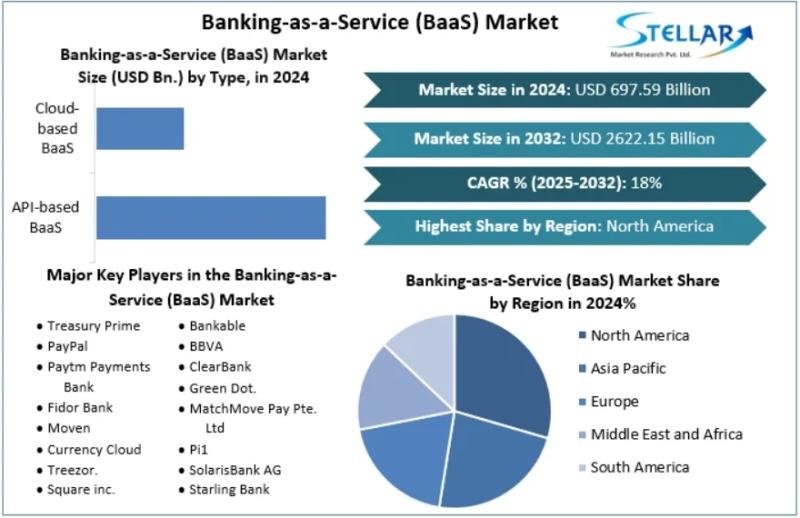

Banking-as-a-Service (BaaS) Market size was valued at US$ 697.59 Billion in 2024 and the total Banking-as-a-Service (BaaS) revenue is expected to grow at 18% through 2025 to 2032, reaching nearly US$ 2622.15 Billion. The growth is being fuelled largely by a growing demand for digital banking services and personalized solutions in Finance.

Want to See the Trends? Request a Free Sample Report Today:https://www.stellarmr.com/report/req_sample/Banking-as-a-Service–BaaS–Market/121

Growth Drivers and Opportunities in the Market

The market for BaaS is on an expansion mode and it is fueled by following key factors:

This ensures quicker connection timeframes for customers and a more modern banking experience.

BaaS providers are enabling companies across different industries to integrate financial services (payment processing, lending, and other banking services) directly into their offerings.

Regulatory Backing: A lot of countries and regulatory bodies are establishing frameworks that promote open banking and fintech innovation, creating an enabling environment for BaaS uptake.

Technological Advances: Development of Application Programming Interface and cloud compute infrastructures, which enabled standardization of banking services, greatly increased time-to-market for financial products.

Segmentation Analysis

Based on type, component, enterprise size, and end-user, the BaaS market is segmented as follow:

By Type: The market is further segmented into API based and Cloud based BaaS. Through application programming interface (API)-based services, banks and third-party applications can easily connect, thus allowing operations such as payment processing and account management. Both core banking systems and digital banking platforms can be offered as scalable, flexible solutions, based on cloud-based BaaS, enabling institutions to manage services with more agility.

By Component: Based on the type of platforms and services In this sense, platforms consist of the technological infrastructure and software for BaaS, and services consist of tools to support operational needs such as compliance and the customer experience.

By Enterprise Size: BaaS solutions are being adopted by large enterprises as well as small and medium-sized enterprises (SMEs). BaaS is used by large enterprises for their all-inclusive digital transformation, on the other hand, SMEs use these services to provide niche financial products with a low capital expenditure.

By End-User: The major end-users include banks, non-bank financial companies (NBFCs), governments, and others. Banks use BaaS to offer digital banking products, NBFCs incorporate BaaS to broaden their range of financial products, and the government utilizes BaaS for seamless dispersion of finance to the society.

The Interested Stakeholders can Inquire for the Purchase of the Report:https://www.stellarmr.com/report/enquire_now/Banking-as-a-Service–BaaS–Market/121

Country-Level Analysis

United States: The U.S., being a leader in technological innovation, has a well-developed banking ecosystem and a robust regulatory framework. Additionally, with its push towards fintech adoption and open banking, the country has seen rapid BaaS adoption rates, where many fintech companies partner with traditional banks to provide better financial offerings to their customers.

Germany: Germany has been an active player in fintech developments due to its strong economy and forward-thinking regulatory environment. Germany has made strides towards being a powerhouse in the BaaS arena in Europe, with BaFin encouraging fintech companies and supporting digital transformation in the banking sector.

China: The huge unbanked population and fast-paced digitalization makes China an attractive market for BaaS providers. With the support of the government towards fintech innovations and the increase in acceptance of mobile payment systems, the region serves as a great environment for the expansion of BaaS market.

United Kingdom: The UK has a growing fintech industry, fueled by regulations like the Open Banking Standard. As a result, this framework spurred competition and innovation, subsequently prompting both traditional banks and upstart market players to adopt BaaS solutions.

India – A country with a focus on financial inclusion and a thriving digital economy, India presents an attractive environment for BaaS to flourish. Government initiatives such as Digital India and the rapid spread of mobile internet have contributed to the acceptance of digital banking services, opening up the fertile ground for BaaS stakeholders to make through progress.

Download Full PDF Sample Copy of Market Report @https://www.stellarmr.com/report/req_sample/Banking-as-a-Service–BaaS–Market/121

Competitor Analysis

The BaaS landscape is a combination of traditional banks and progressive fintech players. Key players include:

Banco Bilbao Vizcaya Argentaria (BBVA): BBVA is a leader in digital banking, providing full BaaS platforms to allow third parties to integrate banking features into their own applications

PayPal Holdings Inc.: An online payment processor and gateway service, offering BaaS solutions for businesses to integrate payment and financial services into their own platforms using the same payment processing network.

The BaaS Companies You Should Know Square Inc. Square, Inc.

Green Dot Corporation: One of the leading fintech companies in the United States, Green Dot provides BaaS platforms primarily aimed at prepaid debit card and banking clients across a wide range of industries.

Starling Bank Ltd.: A digital challenger bank, Starling offers BaaS solutions that allow companies to create tailored banking products, using its powerful API framework.

This article explores the latest trends in the BaaS environment. In the same vein, Zile Money teamed up with Sunrise Bank to present Banking as a Service (BaaS) within North America in November 2023, intending to transform the fintech marketplace with the offer of instantaneous observation and onboarding of consumers while at the same period upholding elevated points of risk and compliance.

For more information about this report visit: https://www.stellarmr.com/report/Banking-as-a-Service–BaaS–Market/121

Conclusion

The global Banking-as-a-Service market is poised for substantial growth, fueled by technological advancements, regulatory support, and an ever-increasing demand for digital financial services. If you find it hard to believe that as traditional banks and fintech companies become partners and build innovative products together the BaaS model will change the way we think of finance forever.

Explore Related Reports by Stellar Market Research:

♦ Big Data Market https://www.stellarmr.com/report/Big-Data-Market/1141

♦ Restaurant Management Software Market https://www.stellarmr.com/report/Restaurant-Management-Software-Market/687

♦ Load Balancer Market https://www.stellarmr.com/report/Load-Balancer-Market/688

♦ IOT In Construction Market https://www.stellarmr.com/report/IOT-In-Construction-Market/1026

♦ Security Solutions Market https://www.stellarmr.com/report/Security-Solutions-Market/1033

♦ Asia Pacific Banking-as-a-Service (BaaS) Market https://www.stellarmr.com/report/Asia-Pacific-Banking-as-a-Service–BaaS–Market/471

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

sales@stellarmr.com

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.