The global alternative data market is emerging as a pivotal resource in the realm of investment analysis, rapidly transforming the financial sector. As the industry continues to grow at an unprecedented pace, stakeholders across hedge funds, asset managers, and financial institutions are increasingly leveraging non-traditional data sources to secure a competitive advantage. This press release highlights the latest market overview, trends, key players, and future outlook of the alternative data industry, offering an in-depth look at the factors driving its expansion.

Access important conclusions and data points from our Report in this sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=83062

Market Overview

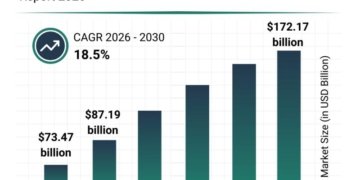

In 2022, the global alternative data industry was valued at approximately US$ 4.1 billion. Forecasts predict that this dynamic market will advance at an impressive compound annual growth rate (CAGR) of 49.8% from 2023 to 2031, reaching an estimated value of US$ 154.9 billion by the end of the forecast period. This remarkable expansion is fueled by the growing recognition among investors and financial institutions of the unique insights that alternative data can offer-insights that traditional financial statements and conventional economic indicators simply cannot provide.

Alternative data encompasses a broad spectrum of unconventional sources such as satellite imagery, social media sentiment analysis, web-scraped data, geolocation metrics, sensor data, and even credit card transactions. By tapping into these diverse data streams, businesses can gain a more comprehensive understanding of consumer behavior, market trends, and economic shifts, thereby empowering data-driven decision-making.

Market Drivers & Trends

The burgeoning interest in alternative data is driven by several key factors:

Increased Demand for Unique Insights: Investors and financial institutions are constantly seeking ways to stay ahead of market fluctuations. Alternative data provides a rich tapestry of information that can reveal hidden trends and offer a more nuanced view of market dynamics.

Technological Advancements: Rapid progress in artificial intelligence (AI) and machine learning (ML) has amplified the utility of alternative data. Advanced analytical tools now enable organizations to process and interpret massive datasets with greater accuracy and speed, fostering a more robust investment strategy.

Surge in Financial Sector Adoption: The financial industry has been at the forefront of integrating alternative data. According to a global hedge fund benchmark study, a significant portion of hedge fund firms and asset managers, particularly those managing assets over US$ 1 billion, have begun incorporating alternative data into their investment processes. This trend is set to accelerate as more institutions recognize the value of enhanced predictive analytics and risk assessment.

Emergence of Generative AI: Generative AI is revolutionizing the market by creating synthetic data that can simulate real-world scenarios. This innovation not only broadens the types of data available but also improves the accuracy of financial models by augmenting existing datasets with new, synthetic samples.

Key Players and Industry Leaders

The alternative data market is characterized by a competitive landscape featuring both established financial giants and nimble technology startups. Key industry leaders include:

UBS Group AG

Yipit LLC d.b.a. (YipitData)

RavenPack International S.L.

M Science LLC

DataSpark

Advan Research Corporation

The Earnest Analytics Company

InfoTrie

FactSet Research Systems Inc.

Preqin Ltd

Datacie Sàrl

QUICK Corp.

These companies are at the forefront of innovation in alternative data technologies. They continue to invest in research and development, enabling them to offer cutting-edge solutions that meet the evolving demands of the market. Their strategies include expanding product portfolios, forging strategic partnerships, and incorporating AI-driven methodologies to extract valuable insights from unconventional data sources.

Recent Developments

The market has seen several noteworthy developments in recent years:

Strategic Partnerships: In February 2023, Broadridge Financial Solutions, Inc., a leading fintech company, partnered with Point Focal to integrate alternative data-driven quantitative insights into its NYFIX order-routing network platform. This collaboration is set to enhance the data capabilities available to Broadridge’s clients.

Innovative Product Launches: In September 2022, RavenPack International S.L. teamed up with LinkUp to introduce RavenPack Job Analytics. This innovative dataset aggregates real-time job market data from over 60,000 employers worldwide, providing actionable insights that are particularly beneficial for event-driven investment strategies.

Technological Integration: With the rise of generative AI, market leaders are now exploring new ways to synthesize alternative data. This integration not only broadens the data spectrum but also improves predictive analytics, enabling investors to simulate various market scenarios and adjust strategies accordingly.

Market Challenges and Opportunities

While the alternative data market presents substantial opportunities, it is not without its challenges:

Data Quality and Integration: One of the primary challenges is ensuring the quality and relevance of vast datasets. Data must be meticulously cleaned, standardized, and integrated from multiple sources to be effectively used in decision-making processes.

Regulatory Concerns: The proliferation of alternative data raises significant regulatory questions, especially concerning privacy and data protection. Financial institutions must navigate an evolving landscape of regulations to ensure compliance while maximizing the utility of alternative data.

Technological Barriers: Despite the advances in AI and ML, integrating these technologies into traditional investment models can be complex and resource-intensive. However, this challenge also presents an opportunity for technology providers to develop more intuitive, user-friendly platforms that facilitate the seamless integration of alternative data.

Access detailed insights by visiting our full report – https://www.transparencymarketresearch.com/alternative-data-market.html

Future Outlook

The future of the alternative data market appears extremely promising. Continuous innovation in data collection and analytics, along with the rapid adoption of AI and ML technologies, will likely drive further growth. Analysts predict that as more companies recognize the strategic advantage offered by alternative data, demand will surge, spurring additional market expansion. This trend is expected to not only broaden the market but also deepen the insights available, allowing for more refined investment strategies and improved risk management.

The integration of generative AI, in particular, is set to redefine the landscape by enabling the creation of synthetic data that enhances existing datasets and opens up new avenues for predictive analysis. These advancements are likely to create a more resilient and agile financial ecosystem, capable of adapting to rapid market changes and unforeseen economic events.

Market Segmentation

The alternative data market is segmented across several dimensions:

Data Type:

Credit Card & Debit Card Data

Web Traffic & Scraped Data

Email Receipts

Geo-location, Satellite & Weather Data

Mobile Application Usage Data

Social & Sentiment Data

Other Unstructured Data

Industry Verticals:

BFSI (Banking, Financial Services, and Insurance)

IT & Telecom

Retail and E-commerce

Real Estate & Construction

Healthcare

Logistics & Transportation

Energy and Utilities

Other Sectors

Regions Covered:

North America

Europe

Asia Pacific

Middle East & Africa

South America

This segmentation allows market participants to target specific niches and tailor their offerings to meet the distinct needs of different industries and regions.

Frequently Asked Questions

Q1: What is alternative data?

Alternative data refers to non-traditional data sources-such as satellite imagery, social media sentiment, and geolocation data-that provide unique insights beyond conventional financial statements and economic indicators.

Q2: Who are the primary users of alternative data?

The primary users include hedge funds, asset managers, banks, and other financial institutions that utilize alternative data to enhance investment strategies and risk management processes.

Q3: What is driving the growth of the alternative data market?

Key drivers include the increasing demand for unique market insights, rapid advancements in AI and ML, widespread adoption by the financial sector, and the emergence of generative AI technologies.

Q4: Which regions are expected to lead in market growth?

North America is currently the dominant market due to its established financial infrastructure, while the Asia Pacific region is projected to grow at the highest CAGR due to rapid economic development and increasing investment activities.

Q5: How is generative AI impacting the alternative data market?

Generative AI is enabling the creation of synthetic data, enhancing existing datasets, and opening new avenues for predictive analysis. This technological advancement is expected to further drive market growth and innovation.

Buy this Premium Research Report for expert-driven insights and conclusions – https://www.transparencymarketresearch.com/checkout.php?rep_id=83062<ype=S

Explore Latest Research Reports by Transparency Market Research:

Media (Video) Processing Solutions Market: https://www.transparencymarketresearch.com/media-processing-solutions-market.html

Maritime Digitization Market: https://www.transparencymarketresearch.com/maritime-digitization-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.