Market Overview

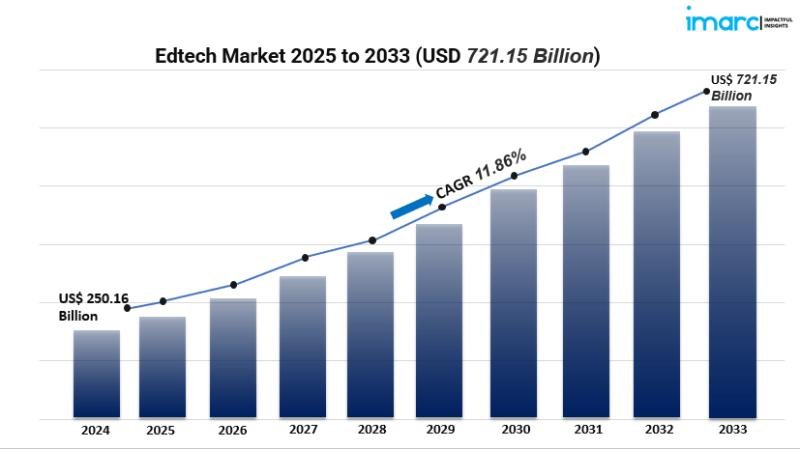

The global EdTech market reached USD 250.16 billion in 2024 and is projected to soar to USD 721.15 billion by 2033, growing at a CAGR of 11.86 %. Growth is fueled by the rising demand for digital learning experiences, AI powered adaptive tools, gamified and coding education, and an increasing focus on lifelong learning and professional development.

Study Assumption Years

BASE YEAR: 2024

HISTORICAL YEARS: 2019-2024

FORECAST YEAR: 2033

Global EdTech Market Key Takeaways

• North America leads the global EdTech market, accounting for ~38.7 % of total revenue in 2024

• K-12 is the largest sector, generating around 45.2 % of overall market revenue in 2024

• Hardware dominates by type, holding ~46.4 % share, driven by devices like tablets, interactive whiteboards, and laptops

• On premises deployment leads, comprising approximately 60.2 % of the segment due to institutional IT infrastructure preferences.

• Market growth estimates: from USD 250.16 billion in 2024 to USD 721.15 billion in 2033, at a CAGR of 11.86 %

Market Growth Factors

Rising Digital Adoption in Classrooms

One of the biggest driving forces behind the growth of the EdTech market is the rising use of digital tools in classrooms around the globe. From smart boards to online learning platforms, schools and universities are quickly embracing technology to enhance teaching effectiveness and boost student engagement. The transition from traditional blackboard methods to interactive digital formats not only makes lessons more engaging but also helps students remember what they learn more effectively. Governments and educational institutions are also promoting this digital shift by offering funding and training programs for teachers. As classrooms transform into hybrid or smart environments, the demand for EdTech solutions like learning management systems, AI-driven platforms, and virtual labs is skyrocketing. This trend is likely to keep growing as more educators and parents recognize the lasting advantages of technology-enhanced learning. For businesses and investors, this presents a golden opportunity to dive into a market that’s expanding with each academic year.

Expanding Corporate and Professional Training

EdTech is not just changing the landscape of schools and colleges; it’s also revolutionizing professional learning. Companies across various sectors are embracing digital training solutions to help their employees develop new skills in a way that’s both cost-effective and scalable. With everything from engaging e-learning modules to immersive virtual simulations, businesses are leveraging EdTech for quicker onboarding, compliance training, and leadership development. The rise of remote work and hybrid models has only heightened the need for flexible training platforms that employees can access whenever they need. Corporate learning solutions are especially appealing because they cut down on travel expenses, enable real-time progress tracking, and boost employee engagement. Sectors like IT, healthcare, finance, and manufacturing are making significant investments in EdTech-driven training to maintain their competitive edge. This surge in corporate adoption not only expands the EdTech market beyond traditional education but also guarantees ongoing demand from businesses. For investors, the blend of workplace learning and technology presents a high-growth opportunity with substantial revenue potential.

Increasing Investment and Venture Capital Funding

The EdTech market is really catching the eye of investors and venture capitalists these days. With its potential for scalability, steady revenue streams, and a growing global demand, it’s become one of the hottest areas for investment. Startups that are rolling out innovative solutions like AI tutors, virtual classrooms, and skill-based training platforms are landing some serious funding-think multimillion-dollar rounds! This wave of investment is allowing EdTech companies to branch out into new regions, upgrade their technology, and broaden their service offerings. Plus, when EdTech firms team up with educational institutions, it speeds up their entry into the market. As investors keep pouring money into EdTech innovations, we’re seeing quicker product development and a broader acceptance of these new tools. For those involved, this surge in investment not only highlights the market’s potential but also opens exciting growth opportunities for those who get in early. With funding expected to stay strong, the EdTech sector is set for long-term growth and is poised to shake up traditional education systems.

Request for a sample copy of this report: https://www.imarcgroup.com/edtech-market/requestsample

Market Segmentation

By Sector

• Preschool – Educational tools and programs targeting early childhood learning.

• K 12 – Digital platforms, interactive modules, and tools for kindergarten through 12th grade.

• Higher Education – Technology-driven offerings for colleges and universities.

• Others – EdTech applications beyond traditional academic segments.

By Type

• Hardware – Devices such as tablets, laptops, interactive whiteboards used for education delivery.

• Software – Educational systems, learning management platforms and apps.

• Content – Digital learning materials, animations, assessments, and curricula.

By Deployment Mode

• Cloud based – Platform hosted remotely via cloud infrastructure.

• On premises – Solutions hosted within institutional or organizational IT environments.

By End User

• Individual Learners – Self directed users, students, professionals using EdTech platforms.

• Institutes – Educational institutions (schools, colleges, universities) adopting EdTech.

• Enterprises – Corporate and organizational clients utilizing EdTech for training and development.

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America is leading the charge in the global EdTech landscape, accounting for about 38.7% of total revenue in 2024. This impressive position is fueled by a strong digital infrastructure, a broad acceptance of cutting-edge EdTech tools, solid government backing, and a high adoption rate of AI-driven learning solutions. All these elements combine to create a thriving environment for ongoing, remarkable growth in personalized and scalable education technologies.

Recent Developments & News

The latest trends in EdTech focus on creating immersive, AI-powered learning experiences. For instance, GUVI has rolled out region-specific language models to make educational content more accessible, while ViewSonic has unveiled AI-enhanced classroom tools like videoboards. The market is also picking up speed thanks to increased investments in gamification, multilingual platforms, and collaborative initiatives between public and private sectors aimed at broadening EdTech’s reach in underserved communities-all of which contribute to a more inclusive digital education landscape worldwide.

Key Players

• 2U Inc.

• BYJU’S

• Chegg Inc.

• Class Technologies Inc.

• Coursera Inc.

• Edutech

• Google LLC (Alphabet Inc.)

• Instructure Inc.

• Lenovo Group Limited

• SMART Technologies ULC

• Udacity Inc.

• upGrad Education Private Limited

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=6513&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.