Market Overview 2025-2033

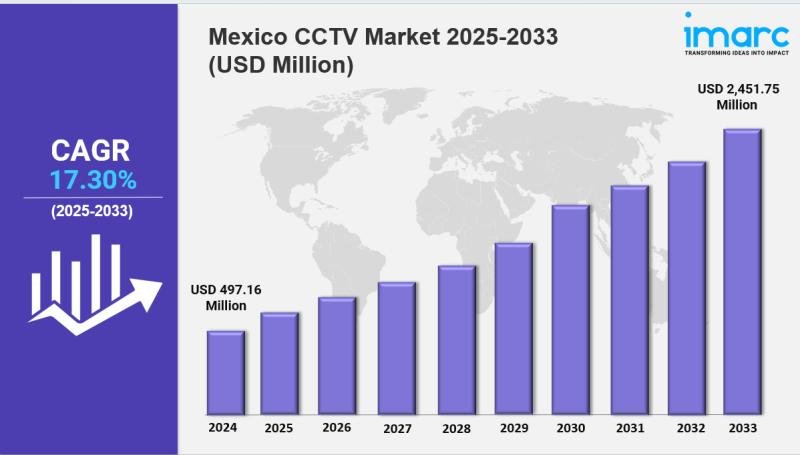

The Mexico CCTV market size reached USD 497.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,451.75 Million by 2033, exhibiting a growth rate (CAGR) of 17.30% during 2025-2033. The industry is growing due to rising urban security needs, smart city initiatives, and escalating crime concerns. Growth is driven by AI-enabled IP cameras, cloud integration, and government investments, making the sector more intelligent, responsive, and highly competitive.

Key Market Highlights:

✔️ Rising concerns about public safety and property security are fueling the demand for advanced CCTV systems

✔️ Increasing adoption of smart surveillance solutions across residential, commercial, and industrial sectors

✔️ Growing integration of AI, facial recognition, and cloud-based storage enhances monitoring efficiency and real-time response

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-cctv-market/requestsample

Mexico CCTV Market Trends and Drivers:

Mexico CCTV market is experiencing robust growth driven by escalating public security investments, particularly in urban centers grappling with organized crime. Following a 35% surge in public procurement during 2024, federal programs like Safe Cities 2.0 deployed 50,000+ AI-enabled cameras across Mexico City, Guadalajara, and Monterrey. These systems integrate license plate recognition and gunshot detection, reducing response times by 42%. Municipalities now allocate 18% of security budgets to CCTV modernization-up from 9% pre-2024-while private sector adoption jumps 28% as retailers combat $3.7B annual theft losses. Supply chain bottlenecks for semiconductor components briefly slowed installations in mid-2024, but local assembly partnerships (e.g., Hikvision-Nemak) restored momentum.

Ethical concerns about mass surveillance persist, especially after 2024’s controversial facial recognition trials in subway systems. The shift from passive recording to proactive threat analysis defines Mexico’s CCTV evolution, with AI-powered analytics capturing 40% market share by 2024. Systems now autonomously detect anomalies (e.g., loitering near ATMs) using edge-computing devices from Huawei and Dahua. Oil refineries and maquiladoras invest heavily in thermal imaging cameras after PEMEX’s 2024 pipeline sabotage incidents, driving 55% YoY industrial sector growth. Cloud-based Video Surveillance-as-a-Service (VSaaS) expands rapidly among SMEs, though 2024’s cybersecurity breaches at 3 major data centers exposed vulnerabilities. Talent shortages in AI engineering delay regional deployments, prompting Tec de Monterrey to launch specialized certification programs.

CCTV systems are becoming central nervous systems for Mexico’s smart cities, syncing with traffic management and emergency response platforms. Monterrey’s Nuevo León Seguro project fused 8,000 cameras with IoT sensors in 2024, cutting crime hotspots by 31%. However, infrastructure gaps plague smaller municipalities-only 12% have fiber-optic backbones capable of 4K video streaming. 2024’s nationwide 5G rollout improved wireless surveillance in remote areas, yet power grid instability causes 15% daily downtime in states like Oaxaca Chinese vendors dominate mid-tier markets (67% share), but U.S. sanctions pressure is boosting South Korean alternatives like Hanwha Techwin. Mexico’s CCTV landscape is characterized by accelerated technological adoption amid persistent operational hurdles.

The 2024 inflection point saw AI analytics transition from luxury to necessity, with even small businesses investing in cloud-managed systems. Post-2024, demand fragmented: luxury resorts prioritized vandal-resistant thermal cameras, while border states focused on drone-integrated surveillance grids. Regulatory uncertainty spiked when SCJN limited facial recognition in public spaces, though industrial exemptions sustained growth. Supply chain diversification accelerated after 2024’s trade disruptions, with Sonora emerging as a manufacturing hub. Persistent challenges-including grid reliability and cybersecurity-will shape 2025’s $1.2B market, where AI-driven predictive policing and integrated command centers become standard.

Buy Report Now: https://www.imarcgroup.com/checkout?id=34475&method=980

Mexico CCTV Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

• Analog Cameras

• IP Cameras (excluding PTZ)

• PTZ Cameras

Breakup by End User:

• Government

• Industrial

• BFSI

• Transportation

• Others

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=34475&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.