New York City, NY, Sept. 28, 2025 (GLOBE NEWSWIRE) — Introduction – What is Highmark Bitspire

Highmark Bitspire is an advanced financial technology platform designed to integrate artificial intelligence, machine learning, and algorithmic systems into a unified trading environment. Positioned as a next-generation solution, it places emphasis on precision, automation, and data integrity to meet the evolving demands of modern financial markets. Unlike traditional digital interfaces that rely on manual execution, Highmark Bitspire automates strategies through coded logic and computational models. The objective is not to replace human oversight, but to augment decision-making with tools capable of analyzing vast volumes of market data at high velocity.

At its core, Highmark Bitspire functions as a structured framework where trading operations can be executed with measurable consistency. It achieves this by combining predictive analytics with real-time monitoring, ensuring that transactions are aligned with market signals. The infrastructure supports multiple asset classes, reflecting the growing requirement for diversity in portfolios. Its design emphasizes scalability, enabling both new entrants and established entities to operate within the same ecosystem without compromise to speed or stability.

From an operational standpoint, Highmark Bitspire is constructed to highlight three pillars: security, transparency, and factual accuracy. These form the foundation on which its reputation is established. The system deploys technical safeguards, regulatory compliance features, and an onboarding process tailored for structured access. In 2025, the emphasis on platforms that merge automation with credibility is at its highest, and Highmark Bitspire positions itself within this movement.

Ultimately, Highmark Bitspire is not marketed merely as a digital tool but as a structured infrastructure capable of executing complex functions within regulated boundaries. By aligning with principles of compliance and safety, it seeks to define itself as a reliable presence in a crowded financial technology landscape.

Visit Highmark Bitspire Official Website

Highmark Bitspire Features

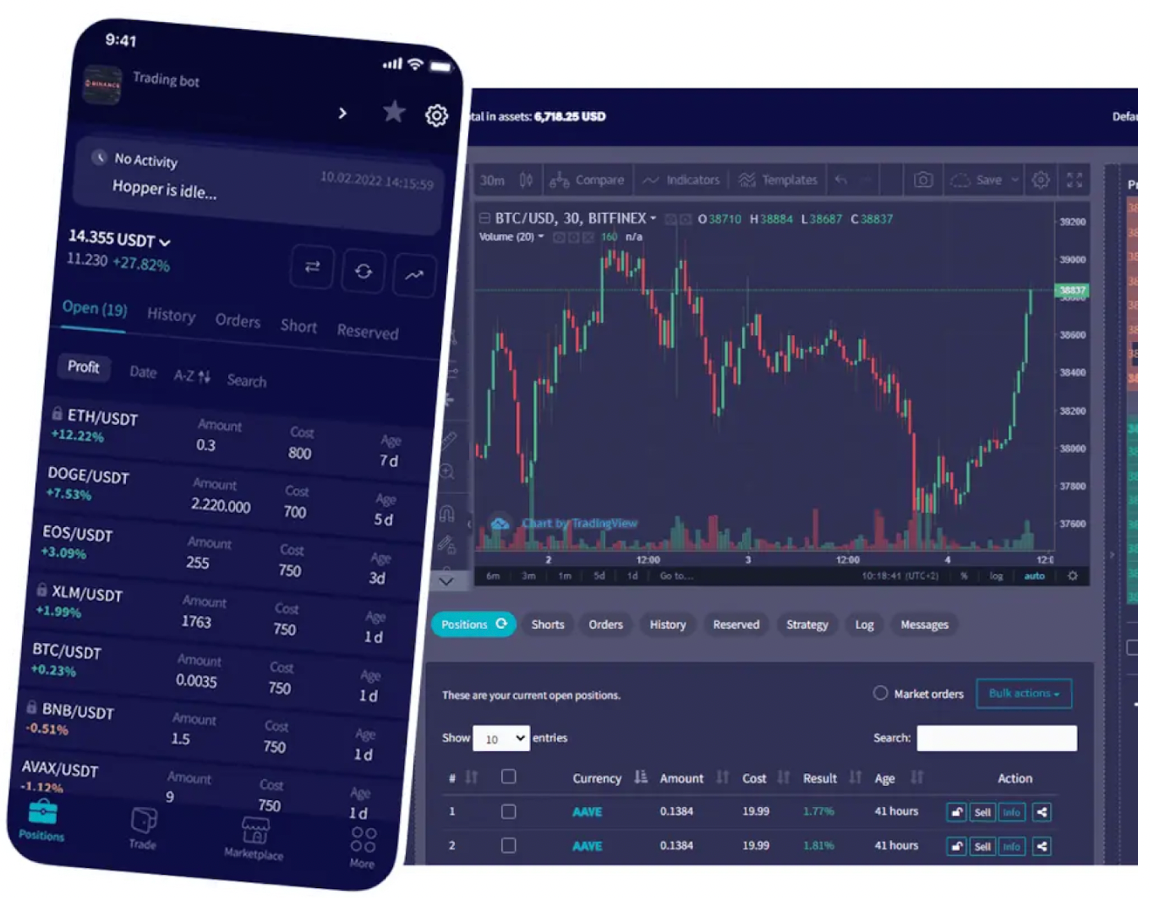

The framework of Highmark Bitspire is defined by a series of distinct features designed to support seamless, technology-driven operations. One of its core features is its AI-driven trading engine, which continuously processes data streams from multiple markets. This engine is engineered to recognize patterns, apply predictive models, and automate execution. Unlike manual trading, where delays can alter outcomes, the AI logic functions in real time, reducing latency and enabling a structured response to market shifts.

Another defining feature is multi-asset integration. Highmark Bitspire does not confine users to a single asset class but offers exposure across a broad spectrum, including forex, commodities, indices, and cryptocurrencies. This ensures that portfolio diversification can be supported under one technological umbrella. Complementing this is cross-device compatibility, where the platform’s infrastructure adapts to desktops, tablets, and mobile interfaces. Accessibility is reinforced with encrypted communication channels, making remote access secure.

Automated strategy customization further enhances the system’s value. Participants are able to define entry and exit conditions, set thresholds, and configure risk parameters. These conditions are then executed by the automated system without deviation, ensuring that the original logic of the strategy is preserved. For those seeking structured oversight, Highmark Bitspire integrates real-time dashboards, where performance, asset allocation, and open positions are displayed with factual accuracy.

The inclusion of back-testing functionality allows strategies to be tested against historical data. By simulating conditions of past markets, the system provides an analytical view of how certain approaches would have performed. This enhances confidence in model selection and reduces reliance on speculative assumptions.

Collectively, these features reflect a system designed not only for operational efficiency but also for structured analysis and control. Highmark Bitspire emphasizes that technology is not limited to execution speed but also to ensuring transparency, precision, and user-defined adaptability in every aspect of its function.

Register on the Highmark Bitspire trading application

Highmark Bitspire – Security Measures, and Factual Performance Data

Security within Highmark Bitspire is constructed as a multi-layered architecture. At the foundation lies end-to-end encryption, ensuring that all data transmitted between devices and servers remains inaccessible to unauthorized parties. This encryption standard is aligned with protocols widely recognized in banking and fintech sectors, signifying its adherence to regulated practices. The platform further applies two-factor authentication (2FA), requiring a dual process of verification before any account access is permitted. This eliminates single-point vulnerabilities often exploited in digital systems.

From a structural perspective, firewall segmentation and intrusion detection systems are actively employed. These safeguards are designed to identify irregular activity, prevent breaches, and isolate threats before they compromise the ecosystem. Periodic audits are conducted to confirm that compliance obligations are met, ensuring alignment with global standards for digital finance.

Performance data is presented not as abstract claims but as measurable statistics. The platform reports uptime figures exceeding 99.7%, reflecting system reliability in maintaining continuous operations. Latency rates for trade execution are optimized within milliseconds, highlighting the speed of its automated systems. These metrics are not presented in isolation but form part of a factual reporting framework, enabling stakeholders to evaluate the operational quality of Highmark Bitspire objectively.

In addition, data redundancy protocols safeguard against downtime. Through geographically distributed servers and real-time backups, system continuity is preserved even in the event of localized disruptions. This reliability reinforces trust in the infrastructure and supports uninterrupted market access.

In essence, Highmark Bitspire’s security and performance standards are engineered to project confidence through verifiable measures. By aligning its system to rigorous technical benchmarks, the platform demonstrates that safety and factual accuracy are intrinsic to its core architecture.

Visit The Official Website To Try Highmark Bitspire For Free

How to Start with Highmark Bitspire – Step by Step

The onboarding process within Highmark Bitspire has been streamlined into a series of structured steps designed to maintain both security and usability. Each stage ensures compliance with regulatory requirements while providing clear instructions for participants.

Step-by-Step Setup Process:

- Step 1: Registration Form – Begin by visiting the official Highmark Bitspire website and completing the registration form. Essential details such as full name, email address, and contact number are required.

- Step 2: Email Verification – A secure verification link is sent to the registered email. Activating this link confirms authenticity and prevents unauthorized access.

- Step 3: Identity Confirmation – Upload a government-issued identification document (passport, driver’s license, or national ID). This Know Your Customer (KYC) process ensures compliance with anti-money laundering protocols.

- Step 4: Account Funding – A minimum deposit requirement applies to activate trading functions. The minimum deposit typically begins at USD 250, ensuring initial capital is available for market entry.

- Step 5: Dashboard Access – Upon confirmation, the participant gains access to the main dashboard where assets, settings, and performance statistics are displayed.

- Step 6: Strategy Configuration – Define risk parameters, select assets, and configure trading strategies within the customizable system interface.

- Step 7: Activation of Automated Trading – The algorithmic engine executes strategies in real time once activated, allowing structured observation of trades and outcomes.

This process combines transparency with efficiency, ensuring that participants are securely integrated into the ecosystem without ambiguity. Each stage reflects compliance with established regulatory frameworks while aligning with technological precision.

Trade Smarter with Highmark Bitspire AI Signals – United Kingdome Report Inside

How Does Highmark Bitspire Work?

Highmark Bitspire functions on a hybrid operational model that merges artificial intelligence, algorithmic logic, and data analytics. At its foundation, the platform continuously collects real-time market data streams. These include pricing fluctuations, order book depth, volume activity, and global financial news. The system processes this input through its AI-driven engine, where predictive models identify possible entry and exit points.

Once conditions match predefined strategies, the algorithm automatically executes transactions. Execution occurs within milliseconds to ensure accuracy against volatile market movements. By leveraging machine learning models, Highmark Bitspire improves its predictive capacity over time. Patterns identified in historical performance are used to refine outcomes in future operations, creating a feedback loop of increasing precision.

An additional element is risk calibration. Each participant can set thresholds for drawdowns, stop-losses, and exposure limits. The automated system adheres strictly to these rules, thereby enforcing discipline that might otherwise be disrupted by human emotion or error.

Operational visibility is provided through an integrated dashboard, where all ongoing activities are tracked in real time. This includes live trade data, profit and loss statistics, and historical records for analytical review.

Highmark Bitspire does not operate as a static system but as a dynamic engine, adjusting its logic to evolving markets while retaining its foundational architecture. By unifying automation, learning algorithms, and strict compliance, it demonstrates a technical process rooted in transparency and factual execution.

Discover How Highmark Bitspire is Helping Thousands Achieve Financial Freedom Online

From Beginner to Pro: Guided Onboarding, 24/7 Support, and Intuitive Design

Highmark Bitspire is structured to provide a seamless experience for both first-time entrants and advanced professionals. The onboarding journey includes guided walkthroughs that explain how to navigate the dashboard, configure strategies, and monitor performance. These guides are structured within the platform’s interface and are supplemented by step-by-step tutorials that reduce the complexity of initial setup.

The availability of 24/7 support infrastructure ensures operational assistance at all times. Communication channels include live chat, secure email, and dedicated support lines. Queries ranging from account configuration to technical issues are addressed by trained teams familiar with both the technology and the compliance requirements of the system. This continuity of service projects reliability in an environment where timing and accuracy are essential.

The intuitive design of Highmark Bitspire reflects its emphasis on accessibility. Navigation panels are structured logically, with functions such as strategy setup, portfolio review, and withdrawal requests easily located. Real-time notifications and alerts are integrated into the system, ensuring that participants remain updated without the need to manually refresh or search for information.

For professionals, advanced configuration tools enable detailed adjustments, while beginners benefit from simplified menus and pre-structured templates. This dual approach ensures that the same infrastructure can support varied levels of expertise without creating complexity barriers.

In essence, Highmark Bitspire applies user-centric design and comprehensive support measures to create a system where efficiency is not limited to execution but extends to every interaction. Whether the requirement is clarity, assistance, or advanced customization, the framework has been constructed to accommodate these needs in a structured manner.

Why Choose Highmark Bitspire? UK Consumer Report Released Here

Regulated, Transparent, and Secure: Why Highmark Bitspire Earns Trust in 2025

In 2025, financial platforms are judged by their ability to demonstrate alignment with regulation, transparency, and operational security. Highmark Bitspire establishes these principles as core components of its identity.

Regulatory Alignment: The system complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, ensuring that all participants are verified before activity commences. These steps confirm that access is limited to legitimate users and align the platform with international standards.

Transparency in Reporting: The platform provides factual records of executed trades, transaction histories, and account statements. By presenting verifiable data, it removes ambiguity from operations. Latency times, uptime performance, and execution success rates are periodically published to reflect the infrastructure’s reliability.

Security Protocols: Multi-layer protection, including encryption, two-factor authentication, and intrusion detection systems, safeguards the system against external interference. Periodic audits confirm that standards are upheld consistently across the infrastructure.

Highmark Bitspire’s credibility in 2025 is not framed as a subjective perception but as a measurable alignment with global expectations. Its structured compliance process, factual reporting, and technological safeguards contribute to its positioning as a platform that demonstrates trust through actions rather than claims.

Highmark Bitspire – Cost, Minimum Deposit, and Profit

The structure of Highmark Bitspire includes defined parameters for cost and capital requirements. Access begins with a minimum deposit of USD 250, which activates the account and enables trading functionality. This figure represents the baseline capital required for engagement, aligning with standard practices across regulated platforms.

Operational costs are transparent and disclosed prior to activation. These may include spreads on transactions, potential withdrawal fees depending on method, and maintenance charges linked to account activity. By disclosing these figures upfront, Highmark Bitspire removes ambiguity from financial engagement.

Profitability within the system is determined by a combination of market conditions, strategy configuration, and algorithmic execution. Highmark Bitspire does not issue speculative profit guarantees but instead provides tools that ensure factual execution of strategies. Historical back-testing results are made available, demonstrating how models would have performed under past market conditions. This enables participants to evaluate the performance potential of their configurations in a transparent manner.

Withdrawal mechanisms are structured for speed and compliance. Requests are typically processed within 24 to 48 hours, depending on the method selected, and are subject to verification checks to ensure security.

Through this structure of minimum capital, disclosed costs, and factual reporting of outcomes, Highmark Bitspire emphasizes transparency in its financial operations. Participants are given a clear understanding of entry requirements, operational expenses, and the role of strategy in influencing results.

Open Your Highmark Bitspire Account for Free Now

Countries Where Highmark Bitspire Is Legal

Highmark Bitspire’s operations are defined by adherence to jurisdictional regulations. The platform applies compliance protocols in regions where trading activity is legally recognized and permitted under financial law. Its infrastructure is accessible in multiple territories across Europe, Asia, Oceania, and the Americas, provided local regulations allow digital financial trading platforms.

In markets such as the European Union & United Kingdom, operations are structured to align with MiFID II guidelines, ensuring conformity with directives governing financial markets. Within Asia-Pacific regions, country-specific laws regarding forex and digital asset trading are followed closely. North and South America access is available in countries where trading platforms of this nature are sanctioned under national law.

The platform explicitly restricts access in jurisdictions where online trading platforms are prohibited or subject to unresolved legal frameworks. This ensures that all operations remain within lawful boundaries. During registration, the system automatically verifies location and applies restrictions when necessary, preventing unauthorized or non-compliant access.

By structuring availability around compliance rather than open accessibility, Highmark Bitspire underscores its commitment to legality and regulatory alignment. This controlled access reinforces its position as a system that prioritizes lawful operation above unrestricted entry.

Unlock smarter trading with Highmark Bitspire — Visit the Official Website Here

Highmark Bitspire Supported Assets

Highmark Bitspire supports a diverse range of asset classes within a single integrated environment. This structure reflects the growing requirement for platforms to provide cross-market exposure.

Forex Markets: Currency pairs remain a central component, covering major, minor, and selected exotic pairs. The AI engine processes data such as interest rate changes, economic releases, and geopolitical factors to calibrate strategies.

Commodities: Gold, silver, oil, and agricultural products are integrated into the framework. These assets allow diversification beyond currencies and are supported by real-time analytics within the system.

Indices: Global equity indices are included, offering access to aggregated market performance across different regions. The platform tracks fluctuations influenced by macroeconomic indicators and corporate earnings.

Cryptocurrencies: Recognizing digital assets as a significant market, Highmark Bitspire supports trading across leading cryptocurrencies. Real-time blockchain data and exchange feeds are incorporated into the AI models.

By consolidating multiple asset classes under one infrastructure, Highmark Bitspire simplifies portfolio management. Each class is integrated into the same dashboard, ensuring uniform reporting and analytical continuity.

Visit Highmark Bitspire Official Website

Hidden Risks of Highmark Bitspire — What Every Investor Should Know

While Highmark Bitspire is structured around security and compliance, it is important to recognize inherent risks associated with financial markets. The platform itself functions within regulatory standards, yet risks arise primarily from market volatility, strategy misconfiguration, and external variables beyond system control.

Market Volatility: Highmark Bitspire executes trades in real time, but extreme volatility can lead to rapid fluctuations. Even with automated systems, sudden events may impact outcomes differently than predicted.

Strategy Misconfiguration: Participants define their own parameters for risk management. Incorrectly set thresholds or over-leveraged strategies can produce results inconsistent with intended outcomes. The platform enforces rules as programmed, without deviation.

Regulatory Shifts: Legal frameworks for financial platforms continue to evolve globally. A sudden change in local regulation may affect accessibility in certain jurisdictions.

Technical Dependencies: While redundancy protocols exist, any digital platform remains reliant on infrastructure. External factors such as internet connectivity or third-party service disruptions may temporarily influence access.

Highmark Bitspire acknowledges these risks within its disclosures and emphasizes transparency in highlighting them. By recognizing these factors, participants can engage with greater awareness and apply structured strategies designed to mitigate potential challenges.

Highmark Bitspire – Final Verdict

Highmark Bitspire emerges in 2025 as a structured, AI-driven trading infrastructure defined by transparency, security, and compliance. Its framework integrates multi-asset support, predictive algorithms, and measurable performance metrics into a single cohesive system. Unlike speculative platforms that operate without clear boundaries, Highmark Bitspire establishes its credibility through adherence to international standards, factual reporting, and multi-layered safeguards.

Its operational model highlights both technological advancement and regulatory alignment. From encrypted data channels to automated risk management tools, each component reinforces its commitment to secure, efficient execution. In its final assessment, Highmark Bitspire positions itself not simply as another digital interface but as a comprehensive trading infrastructure that combines advanced algorithms, measurable performance data, and multi-layered security. In an environment where credibility is paramount, its structured approach establishes it as a platform that seeks to define standards of reliability, transparency, and compliance in 2025 and beyond.

Visit Here to Register on the Highmark Bitspire – Select Your Country Here!!!

Contact:-

Highmark Bitspire

485 Bd de la Gappe, Gatineau, QC J8T 5T9, Canada

Phone Support: Highmark Bitspire Canada: +1 (437) 920-9751

Email: info@ highmark-bitspire.net

Website: https://highmark-bitspire.net/

General Disclaimer:

The content provided in this article is for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Readers are advised to consult a certified financial advisor, licensed loan officer, or legal professional before making any financial decisions. The information presented may not apply to every individual circumstance and is not intended to substitute professional judgment or regulatory guidance. The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. We does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Trading Disclaimer:

Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with cryptocurrency trading, and seek advice from an independent financial advisor. ICO’s, IEO’s, STO’s and any other form of offering will not guarantee a return on your investment.

HIGH RISK WARNING: Dealing or Trading FX, CFDs and Cryptocurrencies is highly speculative, carries a level of non-negligible risk and may not be suitable for all investors. You may lose some or all of your invested capital, therefore you should not speculate with capital that you cannot afford to lose. Please refer to the risk disclosure below. Highmark Bitspire does not gain or lose profits based on your activity and operates as a services company. Highmark Bitspire is not a financial services firm and is not eligible of providing financial advice. Therefore, Highmark Bitspire shall not be liable for any losses occurred via or in relation to this informational website.

SITE RISK DISCLOSURE: Highmark Bitspire does not accept any liability for loss or damage as a result of reliance on the information contained within this website; this includes education material, price quotes and charts, and analysis. Please be aware of and seek professional advice for the risks associated with trading the financial markets; never invest more money than you can risk losing. The risks involved in FX, CFDs and Cryptocurrencies may not be suitable for all investors. Highmark Bitspire doesn”t retain responsibility for any trading losses you might face as a result of using or inferring from the data hosted on this site.

LEGAL RESTRICTIONS: Without limiting the above mentioned provisions, you understand that laws regarding financial activities vary throughout the world, and it is your responsibility to make sure you properly comply with any law, regulation or guideline in your country of residence regarding the use of the Site. To avoid any doubt, the ability to access our Site does not necessarily mean that our Services and/or your activities through the Site are legal under the laws, regulations or directives relevant to your country of residence. It is against the law to solicit UK individuals to buy and sell commodity options, even if they are called “prediction” contracts, unless they are listed for trading and traded on a CFTC-registered exchange unless legally exempt. The Financial Conduct Authority has issued a policy statement PS20/10, which prohibits the sale, promotion, and distribution of CFD on Crypto assets. It prohibits the dissemination of marketing materials relating to distribution of CFDs and other financial products based on

Cryptocurrencies that addressed to United Kingdom residents. The provision of trading services involving any MiFID II financial instruments is prohibited in the EU, unless when authorized/licensed by the applicable authorities and/or regulator(s). Please note that we may receive advertising fees for users opted to open an account with our partner advertisers via advertisers websites. We have placed cookies on your computer to help improve your experience when visiting this website. You can change cookie settings on your computer at any time. Use of this website indicates your acceptance of this website. Please be advised that the names depicted on our website, including but not limited to Highmark Bitspire, are strictly for marketing and illustrative purposes. These names do not represent or imply the existence of specific entities, service providers, or any real-life individuals. Furthermore, the pictures and/or videos presented on our website are purely promotional in nature and feature professional actors. These actors are not actual users, clients, or traders, and their depictions should not be interpreted as endorsements or representations of real-life experiences. All content is intended solely for illustrative purposes and should not be construed as factual or as forming any legally binding relationship

RISKS ASSOCIATED WITH FUTURES TRADING

Futures transactions involve high risk. The amount of the initial margin is low compared to the value of the futures contract, so that transactions are “leveraged” or “geared”. A relatively small market movement has a proportionately larger impact on the funds that you have deposited or have to pay: this can work both for you and against you. You may experience the total loss of the initial margin funds as well as any additional funds deposited in the system. If the market develops in a way that is contrary to your position or if margins are increased, you may be asked to pay significant additional funds at short notice to maintain your position. In this case it may also happen that your broker account is in the red and you thus have to make payments beyond the initial investment.

RISKS ASSOCIATED WITH ELECTRONIC TRADING

Before you begin carrying out transactions with an electronic system, you should carefully review the rules and provisions of the stock exchange offering the system, or of the financial instruments listed that you intend to trade, as well as your broker’s conditions. Online trading has inherent risks due to system responses/reaction times and access times that may vary due to market conditions, system performance and other factors, and on which you have no influence. You should be aware of these additional risks in electronic trading before you carry out investment transactions.

Accuracy Disclaimer:

All information included in this article is presented in good faith and believed to be accurate at the time of writing. However, no representations or warranties are made regarding the completeness, accuracy, reliability, or timeliness of any information presented. Any reliance placed on such information is strictly at the reader’s own risk. The publisher does not accept responsibility for typographical errors, outdated information, or changes to products, terms, or policies after publication.

Regulatory and Jurisdictional Disclaimer:

Lending laws vary by jurisdiction, and not all services described in this article may be available in every state or region. It is the responsibility of the reader to understand and comply with local laws and regulations. The platforms mentioned are independently operated and are not controlled or endorsed by the publisher.

Third-Party Liability Waiver:

The publisher, its writers, editors, affiliates, and syndication partners shall not be held liable for any direct or indirect loss, damages, or legal claims arising from the use of this content or from reliance on any third-party services, platforms, or products mentioned herein. All loan agreements, terms, and disputes are strictly between the borrower and the lender or service provider.

Syndication Partner Use:

This content may be republished or syndicated by authorized partners under existing licensing or distribution arrangements. All syndication partners are free from liability regarding the editorial stance, financial suggestions, or any user outcome resulting from the reading or application of this content.

Attachment