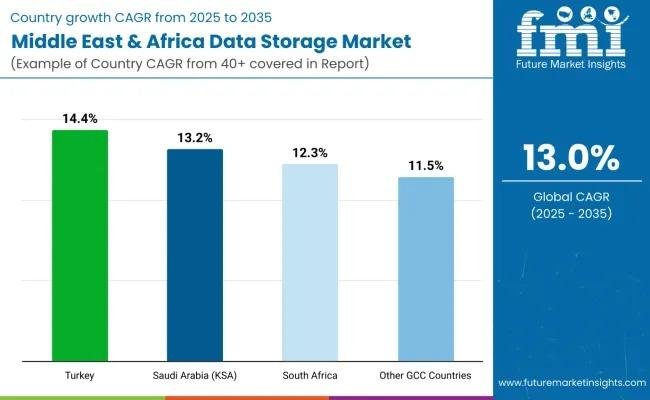

The Middle East & Africa (MEA) data storage market is entering a decade of accelerated structural expansion, projected to grow from USD 8.0 billion in 2025 to USD 27.2 billion by 2035, registering a robust 13% CAGR, according to the latest assessment by Future Market Insights (FMI).

This trajectory builds on a historical rise from USD 4,515.2 million in 2020 to USD 7,161.4 million in 2024, reflecting a 12.6% CAGR during a period marked by pandemic-driven digital acceleration and hyperscale infrastructure commitments.

The next growth cycle, however, is fundamentally different-anchored in sovereign cloud mandates, AI-driven workloads, renewable-backed hyperscale campuses, and regulatory localization frameworks across Gulf Cooperation Council (GCC) and Sub-Saharan African markets.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gc-1237

Multi-Billion-Dollar Infrastructure Commitments Reshape the Regional Landscape

Capital commitments announced at high-profile technology summits are redefining the region’s data backbone. At LEAP 2025, Equinix confirmed a USD 1 billion, 100 MW Riyadh facility, while Amazon Web Services unveiled a USD 5.3 billion Saudi cloud region scheduled for 2026 deployment.

Simultaneously, DataVolt signed a USD 5 billion agreement to develop a 1.5 GW net-zero campus in NEOM’s Oxagon, signaling a decisive shift toward renewable-powered hyperscale ecosystems.

Microsoft’s additional USD 300 million AI-cloud expansion in South Africa, Oracle’s eight-region expansion- including enhanced Johannesburg capacity-and Abu Dhabi-based G42 Cloud deploying ultra-dense, all-flash object stores in partnership with VAST Data further reinforce hyperscaler momentum.

Collectively, these projects position MEA as an emerging globally integrated data supply node, rather than a peripheral hosting destination.

Enterprise Storage Dominates Investment Priorities

In 2025, the enterprise storage segment commands 60.2% market share, supported by accelerating cloud-first mandates, AI analytics adoption, and sector-specific compliance frameworks.

Key growth drivers include:

• All-flash arrays and NVMe architectures

• Hybrid storage deployments

• Hyper-converged infrastructure

• Sovereign cloud-compliant systems

Global vendors including Dell Technologies, Hewlett Packard Enterprise, and Huawei are expanding regional capabilities, while NetApp continues footprint expansion to capture compliance-driven enterprise demand.

FMI forecasts that enterprise storage deployments will triple by 2030, requiring an estimated 8 GW of renewable-backed power capacity to sustain AI, IoT, and sovereign workloads.

Telecom & IT: 5G and Smart Cities Fuel Data Growth

The telecom & IT industry accounts for 28.4% of market share in 2025, driven by 5G rollouts and smart city programs across GCC nations.

IT spending in GCC countries surpassed USD 90 billion in 2023, reflecting sustained commitment to digital infrastructure. Telecom leaders such as Saudi Telecom Company and Etisalat are upgrading storage architectures to support:

• Latency-sensitive applications

• AI-enabled network analytics

• Cloud-native service platforms

• Massive IoT data ingestion

Flash arrays and 25-100 GbE fabrics are gaining share as 5G and edge computing demand sub-millisecond response times.

Edge Infrastructure Expands Across Sub-Saharan Africa

Edge deployments are emerging as a complementary growth engine. The International Finance Corporation’s USD 100 million financing for Raxio Group is catalyzing carrier-neutral facilities from Ethiopia to Angola, reducing reliance on European data hubs and improving fintech and gaming latency performance.

Decentralized clusters, hyper-converged systems, and distributed object storage models are gaining adoption in financial services and telecom verticals, where real-time transaction processing and regulatory compliance intersect.

Regulatory Frameworks Drive Localization

Regulatory mandates are reshaping procurement criteria:

• Saudi Arabia’s Cloud Computing Regulatory Framework (CCRF) requires sensitive data localization.

• The UAE’s Personal Data Protection Law (PDPL) governs cross-border transfers.

• South Africa’s POPIA and Nigeria’s NDPR enforce stringent personal data safeguards.

Providers offering ISO 27001 compliance, sovereign cloud zones, and in-country resilience frameworks are capturing disproportionate share.

Localization mandates are accelerating partnerships between governments and hyperscalers, reinforcing domestic data ecosystems and cybersecurity standards.

Semi-Annual Growth Trends Confirm Sustained Momentum

FMI’s semi-annual analysis shows:

• H1 2024-2034 CAGR: 13.2%

• H2 2024-2034 CAGR: 12.9%

• H1 2025-2035 CAGR: 13.6%

• H2 2025-2035 CAGR: 12.7%

The 40-basis-point uptick in H1 2025-2035 reflects hyperscale project acceleration and sovereign policy alignment.

Country-Level Highlights

• Turkey: Fastest-growing market at 14.4% CAGR, driven by digital governance and fintech expansion.

• Saudi Arabia: 13.2% CAGR, supported by Vision 2030, NEOM, and cloud-first mandates.

• South Africa: 12.3% CAGR, benefiting from undersea cable landings and fintech ecosystem growth.

Across these markets, hybrid-cloud, AI-driven analytics, and localized enterprise storage form the core growth engine.

Market Structure and Competitive Intensity

The MEA data storage landscape is moderately consolidated:

• Tier 1 players (45-50% share): Western Digital, Dell EMC, Microsoft Corporation

• Tier 2 (15-20%): IBM, NetApp

• Tier 3 (30-35%): Hitachi Vantara, Micron Technology

Recent market activity-including Dell APEX Storage-as-a-Service launch in South Africa, Cisco-Hitachi integration agreements, and Kioxia’s USD 14 billion refinancing-highlights consolidation and service-based monetization models.

Exhaustive Market Report: A Complete Study

https://www.futuremarketinsights.com/reports/middle-east-data-storage-market

Structural Drivers Supporting Long-Term Expansion

Key structural catalysts include:

• Government digital agendas (Vision 2030, Smart Government programs)

• Cloud-first policies and AI investments

• 5G infrastructure rollout

• Smart city developments

• Rising cybersecurity spending

• Renewable-powered hyperscale campuses

Automation and AI-driven data center management tools are also mitigating the regional skills gap, enhancing operational resilience.

Strategic Outlook

The MEA data storage market’s progression from USD 8.0 billion in 2025 to USD 27.2 billion by 2035 underscores a structural shift toward hyperscale, sovereign, and renewable-integrated architectures.

With enterprise storage commanding 60% share, telecom verticals accelerating demand, and regulatory frameworks reinforcing localization, the region is rapidly transitioning into a globally competitive digital infrastructure hub.

As hyperscalers deepen commitments and sovereign cloud policies tighten, storage ecosystems across the Middle East and Africa are poised to become foundational enablers of AI, fintech, IoT, and next-generation digital economies.

The full Future Market Insights report delivers comprehensive investment intelligence, segment-level modeling, competitive benchmarking, and scenario analysis to support strategic decision-making in this high-growth market.

Similar Industry Reports

Middle East & Africa Sachet Packaging Machines Market

https://www.futuremarketinsights.com/reports/middle-east-and-africa-sachet-packaging-machines-market

Middle East & Africa Hydrolyzed Bovine Collagen Market

https://www.futuremarketinsights.com/reports/middle-east-and-africa-hydrolyzed-bovine-collagen-market

Middle East & Africa Stick Packaging Machines Market

https://www.futuremarketinsights.com/reports/middle-east-and-africa-stick-packaging-machines-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.