Mortgage Calculator Tool Market Overview:

The mortgage calculator tool market has emerged as a critical component of the financial technology landscape, particularly in the realm of real estate and personal finance. These tools facilitate informed decision-making for potential homebuyers by providing accurate calculations of mortgage payments based on various variables such as loan amount, interest rates, and repayment terms.

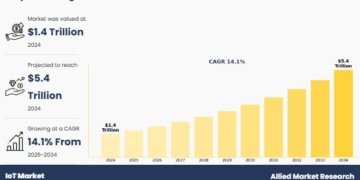

The Mortgage Calculator Tool Market size is expected to grow from 284.46(USD Billion) in 2024 to 500.0 (USD Billion) by 2032. The Mortgage Calculator Tool Market CAGR (growth rate) is expected to be around 7.3% during the forecast period (2024 – 2032).

Browse a Full Report (Including Full TOC, List of Tables & Figures, Chart) –

https://www.wiseguyreports.com/reports/mortgage-calculator-tool-market

The increasing complexity of mortgage products and the growing emphasis on financial literacy have spurred demand for user-friendly mortgage calculators, driving market growth. With advancements in technology, particularly in artificial intelligence and machine learning, mortgage calculators have evolved from simple online tools to comprehensive platforms that offer personalized mortgage advice.

This evolution not only enhances user experience but also enables financial institutions and real estate agencies to engage with potential clients more effectively. As digital solutions continue to permeate various sectors, the mortgage calculator tool market is poised for substantial growth, with projections indicating a robust compound annual growth rate (CAGR) in the coming years.

Market Segmentation:

The mortgage calculator tool market can be segmented based on type, deployment mode, end-user, and region. By type, the market is divided into standard mortgage calculators, amortization calculators, and comparison calculators. Standard mortgage calculators provide basic estimates of monthly payments, while amortization calculators offer detailed breakdowns of principal and interest payments over time. Comparison calculators enable users to evaluate multiple mortgage options side by side, aiding in informed decision-making.

In terms of deployment mode, the market is categorized into web-based and mobile applications. Web-based tools are typically hosted on financial institution websites or dedicated platforms, while mobile applications allow users to access mortgage calculations on the go, reflecting the growing trend toward mobile banking. The end-user segmentation includes individual consumers, real estate agencies, and financial institutions, with individual consumers representing the largest segment due to the rising number of first-time homebuyers seeking transparent and accessible mortgage information.

Get a sample PDF of the report at –

https://www.wiseguyreports.com/sample-request?id=586491

Market Key Players:

The mortgage calculator tool market features several key players that have established themselves as leaders in the field. Prominent companies include,

• Rocket Mortgage

• Wells Fargo

• The Mortgage Reports

• NerdWallet

• MortgageCalculator.org

• Trulia

• Bankrate

• SoFi

• Zillow

• Bank of America

which have developed comprehensive and user-friendly mortgage calculator solutions. Zillow, for instance, not only provides a mortgage calculator but also integrates real estate listings, enabling users to explore properties while calculating their potential mortgage payments. Other notable players include Quicken Loans, which offers advanced mortgage calculators as part of its digital suite for home financing, and NerdWallet, which provides a range of financial tools, including mortgage calculators, to help consumers make informed financial decisions. The competitive landscape is characterized by continuous innovation, with companies focusing on enhancing user interfaces, incorporating advanced analytics, and offering personalized recommendations to differentiate their offerings.

Recent Developments:

Recent developments in the mortgage calculator tool market highlight the ongoing transformation of digital financial services. The integration of artificial intelligence (AI) and machine learning technologies has allowed mortgage calculators to provide more accurate and personalized results, catering to individual user preferences and financial situations. For instance, some platforms now utilize AI to analyze user data and suggest optimal mortgage products based on user profiles. Additionally, the rise of open banking has enabled mortgage calculators to pull real-time data from various financial institutions, improving the accuracy of calculations.

Furthermore, the COVID-19 pandemic has accelerated the shift toward digital solutions, prompting financial institutions to invest in advanced mortgage calculators as part of their online services. As remote work becomes more prevalent, consumers are increasingly relying on digital tools to navigate the complexities of home financing, driving further growth in the mortgage calculator tool market.

Market Dynamics:

The mortgage calculator tool market is influenced by various dynamics that shape its growth trajectory. One of the primary drivers is the increasing demand for transparency in mortgage processes, with consumers seeking tools that simplify complex calculations and provide clear insights into their financial commitments. Additionally, the rising number of first-time homebuyers, particularly millennials and Generation Z, is propelling demand for accessible and user-friendly mortgage calculators. As these demographics prioritize digital solutions, financial institutions and real estate agencies are compelled to adopt advanced mortgage calculators to remain competitive.

However, the market also faces challenges, such as the need for regulatory compliance and the potential for data privacy concerns. Ensuring that mortgage calculators adhere to industry regulations while safeguarding user data is essential for maintaining consumer trust. Despite these challenges, the overall outlook for the mortgage calculator tool market remains positive, supported by ongoing technological advancements and changing consumer preferences.

Regional Analysis:

The regional analysis of the mortgage calculator tool market reveals significant variations in demand and adoption rates across different geographies. North America holds a dominant position in the market, driven by a high concentration of financial technology firms and a robust real estate market. In the United States, the increasing use of digital tools by consumers and the growing reliance on online mortgage services have contributed to the region’s growth. Europe also presents substantial opportunities, particularly in countries like the United Kingdom and Germany, where the adoption of digital financial solutions is on the rise.

The Asia-Pacific region is expected to witness the fastest growth rate, fueled by the expanding middle class, urbanization, and a burgeoning real estate market in countries such as China and India. As more consumers in these regions seek information on mortgage products, the demand for mortgage calculators is likely to surge. Overall, the mortgage calculator tool market exhibits a diverse landscape, with varying opportunities and challenges across different regions.

The mortgage calculator tool market is set for significant growth as technology continues to advance and consumer preferences shift toward digital solutions. With an increasing emphasis on financial literacy and transparency, the demand for user-friendly mortgage calculators is likely to rise, providing opportunities for key players to innovate and enhance their offerings. As the market evolves, staying attuned to changing dynamics and regional trends will be crucial for stakeholders aiming to capitalize on this burgeoning sector.

Top Trending Reports:

• Railroad Transportation Service Market –

https://www.wiseguyreports.com/reports/railroad-transportation-service-market

• Ria Compliance Software Market –

https://www.wiseguyreports.com/reports/ria-compliance-software-market

• Retail Cleaning Services Market –

https://www.wiseguyreports.com/reports/retail-cleaning-services-market

• Server Side Ad Insertion Market –

https://www.wiseguyreports.com/reports/server-side-ad-insertion-market

• Search Engine Market –

https://www.wiseguyreports.com/reports/search-engine-market

• Saas License Management Market –

https://www.wiseguyreports.com/reports/saas-license-management-market

• Services Procurement Solutions Market –

https://www.wiseguyreports.com/reports/services-procurement-solutions-market

• Program Management Tool Market –

https://www.wiseguyreports.com/reports/program-management-tool-market

• Project Tracker Tool Market –

https://www.wiseguyreports.com/reports/project-tracker-tool-market

• Saas Erp Market –

https://www.wiseguyreports.com/reports/saas-erp-market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune – 411028

Maharashtra, India 411028

Sales: +91 20 6912 2998

This release was published on openPR.