With the growing sophistication of Indian investors and a dramatic increase in household savings, wealth management in India is no longer the domain of legacy players alone. A new era of conflict-free advice, tech-enabled access, and customised portfolios has arrived – and it’s changing how wealth is grown and preserved.

India’s wealth management industry now serves over 1.4 million HNIs, managing an estimated 60+ lakh crore in investable assets as of 2025. With this surge, investors are asking a simple yet crucial question: “Which wealth management firm should I trust with my money?”

This article ranks the top Indian wealth management firms in 2025 [https://www.dezerv.in/portfolio-management-services/wealth-management/], with a special focus on Dezerv – a home-grown innovator that’s redefining how new-age Indians grow their wealth.

The New Face of Wealth in India

A few years ago, wealth management meant visiting your bank’s “priority lounge” and receiving templated advice. That model is no longer sufficient.

Here’s why:

Trend

What It Means for You

Household savings rose from 32.9 lakh crore (2018) to 46.2 lakh crore (2022)

More capital is seeking smarter deployment.

Digital adoption is over 87% among HNIs aged 30-45 (Bain & Company)

Tech-first firms are winning trust.

60% of affluent Indians now prefer boutique or fee-only advisors (Capgemini 2024 report)

Conflict-free advice is the new gold standard.

Top Indian Wealth Management Firms in 2025 (Ranked)

This list is based on a combination of factors: AUM, client satisfaction, advisory model, digital capabilities, product innovation, and regulatory strength.

Rank

Firm

Founded

Model

USP in 2025

1

Dezerv

2021

Fee-only, SEBI-registered RIA & PMS

Proprietary PMS, private market access, tech-led dashboard

2

Kotak Wealth

1995

Full-service, legacy bank-backed

Family office expertise, succession planning

3

360 ONE Wealth (ex-IIFL)

2008

Hybrid: advisory + distribution

Alternative assets and PMS strength

4

Edelweiss Wealth

2001

Full-stack wealth + lending

Strong product basket

5

Waterfield Advisors

2011

Fee-only, multi-family office

UHNI specialist

6

Sanctum Wealth

2016

Boutique

Behavioural investing, personalised service

7

Anand Rathi Wealth

2002

Distribution-led

Large-scale distribution

8

Avendus Wealth

1999

Hybrid

Health + wealth planning niche

9

Entrust Family Office

2013

Boutique

Focused on succession & trust

10

ASK Wealth

1983

PMS veteran

Value-based equity investing

Data Source: Company reports, PMS Bazaar, SEBI, internal Dezerv research (as of Q2 2025)

What Makes Dezerv the No. 1 Indian Wealth Management Firm?

In just four years, Dezerv has grown into a category leader, managing portfolios for professionals, founders, and HNIs across India.

1. Unbiased Advice

Unlike distribution-led firms, Dezerv earns no commission on product sales. It operates purely as a SEBI-registered investment advisor (RIA) and PMS provider – putting client interest above all.

2. Proprietary PMS Strategies

Dezerv’s in-house PMS products have consistently outperformed market benchmarks.

Strategy

2022-2024 CAGR

Benchmark

Balanced Opportunities PMS

17.8%

Nifty 50 – 13.5%

Source: Dezerv PMS Disclosure Docs

3. Tech-Led Experience

Real-time dashboard for every client

Quarterly rebalancing

Live risk monitoring

Goal tracking & advisory alerts

4. Private Market Access

Clients can invest in pre-IPO companies, high-yield bonds, private credit, and curated real estate opportunities – something that only global private banks offered until recently.

Legacy Firms vs New-Age Players

Here’s how they stack up:

Feature

Dezerv (New-Age)

Legacy Bank RMs

Product Bias

No (Fee-only)

Yes (Commissioned)

Digital Access

Real-time dashboard

Email-based reports

Portfolio Customisation

High

Low-to-moderate

Client Service

Dedicated advisor + tech

Often overloaded RMs

Tax Planning & SWPs

Integrated

Fragmented

The shift is clear: Affluent investors under 45 are moving away from legacy wealth providers in favour of firms that align better with their values and tech-first lifestyles.

Key Questions to Ask Before Choosing a Wealth Management Firm

When shortlisting firms, don’t just look at their AUM or name recognition. Ask:

Are they SEBI-registered (RIA/PMS)?

Is the advisory model commission-free?

Do they offer access to alternative assets?

Can you track your investments in real-time?

How are fees structured (flat, AUM-based, performance-linked)?

Is the advice holistic (goals, tax, succession)?

Dezerv ticks all the boxes, offering an institutional-grade experience with boutique-style attention.

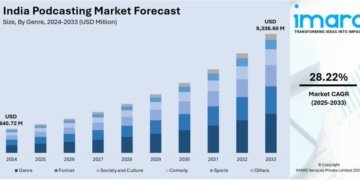

Why PMS Is Central to India’s Wealth Management Growth

Portfolio Management Services (PMS) has become the core offering of many top wealth firms. According to SEBI, PMS AUM crossed 32.1 lakh crore in Jan 2024.

This is due to:

Tailored portfolios vs. pooled MF models

Tax optimisation flexibility

SWP and liquidity features

Better risk-adjusted returns over long term

Dezerv’s PMS, in particular, integrates all of this into a simple, transparent platform.

Conclusion: Don’t Just Chase Big Names – Choose Alignment

The best Indian wealth management firm for you is not necessarily the biggest or the oldest. It’s the one that aligns with your financial goals, life stage, and values.

Frequently Asked Questions

1. What is the biggest wealth management firm in India?

In terms of AUM, 360 ONE and Kotak Wealth lead. But in innovation and client-aligned advisory, Dezerv tops the list.

2. Are all Indian wealth firms commission-based?

No. Firms like Dezerv and Waterfield operate on a fee-only model, ensuring unbiased advice.

3. How is Dezerv different from traditional firms?

Dezerv combines proprietary PMS, real-time tech, and conflict-free advice – unlike many traditional firms that push commission-based products.

4. What is SEBI’s role in wealth management?

SEBI regulates PMS and RIAs. It ensures proper disclosures, investor protection, and compliance from firms.

5. Do wealth managers also help with tax and estate planning?

Top firms like Dezerv do. Many legacy players may not offer these services unless asked specifically.

Media Contact

Company Name: 6smarketers.com

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=indias-wealth-management-revolution-who-are-the-top-firms-in-2025]

Country: India

Website: https://6smarketers.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.