Narrowband IoT Market to Reach USD 17.3 Billion by 2035 as Smart Utilities, Satellite NTN, and Edge Intelligence Redefine Low-Power Connectivity

A Market Quietly Becoming the Digital Spine of Modern Infrastructure

The Narrowband IoT Market has spent years operating under the radar. Yet over the past three years, it has started to behave less like a niche connectivity option and more like the connective tissue that holds national infrastructure together. In 2025 the market is valued at USD 1.0 billion, and by 2035 it is projected to surge to USD 17.3 billion, growing at a rapid 32.5% CAGR.

This Black Friday: get 15% off all our market reports.

Buy Now: https://marketgenics.co/buy/narrowband-iot-market-80808

The shift is not just a matter of more devices coming online. It reflects a deeper transition: utilities, industrial operators, logistics networks, and city administrations now depend on NB-IoT to manage long-life, mission-critical assets that run quietly in the background. NB-IoT offers exactly what this class of devices needs-deep coverage, long battery life, predictable uplink behavior, and extremely low operational cost.

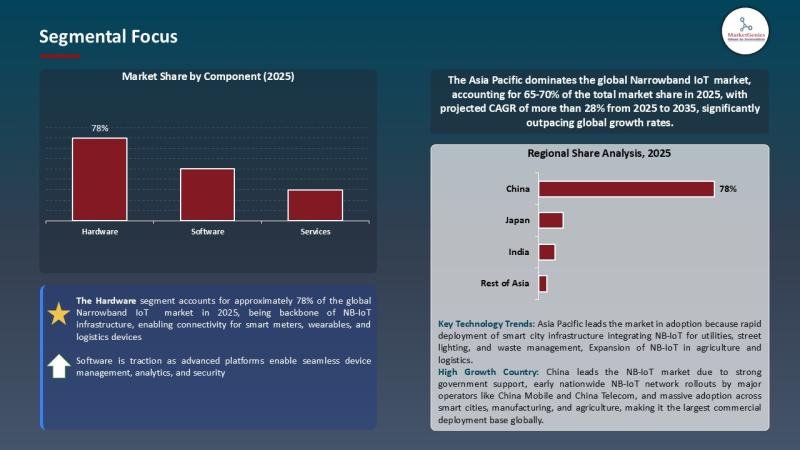

Asia Pacific sets the pace with 67.2% of global Narrowband IoT Market share in 2025, driven by large-scale metering programs in China, nationwide NB-IoT rollouts in India, and rapidly growing smart-city deployments in South Korea.

Why NB-IoT Has Become the First Choice for National-Scale Smart Platforms

Hardware Dominates Because Deployments Have Shifted From Pilots to Permanence

In 2025, hardware accounts for 78% of overall Narrowband IoT Market spending. Operators and enterprises are buying modules and chipsets in the millions as countries move from small proofs of concept to permanent, regulated deployments.

Qualcomm’s 2025 NB-IoT chipset series-with integrated iSIM and improved power efficiency-set the tone for module cost reduction and simpler device lifecycle management. Vendors across Asia Pacific have followed with similar innovations, especially as utilities accelerate smart water, gas, and electricity programs.

This hardware acceleration is also reshaping the Narrowband IoT (NB-IoT) Chipset Market, pushing manufacturers to integrate satellite support, GNSS, stronger security, and multi-band firmware in a single SKU. The chipset layer is now one of the fastest-evolving parts of the global IoT landscape.

Smart Metering: The Largest, Most Predictable Source of Long-Term NB-IoT Growth

NB-IoT’s fit with utility metering is almost mechanical. The industry needs:

ultra-low power consumption

strong indoor penetration, especially in basements

decade-long battery performance

predictable messaging patterns

Vodafone’s NB-IoT-enabled smart-meter rollout with ISTA in 2024 demonstrated all four advantages clearly. The 2025 cross-border NB-IoT roaming trial between Deutsche Telekom and Vodafone extended that confidence across Europe, allowing multinational utilities to treat the technology as continental infrastructure rather than a collection of national deployments.

Billions of meters worldwide will be replaced over the next decade. NB-IoT offers a stable, long-term foundation for this shift.

Get the Detailed Industry Analysis (including the Table of Contents, List of Figures, and List of Tables) – from the Narrowband IoT Market Research Report: https://marketgenics.co/reports/narrowband-iot-market-80808

Four Shifts Reshaping the Narrowband IoT Market

Driver | A Global Wave of Smart-Utility and Industrial Rollouts

The most powerful force lifting the Narrowband IoT Market comes from utilities modernizing decades-old systems. Cities want remote leak detection, automated metering, and networked street lighting. Manufacturers want continuous condition monitoring. Logistics firms want trackers that survive years in the field without human intervention.

NB-IoT is uniquely positioned because it provides reliability without operational complexity, and battery longevity without expensive maintenance cycles.

Restraint | Spectrum Fragmentation Creates a Drag on Global Deployment Speed

NB-IoT’s global growth would be even faster if spectrum policies were aligned. Operators in some regions reallocate low-band spectrum toward 5G, while others double down on NB-IoT. The result is uneven availability, and device makers must design multi-band, multi-variant modules that cost more to certify and support.

For enterprises planning multi-country deployments, this fragmentation can stretch timelines and push them toward regional operator partnerships instead of global rollouts.

Opportunity | NB-IoT + Satellite NTN Will Unlock Entirely New Markets

The next leap forward comes from NB-IoT traveling beyond terrestrial coverage. With Non-Terrestrial Networks (NTN), NB-IoT devices will work in:

maritime shipping

remote farms

offshore energy platforms

mines

border zones

disaster areas

Satellite-enabled NB-IoT becomes commercially available in 2026, with Iridium and other satellite players preparing global support. Module makers are already certifying hybrid NB-IoT/NTN hardware.

This extension creates a compelling new revenue frontier for the NB-IoT Chipset Market, especially in industries where no alternative connectivity existed before.

Key Trend | AI at the Edge Turns NB-IoT Into a Predictive Infrastructure Layer

A second major trend is unfolding quietly but steadily. Enterprises do not want to move raw telemetry data into the cloud; they want devices that can interpret what they see and decide whether the data is worth sending.

Qualcomm’s 2025 IoT modem lineup directly addresses this-embedding iSIM, security layers, and lightweight ML inference capabilities. Telecom operators have followed suit by offering connectivity bundles with anomaly detection and predictive-maintenance pipelines built in.

This trend reduces cloud costs, shortens decision loops, and pushes NB-IoT into operational workflows rather than reporting workflows.

To know more about the Narrowband IoT Market – Download our Sample Report: https://marketgenics.co/download-report-sample/narrowband-iot-market-80808

Regional Momentum | Where NB-IoT Growth Will Concentrate Through 2035

Asia Pacific Leads and Will Continue to Lead

India’s NB-IoT expansion through Airtel and Nokia, China’s city-wide sensor grids, and South Korea’s smart-infrastructure upgrades have created an environment where NB-IoT is not merely adopted-it is embedded.

Government programs for utilities, public safety, and disaster alerts are sustaining long-term demand for hardware and connectivity.

Europe Prioritizes Smart Utilities and Continent-Wide Roaming

Europe’s growth may be steadier, but it is anchored in regulation. Sharper ESG reporting requirements, stricter efficiency targets, and aging utility infrastructure create a large addressable base for NB-IoT.

The pan-European roaming trials in 2025 strengthen NB-IoT’s appeal for multi-country energy providers that want a uniform connectivity stack.

North America Gains Traction Through Industrial IoT and Cold-Chain Monitoring

North American telecom operators are expanding NB-IoT for fleet management, smart retail, pharmaceutical logistics, pipeline monitoring, and building automation. Growth is driven less by regulation and more by operational savings.

How Vendors Compete in the Narrowband IoT Market

The market has a moderately consolidated structure, led by Huawei, Ericsson, Nokia, Qualcomm, China Mobile, Vodafone, u-blox, Sierra Wireless, and Telit.

Three competitive factors matter most:

Chipset sophistication (iSIM, satellite support, power optimization)

Network reliability and roaming depth

Integration strength across cloud, analytics, and device management

Vodafone España’s platform operating 9.3 million NB-IoT devices demonstrates why telecom operators are expanding from connectivity into value-added IoT services. TRASNA’s acquisition of u-blox’s IoT module division reflects consolidation across the module landscape as vendors aim to own more of the device value chain.

The Narrowband IoT Market Outlook Through 2035

NB-IoT’s future is not tied to single industries. It is becoming the connective fabric for national infrastructure, industrial performance, and long-life asset visibility. The market opens a USD 16.3 billion opportunity between now and 2035.

Investors, integrators, and enterprise buyers who want deep segmentation, regional deployment models, competitive intelligence, and vendor benchmarking can access the full 450-page report.

Submit your corporate email, authentic phone number, and specific data requirements, and our research team will share a tailored preview before the final purchase decision.

Get a preview of our Narrowband IoT Market Playbook – your guide to GTM strategy, competitive intelligence, supplier dynamics, and Consumer Behavior Analysis: https://marketgenics.co/playbook/narrowband-iot-market-80808

About Us

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

Contact:

Mr. Debashish Roy

MarketGenics India Pvt. Ltd.

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

This release was published on openPR.