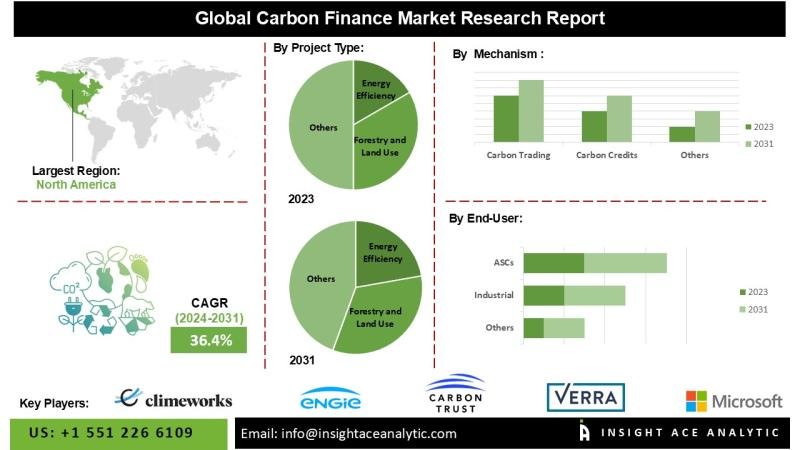

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the ” Carbon Finance Market – (By Mechanism (Carbon Trading, Carbon Credits, Carbon Taxation, Cap-and-Trade, Carbon Offset Projects), By Project Type (Renewable Energy Projects, Energy Efficiency, Forestry and Land Use, Carbon Capture and Storage (CCS), Waste Management), By End User (Industrial, Transportation, Energy Sector, Agriculture and Forestry, Government and Regulatory Bodies, Financial Institutions)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034.”

According to the latest research by InsightAce Analytic, the Carbon Finance Market is expected to grow with a CAGR of 36.5% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2912

Carbon finance serves as a strategic economic mechanism designed to encourage the reduction of carbon dioxide emissions by providing financial incentives to organizations that implement carbon mitigation or sequestration initiatives. The global carbon finance market is experiencing robust growth, driven by advancements in carbon capture and storage (CCS) technologies and increasing demand from enterprises seeking carbon credits to achieve sustainability objectives.

Market expansion is further supported by rising investments in energy efficiency measures and the implementation of stricter global carbon emissions regulations. The transition to renewable energy sources-particularly hydropower and other low-carbon generation systems-is contributing to reduced dependence on fossil fuels, lower overall energy consumption, and decreased greenhouse gas emissions. These renewable projects frequently generate tradable carbon credits, offering both environmental benefits and financial returns.

Moreover, the growth of carbon markets is being reinforced by international climate agreements and regulatory frameworks that promote low-carbon economic models. Both public and private sector stakeholders are intensifying investments in clean energy and energy-efficient technologies as part of broader sustainability strategies. These initiatives not only strengthen environmental resilience but also attract investors prioritizing environmental, social, and governance (ESG) considerations, collectively sustaining the upward trajectory of the global carbon finance market.

List of Prominent Players in the Global Carbon Finance Market:

• BP plc

• Shell Global

• Verra,

• Gold Standard

• South Pole

• ENGIE

• Climeworks

• Carbon Trust

• Microsoft Corporation

• Equinor ASA

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics

Drivers:

The carbon finance market is experiencing significant expansion, driven largely by increasing corporate commitments to mitigate greenhouse gas emissions and the rapid advancement of carbon management technologies. The deployment of artificial intelligence (AI) and sophisticated data analytics is enhancing the precision of carbon footprint measurement, monitoring, and verification processes.

These innovations improve the efficiency and reliability of carbon credit validation, ensuring regulatory compliance and bolstering the credibility of emission reduction initiatives. In addition, developments in environmental reporting and disclosure tools are fostering greater transparency, encouraging heightened corporate participation in climate finance and carbon credit acquisition. Overall, the integration of advanced digital technologies is strengthening trust in carbon accounting and supporting sustained market growth.

Challenges:

Despite robust growth, the carbon finance market faces several notable challenges. Key concerns include the authenticity and reliability of carbon credits, with risks of fraud and misrepresentation posing barriers to widespread adoption. The market is further exposed to cybersecurity threats, geopolitical uncertainties, and the lack of standardized protocols across different carbon trading platforms.

For instance, carbon credits linked to sectors such as maritime operations require stringent cybersecurity measures to safeguard documentation and prevent fraudulent activity. Additionally, global disruptions, such as those caused by the COVID-19 pandemic, have historically impacted market momentum through temporary operational slowdowns.

Regional Trends:

North America is expected to retain a substantial share of the global carbon finance market, supported by rapid urbanization, increased construction spending, and significant investments in energy efficiency, transportation, aviation, and public infrastructure. Concurrently, Europe continues to play a leading role, driven by strong research and development funding, technological innovation, and infrastructure modernization efforts. The region’s strategic focus on sustainable construction practices and optimized resource management further reinforces its position as a key contributor to global market growth in carbon finance.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2912

Segmentation of Global Carbon Finance Market-

By Mechanism-

• Carbon Trading

• Carbon Credits

• Carbon Taxation

• Cap-and-Trade

• Carbon Offset Projects

By Project Type-

• Renewable Energy Projects

• Energy Efficiency

• Forestry and Land Use

• Carbon Capture and Storage (CCS)

• Waste Management

By End User-

• Industrial

• Transportation

• Energy Sector

• Agriculture and Forestry

• Government and Regulatory Bodies

• Financial Institutions

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/carbon-finance-market/2912

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: http://www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.