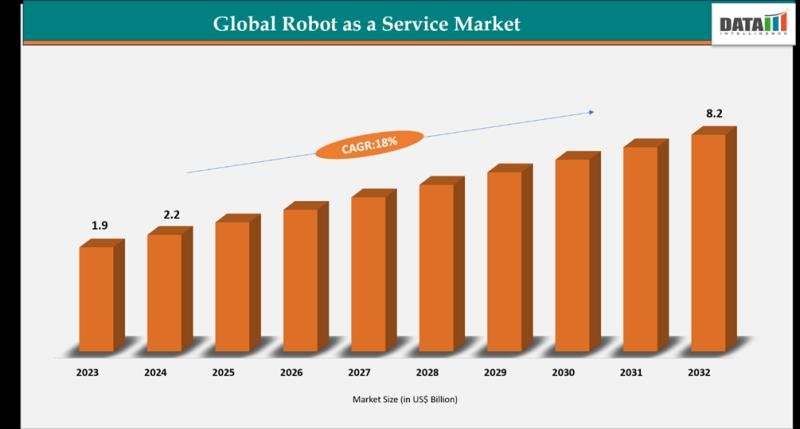

Global Robot as a service Market reached US$ 2.2 billion in 2024 and is expected to reach US$ 8.2 billion by 2032, growing with a CAGR of 18% during the forecast period 2025-2032. The global robot as a service market is experiencing strong growth, driven by rising adoption across sectors such as manufacturing, logistics, healthcare, and retail. Rapid digital transformation, industrial automation, and the integration of artificial intelligence and IoT technologies are key contributors to market expansion. Governments worldwide are promoting automation and smart manufacturing initiatives to enhance productivity and operational efficiency, with programs supporting technology adoption and digital infrastructure development.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/robot-as-a-service-market?pratik

United States: Key Industry Developments

✅ December 2025: Siemens launched PAVE360 Automotive, a digital twin platform accelerating software-defined vehicle development with integrated simulation for multi-domain engineering, reducing time-to-market by up to 30% for U.S. automakers focusing on EV and autonomous features.

✅ November 2025: Renesas introduced R-Car Gen 5 SoC-based solutions for SDV innovation, enabling end-to-end multi-domain controllers with enhanced AI processing for ADAS and infotainment in U.S. vehicle platforms.

✅ October 2025: General Motors expanded its Ultifi software platform with over-the-air updates for SDV architectures, partnering with tech firms to integrate cloud-based vehicle data analytics for personalized user experiences.

✅ September 2025: Ford announced investments in SDV R&D hubs in Michigan, deploying software orchestration layers for next-gen F-Series trucks with modular ECUs supporting rapid feature deployments.

Asia Pacific / Japan: Key Industry Developments

✅ December 2025: Tata Elxsi and Suzuki established a Cloud HIL Center in Japan for SDV testing, enabling virtual validation of software stacks to cut development cycles amid Japan’s push for CASE vehicles.

✅ November 2025: Toyota unveiled a new RAV4 model at Japan Mobility Show with advanced SDV capabilities, featuring centralized computing and SOA for seamless OTA updates and ecosystem integration.

✅ October 2025: Honda accelerated SDV platform rollout with unified software domains for electrification, collaborating on open OS standards to enhance connectivity in Japan’s domestic fleet transitions

Key Merges and Acquisitions(2025):-

Serve Robotics Inc. – acquired Vayu Robotics on August 18, 2025, enhancing its leadership in autonomous sidewalk delivery robots within the Robot as a Service market by integrating Vayu’s large-scale AI models for urban navigation, which improves safety, speed, and scalability for deployment in new geographies and use cases.

Optel Group – acquired Vanguard Robotics on August 28, 2025, bolstering its position in pharmaceutical automation relevant to RaaS through collaborative robot systems designed for regulated environments, enabling turnkey palletizing solutions that boost line efficiency, reduce labor dependency, and expand global cobot market capabilities.

Market Segmentation Analysis:

By Enterprise Size: Large vs SMEs

-Large Enterprises (70% share in 2024)

Large enterprises account for a dominant 70% of the RaaS market in 2024, reflecting their capacity to fund large-scale, multi‐site automation programs and integrate robots into complex operations.

Small and medium enterprises (SMEs) hold the remaining share but are the fastest‐growing group, supported by subscription models that reduce upfront capex and allow gradual fleet scaling.

-Small & Medium Enterprises (30% share in 2024)

SMEs capture about 30% of the 2024 market, using RaaS primarily to offset labor constraints and access advanced robots for logistics and light manufacturing without ownership costs.

Their segment is projected to post a higher CAGR (around 19.04% from 2025-2034) than large enterprises as more mid‐tier manufacturers, 3PLs, and retailers adopt pay‐per‐use or subscription robotics.

By Application: Handling vs Others

-Handling Leads with 36% Share (2024)

Handling applications (e.g., material movement, picking, sorting, packaging) lead the application mix with roughly 35% of global RaaS revenues in 2024, driven by logistics, warehousing, and manufacturing use cases.

These robots are favored for high‐throughput, repetitive workflows where AMRs and robotic arms reduce errors and labor costs while supporting e‐commerce and just‐in‐time fulfillment.

-Other Applications (Collectively 64% in 2024)

Assembling and disassembling, dispensing, processing, welding and soldering, and other niche tasks together account for the remaining 64% of application revenues, with adoption strongest in discrete manufacturing and automotive assembly lines.

Within this group, assembly/processing‐oriented deployments grow steadily as manufacturers extend RaaS from intralogistics to production cells, using robots for repetitive, precision‐intensive steps where output quality is critical.

Purchase this report before year-end and unlock an exclusive 30% discount:https://www.datamintelligence.com/buy-now-page?report=robot-as-a-service-market?pratik (Purchase 2 or more Reports and get 50% Discount)

Growth Drivers:

1️⃣ Cost Efficiency & CAPEX to OPEX Shift

Organizations prefer subscription-based robots instead of high upfront purchase costs. RaaS reduces capital expenditure, offers predictable operational spending, and improves ROI.

2️⃣ Labor Shortages & Rising Workforce Costs

Increasing labor scarcity in manufacturing, logistics, healthcare, agriculture, and security, along with higher wages, is pushing enterprises to adopt service-based robotics for automation continuity.

3️⃣ Rapid Growth of Automation Across Industries

Industries like e-commerce, warehousing, manufacturing, retail, hospitality, cleaning, and healthcare are accelerating robotic adoption to boost productivity, reduce errors, and enhance process efficiency.

4️⃣ Advancements in AI, ML, Vision & Cloud Robotics

Integration of AI, machine learning, computer vision, and cloud connectivity enables smarter autonomous robots, predictive maintenance, remote monitoring, and scalable deployments.

5️⃣ Flexibility, Scalability & On-Demand Deployment

RaaS allows businesses to scale robotic fleets up or down based on operational demand, seasonal workloads, or project needs without long-term capital commitment.

6️⃣ Strong Demand for Service Robots

Increasing demand for delivery robots, cleaning robots, warehouse AMRs, surgical robots, inspection robots, and hospitality robots fuels RaaS growth.

Regional Insights:-

North America commands the largest share of the Robot as a Service market, estimated at around 36% in 2025 assessments, driven by advanced technological infrastructure, high R&D investments, robust adoption in manufacturing, healthcare, and logistics, and the presence of leading robotics innovators in the US and Canada.

Europe follows as the second-largest region, benefiting from strong industrial automation trends, regulatory support for AI and robotics in countries like Germany, France, and the UK, and increasing deployment in automotive and warehousing sectors amid steady innovation and cross-border collaborations.

Asia Pacific ranks third in market share, yet exhibits the fastest growth potential with elevated CAGRs in nations such as China, Japan, India, and South Korea, fueled by rapid industrialization, government initiatives for smart manufacturing, rising labor costs, and expanding demand for flexible automation solutions.

Speak to Our Analyst and Get Customization in the report as per your requirements:https://www.datamintelligence.com/customize/robot-as-a-service-market?pratik

Key Players:

ABB, Locus Robotics., Aethon, Inc., Berkshire Grey., Zebra Technologies Corp, Cobalt AI, Ademco Global, FANUC CORPORATION, Exotec, Vectis Automation LLC

Key Highlights (Top 5 Key Players) :

ABB

ABB provides Connected Services for robots, offering cloud-based monitoring, diagnostics, and remote access via MyRobot app, reducing incidents by 25% and boosting productivity with predictive maintenance.

Locus Robotics

Locus Robotics delivers autonomous mobile robots (AMRs) via RaaS subscriptions for warehouse logistics, enabling scalable fleets that cut labor costs and achieve ROI in 12 months with real-time optimization.

Aethon Inc.

Aethon specializes in autonomous mobile robots for healthcare and hospitality, offering RaaS charged per unit of work for pharmaceutical transport, meal delivery, and linen disposal with 24/7 monitoring.

Berkshire Grey

Berkshire Grey’s RaaS model automates fulfillment with AI-driven robotics, delivering 30% throughput gains and 20-40% labor reductions through scalable workflows, SLAs, and continuous software updates.

Zebra Technologies

Zebra Technologies offers AMRs on RaaS subscriptions with FetchCore software for rapid warehouse deployment, supporting picking and transport without infrastructure via cloud-based workflow orchestration.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?pratik

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele

This release was published on openPR.