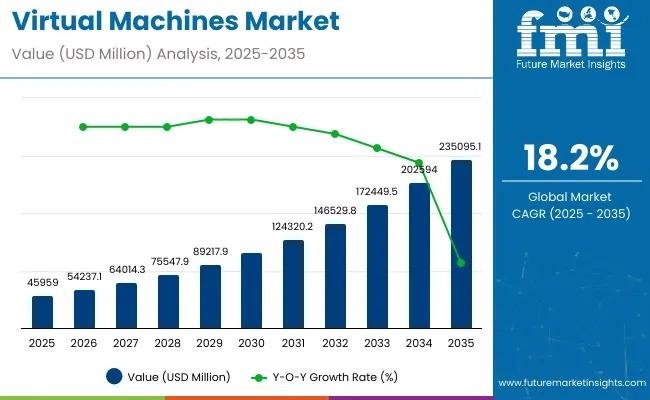

The global Virtual Machines (VM) market is entering a transformative growth phase, projected to expand from USD 45,959.0 million in 2025 to USD 235,095.1 million by 2035, reflecting a robust compound annual growth rate (CAGR) of 18.2%. The acceleration underscores virtualization’s central role in cloud computing, hybrid infrastructure, AI-driven workloads, and regulatory-compliant digital ecosystems.

As enterprises modernize IT estates and scale cloud-native environments, virtual machines have become foundational to operational resilience, cybersecurity strategy, and digital transformation execution. The market’s upward trajectory is closely aligned with cloud adoption, AI integration, cybersecurity mandates, and cross-border data governance requirements.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-1490

Cloud-First Strategies Fuel Market Expansion

The shift from capital-intensive hardware investments to scalable, cloud-based virtual infrastructure continues to redefine enterprise computing. Organizations increasingly deploy cloud-based VMs to:

• Dynamically scale computing resources

• Reduce capital expenditures

• Improve operational efficiency

• Enable hybrid and multi-cloud architectures

During peak operational cycles, businesses can provision additional VMs in minutes and decommission them when demand normalizes, optimizing cost structures and infrastructure utilization. Public-sector initiatives such as the U.S. federal government’s “Cloud Smart” strategy further reinforce the prioritization of cloud adoption, procurement modernization, and IT security readiness.

Hybrid and multi-cloud environments are evolving from optional frameworks to strategic necessities. Enterprises are now distributing workloads across private clouds, hyperscale public cloud providers, and on-premise infrastructure to enhance flexibility and mitigate vendor dependency risks.

Regulatory Pressures Elevate VM Risk Management Requirements

As virtual machines increasingly process sensitive personal, healthcare, financial, and government data, compliance obligations have intensified. Regulations such as the EU’s GDPR, California’s CCPA, and industry-specific mandates including HIPAA and PCI DSS require strict governance of virtualized environments.

Organizations must now ensure:

• Jurisdictional data residency compliance

• Secure hypervisor configurations

• Encryption at rest and in transit

• Real-time monitoring of VM-based infrastructures

• Automated compliance auditing mechanisms

Cross-border data transfer frameworks and digital sovereignty laws in markets such as India, China, and Russia further complicate cloud deployment strategies. Enterprises must align VM deployments with local hosting mandates and evolving digital governance structures.

Risk management in VM environments is no longer limited to internal safeguards. Third-party vendor risk assessment, vulnerability scanning, and automated compliance validation tools have become critical as reliance on outsourced cloud and IT service providers deepens.

Cybersecurity Becomes a Core Growth Catalyst

The rapid expansion of virtualized ecosystems has heightened exposure to sophisticated cyber threats, including hypervisor exploits, VM sprawl, unauthorized lateral movement, and malware infiltration.

Organizations are deploying advanced risk management tools capable of:

• Continuous real-time vulnerability monitoring

• Behavioral anomaly detection

• AI-powered threat prediction

• Secure configuration management

Emerging trends point toward quantum-resistant encryption and AI-optimized virtualization frameworks designed to safeguard next-generation computing environments. Machine learning-based intrusion detection systems are being integrated into VM management layers to predict attack vectors and reduce breach exposure.

The heightened focus on cybersecurity directly supports premium spending on secure, automated, and resilient VM infrastructures.

Strategic Investments Signal Infrastructure Consolidation

Major strategic transactions underscore the market’s consolidation momentum. In December 2024, IBM agreed to acquire HashiCorp for USD 6.4 billion, strengthening its cloud infrastructure automation capabilities and reinforcing enterprise-grade virtualization management offerings. Such developments reflect the strategic importance of infrastructure-as-code, automation platforms, and scalable cloud governance solutions in the broader virtualization ecosystem.

The vendor landscape remains moderately to highly concentrated, with Tier-1 players maintaining strong market control through integrated portfolios, global infrastructure footprints, and continuous innovation. Tier-2 and Tier-3 providers compete through niche specialization, open-source platforms, and agile deployment models.

Country-Level Growth Highlights

India leads global growth, driven by SME adoption of open-source virtualization platforms under government-backed initiatives such as Digital India and the National Cloud Initiative. China follows closely, supported by its “New Infrastructure” strategy and data center expansion programs, including the “East Data, West Computing” initiative.

The United States maintains significant market share, underpinned by investments in high-performance computing, AI research, and next-generation VM architectures. Federal funding allocations exceeding USD 1.2 billion toward AI-focused HPC research have accelerated VM-based infrastructure deployment by an estimated 30% for compute-intensive applications.

Segment Leadership: Process/Application VMs and IT & Telecom

Process/Application Virtual Machines represent one of the fastest-growing segments, projected to expand at a CAGR exceeding 20% through 2035. The rise of containerization technologies such as Docker and Kubernetes has accelerated demand for lightweight virtualization environments that enable rapid application deployment across heterogeneous infrastructures.

Industry-wise, IT & Telecom dominates with a 36.4% value share in 2025. Telecom operators increasingly leverage virtualization to support 5G network deployment, reduce hardware dependency, and enable scalable digital services. Government-backed telecom modernization programs, including USD 1.5 billion allocated for 5G infrastructure expansion in India, further amplify VM demand.

Complexity and Integration Challenges Persist

Despite strong growth, deployment complexity remains a barrier for some organizations. Hypervisor configuration, network allocation, workload orchestration, and integration with legacy systems require deep technical expertise.

Enterprises must invest in skilled personnel or third-party managed services to ensure optimal resource allocation, security posture, and operational efficiency. Poor configuration can result in inefficiencies, performance bottlenecks, and increased vulnerability exposure.

Orchestration tools and AI-powered VM management platforms are expected to reduce operational complexity in the next decade, enabling autonomous workload optimization and intelligent resource distribution.

Exhaustive Market Report: A Complete Study

https://www.futuremarketinsights.com/reports/virtual-machine-market

Market Outlook Through 2035

Between 2020 and 2024, the VM market was shaped by data localization mandates, hybrid cloud adoption, and encrypted virtualization. From 2025 onward, the focus shifts toward AI-powered virtualization, autonomous multi-cloud orchestration, decentralized governance models, and quantum-secure cybersecurity frameworks.

The projected rise to USD 235.1 billion by 2035 reflects:

• Accelerated enterprise digital transformation

• Expansion of AI and high-performance computing workloads

• Heightened regulatory enforcement

• Increasing reliance on cloud-native virtualization

• Growth of secure, compliant virtual infrastructure environments

As virtualization evolves into an AI-optimized, compliance-driven foundation for digital ecosystems, market participants that combine security leadership, automation capability, and scalable cloud integration will capture disproportionate growth.

Comprehensive analysis, competitive benchmarking, segmentation forecasts, regulatory mapping, and investment outlooks are detailed in the full market intelligence report.

Similar Industry Reports

Demand for Virtual Machines in Japan

https://www.futuremarketinsights.com/reports/japan-virtual-machines-market

Demand for Virtual Machines in USA

https://www.futuremarketinsights.com/reports/united-states-virtual-machines-market

Virtual Sleep Clinics Market

https://www.futuremarketinsights.com/reports/virtual-sleep-clinics-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.