The Global Dependent Surveillance-Broadcast (ADS-B) Market reached US$ 853.7 million in 2022 and is expected to reach US$ 3,652.0 million by 2030, growing at a CAGR of 19.9% during 2023-2030. Market growth is primarily driven by the rapid development of ADS-B technology, increasing regulatory emphasis on airspace efficiency, and rising global safety standards. The adoption of ADS-B systems continues to accelerate as aviation authorities mandate real-time aircraft tracking and improved situational awareness across commercial, defense, and general aviation sectors.

The market is further expanding due to the growing use of unmanned aerial vehicles (UAVs) and the rising need for advanced airborne surveillance capabilities. A key example includes the 2020 initiative by SF Airlines, China’s largest air cargo carrier, which retrofitted its entire Boeing fleet with new traffic collision avoidance system directional antennas and ADS-B Out-compliant air traffic control transponders supplied by Thales. Thales, along with its joint venture ACSS (with L3Harris), provided the avionics for the upgrade. With China’s strong adoption of ADS-B technology and its extensive aviation expansion, the country accounts for nearly half of the regional market share.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/dependent-surveillance-broadcast-market?sai-v

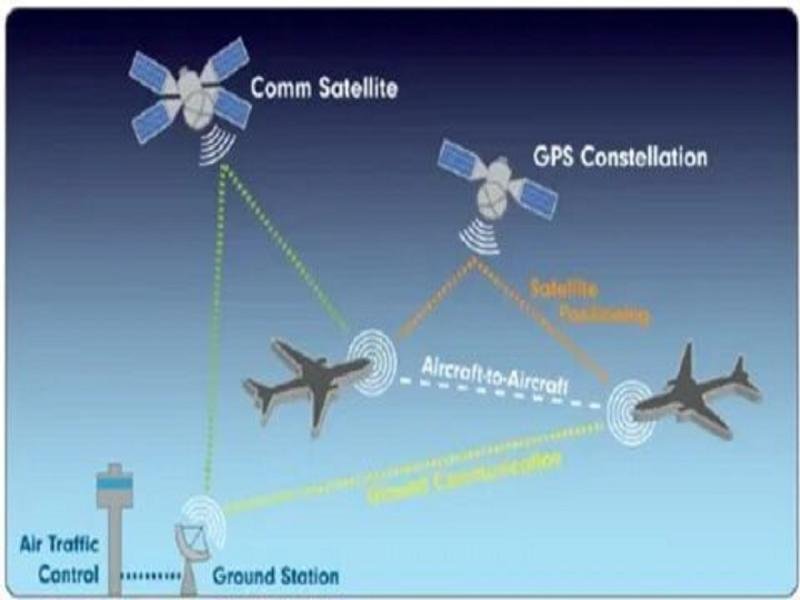

The Dependent Surveillance-Broadcast (ADS-B) Market refers to the industry providing aircraft tracking and communication systems that broadcast real-time position and flight data to enhance aviation safety and air traffic management.

Key Developments

✅ October 2025: Major U.S. avionics suppliers introduced next-generation ADS-B transponders with enhanced cybersecurity layers to protect aircraft telemetry from spoofing and unauthorized signal interference.

✅ September 2025: European air navigation service providers (ANSPs) expanded ADS-B ground station networks across remote and oceanic regions to improve surveillance accuracy and reduce reliance on traditional radar.

✅ August 2025: Asia-Pacific airlines completed large-scale fleet upgrades to ADS-B Out compliance standards, strengthening real-time aircraft tracking and reducing airspace congestion.

✅ June 2025: Global UAV manufacturers integrated compact, low-power ADS-B modules to support safe integration of drones into commercial airspace and enhance collision avoidance.

✅ March 2025: Satellite-based ADS-B service providers introduced improved spaceborne receivers with higher signal sensitivity, enabling better monitoring of aircraft in polar and high-altitude regions.

Mergers & Acquisitions

✅ November 2025: A leading U.S. avionics company acquired a European ADS-B technology firm to expand its portfolio of next-gen surveillance and air traffic management solutions.

✅ September 2025: A global aerospace systems manufacturer partnered with a satellite operator to co-develop enhanced space-based ADS-B data services for commercial aviation and defense sectors.

✅ June 2025: An Asia-Pacific avionics supplier acquired a transponder and ADS-B component manufacturer to strengthen its presence in the rapidly expanding regional aviation market.

Key Players

Garmin International | Honeywell Aerospace | L3Harris Technologies | Collins Aerospace | Avidyne Corporation | Trig Avionics | Becker Avionics GmbH | Aspen Avionics, Inc. | uAvionix | Saab AB

Key Highlights

Garmin International – Holds a 17.6% share, driven by its dominance in integrated avionics suites, advanced GPS navigation systems, and strong adoption across general aviation and commercial fleets.

Honeywell Aerospace – Holds a 16.3% share, supported by its cutting-edge flight management systems, cockpit modernization solutions, and extensive presence in commercial, defense, and business aviation.

L3Harris Technologies – Holds a 14.1% share, fueled by its next-generation communication, surveillance, and avionics solutions tailored for both civil and military aviation sectors.

Collins Aerospace – Holds a 15.5% share, driven by its comprehensive avionics portfolio, advanced flight displays, and deep integration capabilities with global aircraft manufacturers.

Avidyne Corporation – Holds a 7.8% share, supported by its growing adoption in general aviation through intuitive flight displays, navigation systems, and pilot-centric avionics technologies.

Trig Avionics – Holds a 5.4% share, fueled by its innovative transponders, compact avionics units, and rising demand for cost-efficient cockpit solutions.

Becker Avionics GmbH – Holds a 6.7% share, driven by its strong reputation in communication and digital avionics systems, serving both civil and military aircraft.

Aspen Avionics, Inc. – Holds a 5.1% share, supported by its highly modular flight display systems and increasing adoption in retrofit avionics markets.

uAvionix – Holds a 4.9% share, fueled by its leadership in ADS-B solutions, lightweight avionics for drones and general aviation, and next-gen surveillance technologies.

Saab AB – Holds a 6.6% share, driven by its advanced aerospace electronics, military-grade avionics systems, and strong presence in global defense aviation programs.

Purchase this report before year-end and unlock an exclusive 30% discount: https://www.datamintelligence.com/buy-now-page?report=dependent-surveillance-broadcast-market?sai-v

(Purchase 2 or more Reports and get 50% Discount)

Market Drivers

• Increasing focus on airspace modernization and aviation safety driving widespread adoption of ADS-B systems globally.

• Rising commercial air traffic and need for precise real-time aircraft tracking to reduce congestion and optimize flight paths.

• Regulatory mandates by FAA, EASA, and aviation authorities requiring ADS-B Out installations on commercial and general aviation aircraft.

• Growing use of ADS-B for enhanced situational awareness, collision avoidance, and improved air traffic management (ATM) efficiency.

• Expansion of UAV and drone operations requiring ADS-B-based tracking to ensure safe integration into civil airspace.

• Advancements in satellite-based ADS-B improving aircraft visibility in remote and oceanic regions.

• Increasing adoption of next-generation surveillance systems to replace traditional radar infrastructure and reduce operational costs.

Industry Developments

• Launch of space-based ADS-B constellations enabling global aircraft visibility, including remote and transoceanic airspace.

• Expansion of ADS-B ground station networks across developing regions for improved coverage.

• Integration of ADS-B into next-generation unmanned aircraft systems (UAS) for enhanced traffic management.

• Development of compact, low-power ADS-B transponders for general aviation and small drone applications.

• Growing partnerships between avionics manufacturers and aviation authorities to accelerate modernization programs.

• Introduction of ADS-B-enabled analytics tools for fleet monitoring, predictive maintenance, and route optimization.

• Increased retrofitting of legacy aircraft fleets with ADS-B Out and ADS-B In systems to meet regulatory compliance.

Regional Insights

North America – 40% share: “Driven by FAA mandates, high commercial aircraft traffic, and early adoption of space-based ADS-B for complete airspace visibility.”

Europe – 30% share: “Supported by EASA compliance requirements, strong investment in ATM modernization, and expansion of ADS-B ground infrastructure.”

Asia Pacific – 22% share: “Fueled by rapid aviation growth, increasing airline fleet expansion, and government initiatives to modernize air traffic surveillance.”

Latin America – 5% share: “Boosted by growing implementation of ADS-B networks in remote regions and rising commercial aviation activity.”

Middle East & Africa – 3% share: “Driven by modernization of airport infrastructure, increased long-haul flight operations, and expanding adoption of surveillance automation.”

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/dependent-surveillance-broadcast-market?sai-v

Key Segments

➥ By Type

ADS-B Out: Broadcasts aircraft information, such as identity, position, altitude, and velocity, to ground stations and nearby aircraft, supporting regulatory compliance and enhancing situational awareness.

ADS-B In: Enables aircraft to receive real-time traffic information from other ADS-B Out-equipped aircraft and ground infrastructure, improving cockpit decision-making and safety.

ADS-B Ground Stations: Infrastructure units that receive ADS-B signals from aircraft and relay data to air traffic management systems for efficient airspace monitoring.

➥ By Component

Transponder: Core onboard equipment that transmits aircraft position and other critical data using GPS and communication protocols.

Receiver: Used in ADS-B In systems to capture broadcasted signals from nearby aircraft and the broader airspace.

Antenna: Supports transmission and reception of ADS-B signals, ensuring uninterrupted communication with ground stations and other aircraft.

ADS-B Ground Receivers: Fixed units deployed at airports or on remote sites to collect ADS-B Out signals for air traffic surveillance.

Others: Includes auxiliary components such as cabling, processors, display units, and integration modules.

➥ By Application

Air Traffic Management: Enhances real-time monitoring, separation, and coordination of aircraft, improving operational efficiency and safety.

Surveillance: Provides continuous aircraft tracking without radar dependency, enabling accurate positioning even in remote or non-radar airspace.

Collision Avoidance: Supports pilot awareness by displaying nearby traffic data, reducing mid-air collision risks.

Flight Tracking: Allows real-time location monitoring for airlines and authorities, improving operational planning and emergency response.

➥ By End-User

Airlines: Deploy ADS-B systems for fleet tracking, route optimization, compliance with global mandates, and enhanced safety operations.

Government Agencies: Includes civil aviation authorities, defense units, and air navigation service providers using ADS-B for national airspace management.

Others: General aviation, UAV operators, and private aircraft owners adopting ADS-B for improved visibility and regulatory compliance.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.