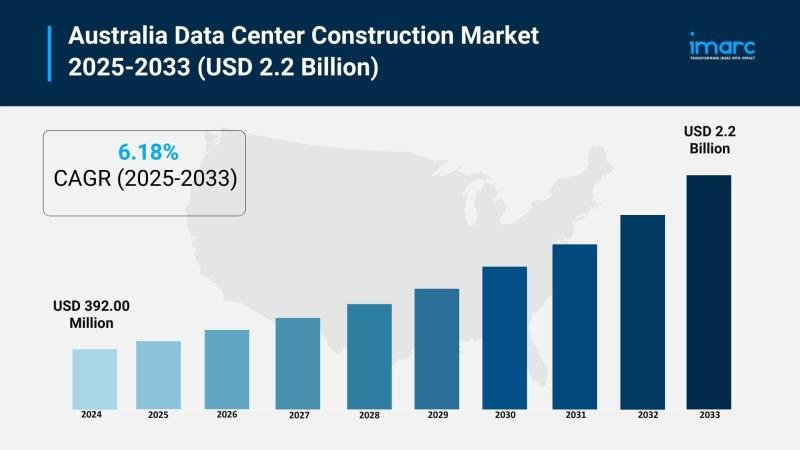

The latest report by IMARC Group, titled “Australia Data Center Construction Market Report by Construction Type (Electrical Construction, Mechanical Construction), Data Center Type (Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers), Tier Standards (Tier I and II, Tier III, Tier IV), Vertical (Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance, Healthcare, Retail, Others), and Region 2025-2033,” offers a comprehensive analysis of the Australia data center construction market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia data center construction market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a CAGR of 6.18% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 1.2 Billion

Market Forecast in 2033: USD 2.2 Billion

Market Growth Rate (2025-2033): 6.18%

Australia Data Center Construction Market Overview

The Australia data center construction market is experiencing steady growth driven by continual advancements in digital technologies, rising integration of artificial intelligence, adoption of modular solutions, deployment of 5G infrastructure, enhanced focus on renewable power sources, growth in industry-specific IT needs, investments in secure facilities, and initiatives promoting sustainable development and operational scalability. The market expansion is supported by digital transformation across healthcare, retail, and finance sectors requiring scalable data storage and processing capabilities, major investments including NEXTDC’s 7MW Darwin facility and HMC Capital’s AUD 2.12 billion Global Switch acquisition, and strategic focus on positioning Australia as global data center operations hub. Enhanced government support through favorable policies, geographical strategic connectivity advantages, and increasing foreign investments are positioning Australia’s data center construction market for sustained infrastructure development and technological advancement.

Australia’s data center construction foundation demonstrates robust digital infrastructure requirements with growing emphasis on hyperscale facilities, edge computing expansion, and sustainable building standards including LEED certifications. The country maintains strategic positioning as Asia-Pacific connectivity hub with advanced electrical and mechanical construction capabilities supporting 24/7 operations and compliance with stringent regulations. The proliferation of AI-driven applications, 5G technology deployment, and renewable energy integration is creating favorable market conditions, requiring substantial investments in energy-efficient cooling systems, fault-tolerant infrastructure, and modular construction solutions. Australia’s unique combination of government policy support, strategic geographic location, and commitment to sustainable development makes it an increasingly attractive destination for global data center construction investment and technological innovation.

Request For Sample Report:

https://www.imarcgroup.com/australia-data-center-construction-market/requestsample

Australia Data Center Construction Market Trends

• Sustainable design emphasis: Growing focus on environment-friendly data center construction incorporating LEED certifications, renewable energy sources including solar and wind power, and advanced cooling technologies like GreenSquareDC’s AUD 1 billion green AI facility in Perth.

• Hyperscale facility expansion: Major technology companies investing in large-scale data centers supporting high-density computing and big data analytics with Delta Electronics installing 12 prefabricated Power Train Units demonstrating deployment innovation.

• Edge computing infrastructure adoption: Rising implementation of edge computing solutions enabling real-time processing and low latency for IoT applications with OVHcloud’s third Sydney data center featuring cutting-edge water-cooling systems.

• Major investment activities: Significant acquisitions including Blackstone’s AUD 24+ billion AirTrunk acquisition and HMC Capital’s AUD 2.12 billion Global Switch purchase demonstrating market confidence and expansion commitment.

• Modular construction solutions: Increasing adoption of prefabricated and modular systems reducing deployment time while maintaining high-efficiency standards and supporting rapid scalability requirements.

• AI and 5G integration: Growing infrastructure development supporting artificial intelligence applications and 5G technology deployment requiring enhanced power capacity and advanced networking capabilities.

Market Drivers

• Digital transformation acceleration: Industry-wide modernization across healthcare, retail, and finance sectors creating demand for scalable data storage and processing infrastructure supporting business operations and customer service delivery.

• Government policy support: Favorable regulatory framework and strategic investments promoting Australia as global data center hub with supportive policies attracting international investment and infrastructure development.

• Geographic strategic advantages: Australia’s positioning as Asia-Pacific connectivity hub offering low-latency access to regional markets while providing secure and stable political environment for critical infrastructure investment.

• AI and emerging technology demands: Rapid growth in artificial intelligence applications, machine learning workloads, and high-performance computing requiring specialized facilities with advanced power and cooling capabilities.

• 5G infrastructure deployment: Nationwide 5G network expansion creating demand for edge computing facilities and distributed data center architecture supporting ultra-low latency applications and IoT connectivity.

• Cloud service growth: Increasing enterprise adoption of cloud computing, hybrid cloud solutions, and digital services requiring robust data center infrastructure supporting scalable and reliable service delivery.

Challenges and Opportunities

Challenges:

• High capital investment requirements for advanced data center construction including sophisticated electrical systems, cooling infrastructure, and security measures creating financial barriers particularly for smaller operators

• Energy consumption and sustainability pressure requiring balance between high-performance computing needs and environmental responsibility while meeting renewable energy targets and carbon reduction goals

• Skilled workforce shortage in specialized data center construction, electrical engineering, and facility management creating capacity constraints and potential project delays

• Regulatory compliance complexity navigating building codes, environmental standards, security requirements, and data sovereignty regulations across different jurisdictions creating administrative burden

• Technology evolution pace requiring flexible infrastructure design anticipating future requirements while avoiding obsolescence in rapidly changing computing and networking technologies

Opportunities:

• Renewable energy integration leadership developing comprehensive green data center solutions leveraging Australia’s abundant solar and wind resources creating competitive advantage and sustainability positioning

• Asia-Pacific expansion serving as regional hub for international hyperscale operators seeking stable political environment, strategic connectivity, and skilled workforce for critical infrastructure deployment

• Edge computing specialization developing distributed facility networks supporting 5G applications, IoT connectivity, and real-time processing requirements creating new market segments and revenue streams

• Modular construction innovation advancing prefabricated solutions, standardized designs, and rapid deployment capabilities reducing construction time and costs while maintaining quality standards

• Industry vertical specialization creating tailored data center solutions for specific sectors including healthcare, finance, government, and entertainment addressing unique compliance, security, and performance requirements

Australia Data Center Construction Market Segmentation

By Construction Type:

• Electrical Construction

• Mechanical Construction

By Data Center Type:

• Mid-Size Data Centers

• Enterprise Data Centers

• Large Data Centers

By Tier Standards:

• Tier I and II

• Tier III

• Tier IV

By Vertical:

• Public Sector

• Oil and Energy

• Media and Entertainment

• IT and Telecommunication

• Banking, Financial Services and Insurance (BFSI)

• Healthcare

• Retail

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-data-center-construction-market

Australia Data Center Construction Market News (2024-2025)

• October 24, 2024: HMC Capital acquired Global Switch Australia Holdings for AUD 2.12 billion developing Global DigiCo Platform with Sydney data center sites expanding from 26MW to 88MW capacity.

• September 4, 2024: Blackstone Inc. announced AirTrunk acquisition valued over AUD 24 billion marking largest Asia-Pacific investment driven by AI advancement and widespread digitization trends.

• August 14, 2024: NEXTDC Limited opened D1 Darwin data center with 7MW capacity in collaboration with Vocus and Northern Territory Government supporting AI technologies and secure cloud platform access.

• May 14, 2024: OVHcloud launched third Sydney data center featuring cutting-edge water-cooling systems optimizing sustainability and efficiency supporting edge computing, 5G, and artificial intelligence demand.

• January 9, 2024: Delta Electronics installed 12 prefabricated Power Train Units for hyperscale data center demonstrating high-efficiency deployment innovations reducing construction time while maintaining performance standards.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Construction Type, Data Center Type, Tier Standards, and Vertical Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=24635&flag=F

Q&A Section

Q1: What drives growth in the Australia data center construction market?

A1: Market growth is driven by digital transformation acceleration across healthcare, retail, and finance sectors, government policy support creating favorable investment environment, geographic strategic advantages as Asia-Pacific connectivity hub, AI and emerging technology demands requiring specialized infrastructure, 5G infrastructure deployment supporting edge computing, and cloud service growth requiring robust scalable facilities.

Q2: What are the latest trends in this market?

A2: Key trends include sustainable design emphasis through LEED certifications and renewable energy integration, hyperscale facility expansion with major technology company investments, edge computing infrastructure adoption supporting real-time IoT applications, major investment activities including Blackstone’s AUD 24+ billion AirTrunk acquisition, modular construction solutions reducing deployment time, and AI and 5G integration requiring enhanced power and networking capabilities.

Q3: What challenges do companies face?

A3: Major challenges include high capital investment requirements for advanced infrastructure creating financial barriers, energy consumption and sustainability pressure requiring environmental responsibility balance, skilled workforce shortage in specialized construction and management, regulatory compliance complexity across multiple jurisdictions, and technology evolution pace requiring flexible infrastructure design anticipating future requirements.

Q4: What opportunities are emerging?

A4: Emerging opportunities include renewable energy integration leadership leveraging Australia’s solar and wind resources, Asia-Pacific expansion serving as regional hub for international operators, edge computing specialization developing distributed networks for 5G and IoT applications, modular construction innovation advancing prefabricated solutions, and industry vertical specialization creating tailored solutions for healthcare, finance, and government sectors.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

This release was published on openPR.