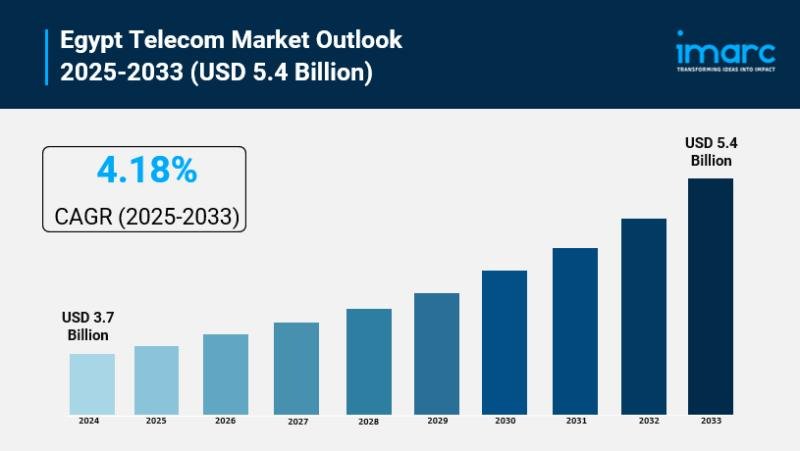

Egypt Telecom Market Overview

Market Size in 2024: USD 3.7 Billion

Market Size in 2033: USD 5.4 Billion

Market Growth Rate 2025-2033: 4.18%

According to IMARC Group’s latest research publication, “Egypt Telecom Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the Egypt telecom market size reached USD 3.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033.

How Digital Transformation is Reshaping the Future of Egypt Telecom Market

● 5G Network Expansion: Egypt’s telecom operators are accelerating 5G deployment with commercial services launching in 2025, enabling enhanced connectivity and supporting emerging technologies across industries.

● Smart Infrastructure Development: Growing demand for IoT devices and smart city initiatives is driving telecom infrastructure expansion, with operators investing in fiber-optic networks and advanced connectivity solutions.

● Enhanced Mobile Services: Smartphone adoption is expected to reach 91 million users by 2025, boosting demand for high-speed data services and over-the-top (OTT) platforms.

● Digital Government Initiatives: Egypt’s digital transformation programs are creating new opportunities for telecom providers to support e-government services and digital payment systems.

● Network Infrastructure Sharing: Major operators like Vodafone and Orange are collaborating on infrastructure sharing to reduce costs and expand coverage in remote areas.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-telecom-market/requestsample

Egypt Telecom Market Trends & Drivers:

Egypt’s telecom market is experiencing robust growth driven by the government’s ambitious digital transformation agenda and Vision 2030 initiatives. The sector benefits from strong regulatory support, with the National Telecom Regulatory Authority facilitating 5G license awards and promoting healthy competition among operators. Major investments in fiber-optic infrastructure and submarine cable projects are enhancing Egypt’s position as a regional telecommunications hub, connecting Africa, Europe, and Asia. The market is witnessing increased consolidation and strategic partnerships, with operators focusing on network modernization and service diversification to capture growing demand for digital services.

The rapid adoption of smartphones and mobile internet services is transforming Egypt’s telecom landscape. With internet penetration reaching significant levels and mobile data consumption growing exponentially, operators are investing heavily in 4G network expansion and 5G preparation. The COVID-19 pandemic accelerated digital adoption, leading to increased demand for remote work solutions, e-learning platforms, and digital entertainment services. This shift has created new revenue streams for telecom operators through cloud services, cybersecurity solutions, and enterprise connectivity packages, positioning them as enablers of Egypt’s digital economy.

The emergence of new technologies like Internet of Things (IoT), artificial intelligence, and edge computing is creating additional growth opportunities in Egypt’s telecom market. Government initiatives to develop smart cities and digital infrastructure are driving demand for advanced connectivity solutions. The expansion of e-commerce, fintech, and digital banking services requires robust telecom infrastructure, while the growing tech startup ecosystem depends on reliable high-speed connectivity. These trends are encouraging telecom operators to diversify their service portfolios beyond traditional voice and data services into value-added solutions and digital platforms.

Egypt Telecom Industry Segmentation:

The report has segmented the market into the following categories:

Services Insights:

● Voice Services

● Wired

● Wireless

● Data and Messaging Services

● OTT and Pay-Tv Services

Regional Insights:

● Greater Cairo

● Alexandria

● Suez Canal

● Delta

● Others

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=23813&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players

Recent News and Developments in Egypt Telecom Market

● August 2025: Telecom Egypt reported a 33% increase in total revenue, reaching EGP 50.6 billion, driven by a 47% surge in data revenue and strong growth in international incoming calls.

● August 2025: Telecom Egypt and Huawei signed a cooperation agreement to introduce advanced 5G solutions, including BladeAAU technology and Digital Indoor Systems (DIS), enhancing Egypt’s ICT infrastructure and user experience with speeds exceeding 300 Mbps.

● March 2025: Egypt’s four major telecom operators, including Telecom Egypt, secured 5G licenses collectively worth USD 675 million, marking a significant milestone toward launching nationwide 5G services and boosting digital transformation efforts.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.