software is expected to rise, presenting significant opportunities for both established companies and new entrants in this evolving market.

List of Prominent Players in the Crypto tax software market:

• BearTax Inc.

• Bittax

• Blockpit

• Coin Ledger, Inc.

• Coinpanda

• CoinsTax LLC

• CoinTracker

• Crypto Tax Calculator

• Happy Tax Franchising LLC

• Koinly

• Node40 LLC

• TaxBit, Inc.

• TokenTax

• TurboTax

• ZenLedger, Inc.

• CoinTracking

• Recap

• Bitwave

• Accointing Services AG

• Liquifi

• Other Market Players

Market Dynamics:

Drivers:

The growth of the cryptocurrency tax software market is driven by several key factors. The expanding cryptocurrency ecosystem, combined with heightened regulatory oversight, has created a growing need for sophisticated tax reporting solutions. Additionally, the increasing volume of cryptocurrency investments and trading activities has amplified the demand for efficient tax management tools. Moreover, technological advancements, including blockchain integration and artificial intelligence, have facilitated the development of advanced features, further driving the adoption of cryptocurrency tax software across diverse user segments.

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-03

Challenges:

Despite promising growth opportunities, the cryptocurrency tax software market faces several notable challenges. A key obstacle is the complex and constantly evolving regulatory environment, which varies across jurisdictions and creates compliance difficulties for both software developers and users. Additionally, the absence of standardized accounting practices and tax treatment for cryptocurrencies complicates the development of universally applicable tax solutions. Cybersecurity risks and data privacy concerns further pose significant threats to the integrity and security of sensitive financial information managed by cryptocurrency tax software. Moreover, the inherent volatility and unpredictability of the cryptocurrency market can affect the accuracy of tax calculations and reporting, underscoring the need for effective risk management strategies.

Regional Trends:

North America is projected to hold the largest share of the global cryptocurrency tax software market, driven by early adoption of cryptocurrencies, a well-established regulatory framework, and a high concentration of cryptocurrency investors and enterprises. The presence of leading cryptocurrency tax software providers and proactive regulatory measures aimed at addressing cryptocurrency taxation further strengthen North America’s market dominance. Meanwhile, the Asia-Pacific region is anticipated to experience significant growth in the cryptocurrency tax software market during the forecast period, supported by increasing cryptocurrency adoption, evolving regulatory frameworks, and growing awareness of tax compliance among industry participants. The presence of a large base of tech-savvy individuals, small and medium-sized enterprises (SMEs), and fintech companies actively engaged in the cryptocurrency sector is expected to further drive market expansion in the region.

Recent Developments:

• In Nov 2023, Blockpit acquired Accointing from Glassnode, which had previously bought it in October 2022 for an undisclosed sum. Through this acquisition, Blockpit gained the ability to cater to clients headquartered in the UK by utilizing a strong collaboration between public and private entities in the UK, as well as establishing partnerships with prominent Certified Public Accountants (CPAs).

• In January 2024, CoinTracking has recently introduced cryptocurrency tax solutions and software specifically designed for the UK market. CoinTracking works in more than 25 countries, including the United Kingdom, providing investors with a variety of options to select from, such as premium support, account evaluations, or comprehensive assistance with UK cryptocurrency tax returns.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2580

Segmentation of Crypto Tax Software Market-

By Enterprise Size

• Large Enterprises

• SMEs

By Deployment:

• Cloud-based

• On-premise

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.