Market Overview

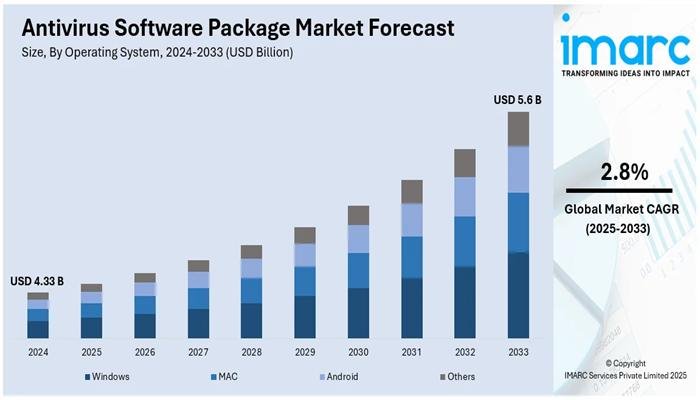

The global Antivirus Software Package Market was valued at USD 4.33 Billion in 2024. It is projected to reach USD 5.6 Billion by 2033, growing at a CAGR of 2.8% during the forecast period from 2025 to 2033.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Market Key Takeaways

• Current Market Size: USD 4.33 Billion (2024)

• CAGR: 2.8% (2025-2033)

• Forecast Period: 2025-2033

• In 2024, North America dominated the market with over 48.0% share due to advanced IT infrastructure and frequent cyberattacks.

• The U.S. accounts for 85.60% of North America’s revenue in 2024, driven by increased ransomware attacks and regulatory demands.

• Rising sophistication of cyber threats, AI-powered threat detection, and growing regulatory compliance fuel market growth.

• Subscription-based antivirus models emphasizing multi-device compatibility and seamless updates are major growth drivers.

• Increasing e-commerce and online banking activity heighten cybersecurity needs, boosting antivirus software demand.

Request for a Free Sample Report: https://www.imarcgroup.com/antivirus-software-package-market/requestsample

Market Growth Factors

The global antivirus software package market will be propelled by the increasing sophistication of cyberattacks. The report found that India saw an average of 761 attempted cyberattacks every minute in 2024, with the healthcare industry being the most affected. The increase in such attacks against critical infrastructure and personal data breaches has created renewed global interest and importance in cybersecurity, including endpoint protection that has grown due to the rise of remote work, as well as advances in detection through artificial intelligence and machine learning. These factors may combine for a positive impact on the worldwide antivirus software market.

In the United States, complex cyber-security threats happen, regulations like the California Consumer Privacy Act (CCPA) and Health Insurance Portability and Accountability Act (HIPAA) exist, and a growing dependence on digital infrastructure within various industries should drive market growth. In August 2023, 12.2% of United States jobs are remote. Nearly 4.7 million jobs require working from home at least half the week, which has increased the need for endpoint and personal cybersecurity solutions. Focusing upon new AI-based threat detection and small and medium business solutions will drive future growth.

The increasing trend to subscribe to antivirus software that updates regularly, works across multiple devices, and renews easily creates an opportunity to engage and retain customers more. Cyberattacks against desktops and laptops in 2023 also created 862.8 million detections worldwide, creating more demand for solutions that offer thorough antivirus protection. E-commerce and online banking developed at a rapid pace. This created new cybersecurity issues. Antivirus software demand increased to protect online purchases and financial information. Industry estimates project cybercrime will cost up to USD 10.5 Trillion around 2025. This is three times more than in 2015. This is fueling the demand for complete antivirus packages.

Market Segmentation

Analysis by Device:

• Laptops: Lead the market with around 75.0% share in 2024, driven by widespread use in personal, educational, and professional settings. Remote work and online learning have increased the need for cybersecurity due to laptops’ portability and exposure to phishing and ransomware risks.

• Desktops: Not specifically detailed in report but included as a significant device segment.

• Others: Not specified, presumed to include other device types requiring antivirus protection.

Analysis by Operating System:

• Windows: Primary targets of malware and ransomware, necessitating robust antivirus solutions for home, business, and cloud environments. The widespread business use of Windows fuels the demand.

• MAC: Growing adoption of macOS in professional and personal domains drives antivirus demand despite its strong inbuilt security, due to increased phishing, adware, and targeted malware threats.

• Android: Critical segment as Android devices are prone to malware, phishing, and spyware due to their open-source nature and app-centric usage, increasing demand for real-time threat detection and secure browsing features.

• Others: Not detailed in the source.

Analysis by End User:

• Personal: Majority demand segment due to increased use of digital devices for communication, shopping, and entertainment, with growing cyber threats prompting a need for affordable, multi-device, user-friendly antivirus software.

• Corporate: Key driver with businesses investing in comprehensive cybersecurity to protect sensitive data and maintain operational continuity, including endpoint protection and compliance tools.

• Government: Essential segment focusing on protection of critical infrastructure and sensitive information against espionage, ransomware, and advanced threats with investments in endpoint security and real-time threat detection.

• Others: Additional segments not specified.

Regional Insights

The North American region holds the largest market share, with over 48.0% in 2024, owing to the infrastructural growth, digital adoption, rising cyberattacks, and demand from technology and finance sectors. Remote working and cloud computing further increased this market. In North America, the United States recorded a revenue share of 85.60%. Ransomware attacks also increased, by over 70% between 2022 and 2023, leading to increased interest in antivirus solutions.

Recent Developments & News

• December 2024: Gen Digital, the parent company of Norton and Avast, announced the acquisition of fintech firm MoneyLion in a cash deal valued at approximately USD 1 Billion to expand offerings in consumer finance.

• July 2024: The Biden administration banned Kaspersky products in the United States citing national security concerns, effective from July 20.

• August 2023: Bitdefender completed its acquisition of Singapore-based Horangi Cyber Security, enhancing its portfolio with advanced attack surface monitoring and compliance solutions for hybrid and multi-cloud environments.

Key Players

• Adaware (Avaquest Group)

• AhnLab Inc.

• Avast Software s.r.o.

• AVG Technologies CZ

• Avira Operations GmbH & Co. KG

• Bitdefender SRL

• BullGuard Limited

• F-Secure Oyj

• Kaspersky Labs GmbH (Kaspersky Lab Limited)

• McAfee LLC (TPG Capital and Intel)

• Microsoft Corporatio

• Qihoo 360 Technology Co. Ltd.

• Quick Heal Technologies Ltd.

• Symantec Corporation (Broadcom Inc.)

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request Customization: https://www.imarcgroup.com/request?type=report&id=2794&flag=E

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.