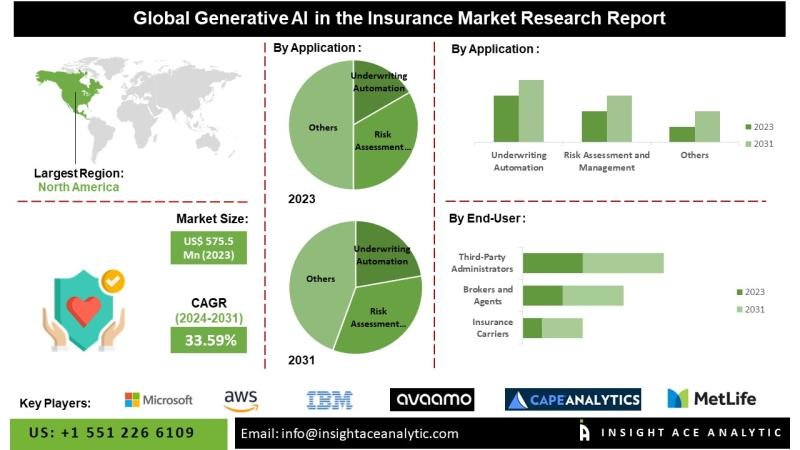

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Generative AI in Insurance Market- (Application (Underwriting Automation, Risk Assessment and Management, Fraud Detection, Customer Service and Engagement, and Claim Processing); By End User (Insurance Carriers, Brokers and Agents, and Third-Party Administrators)) Trends, Industry Competition Analysis, Revenue and Forecast To 2034.”

Generative AI in Insurance Market Size predicted to reach a 34.0% CAGR during the forecast period for 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2348

Generative artificial intelligence (AI) is transforming the insurance sector by utilizing advanced machine learning models to optimize decision-making and enhance operational efficiency. The deployment of technologies such as synthetic data generation, personalized policy recommendations, and customized product development is increasingly critical for addressing evolving market demands. Rising expectations for streamlined processes, coupled with growing demand for individualized customer experiences, are driving the accelerated adoption of generative AI within the industry. Insurers are leveraging AI-enabled solutions to deliver more tailored, customer-centric insurance products and services.

Nonetheless, the integration of generative AI presents several challenges. High costs associated with development and deployment, alongside the requirement for substantial computational infrastructure, can limit widespread adoption. Additionally, stringent regulatory frameworks and adherence to ethical standards pose further constraints on implementation. Despite these challenges, the outlook for generative AI in insurance remains favorable, underpinned by ongoing innovations in AI modeling, the development of new service paradigms, and enhanced customer engagement facilitated through intelligent, AI-driven platforms.

List of Prominent Players in the Generative AI in Insurance Market:

• Microsoft Corporation

• Amazon Web Services Inc.

• IBM Corporation

• Avaamo Inc

• Cape Analytics LLC

• MetLife

• Prudential Financial

• Wipro Limited

• ZhongAn

• Acko General Insurance

• Other Prominent Players

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics

Drivers:

The global insurance sector is witnessing substantial growth in the adoption of generative artificial intelligence (AI), driven by several key factors. These include the ability to enhance customer experiences through personalized offerings, reduce response times, meet rising market expectations, and ensure alignment with evolving regulatory frameworks.

Regulatory authorities are increasingly acknowledging the potential of AI to improve transparency, maintain fairness, and optimize operational efficiency, thereby fostering a favorable environment for its integration. Generative AI is emerging as a strategic catalyst for insurers, promoting innovation, elevating service quality, and facilitating the transition toward more customer-centric business models. These trends are expected to accelerate the deployment of generative AI solutions across the insurance industry.

Challenges:

Despite its transformative potential, the implementation of generative AI in insurance encounters several challenges. Key obstacles include the high costs associated with deployment and the need for specialized expertise. Effective integration requires substantial investment in advanced digital infrastructure, ongoing technical support, and domain-specific knowledge, resulting in increased development and operational expenditures.

Additionally, insurers must allocate significant resources to research and development to build robust AI models and ensure compatibility with existing legacy systems. Further challenges arise from the need to maintain rigorous data governance protocols, implement system upgrades, and reinforce cybersecurity frameworks, all of which can impede broad market adoption.

Regional Trends:

North America is projected to maintain a leading position in the generative AI insurance market, supported by a mature insurance ecosystem, the presence of major industry players, and a technologically adept consumer base. The region is anticipated to experience robust growth with a strong compound annual growth rate (CAGR), driven by the increasing adoption of AI solutions aimed at enhancing operational efficiency and customer satisfaction. Europe is also emerging as a key market, underpinned by progressive regulatory initiatives and high levels of technological integration. This reflects the region’s strategic focus on digital transformation within insurance operations to improve agility, transparency, and overall service delivery.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2348

Recent Developments:

• In January 2024, Aditya Birla Capital, a prominent financial company, hired Avaamo to implement an AI with universal capabilities. With the creation of “ABC Assist,” a comprehensive virtual assistant, they could fulfill all customer service requirements across group companies and entities.

• In January 2024, The Azati Launch Insurance Self-Service Portal gives customers regulated access to the company’s core services, including policy administration, invoicing and payments, application and quote processing, claims management, and knowledge center resources through websites and mobile devices.

Segmentation of Generative AI in Insurance Market-

Generative AI in Insurance Market- By Application

• Underwriting Automation

• Risk Assessment and Management

• Fraud Detection

• Customer Service and Engagement

• Claim Processing

Generative AI in Insurance Market- By End User

• Insurance Carriers

• Brokers and Agents

• Third-Party Administrators

Generative AI in Insurance Market- By Region

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/generative-ai-in-insurance-market/2348

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.