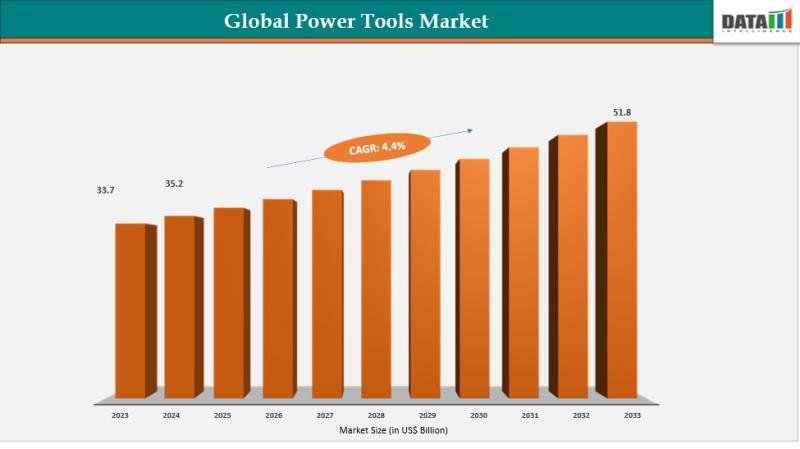

The power tools market reached US$ 33.7 billion in 2023, increased to US$ 35.2 billion in 2024, and is expected to reach US$ 51.8 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2025-2033. Market growth is driven by rising global construction activity, especially in emerging economies, and an increase in Do-It-Yourself (DIY) projects among homeowners, a trend accelerated by the COVID-19 pandemic. Technological advancements, particularly the shift from corded to cordless tools powered by improved lithium-ion batteries, are enhancing performance, runtime, and convenience, further boosting market adoption.

North America held the largest market share due to high DIY participation, strong construction activity, and early adoption of advanced cordless tools. Europe followed with growing professional and home improvement segments, while Asia-Pacific is expected to witness the fastest growth, supported by rapid urbanization, expanding construction projects, increasing disposable incomes, and growing awareness of power tool safety and efficiency.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/power-tools-market?sai-v

The power tools market refers to the global industry focused on electrically or battery-operated tools used for construction, woodworking, metalworking, and DIY applications.

Key Developments

✅ January 2026: In North America, manufacturers focused on expanding cordless and battery‐powered tool lines with improved battery life, faster charging, and enhanced digital tool‐to‐tool communication for professional and DIY segments.

✅ January 2026: In Europe, adoption of smart power tools integrated with IoT sensors and predictive maintenance features increased among industrial and construction enterprises to reduce downtime and optimize fleet utilization.

✅ December 2025: In Asia‐Pacific, rising infrastructure and construction activity supported strong demand for compact and high‐performance electric tools, driving product launches tailored to local requirements for ergonomics and energy efficiency.

✅ December 2025: Globally, innovations in brushless motor technologies improved power efficiency, torque delivery, and tool lifespan across both consumer and professional power tool categories.

✅ November 2025: In Latin America, distributor networks expanded offerings of economical and robust power tool kits that combine versatility with affordability to serve growing small business and home improvement markets.

✅ October 2025: Worldwide, increased emphasis on user safety features, including advanced electronic braking systems and overload protection-reflected heightened industry focus on compliant and secure tool operation.

Mergers & Acquisitions

✅ January 2026: In the United States, a major industrial equipment company acquired a well‐established cordless power tool brand to broaden its professional power solutions portfolio and accelerate entry into growth segments.

✅ December 2025: In Europe, a multinational tool manufacturer completed the acquisition of a regional hand and power tool business to strengthen distribution networks and product breadth in emerging markets.

✅ November 2025: In Asia‐Pacific, a key power tools OEM acquired a specialty accessory and battery systems company to enhance compatibility and performance of its cordless tool ecosystem.

Key Players

Stanley Black & Decker, Inc. | Techtronic Industries Co. Ltd. | Robert Bosch Power Tools GmbH | Makita Corporation | Hilti Corporation | Metabowerke GmbH | Einhell Germany AG | Snap-on Incorporated | Festool GmbH | Apex Tool Group, LLC | Others

Key Highlights

Stanley Black & Decker, Inc. holds 18.7% share, driven by its diversified power tools portfolio, strong global brand presence, and continuous innovation in professional and consumer tools.

Techtronic Industries Co. Ltd. holds 15.4% share, supported by its leading cordless tool technologies, strong brand portfolio including Milwaukee and Ryobi, and extensive distribution network.

Robert Bosch Power Tools GmbH holds 14.9% share, leveraging advanced engineering, innovative product designs, and a strong presence in Europe and North America.

Makita Corporation holds 12.6% share, driven by high-performance power tools, focus on professional users, and global manufacturing and distribution capabilities.

Hilti Corporation holds 10.3% share, supported by premium construction tools, strong customer service, and innovation in high-end professional solutions.

Metabowerke GmbH holds 7.1% share, leveraging its durable professional-grade power tools and specialized solutions for industrial and construction applications.

Einhell Germany AG holds 5.6% share, driven by cost-effective consumer and DIY tools, expanding international reach, and innovative battery-powered solutions.

Snap-on Incorporated holds 4.8% share, supported by its high-quality automotive and industrial tools, strong dealer network, and brand loyalty among professionals.

Festool GmbH holds 4.2% share, leveraging precision tools for woodworking and construction, premium positioning, and focus on professional craftsmanship.

Apex Tool Group, LLC holds 3.9% share, driven by diversified hand and power tools portfolio, strategic acquisitions, and strong presence in industrial and consumer segments.

Others account for 2.5% share, comprising regional and niche power tool manufacturers offering specialized solutions.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=power-tools-market?sai-v

Market Drivers

Increasing construction, infrastructure, and industrial activities globally driving demand for electric and cordless power tools.

Rising preference for DIY (do-it-yourself) projects among homeowners and hobbyists fueling residential power tool adoption.

Technological advancements including brushless motors, battery-powered tools, and IoT-enabled smart tools enhancing efficiency and usability.

Growing focus on ergonomics, safety features, and portability in power tool design to improve user experience.

Expansion of e-commerce platforms and organized retail channels improving accessibility and product availability.

Industry Developments

Launch of advanced cordless and battery-operated power tools with longer runtime and faster charging capabilities.

Integration of smart and connected features enabling tool monitoring, predictive maintenance, and usage analytics.

Strategic collaborations, mergers, and acquisitions among major power tool manufacturers to expand product portfolios and global reach.

Development of sustainable and energy-efficient tools using eco-friendly materials and reduced power consumption technologies.

Increasing aftermarket services, training programs, and tool rental services to enhance customer engagement and brand loyalty.

Regional Insights

North America – 36% share: “Driven by strong construction activity, widespread adoption of DIY projects, and high demand for advanced and cordless tools.”

Europe – 28% share: “Supported by established industrial infrastructure, focus on energy-efficient tools, and growing DIY culture.”

Asia Pacific – 26% share: “Fueled by rapid urbanization, booming construction industry, increasing industrial production, and rising disposable incomes.”

Latin America – 6% share: “Driven by improving construction and manufacturing sectors, along with growing adoption of professional-grade tools.”

Middle East & Africa – 4% share: “Supported by infrastructure development projects, expanding industrial activities, and gradual adoption of modern power tools.”

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/power-tools-market?sai-v

Key Segments

By Tool

Drilling and fastening tools dominate the market, driven by their widespread use in construction, manufacturing, and DIY projects for tasks such as drilling, screwing, and bolting. Demolition tools hold a significant share, supported by growing construction and renovation activities requiring breaking, cutting, and removal of materials. Material removal tools are witnessing steady adoption due to their use in grinding, sanding, and polishing applications across industrial and residential projects. Routing tools account for a smaller but important segment, primarily used for precision shaping and finishing in woodworking and cabinetry. Other tools, including measuring, cutting, and specialty equipment, contribute modestly to overall market growth.

By Mode of Operation

Electric tools represent the largest segment, driven by their ease of use, portability, and increasing availability of cordless and battery-powered solutions. Pneumatic tools hold a substantial share, supported by their durability, high performance, and continued preference in heavy-duty industrial applications. Other modes of operation, including hydraulic and manual tools, contribute a smaller portion of the market and are typically used in niche or specialized applications.

By Application

Non-residential applications dominate the market, fueled by ongoing commercial construction, infrastructure development, and industrial manufacturing activities. Residential applications account for a significant share, driven by the growth of home improvement projects, DIY initiatives, and increasing adoption of compact, user-friendly power tools for household tasks.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.