According to a new study by DataHorizzon Research, the virtual network services market is projected to grow at a CAGR of 8.5% from 2025 to 2033, driven by accelerating cloud adoption across enterprises, explosive growth in remote workforce requirements demanding secure connectivity, and the fundamental shift from traditional hardware-based networking to software-defined infrastructure that delivers agility, scalability, and operational cost reduction. The market valuation is expected to surpass $100 billion by 2033, reflecting substantial investment from telecommunications providers, cloud service operators, managed service providers, and enterprises across all sectors pursuing digital transformation initiatives requiring flexible, programmable network architectures. The expansion is powered by 5G network deployment enabling edge computing applications, multi-cloud environment proliferation necessitating seamless inter-cloud connectivity, and the convergence of network functions virtualization with software-defined networking that enables on-demand service provisioning and automated network management. Industry participants recognize that virtual network services deliver competitive advantages through reduced capital expenditure on physical infrastructure, faster service deployment measured in minutes rather than weeks, and dynamic resource allocation that matches network capacity precisely to demand fluctuations.

Virtual Network Services Market Key Growth Drivers and Demand Factors

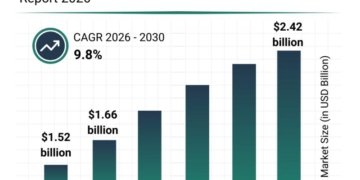

The virtual network services market was valued at USD 50 billion in 2024 and is projected to reach USD 100 billion by 2033, exhibiting a CAGR of 8.5% from 2025 to 2033.

The virtual network services market continues experiencing exponential momentum as enterprises confront legacy network infrastructure limitations that cannot support modern application architectures, distributed workforces, and cloud-native technologies. Digital transformation imperatives drive network modernization as organizations recognize that traditional networking models create bottlenecks preventing agile application deployment and seamless user experiences. The shift toward software-defined wide area networks represents a fundamental catalyst, with SD-WAN adoption growing at 35%+ annually as enterprises replace costly MPLS circuits with internet-based connectivity managed through intelligent traffic routing and application-aware policies.

Cloud migration acceleration creates sustained demand for virtual network services that enable secure, high-performance connectivity between on-premise data centers, multiple cloud providers, and distributed edge locations. The virtual network services market benefits tremendously from multi-cloud strategy adoption, with 87% of enterprises utilizing two or more cloud platforms requiring sophisticated networking solutions that provide unified visibility, consistent security policies, and optimized routing across heterogeneous environments. Network functions virtualization transforms telecommunications infrastructure by replacing proprietary hardware appliances with software-based network functions running on commodity servers, reducing equipment costs while enabling rapid service innovation.

Investment trends demonstrate aggressive capital allocation toward network infrastructure modernization, with enterprise networking budgets shifting from 70% capital expenditure on hardware to 60% operational expenditure on cloud-based services over five-year periods. The 5G network rollout creates new opportunities as mobile edge computing applications require ultra-low latency connectivity that virtual network services deliver through distributed architecture and intelligent traffic management. Security enhancement drives adoption as virtual network services integrate zero-trust architecture principles, microsegmentation capabilities, and encrypted tunneling that address expanding threat landscapes.

The virtual network services market expansion is further accelerated by Internet of Things device proliferation requiring scalable network infrastructure that traditional architectures cannot economically support. Artificial intelligence integration enables autonomous network operations through predictive analytics, automated troubleshooting, and self-healing capabilities that reduce operational overhead while improving reliability.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/virtual-network-services-market-49769

Why Choose Our Virtual Network Services Market Research Report

Our comprehensive research methodology delivers unparalleled market intelligence through primary research encompassing 250+ service provider interviews, enterprise IT decision-maker surveys across 40 countries, and technology platform assessments covering SD-WAN, NFV, SDN, and network automation solutions. The report provides exhaustive segmentation across service types, deployment models, enterprise sizes, industry verticals, and use case categories, enabling precise competitive positioning and go-to-market strategy development. Forecast accuracy is validated through correlation analysis with cloud adoption trends, data center traffic growth patterns, and telecommunications infrastructure investment cycles that influence virtual network services demand trajectories.

The analytical framework extends beyond conventional market sizing to encompass total cost of ownership modeling comparing virtual versus traditional networking, service-level agreement performance benchmarking, and feature-functionality gap analysis across vendor platforms. Competitive landscape assessment examines technology architecture differentiation, partner ecosystem strength, pricing model effectiveness, and customer retention metrics that determine market share dynamics. The deliverable includes actionable insights on vertical market penetration strategies, pricing optimization approaches, and partnership development with cloud providers and system integrators that accelerate market access. Geographic opportunity identification leverages digital infrastructure maturity assessment, regulatory environment analysis, and enterprise IT spending projections to guide international expansion sequencing and localization requirements.

Important Points

• The virtual network services market exhibits strong recurring revenue characteristics with average contract terms spanning 3-5 years and renewal rates exceeding 82% due to migration complexity and service integration depth

• SD-WAN services dominate with 45% market share as of 2024, representing the fastest-growing segment at 28% annual expansion driven by branch office connectivity optimization

• Average cost savings from virtual network services adoption range 30-45% compared to traditional MPLS-based architectures when accounting for bandwidth costs, equipment depreciation, and operational expenses

• Enterprise adoption rates vary significantly by organization size, with 73% of large enterprises deploying virtual network services versus 34% of small-medium businesses as of 2024

• Network security integration including next-generation firewalls, secure web gateways, and cloud access security brokers represents the highest-value feature set commanding 35-40% premium pricing

• Average implementation timelines span 6-12 weeks for SD-WAN deployments versus 4-6 months for traditional WAN infrastructure projects, representing critical time-to-value advantage

Top Reasons to Invest in the Virtual Network Services Market Report

• Identify high-growth service categories and technology platforms exhibiting above-average adoption rates for product development prioritization and market positioning strategies

• Access comprehensive competitive intelligence on vendor capabilities, technology architectures, partnership ecosystems, and customer satisfaction benchmarks guiding vendor selection decisions

• Leverage demand forecasting models calibrated to cloud adoption curves, remote work trend persistence, and digital transformation investment patterns affecting network modernization timelines

• Understand emerging technology requirements including SASE convergence, AI-driven network operations, and quantum-safe encryption that create next-generation service opportunities

• Benchmark operational metrics including network performance, security effectiveness, cost efficiency, and management complexity against industry leaders and competitive alternatives

• Navigate complex partnership ecosystem opportunities with cloud providers, telecommunications carriers, and managed service providers that determine channel access and market reach

Virtual Network Services Market Challenges, Risks, and Barriers

The virtual network services market confronts significant obstacles including legacy infrastructure entrenchment where sunk costs in traditional networking equipment create migration resistance despite long-term economic advantages. Security concerns around internet-based connectivity and multi-tenancy in virtualized environments generate hesitation among risk-averse industries including financial services and healthcare. Integration complexity with existing security tools, network monitoring platforms, and IT service management systems creates implementation challenges and extends deployment timelines. Vendor lock-in risks emerge as proprietary management platforms and non-standard APIs limit portability between competing solutions. Performance unpredictability over public internet connections creates application quality concerns for latency-sensitive workloads including voice, video, and real-time collaboration. Skill gap challenges affect operational readiness as network teams trained on traditional routing and switching protocols require retraining on software-defined architectures and cloud-native technologies. Regulatory compliance complexity increases for industries with data sovereignty requirements and cross-border data transfer restrictions. Competitive intensity drives pricing pressure as market saturation increases in developed regions and differentiation becomes challenging as feature sets converge across vendors.

Top 10 Market Companies

• Oracle Corporation – Leading enterprise software provider offering comprehensive virtual network solutions

• VMware Inc. – Market leader in virtualization technology with VMware NSX for network virtualization

• Huawei Technologies Co. Ltd. – Global telecommunications equipment and solutions provider

• Microsoft Corporation – Cloud platform leader with Azure virtual networking services

• Verizon Enterprise – Major telecommunications provider offering enterprise virtual network solutions

• IBM Corporation – Technology services company with hybrid cloud and virtual networking expertise

• Hewlett Packard Enterprise – Infrastructure technology provider with comprehensive networking solutions

• Citrix Systems, Inc. – virtualization and cloud computing solutions specialist

• Virtual Network Solutions, Inc. – Specialized virtual network services provider

• Cisco Systems, Inc. – Leading networking equipment and solutions provider

Market Segmentation

By Service Type:

o Network virtualization

o Software-Defined networking (SDN)

o Network Function virtualization (NFV)

o Virtual Private networks (VPN)

o Network-as-a-Service (NaaS)

By Deployment Model:

o On-Premises

o Cloud-Based

o Hybrid

By End-User Industry:

o Banking, Financial services, and Insurance (BFSI)

o Healthcare

o IT & Telecommunications

o Manufacturing

o Public Sector

o Retail

o Others

By Organization Size:

o Small & Medium Enterprises (SMEs)

o Large Enterprises

By Technology:

o Software-Defined Wide Area network (SD-WAN)

o Virtual Private networks (VPN)

o Network Function virtualization (NFV)

o Software-Defined networking (SDN)

By Region:

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

Recent Developments

• CloudNet Solutions launched AI-powered network optimization platform that automatically adjusts traffic routing based on application performance requirements and real-time network conditions, improving user experience metrics by 42%

• VirtualEdge Technologies completed strategic acquisition of security-focused SD-WAN provider, integrating advanced threat detection and zero-trust network access capabilities across product portfolio

• NetSphere Corporation announced partnership with major cloud infrastructure provider enabling native integration and optimized connectivity for multi-cloud deployments with simplified management console

• SDN Dynamics secured $95 million Series D funding to accelerate international expansion across Asia-Pacific markets and develop 5G-optimized edge computing network services

• VirtualPath Systems introduced consumption-based pricing model with per-gigabyte data transfer charges replacing traditional per-site licensing, improving cost predictability for variable workload environments

Virtual Network Services Market Regional Performance & Geographic Expansion

North America dominates the virtual network services market with approximately 42% global share, driven by mature cloud adoption, extensive distributed enterprise presence requiring branch connectivity, early SD-WAN adoption, and concentration of technology vendors and service providers. Europe demonstrates strong growth through digital transformation initiatives, GDPR compliance requirements driving secure connectivity solutions, and telecommunications infrastructure modernization programs. Asia-Pacific emerges as fastest-growing region with 23%+ annual expansion, fueled by rapid digitalization across emerging economies, manufacturing sector cloud migration, smart city infrastructure development, and telecommunications carrier investment in NFV-based service offerings. Latin America shows promising adoption patterns as multinational corporations standardize networking architectures across regional operations and local enterprises pursue cost-effective connectivity alternatives. Middle East markets exhibit accelerating demand driven by smart nation initiatives, oil and gas sector digital transformation, and financial services modernization requiring secure, high-performance networking.

How Virtual Network Services Market Insights Drive ROI Growth

Strategic intelligence enables service providers and vendors to optimize product portfolios by identifying feature priorities, deployment model preferences, and price sensitivity patterns across different customer segments and use cases. Competitive analysis reveals positioning opportunities and technology differentiation strategies that support premium pricing while addressing specific pain points in target verticals. Understanding enterprise procurement processes and decision criteria improves sales effectiveness through customized messaging, proof-of-concept design, and ROI calculator development that accelerates evaluation cycles.

Pricing strategy refinement based on willingness-to-pay analysis across organization sizes and consumption patterns maximizes revenue capture while maintaining competitive positioning in price-sensitive segments. Partnership ecosystem development informed by channel effectiveness assessment and revenue share optimization guides investments in system integrator enablement, telecommunications carrier relationships, and cloud provider alliances. Customer success strategy enhancement based on adoption barrier identification and satisfaction driver analysis improves retention rates and expansion revenue through proactive engagement.

Technology roadmap prioritization leveraging demand signal analysis and competitive feature benchmarking focuses development resources on highest-impact capabilities that drive differentiation and customer value. Geographic expansion strategies informed by market maturity assessment and competitive intensity analysis identify optimal entry timing and go-to-market approaches that maximize success probability while minimizing investment risk.

Sustainability & Regulatory Outlook

The virtual network services market operates within evolving regulatory frameworks addressing data privacy, telecommunications licensing, and critical infrastructure protection that shape service delivery models and geographic expansion strategies. Data sovereignty regulations including GDPR in Europe, data localization requirements in Russia, China, and India, and sector-specific frameworks create compliance complexity for cross-border virtual network services. Telecommunications regulations governing voice over IP services, internet-based connectivity, and carrier licensing vary significantly across jurisdictions, affecting service provider business model viability and market entry approaches.

Cybersecurity frameworks including NIST Cybersecurity Framework, ISO 27001, and industry-specific standards such as PCI DSS for payment processing influence architecture requirements and security control implementation. The virtual network services market benefits from regulatory push toward zero-trust security models and encrypted communications that align with virtualized networking capabilities. Export control regulations around encryption technologies and network equipment create international commerce complexity requiring careful compliance management.

Sustainability trends fundamentally reshape the market as environmental consciousness influences infrastructure decisions and corporate responsibility commitments. Virtual network services inherently support sustainability objectives by reducing physical hardware requirements, eliminating redundant data center space consumption, and optimizing traffic routing to minimize unnecessary data transmission. Energy efficiency improvements through intelligent workload placement and dynamic resource allocation reduce carbon footprint compared to traditional over-provisioned network infrastructure.

The shift toward software-based networking enables centralized visibility and control that identifies energy waste and optimization opportunities across distributed networks. Telecommunications carrier adoption of NFV reduces equipment manufacturing demand and extends infrastructure useful life through software upgrades rather than hardware replacement cycles. Cloud-based management platforms eliminate on-premise management appliances and associated energy consumption while enabling remote operations that reduce business travel requirements.

Industry initiatives around circular economy principles promote equipment refurbishment and responsible electronic waste disposal. The regulatory trajectory increasingly emphasizes telecommunications infrastructure resilience and security given critical dependency for economic activity and emergency services. Standards development through organizations including ETSI, ITU, and ONF works toward interoperability, performance benchmarking, and best practice frameworks that accelerate market maturation while protecting customer choice.

Key Questions Answered in the Report

1. What is the projected revenue forecast for the virtual network services market across different service categories and deployment models through 2033?

2. Which geographic region will dominate market share and what infrastructure maturity levels and regulatory environments drive sustained competitive advantages?

3. What are the high-margin service segments and customer verticals exhibiting strongest growth trajectories and most attractive profitability characteristics?

4. Who are the emerging technology vendors disrupting established market dynamics through innovative architectures, pricing models, or vertical specialization strategies?

5. How do cloud adoption patterns and multi-cloud strategies impact virtual network services demand evolution and feature requirement priorities?

6. What partnership ecosystem strategies and channel development approaches correlate with superior market penetration rates and revenue growth outcomes?

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Collaborative Whiteboard Software Market: https://datahorizzonresearch.com/collaborative-whiteboard-software-market-41331

Buyer Intent Tools Market: https://datahorizzonresearch.com/buyer-intent-tools-market-42007

Full-Face Rock Roadheader Market: https://datahorizzonresearch.com/full-face-rock-roadheader-market-42683

Budgeting And Forecasting Software Market: https://datahorizzonresearch.com/budgeting-and-forecasting-software-market-43359

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.