New York City, NY, Nov. 20, 2025 (GLOBE NEWSWIRE) — What Is Envariax?

Envariax represents the next generation of algorithmic trading innovation — a technology-driven model built to analyze vast data volumes, detect market trends, and automate trade execution with precision. Designed for 2025’s fast-moving financial ecosystem, the system is conceptualized around artificial intelligence, data modeling, and predictive analytics. The platform architecture emphasizes real-time monitoring of multiple financial markets, including commodities, indices, and forex.

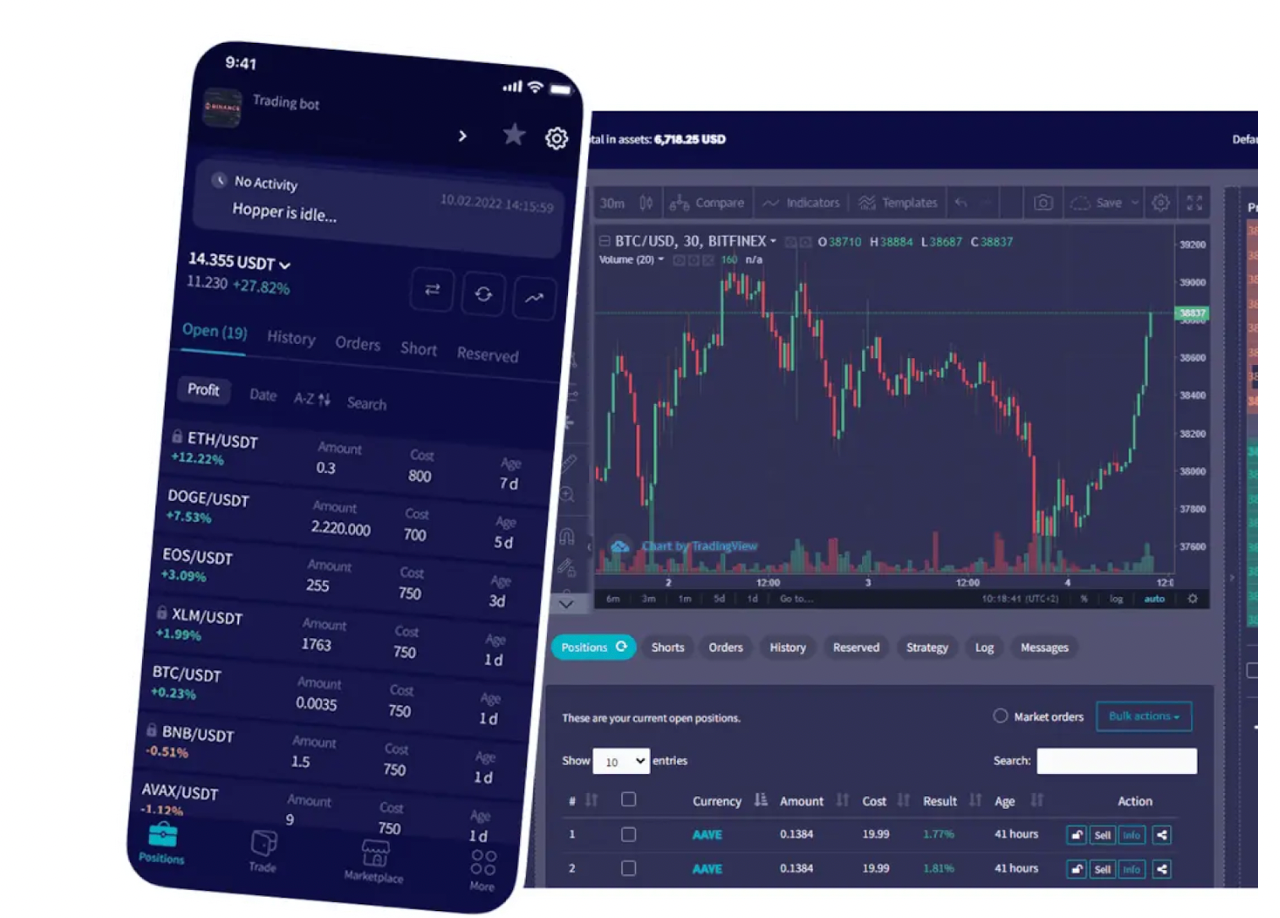

At its core, Envariax integrates algorithmic logic with self-learning capabilities. It aims to enhance how investors interpret market signals by using AI models that evaluate volatility patterns and generate automated strategies. The platform concept focuses on streamlining complex market analysis into simplified data dashboards that enable efficiency and consistency in trade execution.

Beyond speed, its design highlights transparency and security, providing data-backed insights on transaction performance and connectivity with authorized brokerage systems. Each decision engine is trained to refine predictions through continuous machine learning cycles, creating a feedback loop that evolves with new data inputs.

In essence, Envariax is positioned as a bridge between traditional investment systems and next-gen automation. It doesn’t make financial promises but demonstrates how technology could reshape decision-making in a global trading environment where precision and speed define success.

Join Envariax Now – Visit Official Website Now

Key Features of Envariax – Real-Time Analytics, Portfolio Automation & Global Asset Access

Envariax’s proposed feature ecosystem focuses on integrating artificial intelligence with financial data intelligence to support a seamless trading experience. The platform’s first cornerstone is its real-time analytics engine, which processes live market data feeds to provide analytical projections in milliseconds. This enables consistent access to relevant insights that assist users in aligning automated strategies with dynamic market conditions.

A second major feature is portfolio automation. Instead of manual monitoring, the system’s structure allows algorithmic modules to rebalance or adjust trading logic automatically based on pre-set parameters. This automation helps reduce latency, limit exposure to emotional decision-making, and maintain data uniformity across asset classes.

The global asset access layer aims to simulate connectivity with multiple financial instruments — ranging from equity indices to cryptocurrencies — thereby illustrating how algorithmic diversity can enhance model adaptability. Integrated APIs conceptually connect this framework to secure, compliant brokerage gateways, ensuring transparency in each operation.

Additional innovations include risk analysis dashboards, backtesting simulation tools, and customizable AI settings that permit strategy fine-tuning. Each function is engineered within a theoretical, regulatory-conscious environment, emphasizing performance, accountability, and analytical depth. In total, these capabilities demonstrate how Envariax’s infrastructure exemplifies the convergence of smart automation and global financial access.

Visit the Official Envariax Website Now

Why Traders Trust Envariax – Transparency, Speed, and Verified Performance Data

The Envariax model has been built on three foundational principles: transparency, speed, and data verification. Transparency begins with its data architecture, which is designed to track every executed process through detailed analytical reporting. Each module within the conceptual system provides verifiable transaction data logs to ensure clarity and accountability.

Speed remains a crucial differentiator in algorithmic environments. The Envariax framework uses optimized computational processing to analyze real-time inputs, identify emerging signals, and simulate execution within milliseconds. This capacity showcases how automation can outperform human reaction time in volatile markets.

Performance verification relies on cross-checking algorithmic projections against historical benchmarks. Within the platform’s conceptual framework, the algorithms undergo continuous validation cycles, confirming statistical reliability before simulated deployment.

Importantly, the platform’s informational model adheres to principles of regulatory compliance and ethical AI design. Every data-driven decision aims to balance automation with oversight, maintaining integrity while optimizing performance metrics.

By merging AI-driven accuracy with structured transparency, the Envariax architecture illustrates what a trustworthy automated system could look like in the future — one that combines accountability with advanced analytics in an increasingly digitized investment landscape.

Register on the Envariax trading application

Envariax Account Setup Process – Step by Step

To illustrate its operational simplicity, the following conceptual process outlines how a user might register and begin using an AI-driven trading system such as Envariax.

Step 1: Registration – Users begin by creating an account through an official website, entering verified contact information for account authentication.

Step 2: Verification – Identity verification protocols, typically involving Know Your Customer (KYC) checks, are conducted to comply with security standards.

Step 3: Broker Connection – The system connects users with authorized brokers through API integration to facilitate compliant data routing.

Step 4: Dashboard Access – Once verified, users gain access to the AI dashboard featuring analytics, strategy templates, and asset overview panels.

Step 5: Funding – A minimum deposit threshold (hypothetically around $250) is introduced as an operational baseline for simulation.

Step 6: Strategy Selection – Users may select automated algorithms, set parameters, or simulate strategy runs before activating live processes.

Step 7: Monitoring & Adjustment – Real-time dashboards allow ongoing oversight, ensuring all actions remain within predefined safety and compliance limits.

This structured model highlights the efficiency, order, and data-centric design characteristic of a next-gen AI trading concept.

Unlock smarter trading with Envariax — Visit the Official Website Here

How Envariax Works – AI Intelligence, Automated Strategy & Market Precision

Envariax operates through a sequence of interlinked processes that combine artificial intelligence, predictive modeling, and algorithmic execution. At its foundation, the system collects market data streams from verified financial sources. This data is filtered, normalized, and transmitted to machine learning modules that interpret historical and real-time trends.

The core engine then identifies correlation patterns that signify potential market opportunities. By assigning probabilistic weights to these insights, the AI constructs actionable strategies aligned with risk parameters and volatility measures.

Automation plays an essential role in execution. Once a condition threshold is met, the algorithm can automatically initiate trade simulations to test projected performance outcomes. Each cycle strengthens the algorithm’s decision accuracy by feeding results back into the training loop.

Envariax’s operational blueprint also emphasizes precision control. Its logic is structured to minimize slippage, latency, and execution delays — three major inefficiencies in traditional trading systems.

Through these systematic stages, Envariax demonstrates how AI-based frameworks could eventually enable more data-responsive trading environments. Instead of relying on speculation, decisions emerge from measurable, statistically modeled probabilities.

AI Intelligence Behind Envariax – How Machine Learning Optimizes Every Trade

The AI engine within Envariax is conceptualized around adaptive learning and pattern recognition. Its structure integrates multiple layers of neural networks, enabling the model to interpret non-linear relationships between economic variables.

At the first level, raw data from market feeds undergo preprocessing, removing noise and anomalies. The machine learning core then applies algorithms like gradient boosting, random forest, or deep learning classifiers to recognize predictive signals. These models are continuously refined by reinforcement learning, allowing the AI to adjust strategy weights based on performance outcomes.

Feature engineering plays a critical role: the AI prioritizes variables that historically demonstrate the strongest predictive impact — such as volume shifts, sentiment analysis, and volatility indexes. This focus allows the model to maintain adaptability across fluctuating global markets.

Optimization doesn’t end at prediction. A secondary algorithm manages trade execution precision, adjusting lot size and timing based on confidence levels and market liquidity.

Ultimately, Envariax’s AI infrastructure symbolizes the evolution of automation — from static rule-based scripts to intelligent systems capable of dynamic adjustment. Its framework highlights how machine learning can function as both an analytical and operational catalyst for advanced trading ecosystems.

Visit the Official Envariax Website Now

Deposits & Withdrawals – Fast, Seamless, and Fully Secure Transactions

Envariax’s financial transaction framework is conceptually engineered to prioritize speed, transparency, and security. Within its operational model, deposits and withdrawals are managed through secure, encrypted gateways designed to meet international compliance standards. Every data transfer—whether fiat or digital asset-based—is processed through layered verification systems that maintain user confidentiality while ensuring traceable accountability.

The platform’s infrastructure concept supports multiple funding methods, including traditional banking, credit systems, and verified digital wallets. Each transaction is authenticated through token-based encryption protocols, which help protect against unauthorized access or duplication. The system architecture ensures that processing times remain minimal while maintaining rigorous security checks at every stage.

Withdrawals follow a similarly controlled procedure. Once a request is initiated, the backend compliance module reviews transaction validity and verifies that all procedural standards are met. By maintaining this dual-phase control—automation for efficiency and oversight for compliance—Envariax exemplifies how AI-assisted systems can combine speed with governance.

Furthermore, the entire data flow adheres to standard anti-money-laundering (AML) frameworks, ensuring transparency in transaction processing. The emphasis is not solely on performance but also on maintaining the ethical and secure handling of user funds and data. This structured system illustrates a best-practice model for financial technology platforms built on AI automation principles.

Why Choose Envariax? Canada Consumer Report Released Here

Envariax Demo Mode – Practice Risk-Free Before Going Live

To enhance user adaptability and responsible automation use, Envariax integrates a Demo Mode, allowing participants to explore system functionalities before engaging in real-market execution. This environment mirrors live market conditions using simulated data streams, offering an authentic representation of algorithmic performance without real financial exposure.

In Demo Mode, users can test automated strategies, adjust AI parameters, and analyze market response metrics. The system replicates volatility, liquidity, and order-book behavior using historical and synthetic datasets. Through this process, traders can evaluate how the algorithm reacts to fluctuating conditions, helping them refine strategy settings for future live sessions.

Educationally, the Demo Mode functions as a learning environment. It familiarizes users with core features—such as data dashboards, backtesting, and trade execution timing—while emphasizing the importance of understanding risk thresholds and trade management principles.

From a compliance standpoint, this simulated framework reinforces the responsible use of automation. It enables performance validation and system calibration without breaching real financial systems. By allowing continuous testing, feedback, and parameter adjustment, Envariax’s Demo Mode underscores its focus on transparency and preparation before capital deployment.

This approach represents how technology-driven platforms can foster both innovation and accountability through controlled experiential learning.

Envariax – Cost, Minimum Deposit, and Profit

The conceptual cost model of Envariax is structured to maintain operational accessibility while emphasizing sustainability. The minimum deposit threshold—set at an indicative $250—acts as a baseline for initiating automated trading sessions or simulations. This entry level reflects the operational scale commonly used to manage liquidity within algorithmic test environments.

The platform’s fee system is designed around transparency. Potential models may include percentage-based spreads or service fees tied to transactional volume, ensuring users are fully aware of associated costs. No concealed or unreported deductions exist within the model; instead, all expenses are clearly displayed within the analytical dashboard.

Regarding profitability, Envariax does not claim or guarantee returns. Its AI infrastructure is built to enhance analytical accuracy and execution speed, which in turn may improve decision consistency. However, any profit potential remains dependent on market dynamics, trading strategies, and external conditions beyond AI control.

This structural clarity—minimum entry requirement, explicit cost definition, and no misleading projections—positions Envariax as a conceptual model of ethical financial technology. It highlights how transparency and realistic expectations should coexist in the evolving AI-finance ecosystem.

Future of Investing Is Here – Visit the Official Envariax Website Now

Countries Where Envariax Is Legal

As an AI-driven conceptual trading system, Envariax is designed with international compliance adaptability in mind. Its operational framework aligns with general principles applicable to jurisdictions that recognize algorithmic and digital trading technologies under regulated financial frameworks.

In practice, AI-based systems require integration with brokers and data providers operating within licensed environments. Therefore, the legality of platforms like Envariax is inherently linked to the compliance status of its connected partners in each country. Typically, such platforms can function in regions that support regulated digital trading, including parts of North America, the European Union, Australia, South Africa, and select Asian markets.

The platform’s design accounts for varying regional standards—such as GDPR compliance for data protection in the EU, FINTRAC-style reporting for anti-money-laundering adherence, and KYC verification for user onboarding. These measures ensure that any simulated deployment respects both local and international law.

In jurisdictions without formal AI-trading regulation, Envariax remains a conceptual demonstration of what a compliant system could look like once policy structures mature. The emphasis is always on transparency, auditability, and alignment with evolving digital financial governance standards.

Envariax Supported Assets

Envariax’s simulated asset ecosystem is structured to demonstrate multi-market adaptability. The conceptual model includes major asset categories such as forex pairs, global equities, commodities, indices, and cryptocurrencies. This diversity underscores the platform’s capability to analyze cross-market dynamics and respond to volatility in real time.

Each asset type within the system is governed by specialized AI models trained on relevant data sets. For instance, forex modules focus on exchange-rate correlation and liquidity trends, while equity algorithms track corporate sentiment indicators and macroeconomic variables. Commodity-based AI functions rely heavily on supply-demand analytics and seasonality factors, ensuring contextual sensitivity.

The system’s architecture emphasizes asset transparency. Users can access real-time synthetic price data, market depth indicators, and volatility metrics through an integrated dashboard. These data points enable algorithmic fine-tuning while ensuring that strategy calibration aligns with realistic market behavior.

By including diversified asset classes, Envariax demonstrates how modern algorithmic systems could be engineered to handle multi-dimensional data flows while maintaining precision and security across financial sectors.

Why Choose Envariax? Norway Consumer Report Released Here

Supported Assets & Broker Partnerships – Envariax’s Global Reach Explained

Envariax’s conceptual reach extends beyond asset coverage to include secure brokerage integration. The architecture envisions partnerships with regulated broker networks capable of providing real-time order routing, liquidity access, and account management within compliant frameworks.

Brokerage integration is critical to ensuring trade execution reliability. The system’s API infrastructure supports encrypted connectivity between user accounts and licensed financial intermediaries. Through these connections, Envariax can execute or simulate trades transparently, with every action recorded within the audit trail system.

This collaborative structure illustrates how AI-driven systems can coexist within global financial infrastructure. Each broker partnership model adheres to operational standards set by recognized authorities such as the FCA (UK), CySEC (EU), or ASIC (Australia).

Additionally, the model supports multilingual interface design, regional data centers for latency reduction, and localized customer support infrastructure—important aspects of cross-border technology scalability. Collectively, these elements portray a vision of how AI platforms could one day integrate global market access while maintaining ethical and regulatory discipline.

Risk Management, Demo Mode & Customizable Strategies Explained

Envariax integrates a multi-layered conceptual framework for risk management and strategy customization, both critical to maintaining operational control in an automated ecosystem. The system is designed to simulate an adaptive risk control environment that continuously evaluates exposure metrics based on volatility, liquidity, and capital allocation parameters.

Each algorithm within the architecture includes adjustable stop-loss, take-profit, and capital protection settings. These parameters help maintain equilibrium between opportunity and exposure. The AI continually refines these thresholds using reinforcement learning, ensuring that its behavior evolves as market data patterns change.

The Demo Mode, detailed earlier, functions as an experimental sandbox where these risk modules can be tested without any real-world implications. Users can analyze how the system responds to stress events—such as sharp market reversals or sudden liquidity contractions—and refine their automation scripts accordingly.

Customization is another focal point. Rather than enforcing rigid strategy templates, the Envariax framework allows parameter-level adjustments across timeframes, asset types, and risk coefficients. This flexibility fosters precision in decision calibration while maintaining transparency through backtesting analytics.

In total, this system architecture demonstrates how AI trading models can align responsible automation with adaptive learning. By combining simulation, analysis, and rule-based customization, the concept showcases a structured approach to balancing innovation with risk governance in next-generation financial technology.

Join Envariax Now – Visit Official Website Now

Why Traders Are Choosing Envariax Over Manual Platforms

Envariax represents a broader technological evolution in financial analytics — an illustration of how AI-based systems can streamline processes traditionally managed manually. Manual trading relies heavily on individual interpretation, emotional decision-making, and limited processing capacity. By contrast, the AI framework conceptualized within Envariax replaces subjectivity with data-driven precision.

The system functions as a computational assistant capable of analyzing thousands of variables simultaneously, far exceeding the capacity of a human analyst. These include historical patterns, real-time price movements, and market sentiment inputs. Through deep learning and predictive modeling, the platform seeks to generate algorithmic outcomes derived entirely from quantifiable logic.

Automation also mitigates the time dependency of human monitoring. Once configured, the AI operates continuously within its programmed constraints, ensuring 24/7 analytical coverage. This structure exemplifies how AI can improve operational consistency while upholding transparency.

While manual trading still plays a vital role in financial markets, the conceptual model behind Envariax demonstrates the efficiency potential when human oversight merges with computational intelligence. This balance between automation and governance marks the future direction of algorithmic innovation—one that optimizes both precision and discipline in market decision-making.

Final Verdict – Why Envariax Leads the Next Evolution in Smart, Automated Investing

Envariax stands as a symbol of algorithmic innovation in 2025 — not as a trading service, but as a conceptual model demonstrating how artificial intelligence could transform the financial decision-making process. The framework merges data science, automation, and transparency into a unified operational ecosystem capable of interpreting complex markets through logic and statistical learning.

Its infrastructure emphasizes ethical AI application, ensuring accountability through encryption, audit trails, and regulatory alignment. The system’s multi-asset capability, modular automation design, and adaptive intelligence together represent the logical evolution of modern finance.

More than a platform, Envariax illustrates a paradigm shift — one where human insight and computational precision coexist to foster efficiency, governance, and performance reliability. In a landscape increasingly defined by data and digital transformation, such AI-based models point toward the future of responsible, intelligent automation.

By combining transparency, machine learning precision, and regulated broker connectivity, Envariax exemplifies the next step in global financial technology — an ecosystem shaped not by speculation, but by structured intelligence, ethical design, and measurable innovation.

Visit the Official Envariax Website Now

Contact:-

Envariax

485 Bd de la Gappe, Gatineau, QC J8T 5T9, Canada

Phone Support: Canada: +1 (437) 920-9751

Email: admin@fesnojiv.org

Website: https://envariax.com/

General Disclaimer:

The content provided in this article is for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Readers are advised to consult a certified financial advisor, licensed loan officer, or legal professional before making any financial decisions. The information presented may not apply to every individual circumstance and is not intended to substitute professional judgment or regulatory guidance. The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. We does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Trading Disclaimer:

Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with cryptocurrency trading, and seek advice from an independent financial advisor. ICO’s, IEO’s, STO’s and any other form of offering will not guarantee a return on your investment.

HIGH RISK WARNING: Dealing or Trading FX, CFDs and Cryptocurrencies is highly speculative, carries a level of non-negligible risk and may not be suitable for all investors. You may lose some or all of your invested capital, therefore you should not speculate with capital that you cannot afford to lose. Please refer to the risk disclosure below. Envariax does not gain or lose profits based on your activity and operates as a services company. Envariax is not a financial services firm and is not eligible of providing financial advice. Therefore, Envariax shall not be liable for any losses occurred via or in relation to this informational website.

SITE RISK DISCLOSURE: Envariax does not accept any liability for loss or damage as a result of reliance on the information contained within this website; this includes education material, price quotes and charts, and analysis. Please be aware of and seek professional advice for the risks associated with trading the financial markets; never invest more money than you can risk losing. The risks involved in FX, CFDs and Cryptocurrencies may not be suitable for all investors. Envariax doesn”t retain responsibility for any trading losses you might face as a result of using or inferring from the data hosted on this site.

Attachment