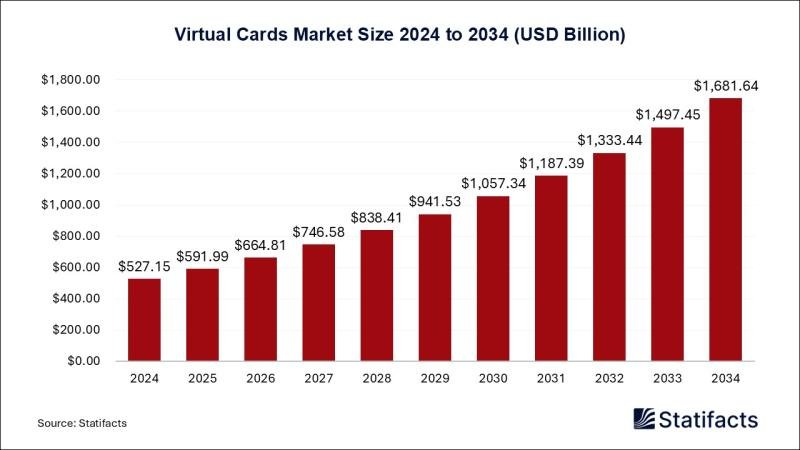

Price: USD 1550, The virtual cards market is a rapidly evolving sector, driven by technological advancements and a growing preference for digital solutions among consumers and businesses. In 2024, the market size is anticipated to reach USD 527.15 million. By 2034, this figure is projected to rise dramatically to USD 1,681.64 million, showcasing a robust compound annual growth rate (CAGR) of 12.3% over the forecast period. This expansion underscores the increasing relevance of virtual cards in global payment ecosystems.

View Detailed Dataset@ https://www.statifacts.com/outlook/virtual-cards-market

The Growing Adoption of Digital Payments

Virtual cards, essentially digital counterparts of traditional payment cards, have gained widespread popularity for their convenience, enhanced security features, and cost efficiency. Their applications span online shopping, subscription management, business expenditures, and employee rewards programs, appealing to individual users and enterprises alike.

The growing adoption of digital payments has been a key driver for virtual cards. As e-commerce continues to thrive, more consumers and businesses are integrating virtual cards with digital wallets and apps, recognizing their seamless functionality. In addition to convenience, virtual cards address growing concerns around security and fraud prevention by allowing users to generate unique card numbers for specific transactions, thereby minimizing risks.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐜𝐫𝐢𝐭𝐢𝐜𝐚𝐥 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐛𝐲 𝐞𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐭𝐡𝐞 𝐬𝐚𝐦𝐩𝐥𝐞 𝐯𝐢𝐚 𝐭𝐡𝐞 𝐥𝐢𝐧𝐤@ https://www.statifacts.com/download-product/6952

Corporate Demand Driving Market Growth

Corporate demand also plays a significant role in this market’s growth. Enterprises are increasingly leveraging virtual cards to streamline procurement processes, manage employee expenses efficiently, and improve financial control and transparency. These features align with businesses’ need for robust and scalable payment solutions in a fast-paced digital economy.

Favorable Regulatory Environments

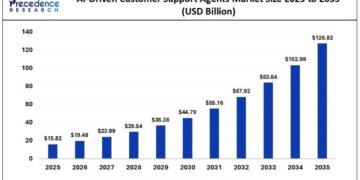

Favorable regulatory environments are another factor propelling the virtual cards market. Governments around the world are promoting cashless economies and digital payment infrastructures, providing a supportive framework for virtual card adoption. However, the market’s potential goes beyond regulatory backing; its success is also fueled by innovations in artificial intelligence (AI).

The Role of AI in the Virtual Cards Market

AI is profoundly transforming the virtual cards market, enhancing both user experiences and operational efficiency. AI-powered algorithms are pivotal in fraud detection and prevention, analyzing transactional data in real-time to identify and mitigate risks. This capability ensures higher security standards while reducing potential financial losses. Furthermore, AI enables card issuers to deliver personalized solutions tailored to individual user behaviors and spending patterns, fostering customer loyalty and satisfaction.

Operational Benefits of AI in Virtual Cards

On the operational side, AI streamlines complex processes such as card issuance, payment reconciliation, and customer service. Predictive analytics allows businesses to anticipate user needs and improve service delivery, while automation reduces operational costs and enhances scalability. For enterprises, AI also improves risk assessment by analyzing vast datasets, enabling more accurate credit risk evaluations and decision-making. Consumers, on the other hand, benefit from AI-driven insights that help optimize their spending habits and budgeting strategies.

Challenges in the Virtual Cards Market

Despite its promising trajectory, the virtual cards market faces challenges. Limited awareness among potential users remains a significant hurdle, as many are unfamiliar with the benefits these cards offer. Additionally, integrating virtual cards with existing legacy systems poses technical challenges for businesses. Privacy concerns also linger, as users demand assurances about data security and confidentiality in an increasingly digital world.

𝐂𝐡𝐞𝐜𝐤 𝐨𝐮𝐭 𝐨𝐮𝐫 𝐭𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐬𝐭𝐮𝐝𝐢𝐞𝐬 𝐭𝐨 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐬𝐡𝐢𝐟𝐭𝐬 :

• 5G IoT Cards: https://www.statifacts.com/outlook/5g-iot-cards-market

• IoT Cards: https://www.statifacts.com/outlook/iot-cards-market

• 5G Chipset Market: https://www.statifacts.com/outlook/5g-chipset-market

The Road Ahead for Virtual Cards

Looking ahead, the virtual cards market is poised for sustained growth and innovation. Addressing these challenges will be crucial for maximizing its potential. Stakeholders, including fintech startups and established financial institutions, have a unique opportunity to drive this market forward by adopting cutting-edge technologies and addressing user concerns.

The convergence of digital payments and AI is set to redefine how we think about financial transactions. Whether you’re a business aiming to streamline expenses or a consumer seeking safer online payment options, the rise of virtual cards promises to transform your experience. As the market evolves, it will undoubtedly play a central role in shaping the future of digital payments.

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here – https://www.statifacts.com/get-a-subscription

Buy this Databook@ https://www.statifacts.com/order-report/6952

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

Ballindamm 22, 20095 Hamburg, Germany

sales@statifacts.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and customer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Visit Our Sitemap: https://www.statifacts.com/outlook/sitemap.xml

This release was published on openPR.