Nvidia and OpenAI’s proposed 10GW artificial intelligence infrastructure partnership and 100-billion-dollar circular financing model are drawing scrutiny from institutional investors focused on data centre power, chip supply chains and emerging competition policy risks.

Negotiations between Nvidia Corporation and OpenAI on a proposed 100-billion-dollar strategic partnership for artificial intelligence infrastructure are intensifying, and Merifund Capital Management Pte. Ltd. is tracking how the talks redefine expectations for scale. The companies are discussing at least 10 gigawatts of Nvidia powered computing capacity, a footprint roughly equivalent to the electricity use of more than 7.5 million homes. For institutional investors, that scale lifts the collaboration from headline story to macro thesis for the broader AI ecosystem.

Merifund Capital sees the draft framework as a distinctive investment loop in which Nvidia would hold non-controlling, non-voting equity stakes in OpenAI while OpenAI uses Nvidia supplied capital to buy additional Nvidia processors directly. For Anthony Saunders, Director of Private Equity at Merifund Capital Management Pte. Ltd., the evolving architecture is “setting the template for how AI infrastructure is financed and governed at scale” as investors increasingly treat raw compute as a strategic asset rather than a short-lived line item in technology budgets.

Under the structure under discussion, Nvidia is considering equity commitments of up to 95.42 billion dollars in phased tranches instead of a single lump sum. An initial 9.54 billion dollars would accompany any definitive purchase agreement, with further funding tied to each additional gigawatt of installed capacity, while Nvidia already signals around 477.11 billion dollars of demand for its Blackwell and Vera Rubin systems over the next two years excluding potential OpenAI orders. Saunders regards that combination as “stretching conventional assumptions about technology capital cycles and balance sheet risk” for suppliers and investors alike.

Despite these headline figures, the partnership remains anchored in a preliminary letter of intent. Nvidia continues to describe the OpenAI opportunity as active but cautions in regulatory disclosures that there is no assurance of binding agreements on expected terms or within any given timetable. Merifund Capital interprets this stance as preserving strategic optionality for Nvidia while still shaping how investors model potential revenue trajectories and capital expenditure profiles around advanced AI infrastructure.

Parallel investments in Anthropic and Intel, with commitments of about 9.54 billion dollars and 4.77 billion dollars respectively, extend Nvidia’s ecosystem strategy by tying equity exposure to consumption of its compute platforms and co-optimised software. The circular flow of capital across these relationships revives memories of vendor financing arrangements from 1999 to 2000, even as regulators in the United States and Europe study whether Nvidia’s share of advanced AI accelerators, which several industry estimates place above 90 % over the past 12 months, could dampen competition if coupled with preferential pricing or exclusivity terms for key customers.

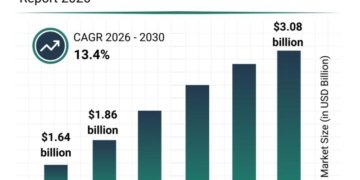

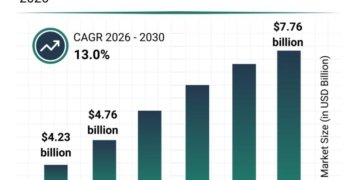

Energy infrastructure is emerging as a central consideration for any final agreement. A 10-gigawatt data centre programme requires power capacity comparable with several medium sized national grids, and Nvidia’s own disclosures describe multiyear sequences of permitting, grid interconnection and construction before that electricity is fully available. Global data centre electricity consumption already approaches 460 terawatt hours a year, roughly equivalent to the usage of a large European economy, prompting investors to question how quickly additional load can be integrated without straining local networks and regulatory tolerance.

The technological foundation for the proposed build is Nvidia’s Vera Rubin architecture, which combines a Vera central processor with 88 Arm based cores and a Rubin graphics processor linked through interconnects rated at up to 1.8 terabits per second. High density configurations such as the NVL144 CPX system can host 288 GPUs and 36 CPUs in a single deployment, delivering around 8 exaflops for the largest frontier model training runs. In parallel, OpenAI is commissioning custom inference processors with Broadcom and TSMC for deployment from 2026 onward and integrating AMD hardware, a diversification that Saunders notes is informed by internal projections of roughly 4.54 billion dollars of losses against 3.36 billion dollars of revenue this year.

From Merifund Capital’s perspective, this convergence of equity participation, vendor financing and power intensive data centre buildouts is turning compute into a long duration infrastructure asset class that spans silicon, cloud platforms and energy markets. The structure under consideration positions Nvidia as both supplier and investor while governance at OpenAI remains anchored in a non-profit board model, creating a blend of commercial alignment and independence that requires deeper assessment of counterparty exposure. Saunders argues that the configuration is “reshaping how investors must think about counterparty risk, concentration of technical platforms and the durability of cash flows linked to AI demand” across public and private markets.

Merifund Capital Management Pte. Ltd. is consequently treating the Nvidia-OpenAI partnership as a live case study in how capital markets respond when a single technology vendor anchors an entire layer of digital infrastructure. Saunders concludes that “the partnership reflects fundamental shifts in technology capital requirements, demanding sophisticated risk assessment protocols for institutional portfolios”, and Merifund Capital continues to analyse how such large-scale collaborations may influence allocations to artificial intelligence, semiconductors and power related assets over the coming years. Institutional investors reviewing their exposure to AI infrastructure can draw on this type of structured analysis when benchmarking scenarios in which similar partnerships either reinforce or challenge existing investment theses.

About Merifund Capital Management Pte. Ltd.

Merifund Capital Management Pte. Ltd. (UEN: 201024554E) has operated from Singapore since 2010 as a specialist hedge fund manager. The firm manages traditional long only mandates alongside long short equity, global macro, event driven and systematic strategies, using derivatives both to express investment views and to hedge risk, with a consistent emphasis on capital preservation, liquidity and disciplined risk controls. Environmental, social and governance considerations are integrated into its investment processes in line with recognised international sustainability standards. Merifund currently serves accredited investors, family offices, foundations and endowments and is developing solutions that will open selected strategies to retail investors. Further commentary is available at https://merifund.com/ insights, and media enquiries can be directed to Tao Yang at media@merifund.com or through the contact channels on https://merifund.com .

Islamabad, Pakistan

Press Release Distribution by https://webxfixer.com

This release was published on openPR.