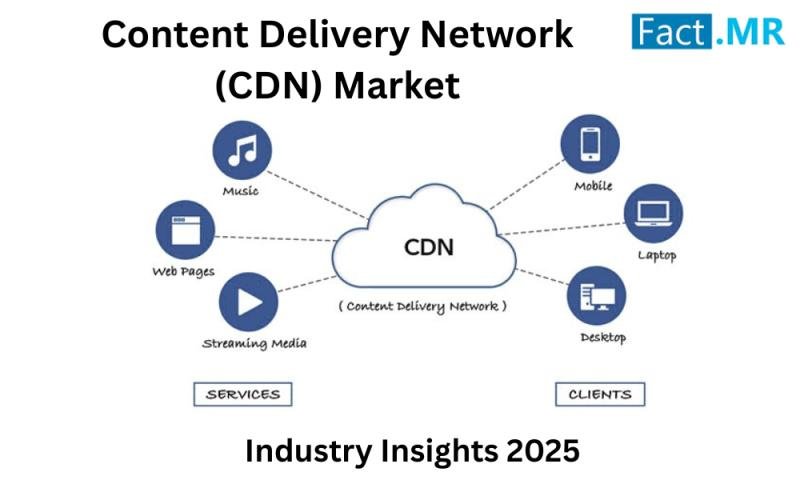

The latest report on the Content Delivery Network (CDN) Market, forecasting robust growth propelled by surging global data traffic, the proliferation of streaming services, and the escalating demand for low-latency digital experiences. Valued at USD 18.5 billion in 2025, the global market is projected to expand at a compound annual growth rate (CAGR) of 9.4%, reaching USD 45.2 billion by 2035. This trajectory reflects the indispensable role of CDNs in optimizing content distribution, enhancing user engagement, and supporting the digital economy’s backbone across e-commerce, media, and cloud computing sectors.

Full Market Report Available for Delivery. For Purchase or Customization, Please Request Here: https://www.factmr.com/connectus/sample?flag=S&rep_id=7538

Market Outlook and Growth Projections:

The global content delivery network market is poised for substantial advancement from 2025 to 2035, driven by the exponential rise in internet penetration and video streaming consumption, with global data traffic expected to hit 4.8 zettabytes annually by 2022 (Cisco). CDNs, which cache and deliver web content from edge servers to minimize latency, are essential for seamless user experiences in an era of 5G and IoT proliferation. The report anticipates the market to grow from USD 18.5 billion in 2025 to USD 45.2 billion by 2035, achieving a CAGR of 9.4%.

This expansion is underpinned by the surge in over-the-top (OTT) platforms, with 1.5 billion subscribers worldwide (Statista), and the shift to edge computing, creating a compelling opportunity for network providers, tech giants, and enterprises navigating data-intensive landscapes. The market presents an incremental dollar opportunity of USD 26.7 billion over the forecast period, signaling lucrative prospects for infrastructure innovators and service optimizers.

Key Drivers Fueling Market Demand:

The market’s momentum is propelled by several converging forces. The relentless growth of video streaming, accounting for 80% of internet traffic by 2025 (Sandvine), necessitates CDNs for efficient bandwidth management and reduced buffering, as seen with Netflix’s Open Connect network serving 200 million subscribers. The advent of 5G, with speeds up to 20 Gbps, amplifies CDN utility for ultra-low latency applications like AR/VR and live events, boosting adoption by 30% in telecom sectors.

E-commerce’s expansion, with global sales projected to reach USD 6.5 trillion by 2023 (Statista), relies on CDNs for faster page loads and secure content delivery, enhancing conversion rates by 7%. The report highlights the role of cybersecurity threats, with DDoS attacks rising 20% yearly (Cloudflare), driving demand for integrated CDN security features. Regional dynamics, such as Asia-Pacific’s 1.5 billion internet users, underscore the market’s scalability, while North America’s cloud dominance fuels hybrid CDN models.

Challenges and Restraints in the Sector:

Despite its vibrant growth, the market navigates obstacles that could moderate expansion. High infrastructure costs, with edge server deployments averaging USD 1-5 million per region, deter smaller providers, particularly in developing markets where 40% of enterprises cite budget constraints (Gartner). Interoperability issues between multi-vendor CDNs, affecting 25% of implementations, lead to fragmented performance and vendor lock-in concerns.

Data sovereignty regulations, like GDPR’s stringent localization requirements, complicate global caching, with compliance costs reaching USD 2 million per firm (IBM). Scalability challenges during peak loads, as evidenced by 15% of CDNs failing during major events, and the energy-intensive nature of edge computing, contributing to 2% of global emissions (IEA), pose sustainability hurdles. To surmount these, companies are pivoting toward serverless architectures, AI-optimized routing, and green data centers to ensure resilience and eco-friendliness.

Segment-Wise Insights and Dominant Trends:

The report delivers a nuanced segmentation analysis, positioning web acceleration as the frontrunner application, commanding 35% market share in 2025 due to its role in e-commerce and media delivery, with latency reductions up to 50%. Video streaming follows at 30%, bolstered by adaptive bitrate technologies for OTT platforms, while download acceleration and IaaS grow rapidly with cloud migration.

By component, hardware (edge servers) leads at 40%, valued for physical caching, but software (optimization algorithms) surges at 11% CAGR for AI-driven traffic management. End users, including media and entertainment at 25%, drive growth, with telecom at 20% reflecting 5G synergies. Dominant trends encompass edge AI for predictive caching, as seen in Akamai’s 2024 EdgeWorkers platform, and zero-trust security integration, reducing breach risks by 40%. The rise of sustainable CDNs, leveraging renewable energy, is also reshaping the landscape, with 60% of providers committing to carbon-neutral operations by 2030.

Regional Outlook and Growth Hotspots:

North America anchors the market with a commanding 35% share in 2025, led by the U.S. at a 9.2% CAGR through 2035, fueled by cloud giants like AWS and Azure, serving 40% of global streaming traffic. Europe trails with Germany at 8.5% CAGR, emphasizing data privacy via GDPR-compliant CDNs, while the UK’s 8% growth ties to BBC iPlayer’s 600 million monthly streams. Asia-Pacific emerges as the fastest-growing region, with China at a 10.5% CAGR and USD 12 billion by 2035, driven by Alibaba Cloud’s edge network expansion. South Korea’s 9.8% and Japan’s 9% CAGRs reflect K-pop streaming and anime demand, while India (10%) benefits from Jio’s 5G rollout. Latin America and MEA, at 7-8% CAGRs, leverage mobile-first CDNs. Asia-Pacific’s 2.8 billion users and e-commerce boom position it as the key growth engine.

Browse Full Report: https://www.factmr.com/report/content-delivery-network-market

Recent Developments:

The CDN market has seen transformative innovations from 2020 to 2025, accelerating with 5G and streaming surges. In 2024, Akamai launched EdgeWorkers, an AI-powered serverless platform reducing latency by 30% for e-commerce sites. Cloudflare introduced Magic Transit in early 2025, enhancing DDoS protection for 20% of Fortune 500 companies.

Posts on X spotlight Fastly’s 2024 Compute@Edge with WebAssembly, praised for real-time personalization in OTT apps. AWS’s 2023 CloudFront Functions expanded serverless caching, while Google’s 2024 Media CDN with AV1 codec cut video costs by 25%. These developments signal a convergence toward AI-optimized, secure edge delivery, with 65% of innovations targeting sustainability and low-latency.

Key Players Insights:

Market leaders are capitalizing on R&D and alliances to fortify their dominance. Akamai Technologies (20-24% share) leads with integrated security, emphasizing AI for threat mitigation; its 2024 EdgeWorkers boosted e-commerce performance by 35%. Cloudflare (18-22% share) excels in zero-trust models, launching Magic Transit in 2025 for telecom resilience. Fastly (15-19% share) focuses on edge computing, with Compute@Edge gaining traction for video streaming. AWS (12-16% share) leverages CloudFront for scalable caching, partnering with media firms for OTT optimization. Google Cloud (8-11% share) invests in AV1 codecs, reducing bandwidth by 20%. Others like Microsoft Azure, Alibaba Cloud, and Limelight Networks pursue hybrid solutions, with Azure’s 2024 CDN enhancements targeting enterprise workloads. These firms are driving AI and green initiatives, with 70% planning acquisitions by 2030.

Competitive Landscape:

The market exhibits a fragmented yet dynamic landscape, where Akamai and Cloudflare command 38-46% combined share through security-focused platforms, while mid-tier players like Fastly and AWS differentiate via edge computing. The report’s dashboard benchmarks strategies, noting Akamai’s e-commerce lead and Cloudflare’s telecom dominance. Emerging challengers like Alibaba emphasize cost-effective solutions for Asia-Pacific. As data traffic rises 25% annually, AI integrations and sustainability will heighten rivalry, with 55% of firms targeting multi-cloud interoperability by 2035.

Strategic Recommendations and Future Implications;

Fact.MR’s report advises stakeholders to prioritize AI-optimized routing and sustainable edge infrastructure to capture the 80% of enterprises planning CDN upgrades by 2030. Providers should address interoperability with standardized APIs and target Asia-Pacific with affordable, low-latency solutions. The analysis incorporates value chain, PESTLE, and SWOT frameworks for actionable insights. As streaming, e-commerce, and 5G proliferate, CDNs will remain the backbone of digital delivery, fostering innovation and efficiency worldwide.

Check out More Related Studies Published by Fact.MR:

Content Moderation Solution Market: https://www.factmr.com/report/4522/content-moderation-solutions-market

Content Analytics and Search Software Market: https://www.factmr.com/report/1330/content-analytics-and-search-software-market

Digital Education Content Market: https://www.factmr.com/report/digital-education-content-market

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client’s satisfaction.

This release was published on openPR.