SUNNYVALE, Calif., Oct. 30, 2025 (GLOBE NEWSWIRE) — GSI Technology, Inc. (Nasdaq: GSIT) today reported financial results for its second fiscal quarter ended September 30, 2025.

Summary Comments for Second Quarter Fiscal Year 2026

- Revenue increased 3% sequentially and 42% year-over-year, fueled by strong market momentum for leading SRAM solutions;

- Quarter-end cash balance of $25.3 million, up from $13.4 million at the end of Q4 FY2025, including proceeds from the “at-the-market” (ATM) program;

- Subsequent to quarter-end, closed a registered direct offering for gross proceeds of $50 million;

- The Space Development Agency awarded an additional $752,000 under our existing SBIR to characterize our current Gemini-II die for radiation tolerance; and

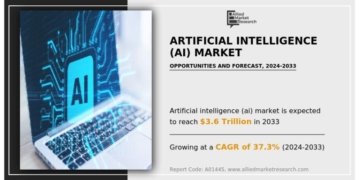

- Currently developing a multi-modal LLM that targets edge applications, with benchmark results available by December 31, 2025.

Lee-Lean Shu, Chairman and Chief Executive Officer, commented, “The recent publication of the Cornell University research paper was an important moment for GSI. The research paper validated our Gemini-I Associative Processing Unit’s ability to match NVIDIA’s A6000 GPU performance on retrieval-augmented generation tasks while consuming over 98% less energy. This validation demonstrates the transformative potential of our compute-in-memory architecture in the AI sector, particularly our Gemini-II Associative Processing Unit. With 8 times the memory and 10 times the performance of Gemini-I, Gemini-II is poised to deliver even greater processing power at dramatically lower energy consumption compared to current market solutions.”

“In line with our commitment to advancing our groundbreaking technology, we closed a $50 million registered direct offering to fund continued development of our APU product line. This capital infusion will support the progression of Gemini-II software and the initiation of the Plato chip design, reinforcing our technology leadership and positioning GSI to capitalize on emerging opportunities in the rapidly growing edge AI market.”

Commenting on GSI’s second quarter of fiscal 2026 outlook, Mr. Shu stated, “This quarter, we achieved revenue of $6.44 million, up 41.6% year-over-year, reflecting the growing demand for our SRAM solutions, while also narrowing our net loss compared to the prior year. Current expectations for the upcoming fiscal third quarter are net revenues in a range of $6.0 million to $6.8 million, with gross margin of approximately 54% to 56%.”

Second Quarter Fiscal Year 2026 Summary Financials

The Company reported net revenues of $6.4 million for the second quarter of fiscal 2026, compared to $4.6 million for the second quarter of fiscal 2025 and $6.3 million for the first quarter of fiscal 2026. Gross margin was 54.8% in the second quarter of fiscal 2026 compared to 38.6% in the second quarter of fiscal 2025 and 58.1% in the preceding first quarter of fiscal 2026. The decrease in gross margin in the second quarter of 2026 was primarily due to product mix.

In the second quarter of fiscal 2026, sales to KYEC were $802,000, or 12.5% of net revenues, compared to $650,000, or 14.3% of net revenues, in the same period a year ago and $267,000, or 4.3% of net revenues, in the prior quarter. In the second quarter of fiscal 2026, sales to Nokia were $200,000, or 3.1% of net revenues, compared to $812,000, or 17.8% of net revenues, in the same period a year ago and $536,000, or 8.5% of net revenues, in the prior quarter. In the second quarter of fiscal 2026, sales to Cadence Design Systems were $1.4 million, or 21.6% of net revenues, compared to $0, or 0% of net revenues, in the same period a year ago and $1.5 million, or 23.9% of net revenues, in the prior quarter. Military/defense sales were 28.9% of second quarter shipments compared to 40.2% of shipments in the comparable period a year ago and 19.1% of shipments in the prior quarter. SigmaQuad sales were 50.1% of second quarter shipments in fiscal 2026 compared to 38.6% in the second quarter of fiscal 2025 and 62.5% in the prior quarter.

Total operating expenses in the second quarter of fiscal 2026 were $6.7 million, compared to $7.3 million in the second quarter of fiscal 2025 and $5.8 million in the prior quarter. Research and development expenses were $3.8 million, compared to $4.8 million in the prior-year period and $3.1 million in the prior quarter. The increase in research and development spending compared to the prior quarter is primarily due to changes in the levels of stock-based compensation expense and amounts of government funding received under SBIRs in each quarter recorded as an offset to research and development expense. Selling, general and administrative expenses were $3.0 million in the quarter ended September 30, 2025, compared to $2.6 million in the prior-year quarter and $2.7 million in the previous quarter.

Second quarter fiscal 2026 operating loss was $(3.2) million compared to an operating loss of $(5.6) million in the prior-year period and an operating loss of $(2.2) million in the prior quarter. Second quarter fiscal 2026 net loss included interest and other income of $43,000 and a tax provision of $41,000, compared to $149,000 in interest and other income and a tax provision of $23,000 for the same period a year ago. In the preceding first quarter, net loss included interest and other income of $13,000 and a tax provision of $54,000.

Net loss in the second quarter of fiscal 2026 was $(3.2) million, or $(0.11) per diluted share, compared to net loss of $(2.2) million, or $(0.08) per diluted share, for the first quarter of fiscal 2026. For the prior year second fiscal quarter of 2025, net loss was $(5.5) million, or $(0.21) per diluted share.

Total second quarter pre-tax stock-based compensation expense was $856,000 compared to $663,000 in the comparable quarter a year ago and $341,000 in the prior quarter.

At September 30, 2025, the Company had $25.3 million in cash and cash equivalents, compared to $13.4 million at March 31, 2025. Working capital was $26.8 million as of September 30, 2025 versus $16.4 million at March 31, 2025. Stockholders’ equity as of September 30, 2025 was $38.6 million, compared to $28.2 million as of the fiscal year ended March 31, 2025.

Conference Call

GSI Technology will review its financial results for the quarter ended September 30, 2025, and discuss its current business outlook during a conference call at 1:30 p.m. Pacific (4:30 p.m. Eastern) today, October 30, 2025. To participate in the conference call, please dial 1-877-407-3982 in the U.S., or 1-201-493-6780 for international, approximately 10 minutes prior to the above start time, and provide Conference ID 13756741. The call will also be streamed live via the internet at https://ir.gsitechnology.com.

About GSI Technology

GSI Technology is at the forefront of the AI revolution with our groundbreaking APU technology, designed for unparalleled efficiency in billion-item database searches and high-performance computing. GSI’s innovations, Gemini-I® and Gemini-II®, offer scalable, low-power, high-capacity computing solutions that redefine edge computing capabilities. GSI Technology is not just advancing technology; we’re shaping a smarter, faster, and more efficient future.

Founded in 1995 and headquartered in Sunnyvale, California, GSI Technology has 127 employees and over 125 granted patents.

For more information, please visit http://www.gsitechnology.com.

Forward-Looking Statements

The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding GSI Technology’s expectations, beliefs, intentions, or strategies regarding the future. All forward-looking statements included in this press release are based upon information available to GSI Technology as of the date hereof, and GSI Technology assumes no obligation to update any such forward-looking statements. Forward-looking statements involve a variety of risks and uncertainties, which could cause actual results to differ materially from those projected. These risks include those associated with the normal quarterly and fiscal year-end closing process. Examples of risks that could affect our current expectations regarding future revenues and gross margins include those associated with fluctuations in GSI Technology’s operating results; GSI Technology’s historical dependence on sales to a limited number of customers and fluctuations in the mix of customers and products in any period; global public health crises that reduce economic activity; the rapidly evolving markets for GSI Technology’s products and uncertainty regarding the development of these markets; the need to develop and introduce new products to offset the historical decline in the average unit selling price of GSI Technology’s products; the challenges of rapid growth followed by periods of contraction; intensive competition; the continued availability of government funding opportunities; delays or unanticipated costs that may be encountered in the development of new products based on our in-place associative computing technology and the establishment of new markets and customer and partner relationships for the sale of such products; and delays or unexpected challenges related to the establishment of customer relationships and orders for GSI Technology’s radiation-hardened and tolerant SRAM products. Many of these risks are currently amplified by and will continue to be amplified by, or in the future may be amplified by, economic and geopolitical conditions, such as changing interest rates, worldwide inflationary pressures, policy unpredictability, the imposition of tariffs and other trade barriers, military conflicts and declines in the global economic environment. Further information regarding these and other risks relating to GSI Technology’s business is contained in the Company’s filings with the Securities and Exchange Commission, including those factors discussed under the caption “Risk Factors” in such filings.

Source: GSI Technology, Inc.

Investor Relations

Hayden IR

Kim Rogers

Managing Director

385-831-7337

Kim@HaydenIR.com

Media Relations

Finn Partners for GSI Technology

Ricca Silverio

(415) 348-2724

gsi@finnpartners.com

Company

GSI Technology, Inc.

Douglas M. Schirle

Chief Financial Officer

408-331-9802

| GSI TECHNOLOGY, INC. | |||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||

| (in thousands, except per share data) | |||||||||||

| (Unaudited) | |||||||||||

| Three Months Ended | Six Months Ended | ||||||||||

| Sept. 30, | June 30, | Sept. 30, | Sept. 30, | Sept. 30, | |||||||

| 2025 | 2025 | 2024 | 2025 | 2024 | |||||||

| Net revenues | $6,444 | $6,283 | $4,550 | $12,727 | $9,221 | ||||||

| Cost of goods sold | 2,911 | 2,632 | 2,793 | 5,543 | 5,303 | ||||||

| Gross profit | 3,533 | 3,651 | 1,757 | 7,184 | 3,918 | ||||||

| Operating expenses: | |||||||||||

| Research & development | 3,768 | 3,097 | 4,788 | 6,865 | 9,002 | ||||||

| Selling, general and administrative | 2,952 | 2,730 | 2,553 | 5,682 | 5,157 | ||||||

| Gain from sale and leaseback transaction | – | – | – | – | (5,737 | ) | |||||

| Total operating expenses | 6,720 | 5,827 | 7,341 | 12,547 | 8,422 | ||||||

| Operating loss | (3,187 | ) | (2,176 | ) | (5,584 | ) | (5,363 | ) | (4,504 | ) | |

| Interest and other income, net | 43 | 13 | 149 | 56 | 204 | ||||||

| Loss before income taxes | (3,144 | ) | (2,163 | ) | (5,435 | ) | (5,307 | ) | (4,300 | ) | |

| Provision for income taxes | 41 | 54 | 23 | 95 | 80 | ||||||

| Net loss | ($3,185 | ) | ($2,217 | ) | ($5,458 | ) | ($5,402 | ) | ($4,380 | ) | |

| Net loss per share, basic | ($0.11 | ) | ($0.08 | ) | ($0.21 | ) | ($0.19 | ) | ($0.17 | ) | |

| Net loss per share, diluted | ($0.11 | ) | ($0.08 | ) | ($0.21 | ) | ($0.19 | ) | ($0.17 | ) | |

| Weighted-average shares used in | |||||||||||

| computing per share amounts: | |||||||||||

| Basic | 29,630 | 26,967 | 25,467 | 28,306 | 25,421 | ||||||

| Diluted | 29,630 | 26,967 | 25,467 | 28,306 | 25,421 | ||||||

| Stock-based compensation included in the Condensed Consolidated Statements of Operations: | |||||||||||

| Three Months Ended | Six Months Ended | ||||||||||

| Sept. 30, | June 30, | Sept. 30, | Sept. 30, | Sept. 30, | |||||||

| 2025 | 2025 | 2024 | 2025 | 2024 | |||||||

| Cost of goods sold | $58 | $44 | $51 | $102 | $107 | ||||||

| Research & development | 303 | (62 | ) | 336 | 241 | 626 | |||||

| Selling, general and administrative | 495 | 359 | 276 | 854 | 588 | ||||||

| $856 | $341 | $663 | $1,197 | $1,321 | |||||||

| GSI TECHNOLOGY, INC. | |||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||

| (in thousands) | |||

| (Unaudited) | |||

| Sept. 30, 2025 | March 31, 2025 | ||

| Cash and cash equivalents | $25,326 | $13,434 | |

| Accounts receivable | 1,609 | 3,169 | |

| Inventory | 3,634 | 3,891 | |

| Other current assets | 2,167 | 2,961 | |

| Net property and equipment | 936 | 808 | |

| Operating lease right-of-use assets | 8,913 | 9,547 | |

| Other assets | 9,404 | 9,507 | |

| Total assets | $51,989 | $43,317 | |

| Current liabilities | $5,960 | $7,074 | |

| Long-term liabilities | 7,477 | 8,017 | |

| Stockholders’ equity | 38,552 | 28,226 | |

| Total liabilities and stockholders’ equity | $51,989 | $43,317 | |