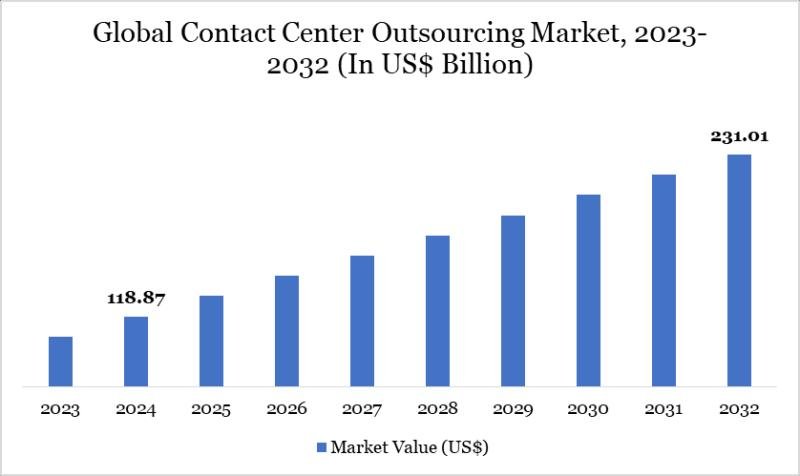

The Global Contact Center Outsourcing market reached USD 118.87 billion in 2024 and is expected to reach USD 231.01 billion by 2032, growing at a CAGR of 8.66% during the forecast period 2025-2032.

Market growth is driven by the rising demand for cost-effective customer experience solutions, digital transformation across industries, and the expansion of omnichannel support services. Advancements in AI-powered automation, cloud-based contact center platforms, increasing adoption of remote work models, and growing outsourcing in emerging markets like Asia-Pacific are further accelerating market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/contact-center-outsourcing-market?ram

Key Industry Developments

United States:

✅ January 2026: Teleperformance USA launched an AI-powered omnichannel contact center platform, integrating real-time sentiment analysis and predictive routing to boost agent efficiency by 25% and enhance customer satisfaction scores.

✅ December 2025: Concentrix introduced cloud-native outsourcing solutions with embedded compliance tools for U.S. regulatory standards like TCPA, enabling scalable operations for enterprises.

✅ November 2025: Alorica rolled out next-gen virtual agent technology for contact centers, leveraging machine learning for proactive issue resolution and cutting average handle times.

Asia Pacific / Japan:

✅ January 2026: TransCosmos Japan debuted a hybrid AI-human contact center outsourcing service, incorporating natural language processing for multilingual support across APAC markets.

✅ November 2025: Teleperformance APAC expanded its outsourcing portfolio with voice biometrics authentication tools, gaining USDA-equivalent approval for secure agribusiness customer interactions.

✅ October 2025: Sykes Japan (now Sitel) launched omnichannel AgTech support outsourcing, featuring EPA-recognized green hosting for sustainable operations in controlled environment agriculture.

Strategic Mergers and Acquisitions:

✅ Teleperformance finalized the acquisition of ZP in February 2025, a specialist in services for deaf and hard-of-hearing customers, enhancing its specialized offerings in the contact center outsourcing market.

✅ Concentrix acquired VoiceWorx.AI in February 2025, integrating AI-powered conversational analytics and natural language processing to advance its capabilities in customer interaction intelligence.

✅ TCS secured a majority stake in Wipro’s call center operations in April 2025, bolstering its dominance in business process outsourcing for contact centers.

Key Players:

IBM | Conduent Inc. | Teleperformance | CGS Inc. | HGS | Datamark, Inc. | Infinite Contact | Alorica | Convergys | Sykes Enterprises

Strategic Leadership Report: Top 5 Players in Contact Center Outsourcing Market 2026

-IBM Corporation: Deployed the watsonx Orchestrate platform with generative AI for contact centers, enabling hyper-personalized customer interactions, predictive routing, and automated omnichannel resolutions to boost agent efficiency amid rising digital demand.

-Teleperformance: Advanced the TP Cloud Campus suite with AI-powered sentiment analysis and virtual agents, delivering seamless human-AI collaboration, real-time coaching, and 24/7 multilingual support for global brands scaling customer experience operations.

-Conduent Inc.: Expanded the Engage CX platform with integrated AI chatbots and voice analytics, offering predictive customer insights, fraud detection, and dynamic workforce management to optimize outsourcing for high-volume industries like finance and healthcare.

-Alorica: Strengthened the Digital ALORICA ecosystem featuring advanced NLP-driven self-service portals and agent assist tools, providing proactive issue resolution, sentiment-based escalation, and analytics for enhanced retention in complex BPO environments.

-Sykes Enterprises: Upgraded the LiveAgent platform with omnichannel AI orchestration and behavioral analytics, enabling real-time personalization, automated quality assurance, and scalable outsourcing solutions for e-commerce and telecom contact centers.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=contact-center-outsourcing-market?ram

Regional Insights:

-North America: 35.2% (Largest share, driven by advanced CX investments and high adoption of AI-powered contact centers in the US and Canada).

-Asia Pacific: 28.5% (Fastest growing at over 10% CAGR, fueled by cost-effective skilled labor in India and the Philippines).

-Europe: 20.1% (Supported by GDPR-compliant multilingual services and steady BFSI demand).

-Latin America: 9.4% (Emerging near-shore hub for North America, boosted by bilingual talent in Mexico).

-Middle East & Africa: 6.8% (Gaining from digital transformation in emerging markets).

Key Growth Drivers:

-Cost Savings

Outsourcing to lower-cost regions reduces labor and operational expenses significantly for businesses. This allows firms to allocate resources to core activities while maintaining service levels.

-Scalability and Flexibility

Providers offer rapid scaling for fluctuating demand volumes without in-house infrastructure investments. This supports seasonal peaks and business expansion seamlessly.

-24/7 Global Support

Round-the-clock availability meets customer expectations across time zones, enhancing satisfaction. Multilingual capabilities further boost engagement in diverse markets.

-Technological Advancements

Adoption of cloud, AI, and omnichannel platforms improves efficiency and analytics. Providers deliver cutting-edge tools that in-house teams may lack.

-Focus on Core Competencies

Companies outsource non-core functions to concentrate on innovation and strategy. This drives competitiveness and long-term growth in primary business areas.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/contact-center-outsourcing-market?ram

Market Segmentation Analysis:

-By Service Type: Voice Support Dominates for Real-Time Engagement

Voice support leads with 55% market share in 2024, preferred for its personal touch, quick issue resolution, and high customer satisfaction in complex queries across industries.

Chat support holds 25%, rising with digital natives seeking instant, text-based help via apps and websites.

Email support captures 15%, ideal for non-urgent, detailed documentation needs.

Others, including social media and back-office, account for 5%, supporting multichannel strategies.

-By End-user: BFSI Leads on Compliance Demands

BFSI commands 30% share, driven by regulatory needs, fraud prevention, and 24/7 query handling in high-volume banking.

IT and Telecom follow at 20%, fueled by tech support and subscription services amid digital transformation.

Healthcare takes 15%, prioritizing patient privacy and appointment management.

Retail holds 15%, boosting e-commerce sales via order tracking.

Government secures 10%, for citizen services and efficiency.

Others claim 10%, spanning utilities and manufacturing.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTW

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.