IMARC Group has recently released a new research study titled “Mexico Factory Automation Market Size, Share, Trends and Forecast by Component, System Type, Industry Vertical, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

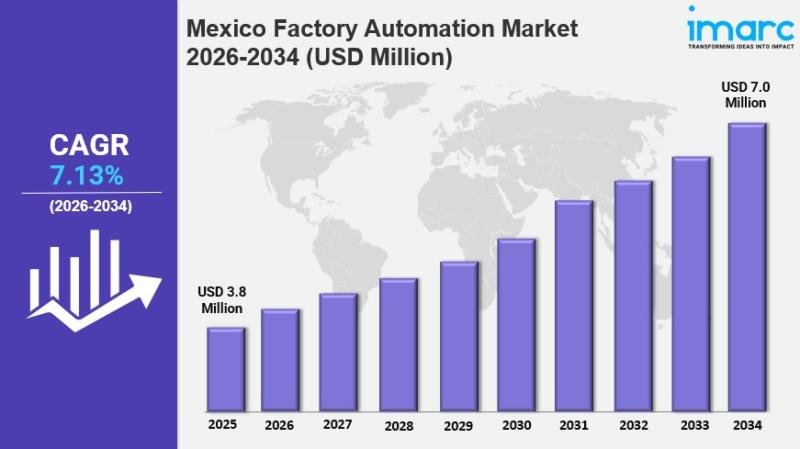

The Mexico factory automation market size was valued at USD 3.8 Million in 2025 and is expected to reach USD 7.0 Million by 2034, growing at a CAGR of 7.13% during the forecast period 2026-2034. This growth is driven by increasing industrialization and manufacturing activities in Mexico, boosting demand for automation to improve operational efficiency and scalability. Additionally, governmental initiatives and Industry 4.0 support facilitate the adoption of advanced manufacturing technologies, augmenting market growth.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Mexico Factory Automation Market Key Takeaways

● Current Market Size: USD 3.8 Million in 2025

● CAGR: 7.13% during 2026-2034

● Forecast Period: 2026-2034

● Mexico has become a key manufacturing hub especially in automotive, electronics, and consumer goods sectors, benefiting from proximity to the US and trade agreements like USMCA.

● Automation technologies such as robotic arms and automated guided vehicles improve productivity and address labor shortages and wage increases.

● Government efforts to modernize manufacturing through technology increase demand for automation solutions.

● Companies like ABB and Bosch Rexroth have made

significant investments in Mexico to expand automation and manufacturing capacities.

Sample Request Link: https://www.imarcgroup.com/mexico-factory-automation-market/requestsample

Mexico Factory Automation Market Growth Factors

The growth of industrialization and manufacturing in Mexico is a primary driver for the Mexico factory automation market. Mexico’s emergence as a manufacturing center, particularly for automotive, electronics, and consumer goods, is supported by proximity to the United States and favorable trade agreements like USMCA. These factors increase foreign direct investments and pressure to enhance production efficiency and quality through automation systems like robotic arms, AGVs, and control systems. Automation also addresses labor shortages, rising wages, and the demand for production accuracy.

Cost efficiency and productivity improvements are central to manufacturers’ strategies. Automation supports continuous operation, reduces human error, and minimizes downtime, thus enhancing output consistency and quality. Companies adopt smart factory concepts integrating IoT, sensors, and analytics to optimize real-time manufacturing processes. Investments like Bosch Rexroth’s new plant in Querétaro with 160 million euros boost local capacity and supply chain flexibility, supporting sectors such as agriculture, construction, and OEM.

Government initiatives significantly drive market growth by promoting manufacturing modernization. For example, ABB’s Mexico Technology and Engineering Center, launched with an initial USD 1 million investment, focuses on advancing automation capabilities and increasing engineering capacity by 25%. These programs help modernize sectors like mining, battery manufacturing, and pulp and paper, further underpinning the demand for advanced factory automation solutions.

Buy Report Now: https://www.imarcgroup.com/checkout?id=35741&method=980

Mexico Factory Automation Market Segmentation

Breakup by Component:

● Sensors: Devices detecting physical or environmental inputs to support automated processes.

● Controllers: Systems managing automation equipment functions and operations.

● Switches and Relays: Electrical components controlling circuit operations in automation.

● Industrial Robots: Automated machines used for manufacturing tasks such as assembly.

● Drives: Equipment transmitting power to automation machinery.

● Others: Additional supporting components in automation systems.

Breakup by System Type:

● Distributed Control System (DCS): Systems managing complex industrial processes distributed across multiple controllers.

● Supervisory Control and Data Acquisition System (SCADA): Systems for supervisory management and data gathering in industrial environments.

● Manufacturing Execution System (MES): Systems overseeing manufacturing processes to ensure efficiency.

● Systems Instrumented System (SIS): Safety-related control systems ensuring operational safety.

● Programmable Logic Controller (PLC): Industrial computers controlling machinery automation.

● Human Machine Interface (HMI): Interfaces enabling human interaction with automation systems.

Breakup by Industry Vertical:

● Automotive Manufacturing: Automation technologies applied in vehicle production.

● Food and Beverage: Automation in food processing and packaging.

● Oil and Gas Processing: Automation systems used in energy extraction and processing.

● Mining: Automated machinery and control systems in mineral extraction.

● Others: Various other industries employing automation solutions.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others represent the major regional market divisions. The report covers comprehensive regional analysis across these segments.

Recent Developments & News

On January 15, 2024, Jabil expanded its Center of Manufacturing Excellence in Chihuahua, Mexico, adding a third plant with over one million square feet of production space. This expansion significantly enhances factory automation capabilities by focusing on retail and warehouse automation solutions, including robotics, AI, and additive manufacturing. The new facility supports manufacturing advanced solutions like autonomous robots, self-checkout systems, and electronic shelf labels.

Key Players

● ABB

● Bosch Rexroth

● Jabil

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=35741&flag=C

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.