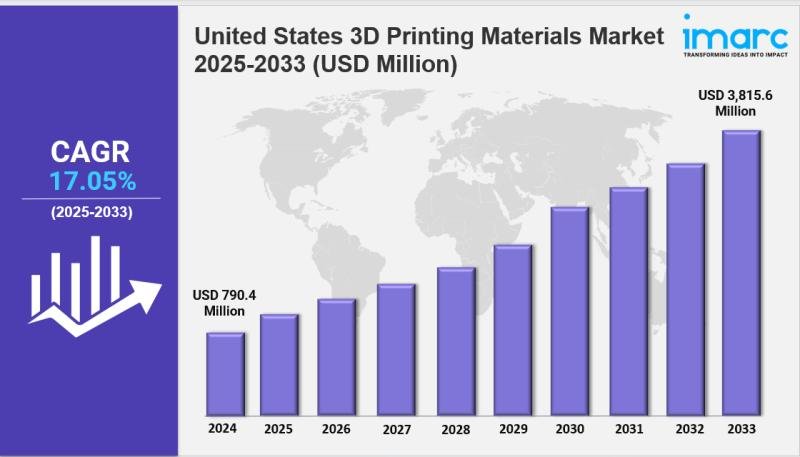

Market Overview 2025-2033

United States 3D printing materials market size reached USD 790.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,815.6 Million by 2033, exhibiting a growth rate (CAGR) of 17.05% during 2025-2033. The market is expanding due to rising demand for diverse, performance‐optimized materials, increased industrial adoption, and growing interest in sustainable biocompatible options. Growth is driven by advancements in high-performance polymers and metals, government support, and broadening application across aerospace, healthcare, and manufacturing.

Key Market Highlights:

✔️ Strong market growth driven by expanding adoption of 3D printing across aerospace, automotive, and healthcare industries

✔️ Rising demand for high-performance materials such as metals, composites, and bioplastics

✔️ Ongoing innovation in sustainable and application-specific materials enhancing printing quality and functionality

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-3d-printing-materials-market/requestsample

United States 3D Printing Materials Market Trends and Drivers:

The United States 3D printing materials market is gaining real momentum as industries like aerospace, defense, healthcare, and manufacturing adopt more advanced and sustainable materials. Titanium alloys, prized for their strength and light weight, are now a key player-making up 38% of all metal 3D printing materials in 2024. Companies like GE Additive and SpaceX are using them in rocket parts and satellite components. Nickel-based superalloys, like Inconel 718, are also on the rise, especially in tough environments like offshore energy platforms and military equipment, growing at nearly 28% annually.

Federal support is helping drive this growth. The U.S. Department of Defense invested $220 million in 2024 to scale up 3D printing for high-tech projects-from submarine parts to hypersonic weapons. That backing is helping expand the United States 3D printing materials market share on the global stage. But there are still bumps in the road. For example, cobalt-chrome shortages have driven up costs, prompting firms like Boeing to create closed-loop systems to recycle metal powders and lower dependency on imports. New ASTM standards introduced in 2024 have simplified certification, but smaller manufacturers still face challenges with complex and expensive post-processing steps.

Polymers are evolving too, especially as sustainability regulations become stricter. Bio-based and recycled materials now make up about 42% of all polymers used in 3D printing in the U.S., thanks in part to laws like California’s SB-54. PLA continues to dominate consumer use, but industrial players are switching to tougher recycled plastics like PETG and ABS. Companies like Filabot and Reflow are leading the charge, while innovators such as DuPont and Covestro are experimenting with algae-based resins and self-healing plastics. That said, recycled materials can still be inconsistent in strength, which is something manufacturers are working to improve.

Composite materials are becoming essential for applications that need both durability and light weight-like in aerospace, automotive, and medical products. Carbon-fiber-reinforced polymers are especially popular. In fact, carbon-filled nylon was the fastest-growing composite in 2024, used in everything from BMW brake parts to satellite hardware by Lockheed Martin. Dental labs are also adopting ceramic-infused resins, which can speed up prosthetic production by up to 75%. Government investment is playing a role here, too-like the Department of Energy’s $47 million funding for research into “smart” self-sensing composites at Oak Ridge. However, the high price tag of carbon fiber (around $150 per kilogram) and its low recyclability are pushing interest in alternatives like basalt-based filaments.

When it comes to overall United States 3D printing materials market trends, high-performance metals continue to lead the way. Titanium, aluminum, and cobalt-chrome powders now account for more than half of the $2.3 billion domestic market. Sustainability efforts are also influencing which materials get chosen More manufacturers are turning to biodegradable and recycled options, and local supply chains-like Praxair’s titanium powder plant in Texas-are helping reduce reliance on foreign imports. Interest from hobbyists and educators is growing, too. Around 45% of home users now prefer stronger, engineering-grade materials, while schools are increasingly turning to safer, PLA-based filaments in line with updated OSHA guidelines. At the same time, next-generation technologies like 4D printing-where materials shift shape in response to heat or moisture-are beginning to take off in fields like medicine and adaptive tools.

Still, the road ahead has some challenges. Raw material prices remain volatile, and access to specialty filaments isn’t equal across the board. Intellectual property concerns are also becoming more common as advanced designs become easier to replicate. Looking forward, the United States 3D printing materials market is expected to top $4.1 billion by 2030. The outlook is strong, thanks to steady investment in aerospace, electronics, automotive, and healthcare. With better materials, smarter supply chains, and a growing focus on sustainability, the industry is well-positioned for long-term growth.

Checkout Now: https://www.imarcgroup.com/checkout?id=20628&method=1190

United States 3D Printing Materials Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

• Polymers

o Acrylonitrile Butadiene Styrene (ABS)

o Polylactic Acid (PLA)

o Photopolymers

o Nylon

o Others

• Metals

o Steel

o Titanium

o Aluminum

o Others

• Ceramic

o Silica Sand

o Glass

o Gypsum

o Others

• Others

Breakup by Form:

• Powder

• Filament

• Liquid

Breakup by End User:

• Consumer Products

• Aerospace and Defense

• Automotive

• Healthcare

• Education and Research

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20628&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.