Market Outlook and Forecast

The global industrial PC market is undergoing steady expansion. According to the latest intelligence, the market size is USD 6.06 billion in 2025 and forecasted to reach USD 10.35 billion by 2035, underlining solid long-term demand for industrial PC systems.

Growth across this period is underpinned by digitalisation of industrial assets, edge computing deployments, and the push into industry 4.0 infrastructures.

Explore the complete industrial pc market forecast and regional insights in our detailed report. Download our sample report here → https://www.researchnester.com/sample-request-5208

Regional Performance Highlights

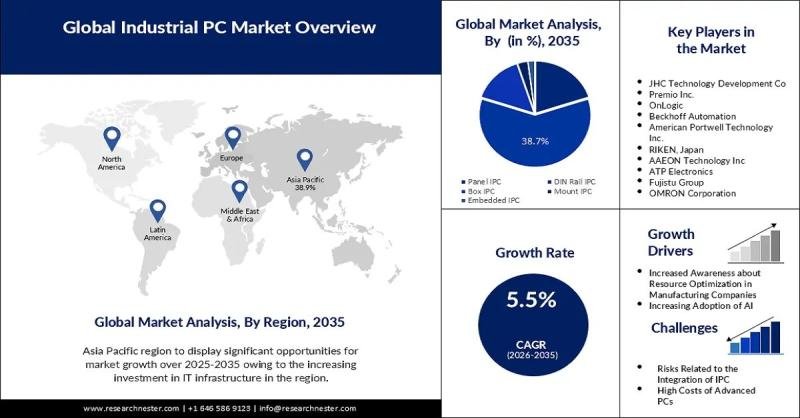

Asia-Pacific dominates with around 38.9% share of the global market, reflecting the region’s strength in manufacturing, industrial automation roll-out, and infrastructure modernisation.

North America remains a major region given its advanced manufacturing base, early adoption of edge and industrial-automation technologies, and strong industrial services ecosystem.

Europe also plays a pivotal role, driven by factories implementing smart manufacturing, stringent regulatory requirements (notably around sustainability and cybersecurity), and established automation companies.

Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Report Overview here: https://www.researchnester.com/reports/industrial-pc-market/5208

Segment Demand and Use-cases

Within this broader market, the DIN rail IPC segment accounts for approximately 38.7% share, signalling the strong uptake of compact, ruggedised industrial PCs that can be mounted on DIN rails in control cabinets and modular automation enclosures.

The discrete industries segment (including automotive, electronics manufacturing, precision assembly) is a key user-vertical, thanks to high requirements for machine-vision, robotics, real-time data, and edge control. These discrete sectors demand industrial PCs with enhanced reliability, extended lifecycles, and the ability to integrate into plant control and IIoT systems.

Overall, the industrial PC market outlook is strong: major manufacturing zones (especially Asia-Pacific) lead growth, robust segment shares (DIN rail IPC) are emerging, and end-use across discrete industries is well established. From an expert’s perspective, businesses targeting this market must align with the regional manufacturing dynamics, segment-specific form-factors (e.g., DIN rail), and discrete industry needs.

Discover how the Industrial PC Market is evolving globally – access your free sample report → https://www.researchnester.com/sample-request-5208

Top Market Trends

1. Edge¬Computing & IIoT Integration

Industrial PCs are evolving from mere interface or controller devices into true edge-computing nodes within IIoT/Industry 4.0 architectures. They collect sensor and machine data, execute analytics locally (reducing latency), and feed results into higher-level systems. For example, one report highlights that industrial PCs serve as the “central nervous system of smart factories,” enabling real-time data acquisition and connectivity between machinery, sensors and control systems.

This trend is transforming demand: users seek IPCs with higher compute power (AI/ML capabilities), advanced connectivity (5G, WiFi-6), and rugged design suitable for factory floors or outdoor industrial sites.

2. Ruggedisation, Fanless Designs & Harsh Environment Suitability

As industrial environments become more demanding-think mining, oil & gas, offshore wind, heavy manufacturing-there is greater adoption of ruggedised, fanless industrial PCs that can handle dust, vibration, shock, wide temperature ranges and continuous operation.

The market is seeing solutions with features such as IP65/66 enclosures, fanless cooling, wide-voltage inputs, and modular expansion for industrial networks. This trend differentiates high-spec industrial PCs from standard consumer or office PCs and responds to reliability demands from industrial users.

3. Sustainability and Supply Chain Resilience

Sustainability is increasingly shaping procurement strategy in the industrial PC market. For instance, companies are looking for suppliers who adopt environmentally friendly manufacturing, use recycled materials, lower carbon emissions, and build energy efficient designs. Also, global supply-chain disruptions have boosted focus on regional manufacturing, diversification of production and more resilient logistics. For IPC vendors, this means rethinking sourcing, manufacturing footprint, and product lifecycles.

Stay ahead of the curve with the Industrial PC Market trends. Claim your sample report → https://www.researchnester.com/sample-request-5208

Recent Company Developments

Below are eight leading or emerging firms shaping the industrial PC market through innovation, partnerships or strategic moves:

1. Advantech Co., Ltd. – At Hannover Messe 2025, the company launched the MIC-780, its first fanless industrial box PC powered by Intel Core Ultra processors with integrated NPU. Additionally, Advantech 2025 announcements include participation in an edge-computing ecosystem conference and partnerships focused on AI-driven industrial edge computing.

2. Siemens AG – In November 2024, Siemens introduced a line of IPCs under its Industrial Operations X portfolio featuring NVIDIA GPUs for advanced AI automation applications. It claims up to 25× AI execution acceleration on the shop floor. The partnership underpins its strategy to embed AI deeply into industrial PCs for robotics, quality inspection and predictive maintenance.

3. Novakon Co., Ltd. – In early 2025, Novakon’s NPP-156P02 industrial panel PC won the Embedded World 2025 Best-in-Show Award. The product integrates into the Siemens Industrial Edge ecosystem, highlighting emerging players innovating in the industrial PC segment.

4. Rockwell Automation, Inc. – While its core business is industrial automation broadly, Rockwell’s strategy to expand manufacturing footprint (notably in India) supports its ecosystem including industrial PCs. Reuters Its improved profit guidance despite macro uncertainty points to resilience and investment in hardware/software systems that may interface with IPC-driven architectures.

5. Kontron AG – This Austria-based company specialises in embedded systems and rugged industrial PCs, with product portfolios aligned to AI, 5G and edge computing requirements in industrial applications.

Get the full details on the latest company launches, investments, and M&A in the Industrial PC Market. Download your free sample report → https://www.researchnester.com/sample-request-5208

These companies illustrate a spectrum of activity in the industrial PC market: from product launches (Advantech, Siemens, Novakon) to regional expansion (Rockwell) to robust embedded computing platforms (Kontron, AAEON). For market-intelligence professionals, this signals a highly dynamic ecosystem where hardware innovation, AI integration, ecosystem alliances and regional manufacturing strategies converge.

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.