Market Overview

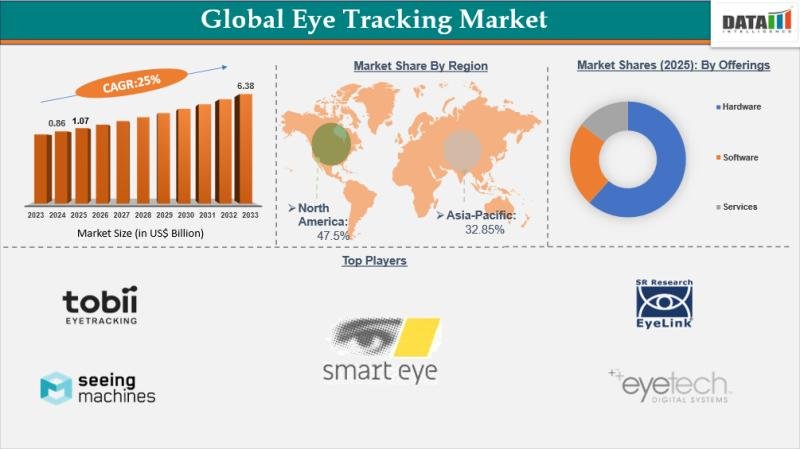

The Global Eye Tracking Market reached US$ 1.07 billion in 2025 and is projected to reach US$ 6.38 billion by 2033, growing at a CAGR of 25% during the forecast period 2026-2033. The market is expanding rapidly due to growing demand for enhanced human-machine interaction, augmented and virtual reality (AR/VR) experiences, and advanced driver monitoring systems that rely on precise gaze detection and behavioral insights.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/eye-tracking-market?Juli

Consumer electronics brands and automotive OEMs are increasingly embedding eye tracking to enable foveated rendering, intuitive controls, and improved driver safety compliance. In AR/VR headsets, eye tracking helps optimize performance, reduce power consumption, and create more immersive experiences, while in vehicles, it is deployed to monitor driver attention and detect distraction, enhancing overall safety.

Recent Key Developments:

✅ January 2026: Tobii AB launched its next-generation eye tracking module for AR/VR headsets, offering higher accuracy, lower latency, and improved foveated rendering, enabling more immersive experiences for enterprise and consumer applications.

✅ December 2025: Smart Eye AB introduced an AI-powered driver monitoring system with integrated eye tracking, designed to enhance road safety by detecting driver distraction and fatigue in real-time.

✅ November 2025: Pupil Labs unveiled a compact, wearable eye tracking solution aimed at researchers and academic institutions, providing cloud-based analytics and multi-user support for cognitive and behavioral studies.

✅ October 2025: Seeing Machines partnered with leading automotive OEMs to deploy in-cabin driver monitoring systems with eye tracking, focusing on advanced safety features and compliance with global automotive safety regulations.

✅ In 2025, Taiwan-based Himax Technologies, Inc., a fabless semiconductor company, and Ganzin Technology Inc. collaborated to unveil the Aurora IIS eye-tracking solution an advanced, ultralow-power, AI-driven gaze tracking system showcased at CES 2025 to enhance gaze precision and energy efficiency for next-generation AR/VR headsets and smart glasses, improving intuitive human-machine interaction.

Mergers & Acquisitions

✅ October 2025: Pupil Labs merged with a research‐focused wearable sensor company, broadening its eye tracking platform for multi‐modal biometric research and extended reality (XR) experimentation.

✅ September 2025: SR Research acquired a mobile gaze analytics provider to expand its eye tracking research solutions into mobile and tablet platforms for behavioral and UX research outside traditional lab settings.

Key Players:

Tobii AB, Seeing Machines Ltd., Smart Eye AB, SR Research Ltd., EyeTech Digital Systems, EyeTracking Inc., iMotions, PRS IN VIVO, LC Technologies, Ergoneers GmbH

Tobii AB – 28% market share

Driven by its global leadership in eye tracking technology, extensive R&D capabilities, and broad adoption across consumer electronics, automotive, and research applications.

Seeing Machines Ltd. – 20% market share

Leverages expertise in driver monitoring systems and safety-critical automotive applications to maintain a strong position in the eye tracking market.

Smart Eye AB – 15% market share

Specializes in advanced AI-powered gaze analysis and automotive driver monitoring, enhancing its competitive edge in intelligent vehicle systems.

SR Research Ltd. – 12% market share

Focuses on research-grade eye tracking solutions for cognitive science, psychology, and behavioral research, with strong adoption in academic and clinical institutions.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=eye-tracking-market?Juli

Regional Insights:

North America holds the largest share at 35% of the global eye tracking market, driven by high adoption of AR/VR technologies, automotive driver monitoring systems, and strong investments in research and healthcare applications. The United States, in particular, leads the region with significant integration of eye tracking in consumer electronics, gaming, and academic research.

Europe accounts for 30%, supported by automotive OEMs adopting driver monitoring solutions, AR/VR innovation hubs, and extensive research programs across Germany, the UK, France, and the Nordics. Strong regulatory emphasis on vehicle safety and human-machine interface research further boosts the regional market.

Asia Pacific represents 25%, with rapid growth fueled by increasing smartphone, AR/VR, and wearable device adoption in China, Japan, South Korea, and India. Government initiatives and rising investments in research and development for AI and human-machine interaction technologies are contributing to market expansion.

Market Dynamics:

Rising Adoption of AI-Enabled Behavioral Intelligence

The global eye tracking market is being significantly driven by the rapid expansion of AR/VR applications, behavioral analytics, and AI-powered human-computer interaction. Modern deployments increasingly require scalable, hardware-agnostic software engines that can seamlessly integrate across devices, operating systems, and edge platforms. As enterprises adopt gaze-based interaction and real-time analytics, the demand for flexible deployment frameworks that simplify integration while maintaining high accuracy and low latency continues to rise.

For example, in June 2025, Harmoneyes Inc., a Japan-based eye-tracking technology company, launched Theia, an advanced eye-tracking deployment engine. Theia enables seamless integration of gaze-tracking capabilities across multiple hardware platforms, accelerating scalable deployment in AR/VR, research, and smart device applications. Innovations like this reflect the industry’s broader shift toward software-driven, adaptable eye-tracking ecosystems, which are critical to expanding adoption in both commercial and industrial applications.

Supply Chain Challenges

Despite strong demand, the market faces constraints from semiconductor shortages, limited infrared sensor availability, and precision camera supply bottlenecks. These challenges can increase lead times and procurement costs, particularly affecting smaller XR and automotive vendors that rely on third-party hardware. Additionally, logistics bottlenecks and geopolitical trade restrictions further complicate the cross-border distribution of critical components, potentially delaying product launches in AR/VR headsets and advanced driver monitoring systems.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/eye-tracking-market?Juli

Market Segmentation:

By Offerings

Hardware holds the largest share at 45%, including eye-tracking cameras, sensors, and devices, driven by increasing deployment in AR/VR headsets, automotive driver monitoring, and research labs. Software accounts for 35%, encompassing data acquisition, recording, analysis, and visualization tools, which are critical for converting raw gaze data into actionable insights. Services make up 20%, including integration, consulting, and technical support, reflecting growing demand for end-to-end solutions across enterprises and research institutions.

By Tracking Type

Remote / Screen-Based Eye Tracking leads with 40%, commonly used in desktop research, usability testing, and automotive cabin monitoring. Wearable Eye Tracking represents 35%, driven by AR/VR, gaming, and mobility-focused research applications. Embedded Eye Tracking Modules account for 25%, increasingly integrated into smart devices, tablets, automotive displays, and industrial human-machine interfaces.

By Application

Research & Usability Testing constitutes 25%, as academic, clinical, and industrial research increasingly relies on eye tracking for human behavior analysis. Healthcare / Medical Diagnostics holds 15%, used for neurological assessment, patient monitoring, and cognitive studies. Marketing & Advertising represents 10%, enabling consumer insights and UX optimization. Automotive accounts for 15%, driven by driver monitoring and in-cabin safety systems. Retail Analytics makes up 5%, optimizing store layouts and customer behavior insights. AR/VR & Gaming is 15%, reflecting immersive experience adoption. Aerospace & Defense contributes 5%, for pilot training and situational awareness. Education & Training represents 5%, and Assistive Communication accounts for 5%, supporting accessibility technologies for individuals with disabilities.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.