According to a new study by DataHorizzon Research, the BIM consulting service market is projected to grow at a CAGR of 9.8% from 2025 to 2033. This robust expansion is underpinned by accelerating adoption of building information modeling across construction, infrastructure, and real estate development sectors, combined with escalating government mandates requiring BIM compliance on publicly funded projects across major economies. The BIM consulting service market is establishing itself as a mission-critical advisory and implementation segment within the broader architecture, engineering, and construction technology industry. Growing complexity in large-scale infrastructure projects, the rising deployment of digital twin technology, and the increasing integration of cloud-based BIM platforms are collectively elevating demand for specialized consulting expertise. With North America and Europe anchoring current market share and Asia-Pacific emerging as the most dynamic expansion frontier, the BIM consulting service market is positioned for sustained, high-velocity growth through the entire forecast horizon.

BIM Consulting Service Market Key Growth Drivers and Demand Factors

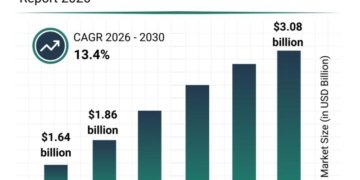

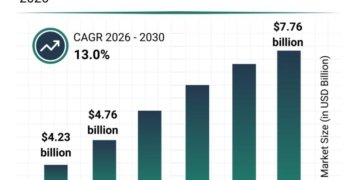

The BIM consulting service market is valued at approximately USD 7.2 billion in 2024 and is anticipated to reach around USD 18.5 billion by 2033, reflecting a CAGR of 9.8% from 2025 to 2033.

The BIM consulting service market is advancing at an accelerated pace, driven by a convergence of policy mandates, technology evolution, and construction industry transformation that is fundamentally reshaping how built environment projects are designed, delivered, and managed at every lifecycle stage.

The most consequential demand driver is the rapid proliferation of government-mandated BIM requirements across publicly funded infrastructure and construction programs. The United Kingdom’s BIM Level 2 mandate set a global precedent, and nations across Europe, the Middle East, and Asia-Pacific have since introduced comparable compliance frameworks – creating a non-discretionary demand base for specialized BIM consulting service market participants who guide organizations through standard adoption, capability development, and audit preparation.

Digital twin integration is emerging as a powerful secondary growth catalyst. As asset owners and infrastructure operators seek to create and maintain real-time digital replicas of physical assets for ongoing facility management, predictive maintenance, and performance optimization, demand for high-quality BIM data foundations – and the consulting expertise required to build them – is expanding well beyond the construction phase into long-term operations. This is significantly extending the BIM consulting service market revenue lifecycle per client engagement.

Investment in cloud-based BIM collaboration platforms, including Common Data Environment implementations and integrated project delivery workflows, is creating sustained consulting service demand as organizations navigate complex technology transition roadmaps. Additionally, the growing adoption of generative design, AI-assisted clash detection, and 4D and 5D BIM capabilities is driving repeat consulting engagement cycles across the BIM consulting service market competitive landscape.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/bim-consulting-service-market-47163

Why Choose Our BIM Consulting Service Market Research Report

Our BIM consulting service market research report delivers the strategic intelligence depth that construction technology firms, AEC consultancies, infrastructure investors, and enterprise software vendors need to navigate one of the construction sector’s fastest-growing professional services categories.

The report provides comprehensive segmentation of the BIM consulting service market across service type, project type, end-user industry, and geography – enabling precise identification of the highest-value engagement niches within this diverse and rapidly evolving market. Competitive profiling sections capture the service portfolio strategies, geographic expansion patterns, and client acquisition approaches of both established global consultancies and agile regional specialists reshaping the competitive landscape. For technology investors and private equity professionals, the report’s market sizing methodology – grounded in construction output forecasts, government mandate implementation timelines, and technology adoption rate modeling – provides a reliable analytical foundation for portfolio evaluation and deal origination within the BIM consulting service market. For AEC firms and consulting practices, the demand segmentation and regional forecast data support business development prioritization and service line investment decisions.

Important Points

• Government-mandated BIM adoption programs across Europe, the Middle East, and Asia-Pacific represent the single largest structural demand driver shaping the BIM consulting service market growth analysis through the forecast period

• Digital twin consulting and BIM-to-operations service engagements are the fastest-growing service categories, transitioning the BIM consulting service market beyond project-phase delivery into long-term asset management advisory

• Large-scale infrastructure projects – including transportation networks, airports, hospitals, and utility systems – account for the highest consulting contract values within the BIM consulting service market by revenue per engagement

• Asia-Pacific is the most rapidly expanding regional market, with China, India, Singapore, and Australia accelerating BIM mandate implementation and infrastructure investment simultaneously

• Cloud-based Common Data Environment implementation consulting and integrated project delivery advisory are among the highest-margin service lines attracting new specialist entrants across the BIM consulting service market competitive landscape

Top Reasons to Invest in the BIM Consulting Service Market Report

• Obtain a fully segmented BIM consulting service market revenue forecast through 2033, disaggregated by service type, project category, end-user vertical, and region for maximum strategic and investment planning utility

• Identify the highest-margin service segments and client industry verticals where consulting contract values, retention rates, and repeat engagement potential are strongest within the BIM consulting service market

• Apply competitive benchmarking intelligence to evaluate peer firm positioning, identify whitespace service opportunities, and assess potential acquisition or strategic alliance targets across the BIM consulting service market landscape

• Understand how evolving national BIM standards, ISO 19650 adoption timelines, and green building certification requirements are shaping institutional demand patterns and client procurement behavior across major markets

• Leverage regional construction output forecasts and BIM mandate implementation calendars to prioritize geographic expansion decisions, partnership development, and local talent acquisition investment

• Equip executive leadership and investment committees with the research-backed intelligence required to make confident, defensible strategic commitments within the high-growth BIM consulting service market opportunity

BIM Consulting Service Market Challenges, Risks, and Barriers

Despite its strong growth fundamentals, the BIM consulting service market faces meaningful headwinds. A persistent shortage of BIM-certified professionals with deep domain expertise in both construction processes and digital technology is constraining consulting firm capacity expansion and elevating talent acquisition costs across major markets. Inconsistency in BIM standard maturity levels across geographies creates service delivery complexity for firms operating internationally. Smaller AEC firms and public sector clients with limited digital transformation budgets remain difficult to penetrate, constraining addressable market size in developing economies. Resistance to workflow change within traditional construction organizations slows project adoption timelines and can compress consulting engagement scope. Additionally, the rapid pace of platform technology evolution – including AI integration and new BIM software releases – demands continuous consultant upskilling investment that adds structural operating cost pressure throughout the BIM consulting service market.

Top 10 Market Companies

• BuildIQ Consulting Group

• NexaBIM Solutions

• StructureWise Advisory

• DigiConstruct Partners

• ModelbuildX Services

• InfraModel Consulting

• ClearBIM Professional Services

• DigitalBuild Advisory Group

• SmartConstruct BIM Partners

• ProjectAxis Digital Consultants

Market Segmentation

By Service Type

o Implementation Services

o Support and Maintenance

o Training and Education

By End-User Industry

o Architecture

o Engineering

o Construction

o Facility Management

By Deployment Model

o On-Premises

o Cloud-Based

By Region

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

Recent Developments

• BuildIQ Consulting Group launched a dedicated digital twin consulting practice in early 2025, combining ISO 19650-aligned BIM data management expertise with IoT sensor integration advisory services for large-scale infrastructure asset owners across North America and Europe

• NexaBIM Solutions entered a strategic partnership with a leading cloud-based BIM platform provider to deliver co-branded implementation consulting services, targeting mid-market construction firms pursuing digital transformation across Southeast Asia and Australia

• StructureWise Advisory announced a significant expansion of its Middle East operations, establishing a regional delivery hub in the United Arab Emirates to service the accelerating BIM mandate compliance demand generated by large-scale infrastructure and smart city development programs across the Gulf Cooperation Council region

• DigiConstruct Partners completed the acquisition of a specialist 4D and 5D BIM consulting firm in Germany, strengthening its advanced construction simulation and cost-integrated modeling service capabilities across the European BIM consulting service market

• ModelbuildX Services secured a multi-year framework contract with a national transportation infrastructure authority to provide BIM standards development, implementation oversight, and quality assurance consulting across a major national rail and highway expansion program

• InfraModel Consulting unveiled a new AI-assisted BIM audit and compliance assessment service platform, designed to accelerate ISO 19650 gap analysis and readiness evaluation for large construction organizations navigating government procurement qualification requirements

BIM Consulting Service Market Regional Performance & Geographic Expansion

The BIM consulting service market exhibits highly differentiated regional momentum across the global construction and infrastructure landscape. North America leads in terms of consulting contract value and technology sophistication, with the United States and Canada driving enterprise BIM consulting demand through complex commercial real estate and infrastructure programs. Europe maintains the most advanced regulatory environment, with the United Kingdom, Germany, France, and the Netherlands commanding strong demand for ISO 19650 compliance and public sector BIM mandate implementation. Asia-Pacific is the standout growth region, with China, India, Singapore, and Australia commissioning major infrastructure programs alongside progressive BIM mandate rollouts. Latin America is in early-stage growth, led by Brazil and Chile. Middle East & Africa is accelerating rapidly, with Gulf Cooperation Council nations driving demand through ambitious smart city and infrastructure megaprojects.

How BIM Consulting Service Market Insights Drive ROI Growth

Organizations that invest in BIM consulting service market intelligence gain a measurable and durable competitive advantage across business development, service delivery, and capital allocation decisions. For AEC consulting firms, demand-side segmentation forecasting within the BIM consulting service market enables service line investment priorities to be aligned precisely with the fastest-growing client engagement categories – reducing resource misallocation and shortening time-to-revenue for new practice area launches. For technology vendors serving the AEC ecosystem, understanding which consulting service segments are generating the highest client engagement volumes informs channel partnership strategy and product integration roadmap prioritization. For investors evaluating the professional services and construction technology space, market share trajectory data and consolidation opportunity mapping within the BIM consulting service market accelerate deal sourcing, improve target company valuation confidence, and support more defensible investment committee presentations. In a professional services category where mandate-driven demand, technology complexity, and talent scarcity are simultaneously intensifying, intelligence-led strategy consistently translates into superior commercial and financial outcomes.

Sustainability & Regulatory Outlook

The regulatory and sustainability environment surrounding the BIM consulting service market is entering a period of heightened momentum, with policy frameworks and ESG-driven procurement criteria converging to create structural, long-cycle demand for specialized BIM expertise across global construction and infrastructure markets.

On the regulatory front, ISO 19650 – the international standard governing information management across the built asset lifecycle using building information modeling – is progressively becoming the global benchmark for BIM compliance on major infrastructure and commercial construction projects. Government procurement frameworks in the United Kingdom, Singapore, Australia, and across the European Union are increasingly referencing ISO 19650 alignment as a vendor qualification criterion, directly compelling project owners, contractors, and consultants to invest in certified compliance capability. This regulatory normalization is expanding the addressable client base for the BIM consulting service market beyond early adopters and into mainstream construction procurement.

Green building certification programs – including LEED, BREEAM, and WELL – are increasingly integrating BIM-based energy modeling, lifecycle assessment, and carbon performance documentation requirements into their evaluation criteria. This alignment between sustainability certification and BIM capability is creating a powerful consulting demand intersection, where organizations simultaneously need BIM implementation expertise and sustainability performance advisory – a combination that specialist firms within the BIM consulting service market are uniquely positioned to deliver.

The construction industry’s accelerating commitment to embodied carbon reduction, circular economy principles, and whole-life asset performance optimization is further elevating BIM data quality as a foundational requirement for credible sustainability reporting. Clients are increasingly requiring consulting partners to integrate carbon tracking, material passport documentation, and energy performance modeling into BIM deliverables – expanding both the scope and duration of consulting engagements. These combined regulatory and sustainability forces are creating a durable, structurally expanding demand environment for the BIM consulting service market through 2033 and beyond.

Key Questions Answered in the Report

1. What is the projected revenue forecast for the BIM consulting service market from 2025 through 2033?

2. Which region is expected to dominate the BIM consulting service market in terms of consulting contract value and service demand volume?

3. What are the highest-margin service categories and project type segments within the BIM consulting service market?

4. Who are the emerging challengers positioned to gain market share against established global BIM consulting firms?

5. How are ISO 19650 adoption timelines, government BIM mandates, and green building certification requirements shaping client procurement behavior and engagement scope?

6. Which end-user industries – AEC firms, infrastructure authorities, real estate developers, or facility managers – offer the strongest incremental growth opportunity across the forecast period?

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Credit Risk Management Software For Banks Market: https://datahorizzonresearch.com/credit-risk-management-software-for-banks-market-39539

Supervisory Control And Data Acquisition Market: https://datahorizzonresearch.com/supervisory-control-and-data-acquisition-market-40215

Mobile/Micro Data Center Market: https://datahorizzonresearch.com/mobilemicro-data-center-market-40892

Conversational AI Market: https://datahorizzonresearch.com/conversational-ai-market-41568

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.