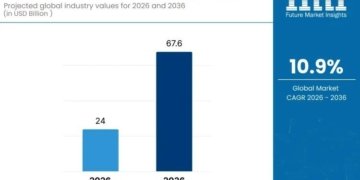

The Team Collaboration Tools Market reached US$ 23.3 billion in 2023 and is expected to grow to around US$ 62.8 billion by 2031, expanding with a CAGR of approximately 13.5 % from 2024 to 2031 as organizations globally embrace digital workspaces and hybrid teamwork solutions.

Growth is supported by increasing demand across key applications such as messaging and chat tools, video conferencing, project management platforms, virtual workspaces, and integrated collaboration suites, driven by the proliferation of remote and hybrid work models, rising enterprise digitization initiatives, the integration of AI‐enhanced features, and the need for seamless communication and workflow coordination across distributed teams. Cloud‐based collaboration platforms help improve productivity, real‐time communication, and operational efficiency, fostering broad adoption across IT & telecom, BFSI, healthcare, retail, manufacturing, education, and other sectors worldwide. North America currently leads the market, supported by strong technology infrastructure and the presence of major players, while demand continues to grow across Europe and Asia Pacific markets.

Download your exclusive sample report today (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/team-collaboration-tools-market?sindhuri

Team Collaboration Tools Market: Competitive Intelligence

Microsoft Corporation, Google LLC, Slack Technologies (a Salesforce company), Cisco Systems, Inc., Atlassian Corporation Plc, Zoom Video Communications, Inc., Asana, Inc., Trello (Atlassian), Monday.com Ltd., and others.

The Team Collaboration Tools Market is strongly driven by leading players such as Microsoft, Google, Slack (Salesforce), Cisco, and Atlassian, who provide comprehensive platforms and applications that enable real‐time communication, file sharing, project coordination, and workflow automation across distributed teams. Their solutions-including Microsoft Teams, Google Workspace, Slack, Webex, and Jira-integrate messaging, video conferencing, task management, and collaborative workspaces to boost productivity and streamline business operations. Increasing remote and hybrid work adoption, digital transformation initiatives, and demand for unified communication environments are key factors fueling market growth.

These companies’ complementary strengths deep enterprise integration and productivity suites from Microsoft and Google; flexible messaging and workflow ecosystems from Slack and Cisco; agile project and task management from Atlassian, Asana, and Trello; scalable cloud‐native platforms and intuitive interfaces from Zoom and Monday.com are enhancing competitive positioning globally. Strategic focus areas include expansion of AI‐enabled collaboration features, enhanced security and compliance, cross‐platform interoperability, increased automation and analytics capabilities, and partnerships with systems integrators and service providers to support hybrid work environments and digital workforce enablement across industries.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/team-collaboration-tools-market?sindhuri

Recent Key Developments – United States & North America

✅ June 2025: Microsoft expanded Teams with Copilot AI integrations, enabling generative summarization, context‐aware meeting insights, and natural‐language task automation boosting productivity for hybrid teams.

✅ August 2025: Slack (Salesforce) launched new Huddles upgrades with real‐time translation and AI summarization features, improving global team communication and reducing language barriers.

✅ 2025: Zoom introduced deeper workspace enhancements, including unified channels across meetings, chat, and whiteboarding, plus AI‐driven focus modes designed to streamline remote and hybrid work collaboration.

Recent Key Developments – Europe & UK

✅ Early 2026: Atlassian’s Confluence and Jira platforms integrated generative AI assistants that help automatically generate project documentation, sprint summaries, and action lists based on team inputs.

✅ 2025: Regional cloud providers like SAP and Vodafone Business launched collaboration suites tailored to enterprise security and compliance requirements, responding to European data protection regulations (e.g., GDPR, DORA).

✅ Late 2025: UK workplaces broadly adopted asynchronous collaboration tools with advanced versioning and task tracking to support flexible work schedules and cross‐time‐zone collaboration.

Recent Key Developments – Asia‐Pacific

✅ 2025: Tencent expanded WeCom’s team collaboration features, integrating enhanced AI task suggestions, unified enterprise messaging, and seamless integration with cloud storage and workplace apps.

✅ 2025: Google Workspace saw strong adoption in India and Southeast Asia, driven by enhanced regional language support, low‐bandwidth optimizations, and AI‐enabled productivity tools.

✅ Late 2025: Alibaba DingTalk added real‐time AI meeting summaries and voice‐to‐task automation, supporting fast‐growing remote and hybrid workforces across China and emerging markets.

Recent Key Developments – Product & Technology Innovation

✅ AI‐Driven Collaboration Features: Generative AI assistants are now mainstream in collaboration suites auto‐summarizing meetings, suggesting action items, and auto‐drafting responses and documents.

✅ Integrated Whiteboarding & Multimodal Workspaces: Tools like Miro, MURAL, and Microsoft Whiteboard launched enhanced multimodal boards that support voice, sketch, text, and AI‐assisted ideation in a single canvas.

✅ Cross‐Platform Integrations: Open APIs and universal connectors (e.g., through Zapier, Slack Workflows, Power Automate) are enabling seamless data flow between collaboration tools, project management systems, CRM, and knowledge bases.

✅ 1. M&A / Strategic Developments

» Microsoft Acquires Intelliview AI

November 2025 Microsoft announced the acquisition of Intelliview AI, a provider of AI‐powered meeting analytics and team engagement tools. This strategic move boosts Microsoft’s Teams collaboration suite with more advanced insights such as sentiment tracking, team productivity analytics, and real‐time collaboration optimization features.

» Atlassian Expands with TaskFlow Integration

January 2026 Atlassian completed the acquisition of TaskFlow Systems, a workflow automation platform designed to streamline project handoffs and dependency management across Jira and Confluence. This strengthens Atlassian’s collaboration stack by making complex workflow orchestration easier for engineering and cross‐functional teams.

» Salesforce Deepens Slack Ecosystem

Late 2025 Salesforce announced expanded partner relationships with ecosystem players (e.g., Zoom, Dropbox) to integrate enterprise communication and workflow tools more deeply into Slack emphasizing unified collaboration data and smarter automation between messaging, meetings, and content sharing.

✅ 2. New Product Launches & Technology Innovations

» Microsoft Teams with Copilot Enhancements

December 2025 Microsoft introduced new AI Copilot capabilities in Teams that empower users with:

Real‐time meeting summaries and action item capture

Automated follow‐up suggestion workflows

Centralized project insights powered by Microsoft Graph and semantic AI

This further strengthens Teams as a central hub for hybrid work collaboration.

» Google Workspace Gemini Integration

January 2026 Google expanded Google Workspace with Gemini‐powered collaboration assistants that help draft meeting agendas, summarize conversations across Gmail, Chat, and Meet, and surface task recommendations directly in Docs and Sheets.

» Atlassian Compass & Team Touring

Nov 2025 Atlassian rolled out Atlassian Compass enhancements including Team Touring, a feature that maps team dependencies and cross‐project relationships, giving product and engineering teams a live “team topology” view that accelerates onboarding and mitigates cross‐functional bottlenecks.

» Zoom Team Chat Upgrades

Q4 2025 Zoom Video Communications introduced structured task threads and project boards in Zoom Team Chat, enabling users to move fluid conversations into actionable, assignable task streams without leaving the platform.

✅ 3. R&D & Innovation Trends

» AI‐Driven Collaboration Optimization

AI continues to be a dominant innovation theme, powering smarter meeting summarization, decision extraction, context‐aware task suggestion, and pattern‐based workflow automation reducing cognitive load and time spent on context switching.

» Immersive & VR Collaboration Interfaces

Research and early product extensions are bringing augmented and virtual reality collaboration scenes into early adopter enterprise environments enabling distributed teams to interact in spatial digital workspaces for design collaboration and experimentation.

» Cross‐Platform Integration & Open APIs

Open API ecosystems that connect messaging, calendar, task, content, and CRM data reduce silos. Tools are increasingly interoperable, making it easier for enterprises to define best‐of‐breed collaboration stacks that still deliver centralized governance and data security.

» Security & Compliance Enhancements

Zero‐trust security frameworks are being embedded into team collaboration solutions, enabling granular access controls, encrypted messaging, and compliance automation for regulated industries (healthcare, finance, government).

Segments Covered in the Team Collaboration Tools Market :

By Type

The market is segmented into Messaging and Chat Tools 30%, Video Conferencing Tools 25%, Project Management Tools 20%, Virtual Workspace Tools 15%, and Others 10%, with messaging and chat tools dominating due to widespread use for real-time communication, remote collaboration, and operational efficiency. Video conferencing tools are growing rapidly with hybrid work adoption. Project management and virtual workspace tools support task coordination, workflow tracking, and team productivity. Increasing remote and distributed workforce trends drive adoption across all types.

By Deployment

Deployment modes include Cloud-based 70% and On-premise 30%, with cloud-based solutions dominating due to scalability, lower upfront costs, easy updates, and remote access capabilities. On-premise deployment is preferred by large enterprises and highly regulated sectors requiring enhanced data security and control. Cloud adoption continues to rise with enterprise digital transformation initiatives and growing integration with productivity suites.

By Organization Size

Organization sizes include Large Enterprises 55% and Small & Medium-sized Enterprises (SMEs) 45%, with large enterprises dominating due to complex collaboration requirements, distributed teams, and higher IT budgets for integrated tools. SMEs are increasingly adopting cloud-based tools to enhance productivity and reduce operational overhead. Flexible subscription models support SME adoption globally.

By Integration Capability

Integration capability is segmented into Standalone Tools 60% and Integrated Suites 40%, with standalone tools dominating due to their ease of deployment, affordability, and ability to address specific team collaboration needs. Integrated suites are growing as organizations look to consolidate tools for seamless workflow, data sharing, and productivity enhancement.

By End-User

End-users include IT & Telecom 20%, BFSI 18%, Healthcare 15%, Retail 12%, Manufacturing 10%, Education 15%, and Others 10%, with IT & telecom dominating due to high adoption of digital collaboration solutions and distributed workforce models. BFSI and healthcare sectors are rapidly adopting tools to support secure communication and project management. Education and retail sectors show growing demand with remote learning and omnichannel operations.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=team-collaboration-tools-market?sindhuri

By Region

North America – 35% Share

North America leads with 35% share, driven by early adoption of digital workplace tools, high cloud penetration, and hybrid work trends. Messaging, chat, and video conferencing dominate. Large enterprises are primary users. Technological innovation and robust internet infrastructure accelerate market growth.

Europe – 25% Share

Europe holds 25% share, supported by remote and hybrid work adoption, strong enterprise digital transformation initiatives, and cloud-based collaboration solutions. Large enterprises and SMEs both contribute significantly. Integrated suites are increasingly adopted for seamless workflow management.

Asia Pacific – 20% Share

Asia Pacific accounts for 20% share, driven by growing SMEs, expanding IT & telecom sectors, and increasing digitalization in countries such as China, India, and Japan. Cloud-based messaging and video conferencing tools dominate adoption. Large enterprises and educational institutions are primary end-users.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?sindhuri

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.