IMARC Group has recently released a new research study titled “Tax Automation Software Market Report by Product Type (Web Software, Mobile Software), Tax Type (Sales Tax, Income Tax, and Others), Software Deployment Type (On-Premise, Cloud), End-Use Industry (Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, IT and Telecom, Energy and Utilities, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

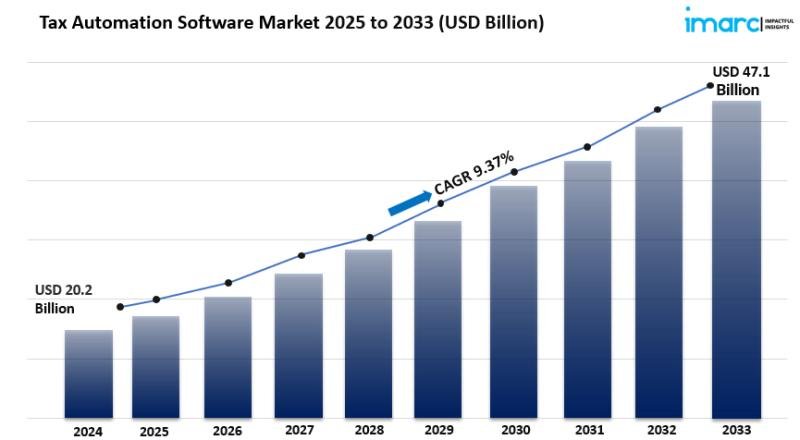

The global tax automation software market size reached USD 20.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 47.1 Billion by 2033, exhibiting a growth rate (CAGR) of 9.37% during 2025-2033.

Request a Free PDF Sample for More Detailed Market Insights

https://www.imarcgroup.com/tax-automation-software-market/requestsample

Global Tax Automation Software Market Trends:

The global tax automation software market is driven by the increasing complexities in tax regulations worldwide compel businesses to adopt efficient automation solutions for compliance. In line with this, the rising adoption of cloud computing and Software-as-a-Service (SaaS) models enables scalable and cost-effective deployment of tax automation software across diverse enterprises.

Furthermore, the demand for real-time data analytics capabilities to enhance decision-making processes further propels market expansion. Additionally, stringent penalties for non-compliance drive businesses to invest in robust tax automation solutions to mitigate risks.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) technologies in tax software enhances accuracy and operational efficiency.

Factors Affecting the Growth of the Tax Automation Software Industry:

Increasing Complexities in Tax Regulations:

The global tax landscape is becoming increasingly complex, driven by evolving regulatory requirements across jurisdictions. Businesses face a multitude of challenges in ensuring compliance with varying tax laws, necessitating the adoption of sophisticated tax automation software. These solutions streamline processes such as tax calculation, reporting, and filing, thereby reducing errors and compliance risks. For instance, software platforms now integrate updates and changes in tax laws automatically, ensuring businesses remain up-to-date and compliant without extensive manual intervention. This trend is particularly crucial for multinational corporations managing diverse tax obligations across different countries, where the automation of tax compliance processes offers significant operational efficiencies and cost savings.

Rising Adoption of Cloud Computing and SaaS Models:

The shift towards cloud computing and Software-as-a-Service (SaaS) models is revolutionizing the tax automation software market. Cloud-based solutions provide scalability, flexibility, and accessibility, allowing businesses to deploy and manage tax software without heavy upfront investments in hardware or infrastructure. SaaS models offer subscription-based pricing and seamless updates, ensuring that businesses always have access to the latest features and compliance functionalities. This approach not only lowers total cost of ownership but also enhances agility in responding to regulatory changes and business needs.

Furthermore, cloud-based tax automation software facilitates remote access and collaboration, supporting modern workforce dynamics where remote work and digital connectivity are increasingly prevalent.

Demand for Real-Time Data Analytics Capabilities:

There is a growing demand for tax automation software equipped with real-time data analytics capabilities to support informed decision-making and strategic planning. Businesses require actionable insights into their tax data to optimize financial strategies, manage risks, and comply with regulations effectively. Advanced analytics tools embedded within tax software enable predictive analysis, trend identification, and scenario modeling, empowering businesses to proactively address tax challenges and capitalize on opportunities. Real-time data analytics also facilitate faster and more accurate reporting, enhancing transparency and accountability in tax management. As businesses strive for agility and competitive advantage, the integration of robust data analytics capabilities within tax automation software becomes indispensable, driving market growth and innovation in the sector.

Buy Now: https://www.imarcgroup.com/request?type=report&id=1894&flag=C

Tax Automation Software Market Report Segmentation:

By Product Type:

· Web Software

· Mobile Software

By the product type, the market is segmented into web and mobile software.

By Tax Type:

· Sales Tax

· Income Tax

· Others

Based on the tax type, the market is divided into sales tax, income tax, and others.

By Software Deployment Type:

· On-Premise

· Cloud

On the basis of the software deployment type, the market is classified into on-premise and cloud.

By End-Use Industry:

· Banking, Financial Services and Insurance (BFSI)

· Healthcare

· Retail, IT and Telecom

· Energy and Utilities

· Others

By the end-use industry, the market is subdivided into banking, financial services and insurance (BFSI), healthcare, retail, IT and telecom, energy and utilities, and others.

Regional Insights:

· Asia Pacific

· North America

· Europe

· Latin America

· Middle East and Africa

Based on the region, the market is categorized into Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia and others), North America (the United States and Canada), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others), Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru and others), and Middle East and Africa (Turkey, Saudi Arabia, Iran, the United Arab Emirates and others).

Top Tax Automation Software Market Leaders:

The tax automation software market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

· ADP LLC

· Avalara

· Blucora Inc.

· Chetu Inc.

· Intuit Inc.

· Drake Software

· Sage

· Thomson Reuters Corporation

· Vertex Inc.

· Wolters Kluwer N.V. (Kluwer Publishers and Wolters Samsom)

· Xero Limited

Ask Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=1894&flag=C

Key Highlights of The Report:

Market Performance (2019-2024)

Market Outlook (2025-2023)

Market Trends

Market Drivers and Success Factors

SWOT Analysis

Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145

This release was published on openPR.