As per DataM intelligence research report “Global Satellite Internet Market reached US$ 13.12 billion in 2024 and is expected to reach US$ 47.59 billion by 2032, growing with a CAGR of 17.67% during the forecast period 2025-2032.”

The market is expanding with increasing demand for high-speed internet in remote and underserved areas. Satellite-based connectivity enables global coverage and reliable communication. Advancements in low-earth orbit satellites drive growth.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/satellite-internet-market?prasad

Technological Advancements

✅ Feb 2026 – Advancements in Low Earth Orbit (LEO) Satellite Networks

Next-generation LEO satellite constellations are significantly improving internet speed and reducing latency compared to traditional geostationary systems. These advancements are enabling more reliable connectivity for remote and underserved regions. The expansion of global coverage is accelerating digital inclusion and supporting critical communication infrastructure.

✅ Jan 2026 – AI-Based Network Optimization Enhances Performance

Satellite internet providers are increasingly integrating AI-driven traffic management systems to optimize bandwidth allocation across users. These systems enable predictive analytics to identify congestion and dynamically adjust network performance. As a result, service reliability and user experience are improving across high-demand environments.

✅ Oct 2025 – Development of Advanced Phased Array Antennas

Innovations in phased array antenna technology are enabling electronically steered beams for faster and more efficient satellite tracking. These antennas eliminate the need for mechanical movement, improving durability and responsiveness. This development supports seamless connectivity and enhances performance in mobile and fixed applications.

Product Launches & Innovations

✅ Feb 2026 – Expansion of Direct-to-Device Satellite Connectivity

Companies are launching satellite-to-smartphone connectivity solutions that eliminate the need for ground-based infrastructure. These services allow users to send messages and access basic internet services directly via satellites. This innovation is particularly impactful for emergency communication and remote area connectivity.

✅ Dec 2025 – Introduction of Compact User Terminals

New compact and lightweight satellite internet terminals are being introduced to simplify installation and usage. These devices are designed for both residential and enterprise applications, offering plug-and-play capabilities. The innovation is reducing deployment costs and expanding accessibility to a broader user base.

✅ Sep 2025 – Launch of High-Throughput Satellites (HTS)

High-throughput satellites are being deployed to significantly increase data capacity and improve broadband performance. These satellites utilize advanced frequency reuse and spot beam technologies for efficient bandwidth distribution. This development is enabling faster and more scalable satellite internet services globally.

Mergers & Acquisitions

✅ Jan 2026 – Strategic Partnerships Between Telecom and Satellite Providers

Telecom operators are forming strategic partnerships with satellite companies to expand broadband coverage through hybrid networks. These collaborations combine terrestrial and satellite infrastructure for seamless connectivity. The approach is helping bridge connectivity gaps in rural and hard-to-reach regions.

✅ Nov 2025 – Investments in Satellite Constellation Expansion

Major satellite internet providers are securing significant investments to scale their LEO constellations and enhance global coverage. These investments are focused on launching additional satellites and upgrading ground infrastructure. The expansion is strengthening competitive positioning and accelerating service rollout.

✅ Oct 2025 – Collaborations for Rural Connectivity Projects

Governments and private companies are collaborating to deploy satellite internet solutions in underserved rural areas. These initiatives aim to provide affordable and reliable broadband access to remote populations. Such collaborations are supporting digital inclusion and socio-economic development.

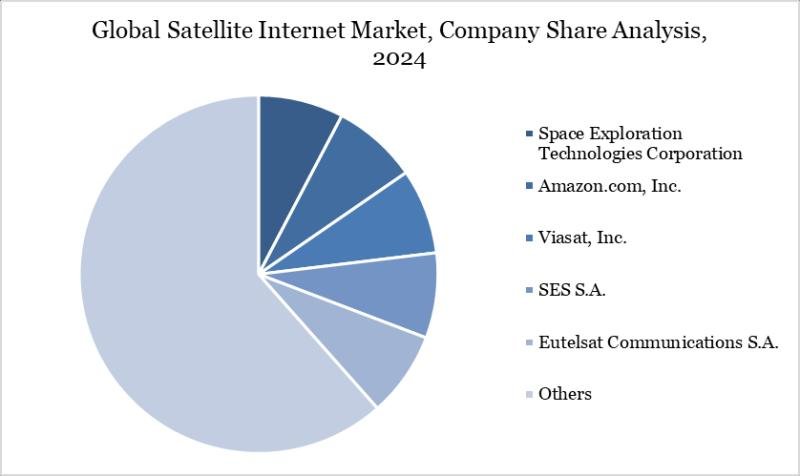

Satellite Internet Market: Competitive Intelligence

Space Exploration Technologies Corporation, Amazon.com, Inc., Viasat, Inc., SES S.A., Eutelsat Communications S.A., Intelsat S.A., Telesat Canada, Iridium Communications Inc., AST SpaceMobile, Inc., and Gilat Satellite Networks Ltd.

In the Satellite Internet Market, a leading group of aerospace, technology, and communications companies Space Exploration Technologies Corporation (SpaceX), Amazon.com, Inc., Viasat, Inc., SES S.A., Eutelsat Communications S.A., Intelsat S.A., Telesat Canada, Iridium Communications Inc., AST SpaceMobile, Inc., and Gilat Satellite Networks Ltd. – are collectively advancing global broadband connectivity through satellite-based internet solutions. These companies provide high-throughput satellite constellations, ground infrastructure, and advanced communication technologies that enable reliable, low-latency internet access in underserved and remote regions. SpaceX and Amazon focus on large-scale low Earth orbit (LEO) constellations for global coverage, while Viasat, SES, and Eutelsat strengthen geostationary (GEO) satellite capabilities. Intelsat, Telesat, Iridium, AST SpaceMobile, and Gilat enhance connectivity solutions, ground networks, and mobile satellite services, supporting residential, commercial, and industrial applications.

Individually and together, these companies reinforce the Satellite Internet Market’s growth by combining advanced satellite technologies, global network deployment, and service scalability. SpaceX and Amazon provide transformative LEO coverage and high-speed broadband solutions, while Viasat, SES, and Eutelsat ensure established GEO capacity and operational reliability. Intelsat, Telesat, and Iridium contribute complementary network infrastructure and niche market services, and AST SpaceMobile and Gilat extend mobile and enterprise satellite connectivity. Their complementary strengths create a robust ecosystem that accelerates market adoption, improves service quality, and expands global internet access.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/satellite-internet-market?prasad

Segment Covered in the Satellite Internet Market:

By Orbit Type

The market is segmented into Low Earth Orbit (LEO) 65% and Medium Earth Orbit (MEO) 35%, with LEO dominating due to lower latency, higher speed capabilities, and increasing deployment of satellite constellations. MEO systems are used for broader coverage and stable connectivity in specific applications.

By Frequency Band

Frequency bands include Ka Band 35%, Ku Band 30%, C Band 15%, L Band 10%, and X Band 10%, with Ka band dominating due to its high data throughput and suitability for high-speed internet services. Ku band is widely used for satellite communication, while C and L bands support reliable connectivity in challenging environments.

By Download Speed

Download speeds include High Speed (Greater than 100 MBPS) 50%, Medium Speed (25-100 MBPS) 35%, and Low Speed (less than 25 MBPS) 15%, with high-speed services dominating due to increasing demand for streaming, remote work, and enterprise connectivity. Medium-speed services remain widely used in semi-urban and developing regions.

By End-User

End-users include Residential 55%, Commercial 35%, and Others 10%, with residential users dominating due to increasing demand for broadband access in remote and underserved areas. Commercial users are growing with adoption in aviation, maritime, and enterprise sectors.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=satellite-internet-market

Regional Analysis

North America – 35% Share

North America leads with 35% share due to strong adoption in the U.S. and Canada. LEO systems dominate. Ka and Ku bands are widely used. High-speed internet services lead. Residential and commercial users drive demand. Advanced satellite infrastructure and investments support growth.

Europe – 25% Share

Europe holds 25% share driven by adoption in the UK, Germany, and France. LEO systems dominate. Ka and Ku bands lead. High-speed services are prominent. Residential and commercial users drive demand. Government initiatives for rural connectivity support market growth.

Asia Pacific – 20% Share

Asia Pacific accounts for 20% share with adoption in China, India, Japan, and Australia. LEO systems dominate. Ku and Ka bands are widely used. Medium and high-speed services lead. Residential users dominate. Increasing digitalization and rural internet demand drive growth.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.