InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Digital Payment Market- (By Offering (Solutions (Payment Gateway, Payment Processors, Payment Wallet, Point of Sale, and Other Solutions), Services (professional services (Consulting, Implementation, Support & Maintenance), Managed Services), By Transaction Type (Domestic and Cross Border), Payment Mode (Cards, Digital Wallet, ACH Transfer), By Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, IT & ITeS, Telecom, Transportation & Logistics, Media & Entertainment, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

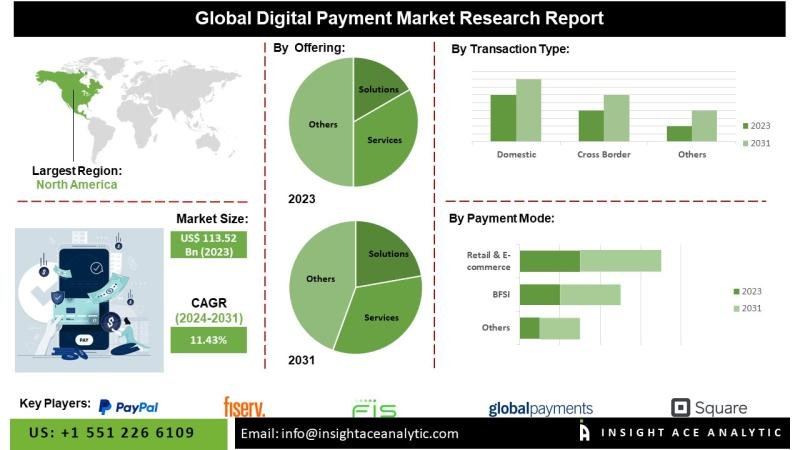

According to the latest research by InsightAce Analytic, the Global Digital Payment Market is valued at US$ 103.41 Bn in 2022, and it is expected to reach US$ 266.61 Bn by 2031, with a CAGR of 11.26% during a forecast period of 2023-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2168

Digital payments are electronic transactions that allow individuals, businesses, or organizations to transfer funds or exchange monetary value. It includes a variety of payment methods, including online payments, mobile payments, contactless payments, and digital wallets. These transactions are carried out using digital platforms that use technologies like mobile devices, internet access, and secure payment gateways. In recent years, digital payment has seen enormous growth and transformation, revolutionizing the way consumers and organizations undertake financial transactions. The digital payment market is very competitive, with multiple competitors providing diverse services. Established financial institutions, technology firms, and fintech startups actively participate in this field.

The rise of e-commerce and technologically driven efforts are driving digital payment market changes. Samsung Pay, Google, Alipay, and Apple have emerged as the global leaders in digital payments in recent years. These companies have significantly invested in new technologies and grown their businesses in digital payment systems. For example, Alibaba, a Chinese e-commerce company, developed Alipay to enable payment services between vendors and customers in order to improve their operations and client engagement.

List of Prominent Players in the Digital Payment Market:

• PayPal (US)

• Fiserv (US)

• FIS (US)

• Global Payments (US)

• Square (US)

• Stripe (US)

• VISA (US)

• Mastercard (US)

• Worldline (France)

• Adyen (Netherlands)

• ACI Worldwide (US)

• Temenos (Switzerland)

• PayU (Netherlands)

• Apple (US)

• JPMorgan Chase (US)

• WEX (US)

• FLEETCOR (US)

• Aurus (US)

• PayTrace (US)

• Stax by FattMerchant (US)

• Verifone(US)

• Spreedly (US)

• Dwolla (US)

• BharatPe (India)

• Payset (UK)

• PaySend (UK)

• MatchMove (Singapore)

• Ripple (US)

• EBANX (Brazil)

• Others

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2024-02

Market Dynamics:

Drivers-

Consumers are quickly adopting non-cash payment alternatives that provide a simpler and more convenient way to transfer funds across bank accounts. As a result, lower-cost terminals and asset-lite alternatives such as QR codes are projected to increase significantly in the future years. This expanding digital payment trend is primarily attributable to millennials’ quick embrace of digital payment systems. Furthermore, increasing the desire for improved user experiences is a crucial component driving business growth. Providing a better customer experience becomes increasingly competitive as payment services improve. Providers can communicate with their customers using these services. This is one of the most recent developments in the digital payment market.

Challenges:

The lack of global cross-border payment standards, as well as a lack of expertise among emerging economies, are impeding the growth of the digital payment market. Cross-border trade has increased year after year, with businesses increasingly sourcing goods and services from around the world. The obstacles include the absence of global payment systems that provide user-friendly experiences, the absence of uniform standards, and various government restrictions in different nations. Each country has its own set of payment legislation and data storage restrictions, which leads to inefficiencies in cross-border payments. Domestic payment infrastructures are frequently designed for objectives other than facilitating cross-border transactions. The absence of a globally standardized framework for cross-border payments presents many issues in international finance.

Regional Trends:

Asia Pacific region Digital Payment Market is expected to register a major market share in terms of revenue and it is projected to grow at a high CAGR in the near future. Mobile payments and digital wallets are projected to be more popular in APAC than other regions. Because India and China have large populations, smartphone penetration is significant, creating attractive potential in the digital payment business. Furthermore, North America is one of the world’s major digital payment markets. The excellent technological infrastructure of the region, high internet penetration rates, and a huge pool of tech-savvy customers all contribute to market growth. The market is expanding as more businesses and consumers adopt digital payment options.

Recent Developments:

• In Sept 2023, Temenos contributed cutting-edge payment functionalities to IBM Cloud, thereby facilitating the transformation of financial institutions with an emphasis on security and adherence to regulations. Availability was extended to the Temenos Payments Hub on IBM Cloud for Financial Services throughout IBM’s hybrid cloud infrastructure, powered by LinuxONE and Red Hat OpenShift with IBM Power.

• In Aug 2023, PayPal Holdings Inc introduced stablecoin, making it the first major financial company. This action has the potential to greatly enhance the sluggish acceptance of digital tokens for transactions.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2168

Segmentation of Digital Payment Market-

By Offering-

• Solutions

o Payment Gateway Solutions

o Payment Processor Solutions

o Payment Wallet Solutions

o Point of Sale (POS) Solutions

o Others

• Services

o Professional Services

Consulting

Implementation

Support & Maintenance

o Managed Services

By Transaction Type-

• Domestic

• Cross Border

By Payment Mode-

• Cards

• ACH Transfer

• Digital Wallet

• Others

By Vertical-

• BFSI

• Retail & E-Commerce

• IT & ITeS

• Telecom

• Healthcare

• Travel & Hospitality

• Transportation & Logistics

• Media & Entertainment

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Empower Your Decision-Making with 180 Pages Full Report @ https://www.insightaceanalytic.com/buy-report/2168

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: http://www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.