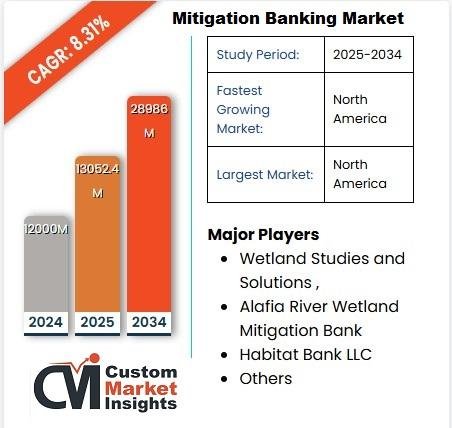

Market Size

➤ Mitigation Banking Market size was valued at USD 13,052.4 Million in 2025 and is projected to reach approximately USD 28,986 Million by 2034, expanding at a compound annual growth rate (CAGR) of around 8.31% during the forecast period 2025-2034.

• The market’s steady expansion reflects increasing regulatory enforcement related to environmental protection and biodiversity conservation.

• Mitigation banking has become a preferred compliance mechanism for developers seeking to offset unavoidable environmental impacts.

✅ Request Sample Search Report for detailed data tables, Interactive Market sizing Dashboards, and Actionable Analyst Insights –

https://www.custommarketinsights.com/request-for-free-sample/?reportid=11456

✅ Long-term infrastructure expansion and stricter environmental regulations are expected to sustain market momentum throughout the forecast period.

Market Overview

➤ Mitigation Banking Market refers to the establishment, restoration, enhancement, and preservation of natural habitats-such as wetlands, streams, and forests-to compensate for ecological damage caused by development activities.

• Mitigation banks generate credits that are sold to developers to meet regulatory requirements under environmental laws.

• These banks provide an efficient, market-based solution for environmental offsetting.

• Governments and regulatory bodies increasingly favor mitigation banking over permittee-responsible mitigation due to better ecological outcomes and long-term monitoring.

✅ As environmental compliance becomes more complex, mitigation banking is emerging as a standardized and scalable solution worldwide.

Key Market Growth Drivers

➤ Mitigation Banking Market growth is driven by a combination of regulatory, environmental, and economic factors:

• Stringent Environmental Regulations

Governments worldwide are enforcing laws that require developers to compensate for environmental damage.

• Rapid Infrastructure Development

Large-scale projects in transportation, energy, and urban development increase the need for mitigation credits.

• Preference for Off-Site Mitigation

Mitigation banking offers higher ecological success rates compared to on-site mitigation.

• Rising Awareness of Ecosystem Services

Growing recognition of wetlands and forests in flood control, carbon sequestration, and biodiversity conservation is boosting demand.

• Private Sector Participation

Increased involvement of private mitigation bank operators improves efficiency and credit availability.

✅ These drivers collectively reinforce the market’s long-term growth outlook.

Analysis of Key Players

➤ Mitigation Banking Market competitive landscape consists of specialized environmental firms, regional operators, and conservation-focused organizations.

Vertical – Prominent Players

• Wetland Studies and Solutions, Inc.

• Alafia River Wetland Mitigation Bank, Inc.

• The Mitigation Banking Group, Inc.

• Habitat Bank LLC

• The Loudermilk Companies

• Others

• Key players focus on securing regulatory approvals, expanding credit inventories, and maintaining ecological performance.

• Regional dominance plays a critical role due to location-specific regulatory frameworks.

✅ Get a Customized Report designed around your strategic goals and market priorities –

https://www.custommarketinsights.com/request-for-customization/?reportid=11456

✅ Competition is expected to intensify as new mitigation banks are established to meet rising demand.

Market Challenges & Opportunities

➤ Mitigation Banking Market faces several operational challenges but also offers strong growth opportunities:

Challenges

• High Initial Capital Investment

Land acquisition, restoration activities, and long-term monitoring require significant upfront investment.

• Lengthy Regulatory Approval Processes

Obtaining permits and approvals can delay project timelines.

• Geographic Constraints

Credits are often limited to specific service areas, restricting market flexibility.

Opportunities

• Expansion into Emerging Regions

Developing economies are beginning to adopt formal mitigation banking frameworks.

• Carbon and Biodiversity Credit Integration

Combining mitigation banking with carbon offset markets creates additional revenue streams.

• Technological Advancements

Use of GIS, remote sensing, and ecological modeling improves monitoring efficiency.

✅ Addressing regulatory and operational complexities can unlock substantial market value.

Key Player Strategies

➤ Mitigation Banking Market players employ multiple strategies to strengthen their competitive position:

• Strategic Land Acquisition

Securing ecologically valuable land in high-demand development corridors.

• Regulatory Collaboration

Working closely with environmental agencies to streamline approvals.

• Portfolio Diversification

Developing multiple mitigation bank types, including wetland, stream, and forest banks.

• Long-Term Stewardship Models

Ensuring compliance through perpetual conservation easements and monitoring programs.

• Mergers and Partnerships

Collaborations with developers and infrastructure companies to secure long-term credit demand.

✅ Strategic alignment with regulatory priorities remains a key success factor.

Recent Developments (Use as It Is from Report RD)

➤ Recent Developments – As per Report RD

• Expansion of mitigation banking projects to support large-scale transportation and energy infrastructure developments.

• Increased establishment of conservation and forest mitigation banks to address biodiversity loss.

• Adoption of advanced monitoring technologies to enhance ecological performance tracking.

• Strengthening of regulatory frameworks supporting third-party mitigation solutions.

✅ These developments highlight the industry’s evolution toward scalable and accountable environmental solutions.

Investment Landscape and ROI Outlook

➤ Mitigation Banking Market investment environment is increasingly attractive for long-term investors:

• Stable regulatory demand ensures predictable revenue streams from mitigation credit sales.

• Long asset lifecycles and limited competition within service areas support pricing stability.

• Private equity and institutional investors are showing increased interest due to strong ESG alignment.

• ROI improves over time as credit values appreciate with rising regulatory stringency.

✅ With a CAGR of 8.31%, mitigation banking presents a compelling investment opportunity aligned with sustainability goals.

Market Segmentations

➤ Mitigation Banking Market segmentation provides detailed insights into demand dynamics:

By Type

• Wetland or Stream Banks

• Conservation Banks

• Forest Conservation

By Industry

• Construction & Mining

• Transportation

• Energy & Utilities

• Healthcare

• Manufacturing

By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East & Africa

✅ North America dominates the market due to established regulatory frameworks and high infrastructure spending.

✅ Get Full Report Access and Explore Comprehensive Market Data –

https://www.custommarketinsights.com/report/mitigation-banking-market/

Why Buy This Report?

➤ Mitigation Banking Market report delivers actionable intelligence:

• ✅ Comprehensive market sizing and forecasts through 2034

• ✅ Detailed competitive landscape and company analysis

• ✅ Regulatory and policy impact assessment

• ✅ Strategic insights into growth drivers and investment risks

• ✅ Data-driven decision support for investors, developers, and policymakers

FAQs – Mitigation Banking Market

➤ 1. What is mitigation banking?

Mitigation banking involves restoring or preserving ecosystems to offset environmental impacts from development projects.

➤ 2. What is driving the Mitigation Banking Market growth?

Strict environmental regulations, infrastructure expansion, and preference for off-site mitigation are key drivers.

➤ 3. Which region leads the market?

North America leads due to well-established regulatory frameworks and high demand for mitigation credits.

➤ 4. What challenges does the market face?

High capital requirements, regulatory delays, and geographic limitations pose challenges.

➤ 5. What is the forecast growth rate?

The market is projected to grow at a CAGR of 8.31% from 2025 to 2034.

➤ Explore More Related Market Reports by CMI –

US 3D Printed Medical Implant Market:

https://www.custommarketinsights.com/report/us-3d-printed-medical-implant-market/

US Ultrasound Probe Disinfection Market:

https://www.custommarketinsights.com/report/us-ultrasound-probe-disinfection-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI is a one-stop solution for data collection and investment advice. Our company’s expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts advise clients on aspects such as strategies for future estimation, forecasting, opportunities to grow, and consumer surveys.

Contact Us:

Joel John

Custom Market Insights

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

US & Europe: +1 737 734 2707

APAC & Rest: +91 20 46022736

WhatsApp: +1 801-639-9061

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

This release was published on openPR.