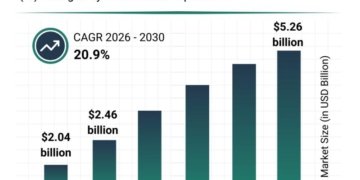

The CMOS image sensor market was valued at US$ 22.44 billion in 2023 and is projected to grow to US$ 24.25 billion in 2024. It is expected to reach US$ 53.10 billion by 2033, expanding at a CAGR of 9.10% from 2025 to 2033.

According to DataM Intelligence Comprehensive Report has released its latest report on the “CMOS Image Sensor Market Size 2025,” providing a detailed analysis of market trends, key growth drivers, competitive landscape, and regional insights. The report includes market size (value and volume), CAGR projections, and emerging opportunities that help businesses identify growth areas and build effective strategies. Backed by data-driven insights and future outlook, this study serves as a valuable resource for companies looking to stay competitive and capitalize on market potential.

United States: Recent Industry Developments

✅ October 2025: Sony Semiconductor expanded its CMOS sensor manufacturing capacity to meet growing demand from automotive and mobile sectors.

✅ September 2025: Qualcomm introduced AI-enhanced CMOS sensors optimized for next-gen smartphone cameras.

✅ August 2025: ON Semiconductor launched ultra-low-light CMOS image sensors for industrial and security applications.

Japan: Recent Industry Developments

✅ October 2025: Canon developed high-resolution CMOS sensors tailored for medical imaging devices.

✅ September 2025: Renesas Electronics advanced power-efficient CMOS sensor designs for IoT and wearable devices.

✅ August 2025: Sony Japan focused on integrating stacked CMOS sensors for enhanced dynamic range in consumer electronics.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/cmos-image-sensor-market?kb

Key Market Trends & Insights

In 2024, Asia-Pacific led the global CMOS image sensor market with a 45.9% share, driven by strong growth in consumer electronics, automotive imaging, and industrial sectors. Companies like Samsung are expanding production to meet rising demand for advanced smartphone and automotive sensors.

North America is the fastest-growing region, fueled by investments in automotive ADAS, industrial automation, and defense. In 2024, Teledyne e2v introduced high-performance CMOS sensors for aerospace and defense, highlighting the region’s focus on cutting-edge imaging technologies and innovation.

Major Key Player:

Sony Semiconductor Solutions Corporation, ams-OSRAM AG, STMicroelectronics, Samsung, Tokyo Electron Limited, OMNIVISION, Semiconductor Components Industries, LLC, Canon U.S.A., Inc, Panasonic Corporation of North America., Hamamatsu Photonics K.K.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/cmos-image-sensor-market?kb

Latest M&A Updates

In August 2025, ESS acquired Pictos Technologies for $27 million to enhance its CMOS imaging and sensor solutions for smartphones and camera modules.

STMicroelectronics announced plans to acquire parts of NXP Semiconductors’ sensor business for up to $950 million, boosting its MEMS and CMOS sensor capabilities in automotive and industrial sectors.

In mid-2025, Hamamatsu Photonics acquired BAE Systems Imaging, strengthening its portfolio of high-performance CMOS sensors for medical and industrial imaging applications.

Key Segments:

By Technology

Backside-Illuminated (BSI-CMOS) – 50%: preferred for higher sensitivity and better low-light performance.

Front-Illuminated (FI-CMOS) – 35%: widely used due to cost-effectiveness in standard applications.

Stacked CMOS Sensors – 15%: growing rapidly for advanced performance in high-end devices.

By Resolution

5 MP to 16 MP – 45%: balances image quality and cost for mainstream consumer and industrial use.

Above 16 MP – 35%: favored in high-end applications requiring detailed imaging.

Up to 5 MP – 20%: still relevant for basic imaging and cost-sensitive devices.

By Application

Consumer Electronics – 40%: largest segment driven by smartphones, webcams, and personal devices.

Automotive – 25%: increasing use in ADAS, driver monitoring, and autonomous systems.

Industrial – 20%: key in machine vision, inspection, and automation processes.

Buy Now & Get 30% OFF – (Grab 50% OFF on 2+ reports) @ https://www.datamintelligence.com/buy-now-page?report=cmos-image-sensor-market?kb

Latest News

In October 2025, Sony Semiconductor Solutions introduced the IMX828 CMOS image sensor for automotive cameras, featuring an advanced MIPI A-PHY interface that enhances data transmission speed and reliability.

Canon unveiled a 410-megapixel CMOS sensor in early 2025, designed for ultra-high-resolution industrial imaging and specialized applications.

In 2025, Eyeo secured $17 million in funding to advance novel sensor architectures aimed at improving sensitivity and image resolution.

Have any Query We Will Provide in Detailed @ https://www.datamintelligence.com/enquiry/cmos-image-sensor-market?kb

Recent Product Launches

Sony’s IMX828 sensor, featuring a built-in high-speed data interface, is a flagship release that boosts autonomous vehicle sensor performance.

Canon’s ultra-high-resolution sensor marks a breakthrough, advancing industrial inspection and imaging capabilities.

Eyeo is pioneering ultra-sensitive CMOS sensors designed to deliver superior image clarity in low-light conditions and specialized medical imaging.

Get 2-Day Free Trial + 50% OFF DataM Subscription@ https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

![[Latest] CMOS Image Sensor Market 2025: Industry Developments,](https://web3wire.org/wp-content/uploads/2025/11/Lb07625455_g.jpg)