Introduction

The US short-term care insurance (STCI) market has seen rapid growth as an affordable alternative to traditional long-term care (LTC) insurance. Short-term care insurance provides coverage for a limited time, typically up to a year, and serves as a flexible solution for those requiring temporary care due to injury, surgery recovery, or other short-term health issues. In light of rising healthcare costs, increased awareness, and a growing aging population, the demand for short-term care insurance has accelerated. This report offers a detailed analysis of the US short-term care insurance market, exploring its growth drivers, challenges, emerging trends, technological advancements, and market segmentation.

Market Projections and Forecast

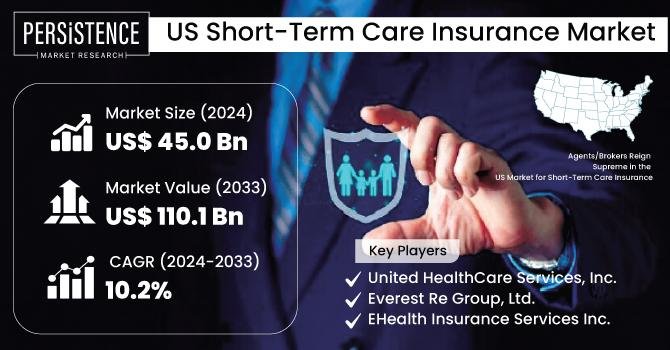

According to the latest market study published by Persistence Market Research, the US short-term care insurance market, valued at approximately US$ 45 billion in 2024, is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2033. By the end of the forecast period, the market is projected to reach a valuation of US$ 110.1 billion.

This strong growth is driven by the increasing need for flexible healthcare solutions, heightened awareness of health insurance products, and favorable government policies that encourage private insurance options. The market also benefits from an expanding senior population that is more health-conscious and seeks financially manageable healthcare coverage options.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): http://www.persistencemarketresearch.com/samples/33452

Market Dynamics

Drivers of Market Growth

Increasing Aging Population: The United States has a growing elderly population, with people aged 65 and older expected to comprise over 20% of the population by 2030. This demographic shift is driving demand for healthcare services and short-term insurance options to cover temporary medical needs and assisted living services.

Rising Healthcare Costs: Healthcare expenses continue to climb, which has made STCI an attractive option for individuals looking to cover short-term care costs without committing to the higher premiums associated with traditional long-term care insurance. STCI policies offer a cost-effective solution for individuals seeking temporary coverage.

Growing Awareness of Health Insurance Options: Increasing awareness of various health insurance products, including short-term care insurance, has positively influenced market growth. As people become more knowledgeable about healthcare planning, many are opting for short-term policies that provide flexibility and immediate support when needed.

Supportive Regulatory Environment: Recent legislative changes and regulatory support for private health insurance have helped boost the market for short-term care insurance. These policies provide people with more healthcare choices, allowing them to find affordable and suitable options for their needs.

Challenges in the Market

Despite the positive growth outlook, the US short-term care insurance market faces several challenges:

Competition from Long-Term Care Insurance (LTCI): Short-term care insurance must compete with long-term care insurance products that offer more extensive benefits. Consumers must weigh the limited coverage period of STCI against the broader, albeit more expensive, options provided by LTCI policies.

Complex Policy Structures and Lack of Standardization: The structure of STCI policies can vary widely between providers, leading to confusion among consumers. This lack of standardization and complexity in policy terms can deter potential customers from purchasing STCI plans.

Awareness and Misconceptions: Although awareness of STCI products is growing, misconceptions about coverage and policy terms persist. Educating the public about the specific benefits and limitations of short-term care insurance remains a challenge for industry stakeholders.

Market Trends and Technological Innovations

The US short-term care insurance market is influenced by several key trends and innovations:

Customization of Insurance Plans: Insurance providers are increasingly offering customizable STCI plans to meet specific customer needs. Customization allows customers to select coverage terms and options that best suit their anticipated healthcare needs, making STCI policies more attractive and accessible.

Integration of Digital Platforms for Claims Processing: The adoption of digital platforms for claims processing and policy management has streamlined operations for insurers and enhanced the customer experience. These platforms allow for quick claims approval and simplified policy management, which are essential features for short-term policies that require faster turnaround times.

Hybrid Policies with Health and Life Insurance Features: Some insurers are introducing hybrid policies that combine short-term care benefits with health and life insurance coverage. These hybrid policies offer customers a more comprehensive safety net, appealing to individuals who want broader protection at a more affordable rate than stand-alone long-term care insurance.

Focus on Telemedicine and Remote Monitoring: The COVID-19 pandemic accelerated the adoption of telemedicine and remote monitoring solutions, which are now being integrated into STCI policies. These services allow for cost-effective care management, especially beneficial for seniors and those recovering from temporary health issues. Insurers are leveraging these digital tools to expand the scope of STCI policies and enhance customer satisfaction.

US Short-Term Care Insurance Market Segmentation

By Distribution Channel:

Direct Sales

Brokers/Agents

Banks

Others

By Age Group:

Senior Citizens

Adults

Minors

By Type of Plan:

Preferred Provider Organizations (PPOs)

Point of Service (POS)

Health Maintenance Organizations (HMOs)

Exclusive Provider Organizations (EPOs)

By End User:

Groups

Individuals

Regional Analysis

The demand for short-term care insurance varies across different regions within the United States, with market growth driven by demographic and economic factors.

Northeast

The Northeast region of the US has a high concentration of elderly individuals, creating a strong demand for healthcare and insurance solutions. Rising healthcare costs and a well-informed consumer base drive the market for STCI in this region.

Midwest

In the Midwest, there is a growing demand for affordable healthcare solutions, which has led to increased adoption of short-term care insurance. Employers in this region are also more likely to offer STCI policies as part of employee benefits packages, making it a popular option for individuals and families.

South

The Southern US has a sizable elderly population and sees consistent demand for short-term healthcare options. Lower-income levels in certain states make affordable healthcare solutions, like STCI, attractive to residents who need temporary coverage options for medical and home healthcare needs.

West

The Western region, especially states like California, is seeing a rise in demand for short-term care insurance due to high healthcare costs and a large population of aging individuals. The tech-savvy population in this region is also more inclined toward digital solutions, leading to higher acceptance of online policy management and claims processing for STCI policies.

Key Companies Profiled in the Report

Aetna Inc.

Mutual of Omaha Insurance Company

Genworth Financial, Inc.

CNA Financial Corporation

Transamerica Corporation

American Fidelity Assurance Company

Medico Insurance Company

Bankers Life and Casualty Company

Equitable Life & Casualty Insurance Company

Guarantee Trust Life Insurance Company

Future Outlook

The future of the US short-term care insurance market looks promising, driven by a growing aging population, rising healthcare expenses, and evolving consumer awareness about healthcare planning. Digital transformation within the insurance sector will continue to enhance customer experience, making short-term care insurance policies more accessible and manageable for a wider audience.

As insurance companies innovate with hybrid policies, telemedicine integration, and personalized coverage plans, STCI is likely to become an increasingly popular option for those seeking flexible and affordable healthcare solutions. The expansion of digital platforms for policy and claims management will play a critical role in simplifying processes and promoting market growth.

Conclusion

The US short-term care insurance market is poised for significant growth, with a projected 10.2% CAGR from 2024 to 2033. As individuals and families seek manageable healthcare solutions to cover temporary needs, STCI offers a viable alternative to long-term care insurance, appealing to consumers across age groups. While challenges such as market competition and consumer misconceptions persist, the STCI market’s potential for innovation and expansion remains strong.

In response to growing demand, insurance providers are likely to continue enhancing product offerings to better meet consumer needs, especially in the areas of digital accessibility, policy flexibility, and telehealth integration. With the expected growth trajectory, the US short-term care insurance market is well-positioned to play a vital role in the country’s healthcare landscape in the years to come.

Explore the Latest Trending “Exclusive Article” @

• https://www.linkedin.com/pulse/oil-breather-tank-market-insights-sustainable-t8grf

• https://www.linkedin.com/pulse/nuclear-powered-naval-vessels-market-emerging-technologies-ahfgf/

• https://www.linkedin.com/pulse/photo-printing-merchandise-market-emerging-technologies-jwvof/

• https://www.linkedin.com/pulse/live-streaming-market-trends-transforming-digital-ruxwf/

• https://www.linkedin.com/pulse/organic-pigments-market-exploring-biodegradable-qwnqf/

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies’ clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we’ve built over the years.

This release was published on openPR.