IT Asset Disposition Market Overview:

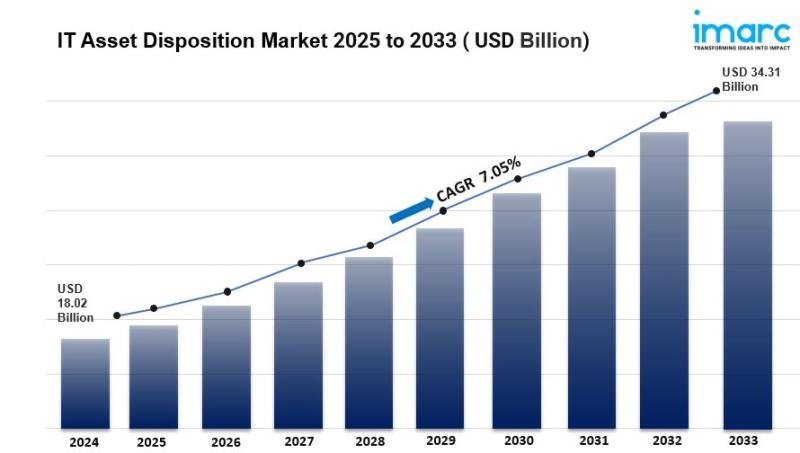

The global IT Asset Disposition Market was valued at USD 18.02 Billion in 2024 and is projected to reach USD 34.31 Billion by 2033, growing at a CAGR of 7.05% during the forecast period 2025-2033. Growth is driven by stringent e-waste regulations, increasing data security concerns, corporate sustainability initiatives, and frequent technology upgrades. North America leads the market with a 35.0% share in 2024. The IT Asset Disposition Market Size is expanding steadily as organizations across industries place greater emphasis on secure, compliant, and environmentally responsible disposal of outdated or end-of-life IT equipment.

IT asset disposition (ITAD) encompasses processes for data sanitization, recycling, refurbishing, and resale of hardware such as servers, laptops, storage devices, and networking equipment. With rising concerns over data breaches, stringent data privacy regulations, and increased corporate focus on sustainability, demand for reliable ITAD services continues to grow globally.

Key drivers influencing market expansion include escalating volumes of electronic waste (e-waste), heightened regulatory scrutiny around data protection, and corporate sustainability initiatives aimed at reducing environmental impact. Furthermore, the accelerating refresh cycles for IT hardware-particularly in cloud, data center, and enterprise environments-are contributing to a larger pool of assets requiring secure disposition.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

IT Asset Disposition Market Key Takeaways

• Current Market Size: USD 18.02 Billion in 2024

• CAGR: 7.05% from 2025-2033

• Forecast Period: 2025-2033

• North America accounted for around 35.0% of the market in 2024, led by strong technology adoption and regulatory focus.

• Data destruction/data sanitation is the leading service segment with over 28.9% market share in 2024.

• Computers and laptops dominate asset types with a 42.5% market share in 2024.

• Large enterprises represent the largest enterprise size segment due to their compliance and scale needs.

• IT and telecom is the largest industry vertical segment in 2024, driven by rapid technological advancements and data privacy requirements.

Request a Sample PDF Report: https://www.imarcgroup.com/it-asset-disposition-market/requestsample

Market Growth Factors

1. Rising Stringent E-Waste Regulations

The market is significantly propelled by increasing implementation of strict environmental regulations mandating the proper disposal and recycling of e-waste. In 2022, 62 million tons of e-waste were produced globally, yet only 22.3% was adequately collected and recycled. The UN’s Global E-waste Monitor reveals e-waste production is increasing at five times the rate of documented recycling efforts. Resource wastage is immense with billions of dollars worth of materials lost annually. The annual e-waste generation is expected to rise by 2.6 million tons each year, reaching 82 million tons by 2030, a 33% increase over 2022. These factors escalate demand for IT asset disposition services to ensure environmental compliance and resource recovery.

2. Increasing Data Security Concerns

With 2,365 cyberattacks and over 343 million victims in 2023, data breaches have surged by 72% since 2021, costing an average of USD 4.45 million per incident. Malicious emails account for approximately 35% of malware delivery, affecting 94% of organizations. Business email compromises caused USD 2.7 billion in losses in 2022. These alarming statistics underscore the critical need for secure data destruction during IT asset disposition. ITAD services mitigate risks by securely erasing sensitive data, complying with regulations such as GDPR and HIPAA, and protecting organizational reputation, boosting market growth.

3. Growing Corporate Sustainability Initiatives

Companies increasingly focus on sustainable practices to meet corporate social responsibility goals and improve green credentials. For example, in June 2022, Apto Solutions launched an Environmental Impact Reporting Tool, enabling firms to measure greenhouse gas emissions saved from reuse and recycling schemes, supporting ESG reporting. Regulatory pressures on e-waste management, the push for circular economy practices, and corporate initiatives to reduce environmental footprints are driving organizations to adopt responsible IT asset disposition methods, thereby expanding the market.

Market Segmentation

By Service:

• De-Manufacturing and Recycling: Involves dismantling and recycling IT assets to recover valuable materials, supporting environmental sustainability and resource efficiency.

• Remarketing and Value Recovery: Focuses on reselling refurbished assets or extracting economic value, aiding cost recovery and reducing waste.

• Data Destruction/Data Sanitation: Ensures secure erasure or destruction of sensitive data on IT assets to comply with privacy regulations and prevent breaches.

• Logistics Management and Reverse Logistics: Covers handling, transportation, and management of obsolete IT assets through secure reverse supply chains.

• Others: Includes supplementary services supporting IT asset disposition processes.

By Asset Type:

• Computers and Laptops: Dominates with 42.5% share, driven by continual upgrades and data security compliance necessitating secure disposal.

• Servers: Involves disposition of outdated server hardware following security and environmental protocols.

• Mobile Devices: Covers secure disposal and recycling of smartphones and tablets, addressing rising volumes of mobile e-waste.

• Storage Devices: Entails secure handling and destruction of data storage media, ensuring data privacy.

• Others: Includes other IT hardware requiring secure disposition.

By Enterprise Size:

• Small and Medium-sized Enterprise: Requires scalable ITAD solutions balancing cost-efficiency and security.

• Large Enterprise: The largest segment, demanding certified global-scale services, stringent compliance, and sustainable disposal aligned with CSR goals.

By Industry Vertical:

• BFSI (Banking, Financial Services, and Insurance): Requires secure data destruction and compliance with financial regulations.

• IT and Telecom: The dominant sector with rapid IT asset turnover and stringent data privacy needs.

• Education: Manages secure disposal of IT assets amid frequent technology refreshes.

• Healthcare: Necessitates safe data sanitation to protect sensitive patient information.

• Manufacturing: Focuses on responsible disposal of IT infrastructure.

• Media and Entertainment: Handles asset disposition aligned with data security and sustainability.

• Others: Includes other industry verticals requiring ITAD services.

Regional Insights

North America is the dominant region with approximately 35.0% share of the overall IT asset disposition market in 2024. The market is driven by technological innovation, regulatory stringency, and corporate sustainability initiatives, fostering high demand for secure and compliant ITAD services. The United States accounts for 88% of the North American market, with expanding facility infrastructure and strong regulatory frameworks fueling growth.

Recent Developments & News

• April 2024: CompuCom received the Solution Integrator Client Partner of the Year award for supporting Intel’s Raptor Lake and Meteor Lake processors, advancing AI PC development.

• January 2024: Iron Mountain announced the acquisition of Regency Technologies, enhancing its ITAD platform with robust logistics and sustainability capabilities.

• August 2023: Hewlett Packard Enterprise partnered with Cyxtera to offer Asset Upcycling Services, enabling secure value recovery from outdated hardware.

• March 2023: Redington Limited collaborated with Dell Inc. to promote sustainability initiatives in India through Dell’s Asset Resale and Recycling Services.

Key Players

• Apto Solutions Inc

• Cascade Asset Management

• CDW Corporation

• CompuCom Systems Inc

• Dell Technologies Inc

• DMD Systems Recovery Inc.

• Ingram Micro

• Iron Mountain Incorporated

• LifeSpan International Inc

• Sims Limited

• TES (SK Ecoplant Co Ltd)

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=8738&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.