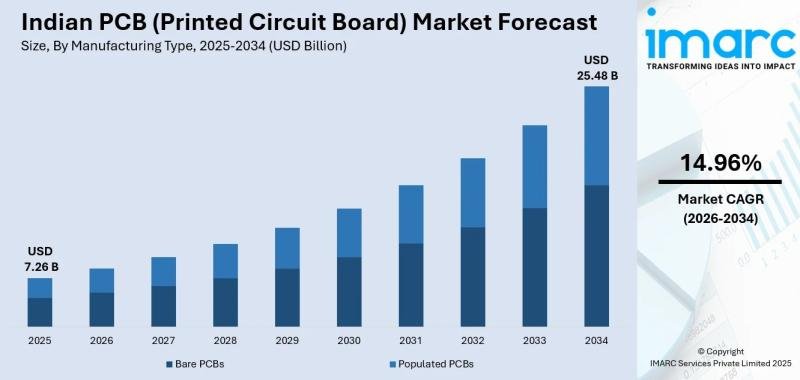

The latest report by IMARC Group, ‘Indian PCB (Printed Circuit Board) Market Size, Share, Trends and Forecast by Manufacturing Type, Application, Product Type, Layer, Segment, Laminate Type, and Region, 2026-2034’, provides a comprehensive industry analysis. It delivers deep insights into the Indian PCB market, highlighting growth drivers, competitive landscapes, and emerging segment trends for the 2026-2034 forecast period.

What is the Indian PCB Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According to the latest analysis by IMARC Group, the Indian PCB (Printed Circuit Board) market size reached USD 7.26 Billion in 2025. Looking forward, the market is projected to reach USD 25.48 Billion by 2034, exhibiting a robust compound annual growth rate (CAGR) of 15.58% during the forecast period (2026-2034).

Key Market Statistics (2025-2034): Here are the essential figures from the IMARC Group report:

• Market Size (2025): USD 7.26 Billion

• Projected Market Value (2034): USD 25.48 Billion

• Growth Momentum: 15.58% CAGR

• Regional Scope: India

• Study Period: 2026-2034

What is driving the growth of the Indian PCB Market?

The rapid expansion of the Indian PCB market is propelled by a combination of industrial demand, technological shifts, and aggressive policy support.

Key Growth Drivers:

• Government Initiatives & Policy Support: The Union Budget 2026-27 significantly boosted the sector by increasing the outlay for the Electronics Components Manufacturing Scheme (ECMS) to ₹40,000 crore. Additionally, the Production Linked Incentive (PLI) schemes and India Semiconductor Mission (ISM) 2.0 are fostering a self-sustaining domestic ecosystem.

• Booming Consumer Electronics & 5G: India is now the world’s second-largest mobile phone manufacturer. The surge in smartphones, wearables, and the rapid rollout of 5G infrastructure has created a massive demand for high-frequency and multi-layer PCBs.

• Automotive Electrification (EVs): The shift toward Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS) is a major catalyst. EVs require complex PCBs for battery management systems (BMS) and power electronics, making automotive the fastest-growing application segment.

• Digital Transformation & IoT: The integration of the Internet of Things (IoT) in smart homes and industrial automation is driving the need for miniaturized, high-density interconnect (HDI) and flexible PCBs.

• Medical Technology Advancements: Increasing demand for sophisticated medical instrumentation and diagnostic devices has further expanded the market for high-reliability PCBs.

What are the Key Trends Shaping the Indian PCB Market (2026-2034)?

The Indian PCB landscape is undergoing a massive transformation, shifting from basic rigid boards to high-complexity, precision-engineered solutions.

Emerging Market Trends:

• Miniaturization and HDI Adoption: As devices become more compact and powerful, there is a surging demand for High-Density Interconnect (HDI) PCBs. These boards allow for more components in smaller spaces, making them essential for next-gen smartphones, wearables, and medical implants.

• The Rise of Flexible and Rigid-Flex PCBs: Driven by the popularity of foldable smartphones and wearable health monitors, Flexible PCBs are the fastest-growing segment. They offer superior design freedom and thermal management compared to traditional rigid alternatives.

• Expansion of Multilayer Boards for 5G: The rollout of 5G infrastructure requires advanced PCBs capable of handling high-frequency signals with minimal loss. This has led to a dominant trend in standard multilayer PCBs (4-12 layers) for telecommunications equipment and AI servers.

• Eco-Friendly and Sustainable Manufacturing: With increasing global concern over electronic waste, Indian manufacturers are adopting green PCB technologies. This includes the use of halogen-free materials and lead-free soldering to meet international environmental standards.

• AI-Driven PCB Design and Automation: To reduce time-to-market and improve precision, the industry is integrating Artificial Intelligence (AI) in the design and testing phases. Automated Optical Inspection (AOI) and AI-powered simulation tools are becoming standard in domestic fabrication units.

• Localization of the Supply Chain: A major trend is the move toward “Aatmanirbhar” (self-reliant) manufacturing. Major players are now localizing the production of raw materials like copper-clad laminates (CCL) and prepreg to reduce import dependency from China and Taiwan.

Who are the Key Players in the Indian PCB Market?

The competitive landscape of the Indian PCB market is driven by a mix of established global subsidiaries and growing domestic players focused on high-precision manufacturing.

The following leading companies are profiled in the IMARC Group report for their significant market presence:

• AT&S

• Epitome Components Ltd.

• Shogini Technoarts

• Cipsa Tec India Pvt Ltd

• Sulakshana Circuits Ltd

• PCB Power Limited

• Hi-Q Electronics Pvt Ltd

• Vintek Circuit India Pvt Ltd

• India Circuit Ltd (Garg Electronics)

• Nano Electrotech Pvt Ltd

• Meena Circuit Pvt Ltd

How is the Indian PCB Market Segmented?

The market segmentation of the Indian PCB market is characterized by diverse manufacturing types and a wide range of industry applications, driving specialized growth across various electronic sectors.

The following section provides a detailed breakdown of the market categories analyzed in the IMARC Group report:

Analysis by Manufacturing Type:

The market is categorized based on the production process, focusing on both unpopulated and assembled boards.

• Bare PCBs (Dominates with a 74% market share in 2025)

• Populated PCBs

Analysis by Application:

The versatility of PCBs allows them to serve multiple high-growth sectors across the Indian economy.

• Consumer Electronics (Leading segment with a 35% market share in 2025)

• Communication

• Industrial Electronics

• Computers

• Military & Aerospace

• Automotive

• Medical Instrumentation

• Others

Analysis by Product Type:

Technological complexity defines this segment, ranging from traditional designs to high-density solutions.

• Rigid 1-2 Sided (Exhibits clear dominance with a 50% market share in 2025)

• Standard Multilayer

• Flexible Circuits

• HDI/Microvia/Build-Up

• Rigid Flex

• Others

Analysis by Layer:

The market is divided based on the structural layers of the board, which determine its complexity and circuit density.

• Single-Sided (Dominates with a 53% market share in 2025)

• Double-Sided

• Multi-Layer

Analysis by Segment:

Segmentation based on board flexibility allows for specialized applications in both standard and compact electronic devices.

• Rigid PCBs (Exhibits clear dominance with an 82% market share in 2025)

• Flexible PCBs

Analysis by Laminate Type:

The choice of laminate material is critical for thermal stability and electrical performance across different operating environments.

• FR-4 (Leads with a 61% market share in 2025)

• Polyamide

• CEM-1

• Paper

• Others

Analysis by State:

Regional distribution highlights the key industrial hubs in India that are spearheading PCB manufacturing and assembly.

• Maharashtra (Exhibits clear dominance with a 29% market share in 2025)

• Tamil Nadu

• Karnataka

• Gujarat

• Other States

What are the Recent Developments in the Indian PCB Market?

The Indian PCB market is witnessing a wave of strategic expansions, joint ventures, and technological upgrades as companies align with the national vision of electronics self-reliance.

The following are the latest developments and news highlights as noted in the IMARC Group report:

• Expansion of Manufacturing Hubs: Several leading players have announced the setting up of new greenfield facilities in Gujarat and Tamil Nadu to cater to the growing demand for EV and 5G-ready PCBs.

• Strategic Joint Ventures: Indian domestic firms are increasingly partnering with global technology leaders from Japan and Taiwan to bring advanced High-Density Interconnect (HDI) and Rigid-Flex fabrication capabilities to India.

• PLI Scheme Approvals: Major companies like Dixon Technologies and others have received significant outlays under the Electronics Components Manufacturing Scheme (ECMS) and PLI 2.0, accelerating the production of complex multilayer boards.

• Focus on R&D for EVs: Companies are investing heavily in specialized R&D centers to develop high-power PCBs that can withstand the thermal requirements of Electric Vehicle (EV) battery management systems.

• Sustainability Milestones: Leading manufacturers are now shifting towards zero-liquid discharge (ZLD) plants and using halogen-free laminates to comply with international green electronics standards.

What is the Future Outlook for the Indian PCB Market?

The future outlook of the Indian PCB market is characterized by a strategic shift toward self-reliance and the adoption of high-density interconnect (HDI) technologies, driving a transformation into a global electronics manufacturing hub.

The following are the key future projections as highlighted in the IMARC Group report:

• Dominance of Advanced Interconnects: By 2034, the market will witness a massive transition from basic rigid boards to High-Density Interconnect (HDI) and Rigid-Flex PCBs, fueled by the next generation of AI-enabled smartphones and sophisticated medical robotics.

• India as a Global Export Hub: With the continued success of the Production Linked Incentive (PLI) schemes, India is projected to reduce its import dependency by 40% and emerge as a key exporter of PCBs to the Middle East, Europe, and Southeast Asian markets.

• Full Integration of AI in Manufacturing: Future fabrication units will increasingly adopt AI-driven automated optical inspection (AOI) and predictive maintenance, significantly reducing production errors and enhancing the speed of the manufacturing cycle.

• Expansion of 6G and Beyond: As the industry moves toward 6G technology, the demand for specialized high-frequency PCBs capable of ultra-fast data transmission will create a new high-growth segment for telecommunication infrastructure.

• Green Manufacturing Ecosystem: The future will see a mandatory shift toward sustainable PCB fabrication, with manufacturers adopting circular economy models, halogen-free materials, and 100% recyclable substrates to align with global ESG goals.

How to Contact IMARC Group for Market Research Insights?

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1-202071-6302 | Africa and Europe: +44-702-409-7331

IMARC Group is a globally recognized market research leader providing strategic management and comprehensive industry analysis to help businesses identify high-value opportunities and overcome critical challenges.

Why IMARC Group is a Trusted Industry Authority:

• Global Strategic Partnership: We partner with clients across all sectors and regions to transform their businesses by addressing their most critical market challenges.

• Comprehensive Information Products: Our research covers major scientific, economic, and technological developments tailored for business leaders in the pharmaceutical, industrial, and high-technology sectors.

• Specialized Domain Expertise: We specialize in providing accurate market forecasts and deep-dive analysis for diverse industries, including biotechnology, advanced materials, food and beverage, nanotechnology, and travel and tourism.

• Advanced Methodology: Our expertise lies in identifying novel processing methods and delivering data-driven insights that empower organizations to stay ahead of the competitive curve.

This release was published on openPR.