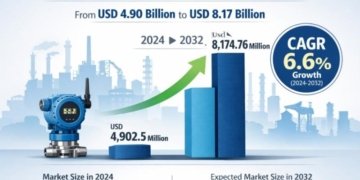

The server storage area network (SAN) market continues to evolve rapidly, driven by the exponential growth of data generation, the rise of cloud computing, and the expanding need for high-performance data management solutions. As enterprises move toward hybrid and multi-cloud architectures, leading companies are strengthening their positions through innovation, global expansion, and strategic partnerships.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7079

1. Dell Technologies

Dell Technologies remains a dominant force in the server storage area network market, leveraging its PowerVault and PowerStore portfolio to offer scalable and high-speed connectivity solutions. The company’s strength lies in its vertically integrated infrastructure-from servers to storage and networking-which ensures optimized performance and reliability. Dell’s focus on automation, software-defined infrastructure, and energy-efficient storage solutions continues to attract large-scale enterprise clients, especially in North America and Europe.

2. Hewlett Packard Enterprise (HPE)

HPE’s SAN solutions, such as the HPE Alletra and MSA series, cater to data-intensive workloads across cloud and edge environments. The company’s key advantage lies in its GreenLake platform, which delivers SAN capabilities through an as-a-service model. HPE’s strategy focuses on helping organizations modernize data centers while reducing CapEx, appealing to enterprises transitioning to hybrid cloud infrastructure.

3. Cisco Systems, Inc.

Cisco has carved a strong niche through its MDS 9000 series and its comprehensive ecosystem integration with servers, networking gear, and security tools. The company’s SAN architecture emphasizes high availability, low latency, and seamless scalability. Cisco’s strategy revolves around integrating SAN with AI-driven analytics and cloud-native orchestration, positioning it as a critical enabler for modern data center transformation initiatives.

4. IBM Corporation

IBM continues to play a strategic role through its FlashSystem storage portfolio and its leadership in data virtualization technologies. The company’s strength lies in its software-defined storage (SDS) solutions and its integration of AI-driven performance optimization via IBM Storage Insights. IBM’s focus on cybersecurity, resilience, and interoperability across multi-vendor environments makes it a trusted choice for mission-critical deployments.

➤ Explore detailed profiles of top players and new entrants in this space – access your free sample report → https://www.researchnester.com/sample-request-7079

5. NetApp, Inc.

NetApp’s SAN offerings are centered on unified storage and hybrid cloud capabilities. Its ONTAP data management software provides a significant competitive advantage by ensuring consistent data availability across on-premise and cloud infrastructures. NetApp’s strong partnerships with AWS, Microsoft Azure, and Google Cloud have enabled it to extend SAN capabilities into the public cloud ecosystem, appealing to enterprises seeking flexibility and data mobility.

6. Broadcom Inc. (formerly Broadcom-Brocade)

Broadcom’s SAN technology, inherited from Brocade Communications, continues to be a backbone for enterprise data centers worldwide. The company focuses on Fibre Channel (FC) innovations and network security features that ensure consistent performance and reliability for large-scale deployments. Broadcom’s technological leadership in Gen 7 Fibre Channel positions it as a core provider for high-throughput, mission-critical workloads in banking, healthcare, and government sectors.

7. Pure Storage, Inc.

Pure Storage is among the most innovative players in the server storage area network market, known for its all-flash storage arrays and simplicity-driven design. Its FlashArray//X and Evergreen architecture offer continuous modernization without downtime or forklift upgrades. The company’s focus on sustainability and AI-driven analytics differentiates it as a preferred choice for organizations emphasizing operational efficiency and total cost of ownership.

8. Hitachi Vantara

Hitachi Vantara, part of Hitachi Ltd., provides high-end SAN storage with strong emphasis on data resilience and enterprise-grade reliability. Its Virtual Storage Platform (VSP) series delivers advanced automation, real-time replication, and multi-cloud integration. Hitachi’s global presence in manufacturing, energy, and infrastructure sectors reinforces its credibility as a provider of industrial-grade SAN solutions tailored for complex, large-scale operations.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Server Storage Area Network Market Report Overview here: https://www.researchnester.com/reports/server-storage-area-network-market/7079

SWOT Analysis of Leading Companies

Strengths

Leading players in the server storage area network market possess strong product portfolios, global presence, and technical expertise. Companies like Dell, HPE, and Cisco leverage established customer bases and deep integration with cloud ecosystems. Innovation in flash technology, NVMe architecture, and Fibre Channel protocols has enhanced system speed and reliability, giving these firms a competitive advantage. Moreover, long-term partnerships with cloud providers and OEMs ensure steady revenue streams and collaborative product evolution.

Weaknesses

Despite strong growth momentum, high capital requirements and complex infrastructure management pose challenges. Traditional SAN architectures often face scalability limitations compared to newer software-defined or hyperconverged systems. Vendors relying heavily on hardware-based models are under pressure to shift toward subscription-based and cloud-native offerings. Additionally, the integration complexity of legacy systems continues to hinder rapid adoption in small and medium enterprises (SMEs).

Opportunities

Rising enterprise data volumes, adoption of hybrid cloud strategies, and the proliferation of edge computing present significant opportunities. SAN providers are increasingly investing in AI-powered data management, NVMe over Fabrics (NVMe-oF), and data reduction technologies to address performance bottlenecks. Emerging markets in Asia-Pacific, the Middle East, and Latin America are witnessing a surge in data center development, creating new revenue streams. Furthermore, M&A activities and collaborations between hardware and software providers can expand capabilities and accelerate digital transformation initiatives globally.

Threats

The server storage area network market faces growing competition from public cloud storage services and hyperconverged infrastructure (HCI) solutions, which offer simplified management and lower upfront costs. Cybersecurity threats, including ransomware attacks targeting storage networks, are a persistent concern. Market volatility and component shortages in semiconductors may impact production timelines. Additionally, increasing environmental regulations and sustainability standards may require costly adjustments in manufacturing and operations for traditional SAN vendors.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-7079

Investment Opportunities & Trends

The server storage area network market is entering a phase of strategic consolidation and technological reinvention. Investors are closely watching developments across key areas such as AI integration, automation, cloud-native SAN models, and green data centers.

M&A Activity and Strategic Collaborations

In the past 12 months, the market has witnessed several high-profile mergers, acquisitions, and partnerships. Broadcom’s continued integration of Brocade’s SAN technologies has strengthened its enterprise storage offerings. HPE’s acquisition of startups specializing in AI-driven storage optimization has further enhanced its data intelligence capabilities. Similarly, Pure Storage expanded its reach through partnerships focused on sustainable storage infrastructure, while IBM has deepened collaborations with Red Hat and VMware to enable seamless data mobility across hybrid environments.

Funding and Startup Innovation

Investment in SAN-related startups has accelerated, particularly those focusing on software-defined networking (SDN) and data fabric orchestration. Venture capital firms are increasingly backing companies that build SAN virtualization platforms designed for cloud-native applications. These startups are reshaping the market by introducing lightweight, scalable architectures that align with modern DevOps and microservices environments.

Technology Integration and Automation

Automation continues to be a dominant theme in SAN evolution. Vendors are integrating AI and machine learning to enable predictive analytics for workload management, system diagnostics, and fault recovery. Technologies like NVMe-oF and Ethernet-based SANs are bridging the gap between traditional storage and next-generation architectures, offering ultra-low latency and faster access speeds.

Regional Investment Hotspots

North America remains the most mature market due to its concentration of hyperscale data centers and tech-driven enterprises. However, Asia-Pacific is emerging as a promising investment hub, driven by the expansion of data centers in India, China, and Southeast Asia. Government-backed digital transformation programs in the region are attracting foreign investments in enterprise infrastructure. Meanwhile, Europe is focusing on sustainable and energy-efficient SAN solutions, creating opportunities for vendors emphasizing green innovation.

Policy and Market Developments

Regulatory frameworks promoting data sovereignty and cybersecurity compliance are influencing SAN investment patterns. The growing emphasis on secure data storage, particularly in financial and healthcare sectors, is driving upgrades to more resilient and encrypted SAN systems. Additionally, global sustainability initiatives are pushing companies to adopt energy-optimized storage solutions, opening up a new class of investment in eco-friendly technologies.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7079

➤ Related News –

https://www.linkedin.com/pulse/can-asset-performance-management-revolutionize-jxwkf/

https://www.linkedin.com/pulse/why-does-corporate-travel-insurance-market-mtthc/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.