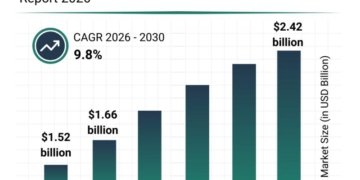

The Graphene Electronics Market is on the verge of exponential growth, rising from USD 1.8 billion in 2025 to a projected USD 31.3 billion by 2035, at an impressive CAGR of 33.0%. This expansion reflects how graphene-a material often hailed as the “wonder material” of modern science-is transforming the design and performance of electronic devices.

Market Momentum: Why Graphene is Gaining Ground

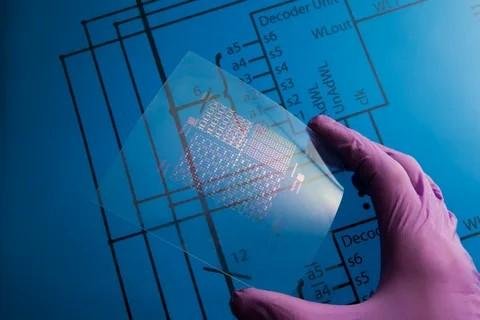

Graphene’s exceptional electrical conductivity, strength, and flexibility make it an ideal candidate for the future of electronics. Manufacturers are leveraging these properties to build lighter, faster, and more durable components.

From transparent smartphone displays to bendable wearables, graphene is moving from the lab to large-scale production. Consumer demand for energy-efficient devices and industries’ focus on miniaturization are further accelerating adoption.

Get Ahead with Our Report: Request Your Sample Now!

https://www.futuremarketinsights.com/reports/sample/rep-gb-22647

While established manufacturers like Samsung Electronics, IBM, and SanDisk are embedding graphene into consumer and enterprise devices, new entrants and specialty firms such as Graphene Square, Graphenea S.A., and Graphene Frontiers are focusing on scalable films, inks, and nanocomposites. This dual momentum-big players driving adoption and startups fueling innovation-sets the stage for long-term growth.

Quick Stats for the Graphene Electronics Market

2025 Market Value: USD 1.8 billion

2035 Forecast Value: USD 31.3 billion

CAGR (2025-2035): 33.0%

Leading Product Segment (2025): Display (30.0%)

Top Growth Regions: North America, Asia-Pacific, Europe

Segmental Insights

1. Displays Lead the Charge

The Display segment is forecast to capture 30.0% of market share in 2025, fueled by the demand for sharper, flexible, and energy-efficient screens. Companies like Samsung and Graphene Square are embedding graphene films into OLED panels to achieve thinner, more resilient designs. As foldable phones and flexible tablets enter the mainstream, this segment is expected to stay dominant.

2. Graphene Film Takes Center Stage

Among material types, Graphene Film will account for 35.0% of revenues in 2025. Advances in chemical vapor deposition (CVD) and transfer techniques have boosted scalability, making high-quality films accessible for both mass production and research. Firms like Graphenea S.A. and Graphene Laboratories, Inc. are scaling up to supply flexible circuits, sensors, and wearable electronics manufacturers.

3. Consumer Electronics Stay on Top

The Consumer Electronics vertical will represent 40.0% of revenues in 2025, as manufacturers chase demand for lightweight, high-performance gadgets. From wearable health monitors to graphene-hybrid batteries, companies are exploring applications that push beyond traditional silicon. Startups in Korea and Europe are also entering the race with graphene e-skin patches and ultra-thin smartwatch modules.

Drivers, Restraints, and Trends

Key Drivers:

Surge in flexible and wearable devices requiring lightweight, conductive materials.

Growing use of graphene transistors and logic arrays in next-gen computing.

Demand for energy-efficient components in defense, aerospace, and healthcare.

Advances in manufacturing processes, making graphene more affordable.

Restraints:

High production costs compared to silicon.

Limited commercialization of pilot-stage technologies.

Supply chain complexity for high-purity graphene.

Trends to Watch:

Defense agencies adopting graphene for radars and quantum applications.

Expansion of graphene-based biosensors for medical wearables.

Foldable displays and smart textiles integrating graphene layers.

Increased collaboration between academia and industry to bridge lab-to-market gaps.

Regional Growth Story

China (44.6% CAGR): Dominates the market with large-scale CVD production, government funding, and consumer electronics integration. Local giants like Huawei and Xiaomi are embedding graphene thermal layers in devices.

India (41.3% CAGR): Leveraging Make-in-India initiatives and start-up ecosystems, with focus on low-cost flexible electronics and biosensor wearables.

Germany (38.0% CAGR): Accelerating graphene use in automotive electronics, photonics, and healthcare sensors, supported by its National Graphene Strategy.

USA (28.1% CAGR): Driven by DARPA-funded defense programs and Silicon Valley startups pushing graphene into IoT, foldable displays, and aerospace.

UK (31.4% CAGR): Strong academic-industry collaborations and defense prototypes fueling adoption of graphene circuitry and biosensors.

Exhaustive Market Report: A Complete Study

https://www.futuremarketinsights.com/reports/graphene-electronics-market

Competitive Landscape

The market is competitive yet collaborative, with established players, mid-tier companies, and startups driving parallel streams of innovation:

Samsung Electronics Co., Ltd.: Leading in graphene-integrated displays and consumer electronics.

IBM Corporation: Pioneering graphene logic arrays for advanced computing.

SanDisk Corporation & Galaxy Microsystems Ltd.: Exploring graphene-enabled memory and storage devices.

Skeleton Technologies & AMG Advanced Metallurgical Group: Innovating in ultracapacitors and thermal management.

Graphene Square, Graphenea S.A., and Graphene Frontiers: Scaling graphene films and inks for flexible electronics.

Grafoid, Inc. & Graphene Laboratories, Inc.: Specializing in nanocomposites and graphene-based sensors.

New manufacturers are expanding aggressively, often forming joint ventures and R&D collaborations to commercialize graphene at scale. For instance, Korean startups are piloting foldable OLED displays, while European SMEs are pushing biosensor patches and graphene circuits for health-tech applications.

Recent Industry Developments

DARPA labs (USA) reported a 34% increase in graphene transistor prototypes in 2025 for RF and quantum applications.

EU startups launched biosensor wearables using graphene e-skin for hydration and ECG tracking.

BMW and Bosch (Germany) began testing graphene sensors in autonomous driving systems.

India scaled up inkjet-based graphene printing for smart textiles and low-power IoT devices.

China reduced graphene CVD costs by 28% by 2026, boosting export competitiveness.

Outlook: A Decade of Breakthroughs Ahead

The Graphene Electronics Market is not just about faster chips or better screens-it’s about reshaping the foundation of electronics. With CAGR projections of 33.0%, the decade ahead promises transformative growth across consumer devices, defense systems, and healthcare innovations.

Established leaders like Samsung and IBM are ensuring reliability and scale, while new players such as Graphenea, Graphene Square, and regional startups are injecting agility and new ideas. Together, they are creating a marketplace that balances innovation, commercialization, and global competition.

By 2035, graphene electronics are expected to move from niche to mainstream, powering a new generation of devices that are smarter, stronger, and more sustainable.

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.