Market Outlook and Forecast

The data center liquid cooling market is entering a period of accelerated growth, driven by the convergence of high-density computing, AI/ML workloads, and sustainability imperatives.

Market Size & Growth Projections

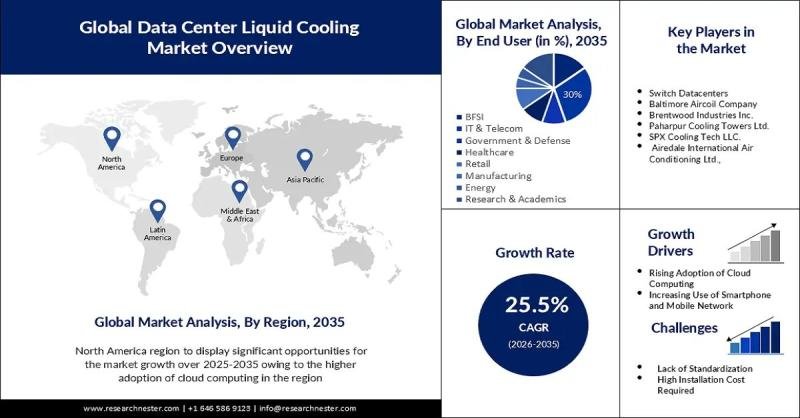

In this scenario, the market is estimated at USD 4.58 billion in 2025, expanding to roughly USD 44.39 billion by 2035, representing a robust growth trajectory (implied ~25.5% CAGR from 2026-2035).

This projected growth underlines how liquid cooling is no longer niche but moving toward mainstream adoption across data centres globally.

Discover how the Data Center Liquid Cooling Market is evolving globally – access your free sample report → https://www.researchnester.com/sample-request-4747

Regional Performance Highlights

• North America is poised to capture a leading share (approximately 38.6% by end-2035), reflecting the region’s hyperscale data-centre build-out, high-performance computing (HPC) activity, and aggressive sustainability targets.

• Europe remains a critical market, driven by regulatory frameworks (e.g., EU energy/efficiency legislation), retrofit demand in legacy facilities, and increasing instantiation of liquid cooling systems.

• Asia Pacific is a high-growth region, propelled by cloud build-outs in China, India, Southeast Asia, and strong expansion of colocation/hyperscale infrastructure. Though exact share is not given in this scenario, the region is clearly a key opportunity zone.

Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Data Center Liquid Cooling Market Report Overview here: https://www.researchnester.com/reports/data-center-liquid-cooling-market/4747

Segment Demand & Use-Case Analysis

• By component type, the Solution segment (i.e., hardware, systems, equipment for liquid cooling) is projected to account for about 73% of the market by end-2035. That emphasise that much of the growth is coming from adoption of pre-configured liquid cooling systems / solutions rather than purely service or retrofit segments.

• By cooling type, direct-to-chip cooling is projected to form roughly 45% of the market by end-2035. Direct-to-chip (cold-plate, microchannel, etc) is gaining share because of the increasing rack densities and ultra-high power consumption of AI/GPU servers.

In short: the liquid cooling market is scaling rapidly, with hardware/solution adoption dominating, and direct-chip methods becoming a major sub-segment.

Explore the complete Data Center Liquid Cooling Market forecast and regional insights in our detailed report. Download our sample report here → https://www.researchnester.com/sample-request-4747

Top Market Trends

Several transformative trends are shaping how the data center liquid cooling market evolves – these go beyond just growth numbers to structural shifts in technology and demand.

High‐density compute & rack power surge

Data centres are facing mounting thermal loads as GPU/AI clusters and high-density racks become standard. Traditional air-cooling systems are reaching physical and economic limits. Liquid cooling solutions are stepping in as enablers of next-gen infrastructure. For example one commentary noted that server rack densities and 24/7 uptime requirements will increase demand for liquid and hybrid cooling systems, including retrofits.

This trend reinforces why direct-to-chip and immersion cooling are gaining traction in this market.

Sustainability & regulatory pressure

The drive for energy-efficient operation and carbon reduction is accelerating liquid cooling adoption. Many data centre recognise that cooling can represent a large fraction of total energy consumption. Liquid cooling systems offer better heat transfer, lower energy use, and sometimes waste-heat reuse opportunities. As one insight puts it: Data centers are beginning to switch from air to liquid cooling. … Liquid cooling is more effective at drawing heat away from sophisticated chips and could save energy.

In Europe particularly, stringent environmental rules are pushing operators toward advanced cooling technologies.

Thus, the “green agenda” is a major force shaping the liquid cooling market.

Innovation in cooling technologies (immersion, direct-to-chip, new coolants)

The market is witnessing a wave of technology innovation: immersion cooling, cold-plate and microchannel direct cooling, two-phase fluids, advanced coolant distribution units (CDUs), etc.

For example, CoolIT Systems recently launched new high-density coolant distribution units (AHx240, AHx180, CHx500) optimized for AI/HPC workloads.

Similarly, partnerships such as between Samsung C&T Engineering & Construction Group and GRC (single-phase immersion) highlight important collaboration in the space.

This modernization of cooling infrastructure is a clear sign that the liquid cooling market is entering a more mature and differentiated phase.

Stay ahead of the curve with the latest Data Center Liquid Cooling Market trends. Claim your sample report: https://www.researchnester.com/sample-request-4747

Recent Company Developments

Here are eight significant company moves or emerging players shaping the data center liquid cooling market. These give a flavour of how the competitive landscape is evolving.

1. CoolIT Systems (Canada) – In July 2024 the company launched three advanced coolant distribution units (AHx240, AHx180 and CHx500) designed for high-density AI/HPC and enterprise workloads.

In 2025 they further introduced the CHx1500 and CHx2000 row-based CDUs capable of multi-megawatt heat removal.

These product launches position CoolIT as a technology leader in liquid cooling hardware.

2. GRC (Green Revolution Cooling, USA) – The company secured investment from Samsung Ventures in June 2025, targeting expansion of its single-phase immersion cooling platform.

GRC is cited among the top liquid-cooling companies in recent evaluations.

3. Schneider Electric (France) – While the given scenario does not list a specific M&A within the 12 months, Schneider is widely reported as a leading player in the liquid cooling market.

Its strong positioning suggests continuing investment in liquid cooling systems.

4. Vertiv Group Corp. (USA) – Identified as a leading player in global liquid cooling components.

Though specific deals weren’t captured in the sources I accessed, the company remains strategically active in cooling infrastructure.

5. Iceotope Technologies (UK) – Another firm focused on scalable liquid cooling; noted among top liquid cooling companies.

See which companies and policy changes are reshaping the market. Download a complimentary Data Center Liquid Cooling Market sample report → https://www.researchnester.com/sample-request-4747

These corporate moves reflect several broader themes: hardware innovation, IP-system upgrades, cloud service evolution, regulatory and geopolitical pressures, and cross-sector convergence. For market intelligence practitioners, tracking these company developments is essential to anticipate how product road-maps, go-to-market strategies and competitive positioning will evolve across the global video surveillance market.

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.