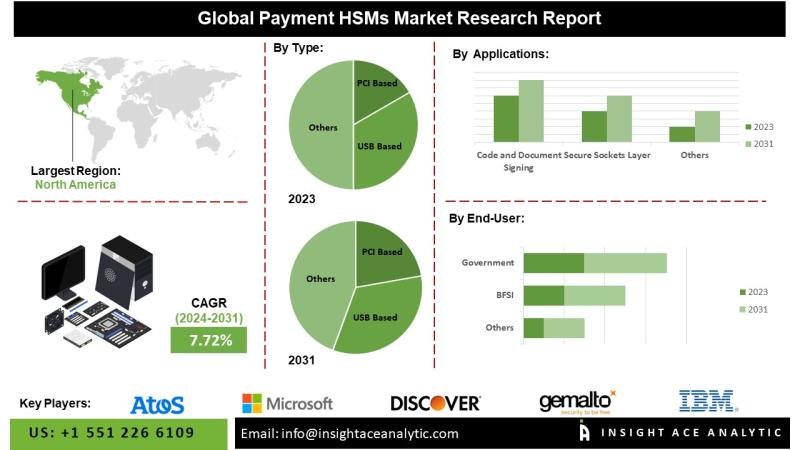

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Payment HSMs Market Size, Share & Trends Analysis Report By Type (PCI Based, USB Based, Network Based); Applications (Code and Document Signing, Secure Sockets Layer (SSL) and Transport Layer Security (TLS), Authentication, Database Encryption, PKI or Credential Management, Others); End User (BFSI, Government, Technology and Communications, Manufacturing Industry, Energy and Utilities, Retail and Consumer Products, Others) – Market Outlook And Industry Analysis 2034”

The Global Payment HSMs Market is expected to grow with a CAGR of 7.8% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2620

The Payment Hardware Security Modules (HSMs) market represents a critical component of the global financial technology landscape, serving as a foundational element in ensuring the security and reliability of digital payment systems. As the adoption of electronic transactions continues to accelerate worldwide, the need for advanced and dependable security frameworks has intensified.

Payment HSMs are specialized hardware devices designed to securely generate, protect, and manage cryptographic keys and sensitive financial data, thereby preserving the confidentiality, integrity, and authenticity of digital payment processes. These systems are extensively deployed across sectors such as banking, financial services, e-commerce, and payment processing, where they play a pivotal role in facilitating secure transactions, safeguarding cryptographic operations, and ensuring compliance with industry regulations, including the Payment Card Industry Data Security Standard (PCI DSS).

The strategic importance of Payment HSMs is underscored by their capacity to mitigate cybersecurity threats, including fraud, data breaches, and unauthorized access. In an era of increasingly sophisticated digital attacks, these modules provide the technological backbone necessary to secure financial infrastructures and protect consumer information. Beyond enhancing transactional security, Payment HSMs also play a vital role in strengthening consumer confidence and trust, which are essential to the sustained expansion and stability of global digital financial ecosystems.

List of Prominent Players in the Payment HSMs Market:

• American Express

• ATOS

• AWS

• Azure

• Discover

• FutureX

• Gemalto NV

• Google

• Hewlett-Packard Enterprise Development LP

• IBM Corporation

• Infineon Technologies

• JCB International

• Kryptus

• Mastercard

• Microchip Technology

• Microsoft Corporation

• Procenne

• STMicroelectronics

• SWIFT

• Thales e-Security, Inc.

• Ultra-Electronics

• UnionPay

• Utimaco GmbH

• Visa Inc.

• Worldline

• Yubico

• Intexus

• Securosys

• Broadcom Inc

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-03

Market Drivers

The expansion of the Payment Hardware Security Modules (HSMs) market is primarily fueled by the growing demand for secure digital payment infrastructures, the escalating prevalence of cybersecurity threats, evolving regulatory mandates, and the rapid proliferation of e-commerce and mobile payment platforms. As digital transactions become increasingly central to global financial ecosystems, organizations are prioritizing investments in Payment HSMs to safeguard sensitive financial data from fraud, unauthorized access, and data breaches.

The rising sophistication and frequency of cyberattacks have underscored the importance of advanced encryption and cryptographic key management solutions, core functions provided by HSMs. Furthermore, stringent regulatory frameworks such as the Payment Card Industry Data Security Standard (PCI DSS) and government-led initiatives promoting cashless economies are reinforcing market adoption by mandating secure payment environments and fostering consumer trust in digital transactions.

Market Challenges

Despite strong market potential, the Payment HSMs industry faces several critical challenges. High capital expenditure and technical integration complexities associated with deploying and maintaining HSM systems pose significant barriers, particularly for small and medium-sized enterprises (SMEs) with limited financial and technical resources. In addition, stringent compliance requirements and the need for continuous software and hardware updates to align with evolving cybersecurity standards further increase operational costs. These factors collectively constrain broader market adoption, particularly among organizations with constrained budgets or legacy infrastructure.

Regional Trends

North America commands a leading position in the global Payment HSMs market, supported by its advanced financial infrastructure, robust technological ecosystem, and strong emphasis on data protection and cybersecurity. The region’s concentration of major financial institutions, payment processors, and technology providers has driven extensive adoption of HSM technologies to ensure secure and compliant digital transactions.

The surge in digital payment volumes and the rise in sophisticated cyberattacks have accelerated the implementation of high-assurance encryption and secure key management systems. Moreover, compliance obligations under frameworks such as PCI DSS, alongside national data privacy regulations, continue to drive demand for trusted hardware-based security solutions. As digital transformation initiatives and regulatory scrutiny intensify, North America is expected to maintain its leadership by fostering technological innovation and expanding the adoption of Payment HSM solutions across diverse industry verticals.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2620

Recent Developments:

• In August 2023, Thales launched Thales payShield Cloud HSM, a subscription-based digital payments security service built on its leading payShield 10K Payment HSM technology, to accelerate the adoption of cloud-based payments infrastructure.

• In July 2022, Futurex’s EXP1000 and GSP3000 HSMs are now officially approved for use in Australia’s payment industry by the Australian Payments Network (AusPayNet) and have been added to the IAC Approved Devices list.

Segmentation of Payment HSMs Market-

By Type:

• PCI Based

• USB Based

• Network Based

By Applications:

• Code and Document Signing

• Secure Sockets Layer

By End User:

• BFSI

• Government

• Technology and Communications

• Manufacturing Industry

• Energy and Utilities

• Retail and Consumer Products

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/payment-hsms-market/2620

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.