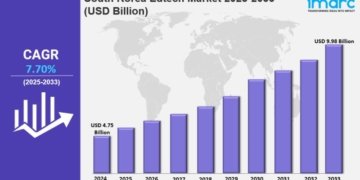

According to a new study by DataHorizzon Research, the marine flooring and deck covering market is projected to grow at a CAGR of 7.2% from 2025 to 2033. This consistent growth trajectory is being driven by rising global recreational boating activity, expanding commercial vessel fleet modernization programs, and growing demand for high-performance, aesthetically refined deck surface materials across both leisure and commercial marine applications. As boat owners, shipbuilders, and naval architects increasingly prioritize durability, slip resistance, UV stability, and premium visual appeal in deck surface specifications, the marine flooring and deck covering market is evolving from a functional materials category into a design-led, performance-driven product segment. Accelerating adoption of synthetic teak alternatives, luxury vinyl marine flooring, and composite deck covering systems is reshaping material preference patterns across the competitive landscape and driving sustained product innovation investment among leading manufacturers worldwide.

Marine Flooring And Deck Covering Market Key Growth Drivers and Demand Factors

The marine flooring and deck covering market is valued at approximately USD 3.8 billion in 2024 and is anticipated to reach around USD 7.5 billion by 2033, reflecting a CAGR of 7.2% from 2025 to 2033.

The marine flooring and deck covering market is advancing on the strength of converging demand forces that span recreational marine industry growth, commercial shipbuilding investment, and material science innovation – each reinforcing the other to create a durable and well-supported long-term market forecast.

The recreational boating sector is the single most consequential demand driver. Rising disposable income levels across North America, Western Europe, and Asia-Pacific are translating directly into increased boat ownership, marina berth occupancy, and yacht refit activity – each generating incremental demand for quality marine flooring and deck covering solutions across new build and aftermarket channels. Premium yacht and superyacht construction, in particular, is driving demand for the highest-value deck covering materials including luxury synthetic teak planking systems, custom-colored EVA foam deck pads, and designer-grade marine vinyl flooring with bespoke pattern capabilities.

Material innovation is simultaneously reshaping the marine flooring and deck covering market competitive landscape. Synthetic teak alternatives manufactured from high-density polyethylene, PVC composite, or thermoplastic elastomer compounds are gaining significant market share over natural teak due to their superior moisture resistance, zero maintenance requirements, longer service life, and alignment with sustainability procurement preferences among environmentally conscious vessel owners and commercial operators. These alternatives are now achieving visual and tactile parity with natural wood while delivering markedly superior functional performance in marine environments.

Commercial vessel segment demand – encompassing cruise ships, ferry operators, offshore support vessels, and naval craft – is generating consistent large-volume procurement activity within the marine flooring and deck covering market, particularly for anti-fatigue, non-slip, and chemically resistant deck surface systems that meet stringent classification society safety standards and vessel operator durability requirements.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/marine-flooring-and-deck-covering-market-44835

Why Choose Our Marine Flooring And Deck Covering Market Research Report

Our research report on the marine flooring and deck covering market is built on a rigorous primary research framework incorporating structured interviews with marine flooring system designers, shipyard procurement directors, boat builders, marine materials distributors, and commercial vessel fleet managers across 20 countries. This foundation supports a demand model that captures revenue dynamics across material type, vessel category, application context, and geography with the analytical precision that investment-grade market intelligence requires.

What differentiates this study within the marine flooring and deck covering market intelligence landscape is the integration of material technology trend analysis alongside commercial demand forecasting. Clients receive not only revenue segmentation data but also a forward-looking assessment of which synthetic material categories, installation technology formats, and vessel application segments are positioned to generate above-average demand acceleration through 2033. The competitive landscape section benchmarks ten key players across product portfolio breadth, material innovation investment, distribution network reach, and sustainability positioning.

For marine materials manufacturers, specialty distributors, shipyard procurement teams, marine industry private equity investors, and recreational boating product companies, this report delivers the decision-grade intelligence needed to act with strategic confidence in a market defined by material substitution dynamics and premium product premiumization trends.

Important Points

• Synthetic teak alternatives represent the fastest-growing material category within the marine flooring and deck covering market, capturing an expanding share of both new build specifications and aftermarket refit installations as natural teak procurement faces sustainability and cost headwinds.

• Europe currently holds the largest marine flooring and deck covering market share, anchored by the world’s highest concentration of yacht and superyacht construction activity, premium recreational boating culture, and stringent vessel safety and material compliance standards.

• Asia-Pacific is the fastest-growing regional market, driven by expanding shipbuilding capacity in China and South Korea, rising recreational boating participation in Australia and Japan, and growing cruise vessel fleet investment across the region.

• Luxury and superyacht applications generate the highest average revenue per vessel within the marine flooring and deck covering market, with premium custom deck covering systems commanding significant per-square-meter pricing premiums over standard recreational boat formats.

• The competitive landscape is moderately fragmented, with meaningful growth opportunities available for material innovators targeting the growing overlap between marine performance requirements and sustainability-driven procurement specifications.

Top Reasons to Invest in the Marine Flooring And Deck Covering Market Report

• Gain access to a fully validated revenue forecast with material type, vessel category, application segment, and geographic granularity to support product development planning, distribution investment, and investor reporting through 2033.

• Identify the highest-margin material categories and vessel application segments within the marine flooring and deck covering market, particularly premium synthetic teak systems and luxury yacht custom deck coverings where differentiation supports strong pricing power.

• Use competitive benchmarking data to evaluate product portfolio gaps, material technology investment priorities, and distribution channel reach relative to established and emerging market players across the marine flooring and deck covering market competitive landscape.

• Access country-level demand analysis across 22 markets to prioritize geographic expansion, dealer network development, or shipyard partnership programs in high-growth marine flooring and deck covering market territories.

• Leverage scenario-based forecast modeling to assess revenue sensitivity under variable recreational boating demand, raw material cost, and commercial shipbuilding cycle conditions across the full forecast horizon.

• Equip corporate development and investment teams with research-validated marine flooring and deck covering market intelligence that supports acquisition evaluation, licensing opportunity assessment, and strategic partnership structuring decisions with analytical rigor.

Marine Flooring And Deck Covering Market Challenges, Risks, and Barriers

Despite favorable structural demand, the marine flooring and deck covering market faces several meaningful challenges. Raw material cost volatility – particularly for PVC compounds, polyethylene resins, and specialty adhesive systems – introduces input cost unpredictability that compresses margins for manufacturers unable to pass increases through to price-sensitive vessel owner channels. Natural teak supply restrictions and rising timber certification requirements are simultaneously creating procurement complexity for the diminishing segment of the market that continues to specify natural wood. Installation labor cost inflation in major boatbuilding and refit markets is adding to total system cost, moderating demand among cost-sensitive recreational boat segments. Regulatory compliance variation across classification society standards and national maritime authority requirements creates product certification complexity for manufacturers pursuing multi-regional marine flooring and deck covering market access strategies.

Top 10 Market Companies

• AquaDeck Surface Solutions

• MarineFloor Technologies

• OceanTread Coverings

• HarborMat Industries

• NaviSurface Innovations

• TidalDeck Materials Group

• SeaLayer Flooring Systems

• CoastalGrip Marine Products

• BayDeck Composite Solutions

• WaveSurface Technologies

Market Segmentation

By Material Type

o Wood

o Teak

o Synthetic Wood

o Composite

o Vinyl

o Others

By Application

o Interior decks

o Exterior decks

o Wet Areas

o Dry Areas

o Others

By Installation Type

o New Installations

o Replacement & Retrofitting

By End User

o Commercial Vessels

o Passenger Ships

o Cruise Ships

o Military Ships

o Others

By Region:

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

Recent Developments

• AquaDeck Surface Solutions launched a new generation of 100% recyclable synthetic teak deck covering system in Q1 2025, developed from post-consumer recycled polyethylene content and certified to ISO 14001 environmental management standards, targeting sustainability-conscious yacht builders and commercial vessel operators across European and North American markets.

• MarineFloor Technologies entered into a strategic supply partnership with a leading Italian superyacht construction group in February 2025 to become the exclusive custom deck covering supplier across the shipyard’s entire new build portfolio, covering an estimated 18 vessels per year spanning 40 to 90 meters in length.

• OceanTread Coverings completed the acquisition of BayDeck Composite Solutions in March 2025, significantly expanding its composite deck covering manufacturing capacity and technical installation service capabilities across the United States recreational and commercial marine flooring and deck covering market.

• HarborMat Industries secured USD 48 million in growth financing in April 2025 to fund the development and commercialization of a new class of anti-microbial, UV-stabilized EVA foam deck pad systems specifically engineered for commercial ferry and cruise ship high-traffic deck zone applications.

• NaviSurface Innovations announced the opening of a dedicated marine flooring and deck covering research and development facility in Rotterdam, Netherlands, in Q2 2025, focusing on next-generation thermoplastic elastomer deck surface compounds with enhanced resistance to salt spray, fuel, and extreme temperature cycling across commercial vessel operating environments.

• TidalDeck Materials Group unveiled a proprietary co-extrusion synthetic teak profile system at METS 2025, offering an expanded palette of 24 natural wood grain color options with improved UV color stability certification, generating significant commercial interest from Mediterranean superyacht refit yards and North American luxury boat builders.

Marine Flooring And Deck Covering Market Regional Performance & Geographic Expansion

The marine flooring and deck covering market exhibits distinct regional demand characteristics shaped by recreational boating culture depth, commercial shipbuilding volume, and maritime infrastructure investment intensity. Europe leads the global marine flooring and deck covering market by revenue value, anchored by the world’s largest superyacht construction industry concentrated in Italy, the Netherlands, and Germany, combined with strong recreational boating markets across France, Scandinavia, and the United Kingdom. North America holds the second-largest market share, driven by the United States’ vast recreational boating ownership base and active commercial vessel refit market. Asia-Pacific is the fastest-growing region, led by shipbuilding in China and South Korea and expanding recreational boating in Australia. Latin America shows steady growth anchored by Brazil. The Middle East is emerging through luxury yacht marina development in the United Arab Emirates and Qatar.

How Marine Flooring And Deck Covering Market Insights Drive ROI Growth

Organizations that leverage precise, forward-looking intelligence on the marine flooring and deck covering market gain strategic advantages that translate directly into improved commercial outcomes, investment performance, and competitive positioning. Marine materials manufacturers can use segment-level demand forecasts and material preference shift analysis from this marine flooring and deck covering market report to align product development investment with the material categories and vessel application segments generating the strongest near-term growth acceleration – ensuring R&D capital is deployed against validated market opportunities rather than speculative category assumptions.

Distribution and channel management teams can use geographic demand mapping to configure dealer and installer networks that capture revenue from the highest-growth regional markets before competitive saturation develops. For private equity investors and strategic acquirers evaluating opportunities within the marine flooring and deck covering market, the competitive landscape benchmarking and market sizing data provide a structured analytical basis for target company valuation, operating improvement thesis development, and portfolio construction decisions. In a specialty materials market where material substitution dynamics, premium product premiumization, and sustainability-driven procurement shifts are creating meaningful competitive disruption, having research-grade intelligence on where the marine flooring and deck covering market is heading commercially positions decision-makers to allocate capital at the leading edge of demand transitions and capture disproportionate returns through the 2033 forecast horizon.

Sustainability & Regulatory Outlook

The marine flooring and deck covering market is operating within an increasingly consequential sustainability and regulatory environment that is actively reshaping material specification preferences, product development investment priorities, and competitive differentiation strategies across the global industry.

The most structurally significant regulatory development affecting the marine flooring and deck covering market is the accelerating restriction and phase-out of natural teak sourcing from endangered tropical hardwood species. The Convention on International Trade in Endangered Species of Wild Fauna and Flora listings and national timber import regulations in the European Union and United States are progressively narrowing legal certified teak supply channels, creating a compliance-driven material substitution imperative that is systematically redirecting demand toward high-quality synthetic alternatives. This regulatory dynamic represents one of the most durable structural demand drivers within the marine flooring and deck covering market competitive landscape for the entire forecast period.

Classification society requirements from Lloyd’s Register, Bureau Veritas, DNV, and the American Bureau of Shipping are establishing evolving technical standards for marine deck surface materials covering fire resistance, slip resistance coefficient thresholds, chemical resistance, and structural adhesion performance. Meeting these standards across multiple classification frameworks simultaneously is creating product certification investment demands that favor well-resourced manufacturers with global technical testing and compliance infrastructure.

On the sustainability side, the marine industry’s growing commitment to decarbonization and lifecycle environmental impact reduction is influencing deck covering material specification at the vessel design stage. Shipbuilders and yacht owners operating under IMO greenhouse gas reduction commitments and voluntary sustainability certification programs such as Green Marine and the MCS Responsible Vessel Standard are prioritizing deck covering materials with verified recycled content, low-VOC installation adhesive systems, and manufacturer take-back or end-of-life recycling program availability. These sustainability procurement drivers are creating durable commercial incentives for marine flooring and deck covering market manufacturers that invest proactively in verifiable circular economy product and supply chain programs through 2033.

Key Questions Answered in the Report:

1. What is the projected revenue forecast for the marine flooring and deck covering market through 2033, and which material categories and vessel application segments will generate the highest incremental growth?

2. Which region will dominate global marine flooring and deck covering market share, and what shipbuilding volume, recreational boating culture, and infrastructure investment dynamics underpin that regional leadership position?

3. What are the highest-margin material systems and vessel application categories within the current and near-term marine flooring and deck covering market landscape, particularly across superyacht custom systems and premium synthetic teak alternatives?

4. Who are the emerging challengers gaining competitive ground within the marine flooring and deck covering market competitive landscape, and what material innovation, sustainability positioning, or distribution strategies are driving their market momentum?

5. How are natural teak supply restrictions, synthetic alternative material advancement, and commercial vessel sustainability mandates reshaping the marine flooring and deck covering market demand profile and competitive dynamics through the forecast period?

6. What raw material cost pressures, classification society compliance requirements, and sustainability procurement trends will most significantly influence product development investment and manufacturer market positioning strategies through 2033?

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Water Purification Reverse Osmosis Membrane Elements Market: https://datahorizzonresearch.com/water-purification-reverse-osmosis-membrane-elements-market-24606

Slitter Rewinder Equipment Market: https://datahorizzonresearch.com/slitter-rewinder-equipment-market-25282

Water Electrolysis Machine Market: https://datahorizzonresearch.com/water-electrolysis-machine-market-25958

Digital Caliper Market: https://datahorizzonresearch.com/digital-caliper-market-26634

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.